“Explore the old vs. new tax regime in India and determine which one is better for you. Understand the income tax slab rates, deductions, and exemptions under each regime. Make an informed decision for the financial year 2023-24.”

The old tax regime and the new tax regime are two income tax regimes available to individual taxpayers in India. The old tax regime is the traditional income tax regime, while the new tax regime was introduced in 2020 with the aim of simplifying the tax system and reducing the tax burden on individual taxpayers.

Page Contents

Old tax regime

For the financial year 2023-24 (assessment year 2024-25), the income tax slab rates for individuals under the old tax regime are:

- Up to Rs. 2.5 lakhs – Nil

- Rs. 2.5 lakhs to Rs. 5 lakhs – 5%

- Rs. 5 lakhs to Rs. 10 lakhs – 20%

- Above Rs. 10 lakhs – 30%

Under the old tax regime, taxpayers are eligible for several deductions and exemptions, which can significantly reduce their taxable income and lower their tax liability.

One of the most significant deductions available under the old tax regime is under Section 80C of the Income Tax Act. This section allows taxpayers to claim a deduction of up to Rs. 1.5 lakhs for investments made in various instruments such as Public Provident Fund (PPF), National Savings Certificate (NSC), and Equity-Linked Saving Scheme (ELSS), among others. This deduction is particularly beneficial for taxpayers who make investments regularly and can help reduce their taxable income significantly.

Another deduction available under the old tax regime is under Section 80D, which allows taxpayers to claim a deduction for medical expenses incurred for themselves and their family members. This deduction can be up to Rs. 25,000 for individuals and Rs. 50,000 for senior citizens.

Similarly, taxpayers can claim a deduction for interest paid on a home loan for self-occupied property under Section 24 of the Income Tax Act. The deduction is available up to Rs. 2 lakhs for the interest paid on a home loan, which can help reduce the taxable income and lower the tax liability.

Apart from these deductions, taxpayers are also eligible for several exemptions such as the exemption for the Leave Travel Allowance (LTA), House Rent Allowance (HRA), and the exemption for the gratuity received by employees, among others. These exemptions can significantly reduce the taxable income and lower the tax liability for the taxpayer.

However, one of the downsides of the old tax regime is that the tax rates are higher compared to the new tax regime. The highest tax rate under the old tax regime is 30% for individuals earning over Rs. 10 lakhs. Additionally, taxpayers need to keep track of their investments and expenses to claim deductions and exemptions, which can be a tedious process.

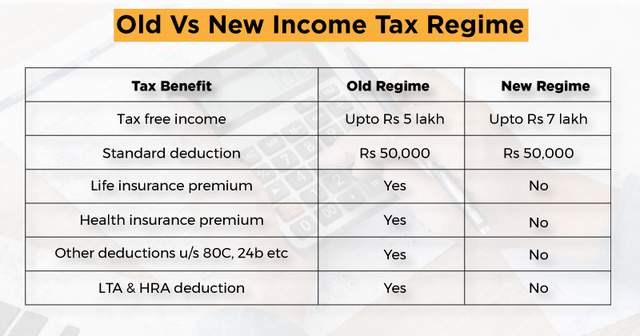

Old Vs. New tax regime – Snapshot of Comparison –

New Tax Regime

The new tax regime was introduced in India with the aim to simplify the income tax structure and to reduce the tax burden on taxpayers. Under this regime, taxpayers have the option to choose between the old and new tax regime. The new tax regime provides a lower tax rate as compared to the old regime, but it comes with certain conditions and restrictions.

Here’s what you need to know about the new tax regime:

Income tax slab rates:

For the financial year 2023-24 (assessment year 2024-25), the income tax slab rates for individuals under the new tax regime are as follows:

- Up to Rs. 3 lakhs – Nil

- Rs. 3lakhs to Rs. 6 lakhs – 5%

- Rs. 6 lakhs to Rs. 9 lakhs – 10%

- Rs. 9 lakhs to Rs. 12 lakhs – 15%

- Rs. 12 lakhs to Rs. 15 lakhs – 20%

- Above Rs. 15 lakhs – 30%

Deductions and exemptions:

Under the new tax regime, taxpayers are not eligible for certain deductions and exemptions, deductions under Section 80C, Section 80D, etc. However, taxpayers can still claim certain deductions such as interest paid on home loans under Section 24, deductions under Section 80CCD(1B) for contributions made to the National Pension Scheme, etc. These deductions are subject to a maximum limit, and taxpayers cannot claim any other deductions or exemptions.

Optional regime:

The new tax regime is optional, which means that taxpayers can choose to pay taxes under either the old or new regime. However, taxpayers who opt for the new regime cannot switch back to the old regime in subsequent years.

Which Tax regime to choose:

The choice of tax regime depends on individual taxpayers’ tax liability and their eligibility for deductions and exemptions. Taxpayers with lower incomes and those who do not have significant investments or expenses that qualify for deductions and exemptions may find the new tax regime more beneficial. On the other hand, taxpayers with higher incomes and those with investments or expenses that qualify for deductions and exemptions may find the old tax regime more advantageous.

******

The author is an Income Tax and GST Practitioner and can be contacted at 9024915488.

Dear sir, My CTC is 10.4 lakhs.i have 80C saving 70 K.please guide me which tax slab is best.

l have worked in CPSU. my employer discharged me under pre maturd retirement. I have received CPF and gratuity. and contribute tary pension computation. please tell me Ithese payments are taxable

.

SALARY 12 Lakh, deductions 80C 1.5L, HL intt 2 L, which one is better -old or new

Whether Deduction u/s. 10(10AA), 10(10b) & 10(10c) allowed in new Tax regime for FY 23-24 ?

Hi sir , kindly help me if my annual ctc is 12.7 lakhs

which is better tax regime old or new ??

I have home loan monthly emi 19219 ( out of 1.5 lakhs is principle and rest is interest ) and health insurance premium is 25k , NPS 20k ULIP 30k, term plan 36k

which is better in this

Old tax regime is better for you.. As there are many ways to save tax under old tax regime. So, your tax liability will be low under old tax regime. if you want to discuss regarding tax saving tips in detail you can contact us at 9024915488.

first you need to make the computation with both regime/system and find the tax figure and you can do it very easily.

Choose Old Tax Regime as Deduction under Section 80C & 80D in not allowed in new tax regime.

What is the taxability of LTA in new vs old regime. Also if we want to switch from New to Old at the time of filing of ROI what will be the impact on LTA taxability at that time?

well explained and thanks

Salaried can switch over Old to New regime & New to Old regime in subsequent years.

yes, salaried employee has an option to switch from new tax regime to old tax regime and from old to new regime

thanks for your kind information please

with best wishes please

Sir, Please re-confirm if deduction under section 80CCD(1B) is allowable under the new tax regime because as per the Finance Act, only deduction under section 80CCD(2) is allowable under the new tax regime.

Hi sir, I have to give declaration regarding my investments to the company, which tax regime should I choose? can you please help in planning my taxes for this year. I also have to file my ITR

Sure, I will file your ITR, to discuss regarding tax saving tips and tricks you can contact us at 9024915488. thanks