AMENDMENT IN TAX AUDIT PROVISIONS

The Finance Act, 2020 has introduced a proviso to sec 44AB(a) to encourage less-cash economy and to encourage digital transactions. If the turnover of the assessee is up to Rs.5 crores and his cash receipts are up to 5% of total receipts and the cash payments are up to 5 % of total payments, then the assessee would not be required to get his books of accounts audited.

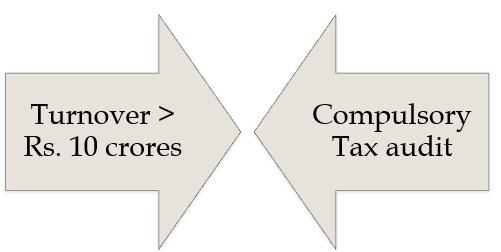

The Finance Act, 2021 has increased the threshold limit of turnover for tax audit u/s 44AB from Rs.5 crores to Rs.10 crores where cash transactions do not exceed 5% of total transactions. This amendment will take effect from 1st April 2021 and will, accordingly, apply in relation to the assessment year 2021-22. Thus, the higher limit of turnover will take effect from F.Y. 2020-21 itself.

The Finance Act, 2021 has added a new second proviso to section 44AB(a) which is reproduced below-

“Provided further that for the purposes of this clause, the payment or receipt, as the case may be, by a cheque drawn on a bank or by a bank draft, which is not account payee, shall be deemed to be the payment or receipt, as the case may be, in cash.”

As per provisions of section 44AB, turnover limit for tax audit has been increased from 1 crore to 10 crore if receipts and payment are within the permissible cash limit. The Finance Act, 2021 has introduced new proviso to section 44AB(a) wherein it has been stated that transactions through non account payee cheques shall be considered as deemed cash for this clause. This point is very important because large chunk of audit shall be governed on interpretation and adoption of this proviso. Here it is interesting to state that deeming provisions is with respect to only cheques and not for E-Payment or digital payment hence RTGS/NEFT etc. shall always be treated as non-cash. Now most important question is how to prove receipt and payment of cheque through account payee mode is a burning issue as assessee does not possess any documentary evidence thereof and only option left with the assessee to collect scanned copies of all cheques from the bank. After introduction of CTS clearing system, scanned copies all receipts and issued cheques remain with the banks but it is very cumbersome to get scanned copies of cheques from the bank looking to the magnitude of cheques. This will lead to a situation where the assessee has to prove that the transactions are indeed carried on through account payee cheques. In the case of RTGS, NEFT or other digital modes of receipts or payments, there will not be any problem in proving that those transactions are carried on digitally in non-cash mode. The problem will be there in case of transactions carried on through cheques. Both the bearer/crossed and account payee cheques will be reflected as ‘cheque transactions’ in the bank statements. Thus it will not be possible for the assessee to prove that such cheque transactions are indeed account-payee cheque. Remember, one needs to prove it for both the receipts of cheques and payments by cheques.

Following observations can be made regarding the increased threshold limit for Tax Audit under section 44AB –

a) The amendment is carried out only in section 44AB and no amendment has been made in section 44AD. Thus, the turnover limit of 2 crores for opting Section 44AD shall continue.

b) The term aggregate of all receipts and aggregate of all payments‟ is very wide and covers not only receipts and payments on account of sale and purchase but also all other business transactions.

All the payments or receipts including capital introduction, drawings, receipt and repayment of loans, purchase of fixed assets, etc. shall be considered. Even taxes paid in cash shall be included for the calculation.

In other words, all the receipts and payments made by the entity shall be considered for calculating total value of receipts and payments as well as the aggregate value of receipts or payments made in cash.

c) It is not pointed out who will certify the margin of transactions in cash mode of 5%. It appears that assessee himself shall declare the percentage of receipts in cash and non-cash mode.

d) This increased threshold limit for Tax Audit is applicable for a business entity only and the threshold limit for Tax Audit for a professional shall continue to be at Rs.50 lacs even if more than 95% of the transactions are in digital mode.

e) Any assessee whose turnover exceeds Rs.10 crores (5 crores for A.Y. 2020-21), is required to get the books of accounts audited. The rate of profits declared, or method of receipt and payment is irrelevant.

DISCUSSION ON NEW PROVISO ON THE SUBJECT MATTER OF DEEMED CASH FOR TURNOVER PURPOSE:

It is to be noted that cash receipts are to be compared with total receipts and cash payments are to be compared with total payments separately. Cash Receipts/Payments are not to be compared with aggregate of receipts and payments.

The expression “aggregate of all amounts received” denotes the Total Receipts of the assessee in cash and through banking channels. Total receipts invariably include receipt from sales or turnover of the business of the assessee. The words ‘in cash’ only includes receipts in cash mode only. In other words, the assessee must have received the amount in cash.

The words ‘said amount’ refers to “aggregate of all amounts received” (Total Receipts) and not to the turnover or sales amount.

Similarly, the expression “aggregate of all payments” denotes the Total Payments of the assessee in cash and through banking channels. Similarly, the words ‘said payment’ refer to the total payment which is invariably the “aggregate of all payments”.

In certain provisions, the law has used the words “an account payee cheque or an account payee bank draft or use of electronic clearing system through a bank account or through such other electronic mode as may be prescribed” and not the ‘cash’.

Hence transactions in the following modes will be regarded as transactions not carried on in cash-

(i) Account Payee Cheques

(ii) Demand Draft/Pay Order

(iii) Credit Card

(iv) Debit Card

(v) Net Banking

(vi) IMPS (Immediate Payment Service)

(vii) UPI (Unified Payment Interface)

(viii) RTGS (Real Time Gross Settlement)

(ix) NEFT (National Electronic Funds Transfer)

(x) BHIM (Bharat Interface for Money) Aadhaar Pay

CBDT has notified the ‘other electronic mode of payments’ by Notification No. 08/2020 dated 29.01.2020.

The limit of 5% receipt in cash or payments in cash is not limited to sale or purchase transactions. It rather covers all receipts and payments in cash including sales and purchases. In general receipts in cash of the following nature are included-

- Receipt on Sale of goods and services

- Receipt from debtors for the current year sales/outstanding receivables from earlier years

- Sale of fixed assets

- Sale of scrap

- Receipt of Loans and Advances

- Trade advances

- Receipt of deposits

- Sale of investments

Some typical payments in cash of a business concern included are-

- Payments for Purchases

- Payment to Creditors for current year purchases/outstanding creditors

- Purchase of Fixed Assets and other Capital Expenditure

- Payments for salary, electricity, telephone charges, and other revenue expenditure

- Payments for Insurance

- Repayment of Loans and Advances

- Loans given

- Trade Advances given

- Deposits made, etc.

ISSUES WHILE COMPUTING THE LIMIT OF 5% CASH TRANSACTIONS

Some of the issues in computing the limit of 5% cash transactions (receipts and payments) for the purpose of applicability of higher turnover limit of Rs.5 crore u/s 44AB are discussed below-

1. CAPITAL CONTRIBUTION:

When an Individual/sole proprietor introduces capital in his business in cash, then the same shall not be included in the total receipts in cash of the assessee. This is for the simple reason that one cannot transact with himself.

However, the notified ITR forms do not follow this principle. It requires that all the cash receipt of the business including capital contribution should be considered in determining the 5% cash transactions limit.

However, in case of partnership firms, the situation is different since a firm is assessed as a separate person under income tax law and is considered distinct from its partners. To clarify, if a firm receives any capital contribution in cash from any partner, it shall be counted towards the limit of 5% cash transactions limit..

2. DIRECT CASH DEPOSIT INTO BANK ACCOUNT BY CUSTOMERS:

The debtors deposit cash directly in the bank account of the creditors to settle their accounts. Now a question arises whether direct payments deposited in the bank account of the supplier is to be treated as cash or non cash payments. It is to be noted that such payments will be taken as cash payments and will be included in cash transactions even if the assessee debits the bank account in his books, it will be regarded as a cash transaction since the account is ultimately settled in cash. The Allahabad high Court has held in the case of Ajai Kumar Singh KhaldelialTS-35-HC-2020(ALL) that cash deposit in the bank account of supplier is disallowed u/s 40A(3) of the Act. The court held that depositing cash directly in the bank account of the supplier /beneficiary cannot be referred to as payment made through electronic clearing system, covered as an exception under Rule 6DDI(v); Observes that the term use of electronic clearing system through bank account” as stipulated in Rule 6DDI(v) would necessarily include the transaction of funds by electronic mode through clearing system i.e. through electronic mode of transfer such as NEFT, RTGS, IMPS, etc.; Opines that, Such transaction by depositing cash directly in the bank account of the beneficiary is not routed through any clearing house nor is the money send through electronic mode and therefore such a transaction in my considered opinion cannot be covered by Rule 6DDI(v) ”; Moreover notes that the assessee failed to provide any evidence to show that he had deposited the amount on the instructions of the beneficiary or due to any business exigency, thus holds that, In absence of such evidence, the assessing authority rightly denied the benefit of exemption to the petitioner.”, cites SC ruling in Attar Singh Gurmukh Singh.

3. DIRECT CASH DEPOSIT IN CREDITORS ACCOUNT:

It will be included in computing cash payments of the assessee since the account is ultimately settled in cash.

4. RECEIPTS/PAYMENTS IN BEARER CHEQUES:

In case the amount is received by a ‘bearer cheque’ and the same is used for withdrawing cash from the payer’s account, it will amount to a cash transaction.

5. CAPITAL EXPENDITURE:

All the payments in cash are included whether it is paid for revenue expenditure or capital expenditure. There is no differentiation provided in the law.

6. CAPITAL RECEIPT/EXEMPT INCOME–

All receipts include receipts of capital nature and also the exempt income for e.g. Agricultural Income.

7. ADJUSTMENT BY BOOK ENTRY:

In a case where a person is a customer as well as vendor of the assessee. The debtors’ amount is set-off with the amount payable to the same person/vendor. Since no cash is involved in settling the due amount, this will be considered as non-cash transactions.

8. CASH DEPOSITED AND CASH WITHDRAWALS FROM BANK ACCOUNT:

Cash deposits and the cash withdrawals from the bank account amounts to contra entry or transactions with self and hence are excluded for computing the 5% cash limit.

Thus, any receipt of advance, receipt and repayment of loan, direct and indirect expenses, etc. – every transaction is covered in calculating the limit of 5% transactions in cash.

In order to compute the limit, the assessee should aggregate all the receipts from his cash ledger and bank ledger and then find out the percentage of cash receipts.

Similarly, the assessee should aggregate all the payments from his cash ledger and bank ledger and then find out the percentage of cash payments.

If both the cash receipts and cash payments is 5% or less, he shall get the benefit of higher turnover limit of Rs.10 crores for tax audit. Otherwise, the limit of turnover for applicability of tax audit shall be Rs.1 crore.

CONDITIONS FOR THE APPLICABILITY OF NEW PROVISIONS OF TAX AUDIT

Limit of Rs. 10 crore applicable when following conditions are satisfied:

(i) Aggregate of all amounts received in cash does not exceed 5% of the said amount;

AND

(ii)Aggregate of all payments made in cash does not exceed 5% of the said payment

Example: Mr. X, is in business of cloth has turnover of less than Rs. 10 crores during the financial year 2021-22. The following transactions in FY 2021-22 are hereunder:

A. CALCULATION OF TOTAL RECEIPTS:

|

Particulars |

CASH | CHEQUE | TOTAL |

| Cash Sales | 100 | 380 | 480 |

| Receipt from debtors | 20 | 1300 | 1320 |

| Loan receipts | – | 200 | 200 |

| Total | 120 | 1880 | 2000 |

B. CALCULATION OF TOTAL PAYMENTS:

|

Particulars |

CASH | CHEQUE | TOTAL |

| Payment of expenses | 81 | 519 | 600 |

| Payment to creditors | – | 1080 | 1080 |

| Loan payments | – | 120 | 120 |

| Total | 81 | 1719 | 1800 |

C. COMPUTATION OF PERCENTAGE OF CASH RECEIPTS & PAYMENTS

|

Particulars |

TOTAL (A) | CASH (B) | % in cash (B/A *100) |

| Receipts | 2000 | 120 | 6 |

| Payments | 1800 | 81 | 4.5% |

In the given case, Mr. X isn’t entitled to the benefit of the increased threshold limit of Rs.10 crores for the tax audit. In his case, though the payment made in cash during the year does not exceed 5% of total payments, the percentage of cash receipts exceeds the limit of 5%. In this case Mr. X is fulfilling only one condition of payments and the condition in case of receipts is not fulfilled. To take the benefit of this section he has to follow both the conditions.

Whether Mr. X is entitled to get benefit of the limit of Rs.10 crore if he is into the profession?

Clause (a) of Section 44AB talks about a person carrying on business whereas clause (b) talks about a person carrying on a profession. The new proviso to section 44AB providing the enhanced turnover limit of Rs.10 crores for the tax audit is inserted to clause (a) to section 44AB. Thus, the persons engaged in the profession aren’t entitled to claim enhanced turnover limit of Rs.10 crore for the tax audit.

WHETHER THE AMENDMENT BROUGHT BY FA 2020 IS APPLICABLE RETROSPECTIVELY?

Yes, it is trite law that where a provision is curative or merely declaratory / clarificatory of provisions of law shall be applied retrospectively.

- Allied Motors Pvt Ltd Vs. ITO (1997) 224 ITR 677 (SC).

- CIT Vs. Gold Coin Health Food Pvt Ltd (2008) 304 ITR 308 (SC).

- CIT Vs. Calcutta Export Co. (2018) 404 ITR 654 (SC).

- CIT Vs. Ansal Landmark Township Pvt Ltd (2015) 377 ITR 635 (Del. HC).

A. BENEFITS OF NON CASH TRANSACTIONS WHEN BUSINESS TURNOVER IS EXCEEDING RS.1 CRORE BUT UPTO RS.2 CRORE

The turnover limit for audit u/s 44AB(a) is Rs.1 crore. However, Sec 44AD allows a person to declare profits @ 8% or 6% of turnover if turnover is up to Rs. 2 crores. This makes the interplay of Sec 44AB and 44AD more interesting. In such a situation, a person may come across the following situations :

(a) New business started during the previous year

In such a situation, if a person has cash receipts and payments less than 5% then by virtue of the proviso to sec 44AB(a), he is not required for tax audit. But if his cash receipts and payments from business are more than 5% then he is liable for audit under section 44AB(a) of the Act. In both the cases, he has to maintain the books of account . It is also open to the person who has turnover upto Rs.2 crores to declare profits @8% or 6% of the turnover. In such a situation that person will not be liable for audit and maintenance of books of accounts.

Q1. Mr. X has started a new business in P.Y. 2020-21 and has turnover of Rs. 1.5 crore. Whether he will be liable for audit u/s 44AB?

Ans. If the cash receipts and payments from business of Mr. X are more than 5% then he is liable for audit under section 44AB(a) of the Act. Since his turnover is upto Rs. 2 crores he has a option to declare profits @8% or 6% of the turnover. In such a situation that person will not be liable for audit and maintenance of books of accounts. If the cash receipts and payments from business of Mr. X are less than 5% then he will not be liable for audit.

(b) A person who has opted presumptive taxation during any of the previous year

In such a situation, if a person who has opted presumptive taxation in the previous year and he can opt for the same in the current year also. But in case he does not want to opt the provisions of presumptive taxation, he will be liable to maintain books of accounts and get them audited under section 44AB(e) of the Act. It does not matter whether his transactions are less than or more than 95% in any mode other than cash. In this connection, it is to be noted that the proviso to section 44 AB(a) is not applicable to section 44AB(e) of the Act.

Q2.Mr. X is engaged in a business of trading of goods. During FY 2019-20 relevant to AY 2020-21, he reported Total turnover of the business as Rs.1.45 Crore, entire sales were made in cash. Mr. X computed profit from the aforesaid business to be Rs.6.80 Lakh which was his sole income during the year. During FY 2017-18 and FY 2018-19, he opted for presumptive taxation scheme u/s 44AD. Whether Mr. X is required to get his accounts audited u/s 44AB ?

Ans. Mr. X is required to get his accounts audited u/s 44AB(e) of the Act as he had claimed profit from business less than deemed income u/s 44AD i.e., actual income of Rs.6.80 Lakh is less than deemed income of Rs.11.6 Lakhs (8% of 1.45 Crore). Whereas, total income of assessee for the FY 2019-20 exceeds the maximum amount not chargeable of tax. [Section 44AD(5)]

Also, Mr. X Shall not be allowed to avail the benefit of presumptive taxation for next 5 assessment years as well i.e., AY 2021-22 to AY 2025-26 as he was eligible for opting for presumptive taxation u/s 44AD for A.Y. 2020-21 but had not opted for the same [Section 44AD(4) r.w.s. 44AB(e)].

(c) A person who has not opted presumptive taxation in any of the previous year

If a person who has not declared profits u/s 44AD in any previous year and for the current financial year he does not want to opt the provisions of the presumptive taxation then he would be liable for audit under sec 44AB(a)of the Act. If he wants to opt the provisions of presumptive taxation then he is not liable to maintain books of accounts and get them audited.

(d) A person having income below the basic exemption limit

In such a scenario, the following situations may emerge

i. If a person who has declared profits u/s 44AD in any of the preceding previous year, and he does not want to opt the provisions of presumptive taxation for the current year. His total income is below the exemption limit, even then the audit would be conducted as per the provisions of sec 44AB(a). In such a situation, he can take the benefit of proviso to section 44AB(a).

ii. If a person who has failed to opt the provisions of presumptive taxation under section sec 44AD(1) and his income is above the basic exemption limit, then he will be required to get his books of accounts audited u/s sec 44AB(e) even if he declares profits above 8% or 6% of turnover.

Q3. Mr. X is engaged in a business of trading of goods. During FY 2020-21 relevant to AY 2021-22, he reported Total turnover of the business Rs.1.47 Crore, entire sales were made in cash. Mr. X computed profit from the aforesaid business to be Rs.2.15 Lacs which was his sole income during the year. During FY 2018-19 and FY 2019-20, he opted for presumptive taxation scheme u/s 44AD. Whether Mr. X is required to get his accounts audited u/s 44AB for F Y 2020-21?

Ans. MR. X is required to get his accounts audited u/s 44AB(a) of the Act as total income of assessee for the FY 2020-21 relevant to AY 2021-22 is less than maximum amount not chargeable to tax even if he had claimed profit from business less than deemed income u/s 44AD i.e., actual income of Rs.2.15 Lacs is less than deemed income of Rs.11.76 Lacs (8% of 1.47 Crore).

However, Mr. X shall not be allowed to avail the benefit of presumptive taxation for next 5 assessment year as well i.e., AY 2022-23 to AY 2026-27 as he was eligible for opting for presumptive taxation u/s 44AD for A.Y. 2021-22 but had not opted for the same. (Section 44AD(4) r.w.s. 44AB(e)).

This implies that if in AY 2022-23 to AY 2026-27, his total income exceeds maximum amount not chargeable to tax, he shall be mandatorily required to get his accounts audited u/s 44AB irrespective of the fact that his profit from such business exceeds deemed profit stipulated u/s 44AD(1).

(e) A Person who has received commission during the year

A restriction under section 44AD(6) of the Act has been imposed that a person receiving any commission or brokerage cannot opt for the provisions of presumptive taxation. If it is the first year of business and the person receives any commission then he cannot opt the benefits of presumptive taxation. That person will have to get his books of accounts audited under section 44AB(a) of the Act. In such a case, the assessee can avail the benefit of proviso to the section 44AB(a) of the Act.

As per the provisions of sub section 6 of section 44AD, if an assessee has earned any income from specified activities such as commission, then provisions of section 44AD shall have no bearing on such assessee .In such a case, the assessee is not entitled to opt the provisions of sec 44AD.If ,in a year, the chain of sec 44AD is broken due to the receipt of commission ,that will not be considered as the assessee has gone out of the umbrella of sec 44AD.The asseessee is entitled to opt for sec 44AD in subsequent years.

Q4: Mr. X is engaged in a trading business. In P.Y. 2020-21 his turnover is Rs.1.5 crores (all by digital mode) Also he has received Rs.5,000 as commission income. Profit shown as per books is Rs.2,40,000. In P.Y. 2018-19 and P.Y. 2019-20 he has opted for presumptive taxation. Whether he is liable to get his accounts audited u/s 44AB?

Ans: MR. X is not eligible to opt the provisions of presumptive taxation by virtue of the provisions of section 44AD (6) of the Act. In this case the provisions of Section 44AB (a) will be applicable and not Section 44AD (e). However by virtue of proviso to Section 44AB (a), he is not liable to get his books of accounts audited.

(f) Professional firms falling under this category whether they have more than 95% receipts and payments by non cash mode, then these persons cannot take the benefit of proviso u/s 44ab(a) and they must maintain books of account and get the audit done.

This can be understood with the help of an example. Mr. X has started business on 01.04.2019.

|

Previous Year |

Turnover (in Lacss) | Profit % | Whether cash Receipts/Payments up to 5% of total receipts/ payments | Whether income above basic exemption limit | Whether audit required? |

| 2019-20 | 150 | 5% | Yes | Yes | No [Proviso to sec 44AB] |

| 2020-21 | 140 | 5% | No | No | Yes [44AB(a)] |

| 2021-22 | 120 | 10% | Yes | Yes | No |

| 2022-23 | 175 | 4% | No | No | Yes [44AB(a)] |

| 2023-24 | 175 | 4% | Yes | yes | Yes [44AB(e)] |

B. When business turnover exceeding Rs.2 crore but upto Rs.10 crore

As per the proviso to section 44AB (a),in cases where the aggregate cash receipts and aggregate cash payments made during the year from business does not exceed 5% of total receipts and total payments respectively the assessee is not liable to get his books of accounts audited under section 44AB(a) if his turnover does not exceed Rs.10 crores. However if the less than 95% of the business transactions is done through banking channels, the assessee is liable to get his books of accounts audited. This provision is only applicable if the assessee is engaged in a business and not in a profession. A person engaged in a profession is liable to get his books of accounts audited under section 44AB(b) if his turnover exceeds Rs.50 Lakhs.

C. When business turnover exceeding Rs.10 crore

A person engaged in business whose turnover exceeds Rs.10 crores is liable to get his books of accounts audited under section 44AB even if more than 95% of the business transactions is done through banking channels. It is to be noted that the proviso to section 44AB(a) is only applicable to a person engaged in a business. A person engaged in a profession is liable to get his books of accounts audited under section 44AB(b) if his turnover exceeds Rs.50 Lakhs.

BENEFIT OF THE REDUCTION OF DEEMED PROFIT RATE UNDER SECTION 44AD OF THE INCOME TAX ACT, 1961 TO TAXPAYERS WHO WILL ACCEPT DIGITAL PAYMENTS

Section 44AD of the Income Tax Act, 1961 provides that if taxpayer is engaged in the any eligible business and having a turnover of Rs.2 crore or less, its profits are deemed to be 8 per cent of the total turnover or gross receipts.

In order to achieve the government mission of moving towards a cash-less economy and to provide incentive small traders/businesses to proactively accept payments by digital means, it has been decided to reduce the existing rate of deemed profit of 8 per cent under Section 44AD of the Act to 6 percent in respect of the amount of total turnover or gross receipts received through banking channels digital means.

However, the existing rate of deemed profit of 8 per cent referred to in Section 44AD of the Act, shall continue to apply in respect of the total turnover or gross receipts received in cash. It has been provided that this sub-section shall affect as if for the words “eight percent”, the words “six percent” had been substituted, in respect of the amount of total turnover or gross receipts which is received by an account payee cheque or an account payee bank draft or use of electronic clearing system through a bank account [or through such other electronic mode as may be prescribed] during the previous year or before the due date specified in sub-section (1) of section 139 in respect of that previous year……….

The presumptive rate of income would be 8% of total turnover or gross receipts. However, Proviso to sub-section (1) provides that the presumptive rate of 6% of total turnover or gross receipts will be applicable in respect of amount which is received.

- By an account payee cheque or

- By an account payee bank draft

- By use of electronic clearing system through a bank account or through such other electronic mode as may be prescribed.

During the previous year or before the due date of filing of return under section 139(1) in respect of the previous year. It is to be noted that the payment should have been received by an account payee cheque or an account payee bank draft. The payment received by crossed cheque shall be treated as cash payment received. In this connection it is to be noted that the difference between crossed cheque and account payee cheque is that the crossed cheque is being endorsed in favour of a person other than the drawee making it difficult to trace the constituent of the money. Keeping this idea in mind, the crossed cheques are not being considered payment as other than cash. This payment will be treated as cash.

However the assessee can declare in his return an amount higher than presumptive income so calculated, claimed to have been actually earned by him. Therefore here we can see that instead of adopting the accrual method, we have to focus on actual receipt of the sum.

√ Other Electronic Prescribed by CBDT: The Central Board of Direct Taxes has prescribed other electronic modes to provide for the followings as an acceptable electronic mode of payments-

(a) Credit Card;

(b) Debit Card;

(c) Iet Banking;

(d) IMPS (Immediate Payment Service);

(e) UPI (Unified Payment Interface);

(f) RTGS (Real Time Gross Settlement);

(g) NEFT (National Electronic Funds Transfer), and

(h) BHIM (Bharat Interface for Money) Aadhaar Pay”͖

For this purpose, a new Rule 6ABBA with the heading ‘Other electronic modes’ is introduced in the Income Tax Rules, 1962. This rule has been given a retrospective effect and will come into force from 01- 09-2019 even though the notification was issued on 29-01-2020.

This proviso to sub-section (1) has been inserted w.e.f. 01/04/2017 to promote digital transactions. The government has offered incentive to the seller for accepting payment by banking channels or digital means by allowing lower rate of income. This was particularly necessaryto encourage digital transactions after demonetization.

Assessee accepting payment through account payee cheque/ account payee draft or ECS through bank or other electronic mode can declare income at 6 % of turnover/ sales or gross receipts. However, the payment must be received before the due date of filing of return.

Q 5.M/s ABC, a partnership firm, is engaged in the trading business of readymade garments. Its turnover for the previous year 2020-21 is Rs.1,10,00,000. It follows mercantile system of accounting. It has received the amount of its turnover in the following manner

|

Amount of turnover |

Mode of Receipt | Period of receipt of payment |

| 70,00,000 | Account payee cheques | 01.04.2020-31.03.2021 |

| 15,00,000 | Crossed cheques | 01.04.2020-31.03.2021 |

| 10,00,000 | RTGS (2,00,000 received on 25.5.2021) | |

| 10,00,000 | Cash (whole amount received during the P.Y. 2020-21) | 01.04.2020-31.03.2021 |

Rs.5,00,000 is not received by the firm till the due date of filing return of income for the current previous year. The profits and gains as per the books of account maintained as per section 44AA is RS.6,80,000. What would be the total income of the firm for A.Y.2021-22, if it wishes to make maximum tax savings without getting its books of accounts audited?

Ans: M/s ABC is eligible for presumptive taxation as per Sec 44AD, since his turnover is upto 2Cr. Presumptive PGBP income = Turnover/ Gross Receipt x 8% but if turnover or gross receipt isreceived by account payee cheque/DD/ECS upto due date of return of return filing u/s 139(1) and the PGBPIncome = Turnover/ Gross Receipts x 6%.

M/s ABC have not got the books of a/c audited so they can opt for presumptive taxation.

Income 7,20,000 i.e. [(6% of 80,00,000) +(8% of 30,00,000)]

Amount received through account payee cheque or ECS before the due date of filing

= 70,00,000+10,00,000

= 80,00,000

Profit chargeable to tax under presumptive taxation

| PARTICULAR | AMOUNT |

| 8% of Rs.30,00,000 (10 Lacs + 15 Lacs+ 5 Lacs) | 4,80,000 |

| 6% of Rs.80 Lacs (70 Lacs + 10 Lacs) | 2,40,000 |

| Total income from PGBP | 7,20,000 |

Note: It is to be noted that amount received through crossed cheque will be treated as cash.

Example: Mr. X, an individual carrying business of laptopTurnover of Rs.80 Lacs during the F.Y. 19-20. He has received the payments as:

Rs.60 Lacs in cash

Rs.10 Lacs by account payee cheque during the previous year

Rs.4 Lacs by ECS through bank account upto 31st July 2019

Rs.6 Lacs has not been received yet.

Now, since the Turnover is below Rs.2 Cr, he has the option of availing benefits of section 44AD. Mr. X can exercise this option and declare income as

| PARTICULAR | AMOUNT |

| 8% of Rs.66,00,000 (60 Lacs + 6 Lacs) | 5,28,000 |

| 6% of Rs.14 Lacs (10 Lacs + 4 Lacs) | 84,000 |

| Total income from PGBP | 6,12,000 |

Computation of Income under Section 44AD

The benefit to traders and small businesses is explained in following different scenarios considering FY 2021-22

|

Particular |

100% Cash Turnover | 80% Digital Turnover | 100% Digital Turnover |

| Total Turnover | 1.90 Crore | 1.90 Crore | 1.90 Crore |

| Cash Turnover | 1.90 Crore | 38 Lacs | NIL |

| Digital Turnover | NIL | 1.52 Crore | 1.90 Crore |

| Profit on Cash Turnover @ 8% | 15.20 Lacs | 3.04 Lacs | NIL |

| Profit on Digital Turnover @ 6% | NIL | 9.12 lacs | 11.40 Lacs |

| Total Profit | 15.20 Lacs | 12.16 Lacs | 11.40 Lacs |

| Tax Payable under New Regime | 201240 | 122928 | 107120 |

| Tax Saving | NIL | 78312 | 94120 |

From the above table, it is clear that if an assessee makes his transactions in cash on a turnover of Rs.1.90 crore, then his income under the presumptive scheme will be presumed to be Rs.15.20 Lacs at the rate of 8 per cent of turnover, his total Tax Liability under new tax regime will be Rs.2,01,240. However, if an assessee shifts to 100 percent digital transactions and his profit will be presumed to be Rs.11.40 Lacs at the rate of 6 per cent of turnover, his total Tax Liability under new tax regime will be Rs.107120. It is to be noted that by adopting digital system i.e. non cash system. He will save income tax of Rs.94,120 .

LOWER RATE OF INCOME IN DIFFERENT SCENARIOS

As per the proviso to 44AD(1), income can be declared as 6% of the turnover if the payment is received digitally or through banking channel before the due date of return filing u/s 139(1). However, many a times due date for return filing is extended or sometimes it may happen that assessee files his return after due date or he has filed return earlier than the due date. We shall discuss here whether the assessee can claim 6% of turnover as his income under these scenarios.

Case 1- Due date of return filing is extended

The due date of return filing u/s 139(1) is extended by the Income Tax Department due to different reasons such as natural calamities, pandemic, technical glitches etc. The extended date becomes the due date u/s 139(1) of the Act for that assessment year. Therefore, any payment received through banking channel/digitally up to the extended due date u/s 139(1) of the Act shall be eligible for claiming 6% of turnover as income.

Example: Suppose the due date for filing return u/s 139(1) for the A.Y. 2020-21has been extended to August 31, 2020. An eligible assessee who has received payment through account payee cheque, account payee draft, ECS through banking channel or other prescribed modes up to 31/08/2020 shall be eligible for declaring profits at the rate of 6% of turnover.

Case 2- If the assessee files his return after the due date of return.

The proviso to sec 44AD(1) of the Act requires payment to be received up to due date of return filing. Any payment received even digitally/ through banking channel after the due date of return filing shall not be eligible for lower rate of income i.e. 8% of turnover or higher shall be assumed as income.

Q6. Suppose the due date for filing return u/s 139(1) for the A.Y. 2020-21 is July 31, 2020 and the assessee files his return on Dec 26, 2020. Whether receipts through banking channel/ digitally up to Dec 26, 2020 will be eligible for claiming 6% of turnover as profits?

Ans. The receipts through banking channel/ digitally up to July 31, 2020 shall be eligible for claiming 6% of turnover as profits. The payments received after the due date i.e. 31/07/2020 shall not be eligible for lower rates and these payments received after the due date of filing return will not be given the benefit of 6% of turnover.

Case 3- If the assessee files his return before the due date of return.

When the assessee files his return before the due date u/s 139(1) of the Act, he would have considered the facts on the date of filing of return and not assumed the facts beyond that date. The receipts through banking channel/digitally up to date of return filing are considered for lower rate of income and the amount not received yet shall be considered for 8% of turnover as profits. The interesting issue here is what about the payments received through banking channel/ digitally after the date of return filing but before the due date of return filing. Whether these will be considered for 8 % of turnover or 6% of turnover as profits? If 6% is to be considered whether the return can be revised? Let us understand this with help of an example.

Q7. Mr. X has a turnover of Rs.80 Lacs for the A.Y. 2020-21. The due date of return filing is July 31, 2020. He files his return on May 15, 2020. He has received the following payments by account payee cheque:

|

Up to 31/03/2020 |

= Rs.50,00,000 |

| Up to 15/05/2020 | = Rs.15,00,000 |

| From 16/05/2020 to 31/07/2020 | =Rs.10,00,000 |

| Received after 31/07/2020 | =Rs.5,00,000 |

Ans. Mr. X has filed return on 15/05/2020. Till that date, payments to the extent of Rs.65,00,000 has been received by account payee cheque. Mr. X can declare profit from business as:

| 6% of Rs.65,00,000 | = Rs.3,90,000 |

| 8% of Rs.15,00,000 (80L – 65L) | = Rs.1,20,000 |

| Total profits | = Rs.5,10,000 |

Mr. X has received Rs.10,00,000 after date of return filing but before due date of return filing. Mr. X can claim 6% of Rs.10,00,000 as profits by revising the return. There is no doubt that the return can be revised u/s 139(5) before the end of assessment year or up to completion of assessment whichever is earlier.

ITAT Delhi has held in the case of PAWA INDUSTRIES PVT LTD. VS. ITO, ITAT DELHI, 2017 it was held that if an assessee who was eligible for opting the scheme of presumption forgets to take the benefit of same can apply for revising the return to declare a lesser income and therefore file a revised return cannot be denied the benefit available to him.

PRACTICAL DIFFICULTY IN IMPLEMENTATION

The assessee has to maintain complete records about the receipts from customers, whether they are received in cash or through banking channel/ digitally and whether they are received up to due date of return filing or not. Further, the record maintenance is for two financial years. Maintenance of all these records is a cumbersome task for a small business person. It is also against the basic object of presumptive taxation which is to make the taxation system simple, easy and hassle-free for small taxpayers. There is a need to create a balance between the object of less-cash economy and creating ‘ease of doing’ business environment.

****

AUDIT OF ACCOUNTS OF CERTAIN PERSONS CARRYING ON BUSINESS OR PROFESSION.

Section 44AB

Every person –

carrying on business shall,

> if his total sales, turnover or gross receipts,

> as the case may be,

> in business exceed or exceeds

> one crore rupees in any previous year

Following proviso is inserted after clause (a) of section 44AB by the Finance Act, 2021, w.e.f. 1-4-2021:

[Provided that in the case of a person whose—

(a) aggregate of all amounts received including amount received for sales, turnover or gross receipts during the previous year, in cash,does not exceed five per cent of the said amount; and

(b) aggregate of all payments made including amount incurred for expenditure, in cash, During the previous year does not exceed five per cent of the said payment,

this clause shall have effect as if for the words “one crore rupees”,

the words “ten crore rupees” had been substituted; or]

It has been provided further that for the purposes of this clause, the payment or receipt, as the case may be, by a cheque drawn on a bank or by a bank draft, which is not account payee, shall be deemed to be the payment or receipt, as the case may be, in cash.

Read Also:-