In this age of globalization many organizations including individuals have got their wings spread all over the world.

In any country the tax is levied based on 1) Source Rule and 2) the Residence Rule. The source rule holds that income is to be taxed in the country in which it originates irrespective of whether the income accrues to a resident or a non-resident whereas the residence rule stipulates that the power to tax should rest with the country in which the taxpayer resides. If both rules apply simultaneously to a business entity and it were to suffer tax at both ends, the cost of operating on an international scale would become prohibitive and would deter the process of globalisation. It is from this point of view that Double Taxation Avoidance Agreements (DTAA) becomes very significant.

In India the residential status is the key point for determination of income tax. In case of Residents their global income (i.e Indian Income as well as Foreign Income) is taxable in India whereas in case of non-residents only Indian Income is taxable. So we can say that in India residence rule is applied for residents whereas source rule is applied for Non-residents. The residential status of a person is determined based on the provisions of Section 6 of Income Tax Act 1961.

Image courtesy of David Castillo Dominici at FreeDigitalPhotos.net

Many a times, it is seen that in case of residents, the income tax has been paid in other countries on their income abroad (i.e Foreign Income) and on the same income they are also required to pay tax in India. In such cases, there are provisions of providing relief from double tax. Basically there are two sections (i.e section 90 and section 91) in Income Tax Act 1961, which provides relief from Double tax.

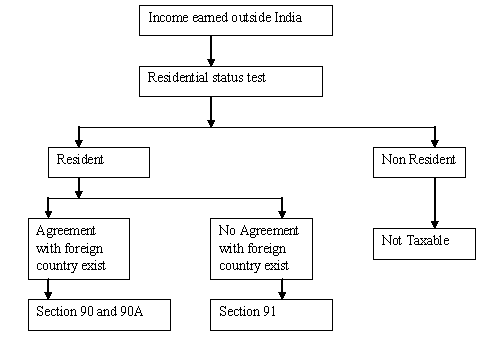

The application of section 90 and 91 can be explained with the help of the following diagram.

As can be seen from the above diagram that section 90 is applicable in cases where India has entered into a Bilateral agreement with other country and section 91 is applicable in case where there is no such bilateral agreement (i.e there is unilateral agreement)

As of now India has entered into DTAA with 93 countries and Limited Agreements with 8 Countries.

Where the Central Government has entered into an agreement with the Government of any country outside India or specified territory outside India, for granting relief of tax, or as the case may be, avoidance of double taxation, then, in relation to the assessee to whom such agreement applies, the provisions of this Act shall apply to the extent they are more beneficial to that assessee. However the provisions of Chapter X-A(GENERAL ANTI-AVOIDANCE RULE) of the Act inserted wef 01.04.2016 shall apply to the assessee even if such provisions are not beneficial to him.

Where there is an DTAA agreement (Section 90)

U/s 90 there are two methods of granting relief under Double Taxation Avoidance Agreement.

1) Exemption method – A particular income is taxed in one of the both countries and exempted in the other country. (For example- For the Income from Dividend, Interest, royalty and fees for technical services source rule is applicable in treaty with Greece, Libyan and United Arab Republic. So for a citizen of these 3 countries if the dividend, interest, royalty or fees for technical services is arising in India, then it will be solely taxable in India only and if for a resident if such income is arising in any of these 3 countries then the income will solely be taxed in these 3 countries and it will not be at all taxable in India).

2) Tax Credit method- The income is taxed in both the countries as per the treaty and the country of residence will allow the tax credit / reduction for the tax charged in the country of source. For example- Mr A (an Indian resident) has received salary from a US company for job in US. Since Mr A is a resident so his global Income will be taxable. In this case source country is US (since the service has been rendered in US) and resident country is India. So at the time of computation of tax liability of Mr A the tax paid in US will be allowed as set off against his total tax liability but limited to the tax payable on such foreign income at Indian tax rates.

In case where Bilateral agreement has been entered u/s 90 with a foreign country then the assessee has an option either to be taxed as per the Double Taxation Avoidance Agreement (hereinafter referred as “DTAA”) or as per the normal provisions of Income Tax Act 1961, whichever is more favourable to assessee. [CIT Vs ITC Ltd (2002)]

For example: As per DTAA between Indian and Germany, tax on Interest is specified @ 10% whereas under Income Tax Act 1961, it depends on slab rates for individuals & HUF and flat rates (generally 30%) for other kind of assessees (like firm, company etc). Hence one can follow DTAA and pay tax @ 10% only.

Where there is an NO DTAA agreement (Section 91)

(1) If any person who is resident in India in any previous year proves that, in respect of his income which accrued or arose during that previous year outside India (and which is not deemed to accrue or arise in India), he has paid in any country with which there is no agreement under section 90 for the relief or avoidance of double taxation, income-tax, by deduction or otherwise, under the law in force in that country, he shall be entitled to the deduction from the Indian income-tax payable by him of a sum calculated on such doubly taxed income at the Indian rate of tax or the rate of tax of the said country, whichever is the lower, or at the Indian rate of tax if both the rates are equal.

(2) If any person who is resident in India in any previous year proves that in respect of his income which accrued or arose to him during that previous year in Pakistan he has paid in that country, by deduction or otherwise, tax payable to the Government under any law for the time being in force in that country relating to taxation of agricultural income, he shall be entitled to a deduction from the Indian income-tax payable by him—

(a) of the amount of the tax paid in Pakistan under any law aforesaid on such income which is liable to tax under this Act also; or

(b) of a sum calculated on that income at the Indian rate of tax;

whichever is less.

(3) If any non-resident person is assessed on his share in the income of a registered firm assessed as resident in India in any previous year and such share includes any income accruing or arising outside India during that previous year (and which is not deemed to accrue or arise in India) in a country with which there is no agreement under section 90 for the relief or avoidance of double taxation and he proves that he has paid income-tax by deduction or otherwise under the law in force in that country in respect of the income so included he shall be entitled to a deduction from the Indian income-tax payable by him of a sum calculated on such doubly taxed income so included at the Indian rate of tax or the rate of tax of the said country, whichever is the lower, or at the Indian rate of tax if both the rates are equal.

Misuse of DTAA, Treaty shopping and amendment made by Finance Act 2012

Treaty Shopping occurs when the resident of a third country takes advantage of the provisions of DTAA between two countries.

As per the DTAA with Mauritius, Capital Gain accruing in India to a resident of Mauritius is not taxable in India subject to certain exception. Again there is no capital gain tax applicable in Mauritius. Hence it leads to tax exemption in both the countries.

FIIs (Foreign Institutional Investors) in order to take advantage of such treaty get themselves incorporated in Mauritius and becomes the resident of Mauritius. As held by the Supreme Court in the case of UOI Vs Azadi Bachao Andolan (2003) and via CBDT Circular No 789 dated 13.04.2000 it has been clarified that wherever a certificate of residence is issued by Mauritius Authority, such certificate will constitute sufficient evidence for accepting the status of residence as well as beneficial ownership for applying DTAA accordingly. Hence a number of cases of treaty shopping has been observed which is very legal.

In order to curb this treaty shopping section 90 has been amended by Finance Act 2012, by which now submission of Tax Residency Certificate (TRC) will be a necessary but not sufficient condition for availing the benefit of the agreements referred to in this section. The format of TRC will be notified by board. It appears that after notification of the format of TRC it will be difficult for an intermediate country like Mauritius to issue TRC to certify that a global company has significant operation in Mauritius.

The details of DTAA can be extracted from the site www.incometaxindia.gov.in

Contributed by: CA Srikant Agarwal

srikantagarwal@bharatpetroleum.in, srikant.agarwal@gmail.com

Click here to read Other Articles of CA Srikant Agarwal

(Republished With Amendments)

Very good Article with good clarify and in simple and understandable language

My son is an NRI since last 5 years, he works in a Pvt Ltd company at Bahamas and is getting his salary in Bahamian dollars. Bahamas is a Tax Free Zone and no tax is aplicable on salary.

Due to recent introduction of Form ITR 2, how and where to show the income received outside India. I am confused I filed Form ITR 1 for his Bank Interest income and other income received in India on FDR’s in his NRO account and for other professional work he did online. Please guide me properly.

Hi Srikant,

I came back from USA to Induia in Aug2019, so when i get my Indian salary in FEB2020, company has deducted tax for the salary paid in US (deducted tax in India on my global income).

I am ending up paying tax in US and in India also for the period of April 2019 to Aug2019

Please guide.

Hi Srikant,

I am a German nation and works in Germany for Indian company and the India company make the consultancy fees every month to me.While making the payment, Indian co deduct 20% TDS.I would like to know whether i can get any benefit while taxing in Germany

Sir

I am indian resident having salary income in india

also received dividend in$ from U. S. based co

after deduction of tax

How i can claim tax deducted by u s co.

How i will show dividend income recd.from usa

Further bank has also deducted service charges for

realisation of foreign currency

Sir good evening.

My daughter worked in india upto september 2020 and on 31 January she went to UK and joined her job in the month of Feb 2021. So i have lots of confusion while filling ITR as she will be treated as resident for FY 2020-21. I Have gone through DTAA Section (90) but not clear to me. Will you pls guide me to file ITR to avoid any future complications.

Regards

Tarun Kumar

Bhilai (CG)

Dear Srikant,

Your explanation is very useful and clear. But I need more information and some clarity. My case is also Double taxation with Germany. I worked in Germany as deputation as Company contract.

Income Earned in Germany : xx

Income earned in India : yy

The Income in both the places is from my employer.

Tax in Germany : Slab rate for (xx + yy )

Tax in India : Slab rate for yy.

I am bringing the saved earning of xx to India.

What is the amount of tax to be paid in each country ?

Regards,

Santhosh

I am Indian resident and a retiree. I received Pension arrears for the period of 1-1-1996 to 30-9-September 2013 during this F.Y i.e 2016-2017. Please inform the rule under which I can claim the arrears to the relief to avoid double taxation. Also please inform what information is necessary while filing the Income Return. I have been I.T.Returns regularly.

I am an individual Indian Resident. I got pension arrears for the period of 1-1-1996 to 30-9-2013 during this Fin. year i.e 2016-17.

Pl inform the steps to be taken to avoid double taxation and get the tax relief . Pl quote the relevant tax rule for this purpose.

Kishen Narayan

My daughter is an Indian resident; works for Canadian firm on salary which is credited to her Bank a/c in Canada, and TDS regularly deducted by the firm. She also has income in India.

1. Which method would be practicable and suit her most?

2. Also what documents are to be submitted to Indian tax authorities for claiming tax credit? (Canada will not give TRC for Canadian Non-residents) Will the Firms monthly salary slips do? Any thing else?

3. She has worked there during November and December 2016. In Indian ITR 4, can she claim credit for 5 months Nov 2016 to March 31 2017, assuming TDS has been made for these 5 months?

I shall be grateful for your kind clarification.

DCB

Dear sir.

I have earned foreign income as well as Indian business income. But i have paid taxes on foreign income in that country. While filing I.T. Return in India, I should show foreign income or not. If yes then under which Head.

As there is double taxation Avoidance agreement between India and Foreign country. so can you suggest me what to do, and how where to show Income.

Sir it really helps me to understand both the sections. Thanks.

SIR,

i have salary income from usa and i am ordinary resident in india for the current year. i paid tax in usa on the salary from there now while claiming relief under section 90 i want to know for which taxes i will get the relief as taxes paid in usa inclues different kind of taxes like FICA-OASDI,Federal withheld tax,FICA-HI, FICA, California, CA ST DISAB etc.

in continuation to my previous mail

company is A is belonging to India and has branch in UK also.

my query is that x is non resident in india for fy 2014-15 but he was in india for 55 days and works for A company and was residing in UK. UK govt already deducted tax on amount received there and also company in India deducted TDS for entire amount received both in India and UK and issed form 16 for full amount.

when this is raised before the company about non requirement of TDS in INDIA for whole amount of salary they are not hearing to it and asking to claim relief in INDIA.

what should be the procedure to claim relief in INDIA or any other suggestion to avaid Double taxation.

An assesee who is a resident recieves bank interest in australia.the assessee comes in 10%slab. dtaa agreement states that such interest shall be taxable at 15%.How the tax liability will be computed. australian bank deducts tax@1% on such interest.

Dear Mr Srikant,

Thanks for this informative article.

Extending the discussion on the topic raised by Mr Sunil and then the detailed computation done by you, in regards to India + UK dual taxation.

I have a further complex case.

Adding to the complexity in this case is the fact that.

Suppose that the company of Mr A, provides to Mr A along with UK salary, an accommodation as well as Health insurance Costing 10000 GBP and 1000 GBP respectively.

As per UK laws this amount is taxable in UK however the tax has to be borne by employer and not employee.

For accounting purposes all these benefits have to be shown in salary slip in different heads.

The final UK P60 for the employee is thereby as follows:-

UK Income:– 19303 GBP [8303 + 10000+1000]

PAYE tax in UK:– 3362 GBP [1162 + 2000 + 200]

Should the employee while filing return in india deduct the 11000 GBP paid by company towards benefits. If so how would the calculations be done?

I am a resident in India. I have pension and rental income in India. I received $15 a month by way of canadian pension plan which is given for my contribution to canadian pension plan while I was a student in canada. I have no other income or assets abroad. What form should I submit? My income details are as follows.

Pension 532212

Interest 324485

Income from ptoperty 145424

Canada pension 8650 on which tax dededucted Rs. 2163. Is there any tax relief? If so how do I calculate under sec 90? I have paid total tax plus edu cess Rs 89379.

What is now tax due. What form should I submit? Thanks . Please reply to my email

Sir

I am a Green Card Holder in USA.

I own an IT company (SLP company) in USA (Say M/s ABCD)

But I stay in India (Indian resident as per law) and operate the company from India.

My USA clients pay in USD for the services I provide and deposited in USA company account of M/s ABCD. (say 1,00,000 USD for the year 2014)

At periodic intervals I transfer some amount to my other US bank account, taken as salary(say 55000 USD in the year 2014)

and then some of that amount I transfered to my Indian Bank account (say 40,000 UDS)

The money left at my company M/s ABCD account at the end of the year 2014 is 45,000 USD)

I paid tax at US for the company earnings for the year 2014 (say 8,000 UDS)

I paid tax for my personal income (taken from the company toward salary 55,000 UDS) as given above say 5,000 USD.

I do not have any income in India.

Please guide me the tax liability for the year 2015 assessment year as per Indian practice.

regards

S.Nagarajan

dear sir,

I my conducted study visa for Australia, New Zealand, canada. and we are received commission for colleges against student study visa.

college give me commission deduction after GST . Kindly suggest me we are claim for GST in India against Income Tax. What is the section is under?

waiting for reply……

Hi Srikant,

I was in Australia from 5th Aug 2012 till 31st Dec 2013. So for FY 2013-14 will i be considered as resident of India??, and for FY 13-14 from 1st April 14 to 1st Sept 14 there was only one Australian component in my salary, but from 1st Sept 14 there were two components introduced in my salary package 1st was Australian and 2nd was Indian,however my gross salary was the same. Now from 1st April 14 to 31st Dec 13 tax was deducted in Australia on gross salary and a tax was also deducted in India for period Sept 13 to March 14, resulting double taxation from Sept 13 to Dec 13.Can i get the benefit of double tax deduction and how can i file the return.

Thanks,

Ajay Sharma

Hi I provide services to foreign companies for services in and outside India and earn commission in foreign currency. Up until now there was no service tax for such services. Now my CA has informed that service tax is payable on all the commissions received from foreign companies effective September, 2014. My foreign clients are not

ready to pay service tax as this law is not applicable in their country. How do I tackle this situation as I will have to pay 14% out of my pocket.

Hi ,

I have around 300000 USD in India in a FD , if i am resident in Australia form current year only what amount of tax do i need to pay on this amount of interest earned from Indian bank which is then brought to Australia in AUD.( principle amount is earned before i was an Australian resident with permanent residency visa)

Dear All,

I have a case in which a person earns income from US but payable in India. He is resident. Now if TDS is deducted in both the countries, how could i claim refund for such TDS.

Hi

My name is Vijay. Our company (Indian company) works with a colombian company where the taxation is 33%.

Lets assume if we bill the colombian client for the service we offer for them from India.

If our billing amount is USD 1000, the client deducts 33% which is USD 330 and they say it is as per the colmbian taxation rule.

Is there any chance to avoid this tax legally. Or if we are forced to pay this, is there any chance to get exemption in our Indian Income tax. Please advise.

Dear,

MY INCOME:

1) I am working in Oman as expat employee to a Omani based Company. I am not a business man.

I earn monthly salary PLUS yearly Bonus. There is NO tax paid in Oman on Expat’s salaries.

All our expat salaries are routed through individual’s Saving Bank Accounts in Oman and it is quite natural, there will be some amount in the saving banks Accounts in Oman at any piont of time…

2) I have other source of (only Interest) Income from India as follows:

2a) Interest from the NRE Saving Bank and FDs

2b) Interest earned from NRO Saving banks and FDs

I have NO OTHER SOURCES on Income such as capital gains / House property debenture / shares etc

Oman is also coming under DTAA with India and flat rate of 10%. What does it means…

I have impression that all foreign earned income (monthly Salary + yearly commissions earned in Oman) are EXEMPT income as it is foreign (earned) source of income.

It is NOT necessary to pay any Tax on interest received from NRE Savings or NRE FDs.

It is only necessary to pay tax on Interest earned from NRO Saving Accounts and NRO FDs at 10%.

Please guide me how to fill the following in the Java Utility IT Assessment Return form ITR-2:

A) Schedule FSI

B) Section TR

C) Section FA

I guess these three sectiona are to be filled by Indian residents represent companies who depute them to foreign countries for their work or for the residents earn money outside countries and not for NRIs.

Are the above sections related to NRIs? If it is related …how to fill the same.

I will be happy if you can guide me in this regards. Thanks.

Rajakumar / Muscat / kumarksa@yahoo.com

tax treatment in case non resident salaried individual with an annual income of 2500,000 INR wanted to file an ITR…….salari is credited in NRE account

guidance required in filing of incometax return

Can individual claim basic exemptions in both India and UK as resident?

UK allows non-resident to claim basic exemption as resident on global income on arising basis

OR get taxed on UK earnings only without basic exemption.

How is UK dividend going to be clubbed with UK salary and taxed in India? Can you please add an example to above case and answer?

Hi,

I have transferred around 12 lakhs of rs from UK during last financial year 2012/13.This was tax paid amount in UK I earned during year 2011.

Will this amount be taxable now in India for me as I have been residing in India since mar 2012.How can I claim tax benefits on this & do I need to mention this in my returns.

Thanks

dear sir

I am Indain earned salary from outside india in arab get salary 8 lakh per year

pls calculate income tax in india filling of income tax return

AT THE TIME OF IMPORT FROM A NON DTAA MATERIAL TRANSFERRED ON INDIAN PORT WILL IT CONSIDER ON THAT TIME AS BUSINESS CONNECTION IN INDIA ?????

Hello,

I have worked in India from April/12 till Jan/13. Since 30/01/13 I am working in UK salary(intra-compamy transfer from Indian Company) . For Indian salary my employer has deducted Tax at source which is applicable as per Indian Law.

My UK salary for Feb and March is less than 8000£. So after accessing it is found not taxable as per UK law.

In this case what will be my Tax obligation in India for Feb and March Salary? Please explain.

Thanks & Regards

Samarjit

Sir I want to know the tax implication if somebody is resident in India and having interest income arising from US country in NRO account?

I worked in India from April 2012 to Nov 2012. Earning were 4,80,000. From Dec 1st 2012 to March 31st 2012; I stayed in UK and earnings were 11,54,667. I have paid income tax in the UK on my UK earnings ( deducted from Salay )

Whats my Tax obligation in India

Hi srikant,

My client is a director in a Malaysian Company. He earns Directors remuneration over there. He has not remmited such remuneration till date. I want to know the status of taxation for the current year:-

a) If he remits current year remuneration.

b) If he remits previous year’s remuneration

Thanks a lot for the useful suggestions.

Dear Srikant,

Your article is very useful,but can you please let me know,in my case:-

I am a resident of india & stays in india and get my salary from a mauritius company direct in my bank account,in this case my income will be taxable in india or not.

Waiting for your early reply.

best regards

pankaj

Hi to every body. Now i am doing ICWA intermediate, ihave one doubt in applied direct taxation. 1.Income from Profession Rs 300000 2. Share income from a partnership in country x ( Tax paid in country Y for this incomein equivalent indian rupee Rs 25,000)

3.Commission income from a concern in country y ( taxpaid in country Y at 20%) converted into Indian rupee

4. Interest from Schedule banks Rs 20,000

They computed total income is Rs 560000

Tax liability is @560000 Rs 117000 –> How they compute and Get Rs 117000?

Post the comment immediately…

Great answers.

My question is that can we declare this relief under Section 90 or 91 to my India employer and ensure that he calculates the India tax based on the relief so that I do not end up paying extra tax and then claiming.

Or is it something that I have to do while filing my ITR 2?

Regards

Ranjit

Hi Sachin,

Your status will be ROR, so his global income will also be taxable in India. But he will be

entitled to relief under section 90 of I T Act.

The general rule of computation of relief is as under:

Ascertain doubly taxed income.

Ascertain tax by applying Indian rate of tax as well as rate of foreign country separately.

Whichever is less , relief is given to that extent.

Example: All calculation in Rupees

Salary from India

1-4-2011 to 31.12.2011- 4,50,000 TDS deducted- 50,000

Salary from Australia

1.1.2012 to 31.03.2012- 2,40,000 TDS deducted- 30,000

Total Income- 6,90,000

Tax on above in India-70,000

Ascertain doubly taxed income i.e, 2,40,000

Tax by applying Indian rate- 24,000

Tax of foreign country-30,000

Relief will be 24,000 only. Therefore he can refund of 4,000. (70000-50000-24000=4000)

ITR- 2 should be filled with IT Act.

Hi Srikant,

Continuing with Sachin’s question, is there any deduction allowed on foreign income. Say if the income per month abroad is Rs 1 lac, the income tax dept. would consider 1 lac is the taxable income or exempt housing or other cost of living which is 2-3 times or more costlier abroad depending on country to country? My point is since cost of living is so high, govt. would consider gross income or net income for tax.

Secondly, incase an employee joins a company based outside India in say Nov and continues to stay outside India for say 1 year or more. In this case, the employee will have to pay tax on “Indian income from Apil-Nov + gross income abroad from nov-march”?

Hi Srikant, Please let me know the treatment in my case:

I am a TCS employee. I was sent to Austrailia for a assignment on 31 st December 2011 and I stayed there till year end, So I am a resident of India for FY 2011-2012. Now when i have received form 16 for AY 2012-2013 it is only reflecting salary upto december 2011. Altough I received salary slips in australia in which I see tax of thier country was deducted. My Question is how should I file the return and in which ITR form.

Dear Mr Sunil,

Good morning. From your query I understand that Mr A has earned salary in UK for 4 months only.

Firstly we need to know the residential status of Mr A. If he has stayed in India for 182 days or more then he will be treated as Resident else he will be treated as Non-resident.

If Mr A is non-resident, then his UK income will not be taxable at all in India and he will have to pay tax on his salary income of Rs 3.90 lacs and rental income of Rs 2 lacs in accordance with the provisions contained in Income from Salaries and Income from House property.

If Mr A is Resident then his global Income (i.e Indian as well as Foreign Income will be taxable). Since India has entered into a bilateral agreement with UK so he will be governed by section 90 (i.e he will be guided by the agreement between Indian and UK).

Article 24 (Elimination of double taxation) of the agreement between India and UK extract is reproduced below to have a clear understanding of the matter:

Article 24(2). Subject to the provisions of the law of India regarding the allowance as a credit against Indian tax of tax paid in a territory outside India (which shall not affect the general principle hereof), the amount of the United Kingdom tax paid, under the laws of the United Kingdom and in accordance with the provisions of this Convention, whether directly or by deduction, by a resident of India, in respect of income from sources within the United Kingdom which has been subjected to tax both in India and the United Kingdom shall be allowed as a credit against the Indian tax payable in respect of such income but in an amount not exceeding that proportion of Indian tax which such income bears to the entire income chargeable to Indian tax.

If we assume Previous year to be 2011-12 and Mr A to be an individual and below 60 years of age, exchange rate between India and UK Rs 80/GBP then the tax computation will be as below:

S.N Particulars Am Rs

A Foreign Income 664,240.00

B Indian Salary 390,000.00

C Rental Income 200,000.00

1,254,240.00

D Deduction u/s 80 (assuming Nil) –

E Total Income 1,254,240.00

F Indian Tax payable (calculated at slab rates) 235,120.00

G Indian Average rate of Tax (F/E*100) 18.75

H UK Income (8303*80) 664,240.00

I UK Tax (1162*80) 92,960.00

J UK average rate of Tax (I/H*100) 13.99

K Rate at which rebate is admissible (lower of G and J) 13.99

L Doubly taxed Income (i.e H) 664,240.00

M Amount of Rebate (L*K/100) 92,960.00

N Tax payable in India (F-M) 142,160.00

Hope above clarifies your query.

Regards

Srikant Agarwal

Srikant.agarwal@gmail.com

Such a useful articles.

kindly explain this with equation to understand more that Mr. A earned Salary in U.K. GBP 8303 and tax deduct there GBP 1162 for 4 month, and in india he earned Salary Rs. 3.90 Lakhs and rental income Rs. 2 Lakh. then how to calculate tax ?