If a tax deductor done any inadvertent mistake at the time of making payment of tax than how to correct the challan detail which is already generated with wrong data. Before knowing the procedure to correct error in TDS challan we need to know about that what is the types of mistakes.

Page Contents

A. Type of errors in TDS Challan

1. TAN

2. Assessment Year

3. Major Head code

4. Minor Head Code

5. Nature of Payment

6. Total Amount

7. Name

Note – Deductee will not able to get tax credit in presence of such type of errors.

B. Procedure to Correct Error in TDS Challan

1. TAN Number Correction

If Deductor are deposited tax in another TAN than he is not able to do correction in challan. Two Method for correction are available mentioned below: –

| S.no | Tax deposit method | Authority to correct |

| 1 | Online challan Deposit (e -payment) | Concerned assessing officer |

| 2 | Physical challan deposit in bank | Bank- if correction request received within 7 days from challan deposit |

| After 7 days – Concerned assessing officer |

1.1. Step for submit application to concerned assessing officer for tan correction

1. If challans paid through online mode than taxpayer may contact their concerned Assessing officer of the income tax department.

2. Write an application on letter head of taxpayer to concerned assessing officer for correction of TAN NUMBER in deposited challan.

3. List of Document need to be attached with application

a. No objection Certificate

b. Affidavit

c. Tan Number Certificate

d. Copy of challan

e. One Id proof of taxpayer

4. After that Application will be submitted with all required documents to concerned assessing officer of income tax department.

1.2 Steps of request to bank for TAN correction

1. The taxpayer has to submit the request form to the concerned bank

2. Request should be done with in the 7 days from challan deposit

3. Any correction request initiated by the taxpayer after the time limit specified above shall be rejected by Bank

4. Attach copy of original challan

5. If challan is more than one than a separate request form is to be submitted for each challan.

6. If tax payer is other than individual than the authorisation letter of authorized person should be attach with seal sign

7. Form of correction in TDS challan will be provided by bank

2. Assessment Year, Minor Head, major Head , nature of payment Correction

If taxpayer choose wrong Assessment year, Minor Head, Major Head, Nature of Payment at the time of deposit of tax than he will also able to do correction through TRACES portal. Please follow the steps mentioned below for doing correction in challan: –

1. First go to website https://www.tdscpc.gov.in/

2. Login TRACES id

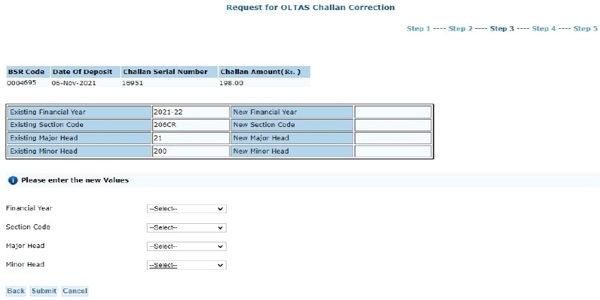

3. After login click on statement /payments Tab and select Request for OLTAS Challan Correction and proceed

4. After proceed you need to enter challan details for which OLTAS correction is to be submitted

5. Challan Detail are Covered: –

a. BSR Code

b. Date of Deposit

c. Challan serial Number

d. Challan Amount

Fill the required information of challan and proceed

6. Select the tab type of correction and do required correction by drop down and click on submit button.

Challan correction screen: –

7. After that You will get a request Number for track the status of submitted correction in future.

8. Challan Correction request will proceed with in one day.

3. Correction in Total Amount and Name

If Total amount of challan or name wrong entered by bank at the time of deposit of challan than bank is able to do this correction with in 7 days on request of taxpayer.

This is possible only in case of physical challan deposit.

C. Some Important Points Related To Correction In TDS Challan

1. Minor head means- It is related to deductees. If deductee is:-

a. Company – (0020) is Minor head

b. Non company – (0021) is Minor head

2. Major Head means- It is related to type of payment. Two types are available: –

a. (200)- TDS/TCS Payable by Taxpayer

b. (400)- TDS/TCS Regular Assessment

3. No objection Certificate will have to be taken from the tan holder in which we have made wrong tax deposited by mistake

I want to change nature of payment from 92A to 92B. Under Oltas challan correction 92B is not coming for selection. How can i change

Assessee has made a payment of tds through his e-filing login on purchase of immovable property.But he has selected the wrong major head and minor head.How to correct it now.It has already been 2 months

How to change challan 282 to 280 and major head 0024 to 0021 for self assessment tax minor Head 300

Is it possible to correct TAN to PAN in income tax challan. If yes, what is the procedure?

Please send me NOC draft for TAN correction in TDS challan.

i have paid TDS 2nd qtr of FY 2022-23 payment mistakenly selected 2022-23 assessment , now hoe to change this

I have made the TDS payment of Rs.54000.00 in 26QB for purchasing property and challan of the same generated. But in challan status claim amount in statement shows Rs.8039.00 and status is partially consumed as well as available balance shows Rs.45961.00. So, I have made correction in Form 26QB (Amount Paid/Credited) through digital signature and same verified by the builder and now the correction status is ” Pending for AO approval”. Will it get auto approve or what??

It is not auto approved correction. AO are authorised to do correction. Please wait 4 to 5 days.

i have paid TDS 3rd qtr of FY 2022-23 on 05/12/2022 payment mistakenly selected 2022-23 assessment , now how to change this

Affidavit format please for submitting for correction of TAN

i have paid TDS 2nd qtr of FY 2022-23 payment mistakenly selected 2022-23 assessment , now hoe to change this

IN CASE IF U HAVE MAKE MISTAKE PAYMENT REGARDING FY & AY THEN U HAVE TO PREPARE THE LETTER IN THE NAME OF TDS INCOME TAX DEPT AND U HAVE TO SUBMIT LETTER INCLUDING CHALLAN WHICH U HAVE PAID IT TAKES 1 TO 3 WEEKS.

within how many days after online correction would the changes in challan be reflected any idea??