PAYMENTS RELATING TO MICRO, SMALL AND MEDIUM ENTERPRISES – IMAPCT OF SECTION 43B(h) and FAQs

Introduction

The Finance Act, 2023 through inserting section 43B(h), applicable from AY 2024-2025, has tried to help small enterprises by ensuring timely payment to micro and small enterprises which are registered under MSME Act, 2006.

However, such provision has created a chaos and fear in the entire business world. This article aims to help business to understand new provision and provide guidelines for various enterprises.

Guidelines for all enterprises:

1) Get registered at Udyam website, if they are eligible for micro, small and medium enterprises.

Composite criteria of investment and turnover is as under:

| Category | Investment in P&M at WDV (income tax) | Turnover |

| Micro | 1 crores | 5 crores |

| Small | 10 crores | 50 crores |

| Medium | 50 crores | 250 crores |

Source– F. No. 2/1(5)/2019-P&G/Policy (Pt.-IV) dated 01-06-2020

Note:

a. Export turnover to be excluded in computing turnover.

b. Investment in P & M does not include the cost of pollution control, research and development, industrial safety devices and such other items as may be specified, by notification.

2) Registration is based on last year statistics.

3) Criteria has to be seen on PAN based, not organization wise.

4) Provisions of 43B (h) is applicable for micro & small category only, that too for manufacturer and service provider. Also unlike other items of 43B , such payment is not allowable even paid before due date of return filing.

Relevant extract from Income Tax Act, 1961 is as under:

43B. Notwithstanding anything contained in any other provision of this Act, a deduction otherwise allowable under this Act in respect of:

h) any sum payable by the assessee to a micro or small enterprise beyond the time limit specified in section 15 of the Micro, Small and Medium Enterprises Development Act, 2006 (27 of 2006),

shall be allowed (irrespective of the previous year in which the liability to pay such sum was incurred by the assessee according to the method of accounting regularly employed by him) only in computing the income referred to in section 28 of that previous year in which such sum is actually paid by him :

Provided that nothing contained in this section except the provisions of clause (h) shall apply in relation to any sum which is actually paid by the assessee on or before the due date applicable in his case for furnishing the return of income under sub-section (1) of section 139 in respect of the previous year in which the liability to pay such sum was incurred as aforesaid and the evidence of such payment is furnished by the assessee along with such return

5) Do fill proper category as trader/manufacturer/service provider i.e. which is enterprises main activity.

6) Manufacturing means any process which results to new identifiable product with separate name, identity, usage. Single process may result to manufacture & corollary many processes may not amount to manufacturing.

Eg: Cutting of cloth is not manufacturing, but making of garments is manufacturing.

7) Manufacturer is one who himself manufactures or get it from others on account of him. For proper understanding of term manufacturing one may refer to Apex court decisions. In Union of India Delhi Cloth Mills Co. Ltd. AIR 1963 SC 791 = 1963 Suppl (1) SCR 586 = 1977 (1) ELT (J199) (SC) and 1990 (27) ECR 151 (SC five member constitution bench) it has been held that the manufacture means: bringing into existence a new substance. Manufacture is end result of one or more processes, through which original commodity passes. Thus, manufacture implies a change but every change is not manufacture. A new and different article must emerge having a distinctive name, character or use.

Manufacture under Central Excise law is the process or activity which brings into being articles which are known in the market as goods, and to be goods these must be different, identifiable and distinct articles known to the market as such. For articles to be goods, these must be capable of being sold or being sold in the market as such – Hindustan Polymers v. CCE – 1989 (43) ELT 165 (SC) = (1989) 4 SCC 323 = AIR 1990 SC 1676.Test to determine leviability of excise duty is whether a new commercial commodity has emerged. Ujagar Prints v. UOI 39 ELT 493 (SC) = 1989 (3) SCC 488 = 179 ITR 317 = 42 Taxman 151 = AIR 1989 SC 516 = 74 STC 401 (SC) (5 member Constitution bench)

8) It is advisable to mention Udyam registration No. on invoice itself.

9) Period of limitation of payment, starts from date of acceptance i.e. date of actual delivery of

goods or rendering of services.

Liability of buyer to make payment is regulated by section 15 of MSME Act,2006

15. Where any supplier, supplies any goods or renders any services to any buyer, the buyer shall make payment therefor on or before the date agreed upon between him and the supplier in writing or, where there is no agreement in this behalf, before the appointed day:

Provided that in no case the period agreed upon between the supplier and the buyer in writing shall exceed forty-five days from the day of acceptance or the day of deemed acceptance.

10) If supply is questioned for quality etc, one must communicate the same to supplier in writing (need not necessary on paper) within 15 days of receipt of goods or services. Then period of limitation of payment shall commence from date of rectification by supplier.

11) For delay in payment to such supplier interest is payable in accordance with section 16 of MSME Act,2006 i.e. three times of rate notified by RBI (presently notified rate is 6.75%). Date from which and rate at which interest is payable is regulated by section 16 of MSME Act, 2006.

16. Where any buyer fails to make payment of the amount to the supplier, as required under section 15, the buyer shall, notwithstanding anything contained in any agreement between the buyer and the supplier or in any law for the time being in force, be liable to pay compound interest with monthly rests to the supplier on that amount from the appointed day or, as the case may be, from the date immediately following the date agreed upon, at three times of the bank rate notified by the Reserve Bank.

12) Interest so paid/payable in not allowable as expenses under income tax law in view of section 23 of MSME Act,2006 which reads as:

23. Notwithstanding anything contained in the Income-tax Act, 1961 (43 of 1961), the amount of interest payable or paid by any buyer, under or in accordance with the provisions of this Act, shall not, for the purposes of computation of income under the Income-tax Act, 1961, be allowed as deduction.

However, it shall be subject to TDS as per Income Tax Act,1961.

13) Payment to supplier includes giving of cheque as well. It is not necessary that amount should be credited to supplier’s account in prescribed time period.

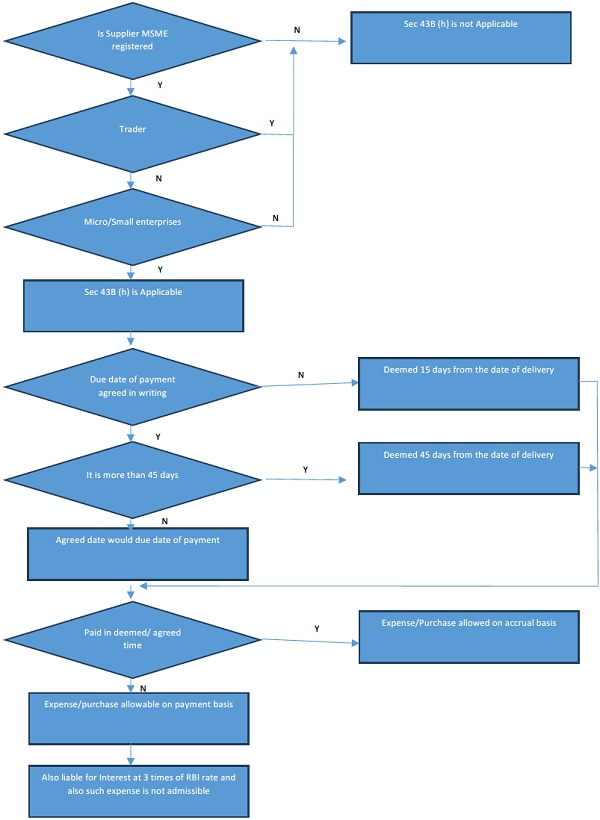

Entire concept of newly applicable section 43B(h) may be understood with following flowchart:

Frequently Asked Questions (FAQs):

Q.1) What is the effect of registration date with Udyam (MSME)?

Ans: Provision is applicable only from the date when supplier is registered as micro or small enterprise.

Q.2) Are all supplier covered under the provision of 43B(h)?

Ans: Only supplier who are manufacturer or service provider and registered as micro or small enterprise with Udyam is covered.

Q.3) If supplier is trader and even if he is MSME registered, then is he out of purview of section 43B(h)?

Ans: Yes, they are out of purview.

Q.4) Whether interest is compulsorily payable for delay to such supplier?

Ans: Yes, if supplier insist upon it. Else if they both agree for no interest then such interest need not to be provided. Mandatory interest may create lot of tax implication on buyer and supplier side e.g. TDS. GST, ITC etc. (writers view).

Q.5) Whether such interest if payable need TDS deduction under income tax, particularly when such interest is disallowable as per sec 23 of MSME Act,2006?

Ans: Yes, TDS is still deductible as per provision of Income Tax Act 1961. There is even prosecution provision for default in TDS.

Q.6) Whether opening balance in supplier account as on 01.04.2023 is also covered under provision of newly inserted 43B(h)?

Ans: No, they are not covered.

Q.7) How to bifurcate payment made during the year, whether for opening balance or against current inward supply?

Ans: Normally adhoc payment will be treated at FIFO basis. However, specific payment with documented reference shall be treated as payment of specific inward supply.

Q.8) Whether capital expenditure supplies also covered under section 43B(h)?

Ans: No. However, Assessing Officer may take stand of disallowance of depreciation thereon (writers view).

Q.9) Is there any facility of PAN based enquiry for finding MSME registration of supplier on Udyam or other platform?

Q.10)Ans: As of now, no such facility is available. Such details can be obtained only from enquiry from suppliers.

Where to report disallowable interest in form 3CD?

Ans: Clause number 22.

Q.10)Is limitation of payment starts from invoice date?

Ans: No, it commences from date of actual delivery of goods or rendering of services.

Q.11) Whether companies or other body registered under any law and engaged in selling goods produced by micro or small enterprises or rendering services which are provided by such enterprises, are also covered for section 43B(h) and eligible for interest on delayed payment?

Ans: They are not micro/small enterprises per se, hence out of purview of section 43B(h). However, they are eligible for interest on delayed payment (Section 2(n) read with Section 16 of MSME Act,2016)

Q.12) Whether provision of section 43B(h) is applicable for expenses provisions made in accounts?

Ans: No, period of limitation starts from date of actual rendering of services.

Q.13) Whether provisions of section 43B(h) applicable when income declared in presumptive taxation e.g. 44AD ,44ADA etc.?

Ans: No, it is not applicable in those cases.

Q.14) Whether credit to supplier’s a/c is necessary for showing payment?

Ans: No. However, cheque issued must be cleared in reasonable time and at times one should be in a position to establish that sufficient fund existed when cheque was issued. This may be required when authorities allege for using colorable device to circumvent the provision.

Q.15) Should auditor rely on management representation regarding supplier status of MSME?

Ans: No, this may not be enough. He must insist on confirmation from supplier.

Q.16) If supplier accept in writing time of payment for more than 45 days, then extended period will be applicable?

Ans: No, it will be maximum 45 days for making payment to supplier.

Q.17) What if no time of payment is agreed in writing?

Ans: It shall be taken to be 15 days from date of actual delivery of goods or rendering of services.

Q.18) What is position if there is any objection in good supplied or services rendered?

Ans: Then period of limitation shall be commenced when objection is removed by supplier. However, in such cases buyer must make his objection in writing within 15 days of actual delivery of goods or rendering of service.

Q.19) In writing means on paper or even mention with electronic means shall suffice?

Ans: Even electronic shall suffice such as email will suffice. (Section 4 of Information Technology Act, 2000).

Conclusion: Section 43B(h) of theFinance Act, 2023, marks a significant shift in ensuring timely payments to MSEs, yet it introduces complexities and challenges for businesses. By understanding the provisions, adhering to guidelines, and clarifying FAQs, enterprises can navigate the regulatory landscape effectively. Compliance with these regulations not only fosters healthy business relationships but also contributes to the growth and sustainability of MSEs in the economic ecosystem.

****

Author: CA Sunil P Jain and CA Ayush S Jain, Indore | caspjainindore@gmail.com