In #budget 2020 speech, our FM came up with the news of online allotment of PAN based on Aadhaar details (online PAN). The mechanism is implemented in less than 2 weeks of time by the Income Tax Department.

Let’s know about who can avail, conditions, steps and many more…

Who can get the online PAN??

-The applicant should be an individual (as obvious it is Aadhaar based) other than minor (age > 18 years of age).

-The applicant should have a valid Aadhaar which is not linked to any other PAN.

-The applicant should have his mobile phone number registered with Aadhaar.

-Complete Date of birth should be available on Aadhaar card, not only year of birth.

Steps to apply for online PAN

It is a simple 4 step process

Step 1: Visit the income tax e-filing portal, and click on “Instant PAN through Aadhaar” under Quick links on the left side. Then click on Get New PAN.

Step 2:

A. Enter the Aadhaar Number and Captcha,

B. Click on Generate Aadhaar OTP and enter the OTP received on the Adhaar linked mobile number

Step 3: Verify the Personal details and Click on Submit PAN Request. You will be provided with an acknowledgement number, you can check the status by clicking on “Check Status”.

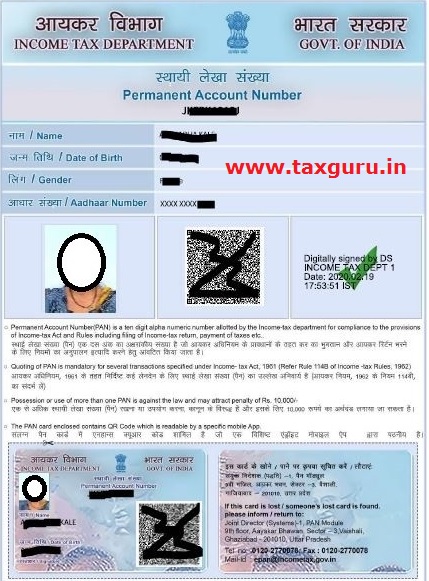

Step 4: As a final step, check the status by entering the Aadhaar Number and the OTP. The password protected PAN in pdf can be downloaded using Download PAN button. The password will be Date of birth in DDMMYYYY format.

What are the Pros and Cons?

Pros: Online PAN can be obtained in less than 2 mins. It is free of cost. A paper-less process and applicants are not required to submit or upload any documents.

Cons: No physical card is delivered. However, you can print & laminate the bottom part of the pdf file and use as a normal PAN card.

The immediate update of the PAN details in department’s database will not happen, hence one can not file the income tax return soon after obtaining the PAN.

Beware of the Penalty

The applicant should not have another PAN. Possession of more than one PAN will result in penalty of Rs.10,000 us 272B(1) of Income-tax Act.

I like my pan card

Dehari satraon deoria up