CBDT has released the ITR forms, ITR V and acknowledgement and has made major changes. Here, I’m discussing ITR V and acknowledgement for A.Y. 2020-21.

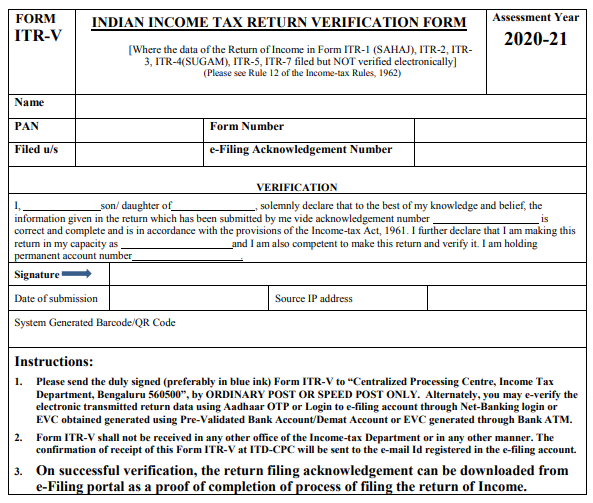

So in earlier years, we have only ITR V i.e., acknowledgement generated after filing and verified ROI. Now in A.Y. 2020-21, after filing ROI, there will generate an ITR V ‘Indian Income Tax Return Verification Form’. [Where the data of the ROI in Form ITR-1 (SAHAJ), ITR-2, ITR3, ITR-4 (SUGAM), ITR-5, ITR-7 filed but NOT verified electronically]. Extract of ITR-V:

There are no Income, Deductions, tax in this ITR V, this is just a verification form. This verification form can either be verified electronically or by sending it to “Centralized Processing Centre, Income Tax Department, Bengaluru 560500”, by ORDINARY POST OR SPEED POST ONLY.

ITR V can be verified electronically through:

1. Aadhaar OTP

2. Login to e-filing account through Net-Banking login

3. EVC obtained generated using Pre-Validated Bank Account

4. EVC obtained generated using Pre-Validated Demat Account

5. EVC generated through Bank ATM.

On successful verification, the return filing acknowledgement “Indian Income Tax Return Acknowledgement” can be downloaded from e-Filing portal as a proof of completion of process of filing the ROI. Extract of acknowledgement:

Itr2 for the Ay 21-22 filed last week. But the acknowledgement is incomplete.It doesn’t have

the gross income and the tax computation.

Hi ,

ITR 2 is successfully verified but an acknowledgement

In Point No 8 Shows Refund in my acknowledgement And in Pont Number 19 is NIL

What does it mean? DO I get a refund?

Is new ITR acknowledgment ay 20-21 without computation of income. ????

Filing ITR1 using java utility. While updating all bank details in the sheet taxes and verification, after adding the Bank Details the utility is getting hanged, not saving the data fed . So not able to update any bank detail and complete the ITR. Can help me to resolve the issue please.

ITR filed by me has been received by CPC, Bengaluru and I have received SMS/e-mail for the same. However, updated ITR acknowledgement with income details is not updated on department website even after 3 weeks. Is the updated ITR acknowledgement to be received after ITR processing u/s 143(1) or receipt of signed ITR-V at CPC, Bangalore.

I am having the same doubt as jitendra.No column got gross income and deduction under chapter V1 a

Ack copy is not complete. it should contain gross income, deduction under chapter VI A and the net taxable income.

new ack copy is not showing the correct picture.