How to link Aadhaar and PAN on Income Tax Website – FAQs

Q1 Who needs to link Aadhaar and PAN?

Section 139AA of the Income Tax Act provides that every person who has been allotted a permanent account number (PAN) as on the 1st day of July, 2017, and who is eligible to obtain an Aadhaar number, shall intimate his Aadhaar number in the prescribed form and manner. In other words, such persons have to mandatorily link their Aadhaar and PAN before the prescribed date (Presently, 31.03.2022 without fee payment and 31.03.2023 with prescribed fee payment For more details refer to CBDT circular No.7/2022 dated 30.03.2022.

2. For whom is Aadhaar-PAN linking not compulsory?

Aadhaar-PAN linking presently does not apply to any individual who is:

- residing in the States of Assam, Jammu and Kashmir, and Meghalaya;

- a non-resident as per the Income Tax Act, 1961;

- of the age of eighty years or more at any time during the previous year;

- not a citizen of India.

“The exemptions provided are subject to modifications depending on subsequent government notifications on this subject “

“For more details refer to Department of Revenue Notification no 37/2017 dated 11th May 2017“.

Q3. How to link Aadhaar and PAN?

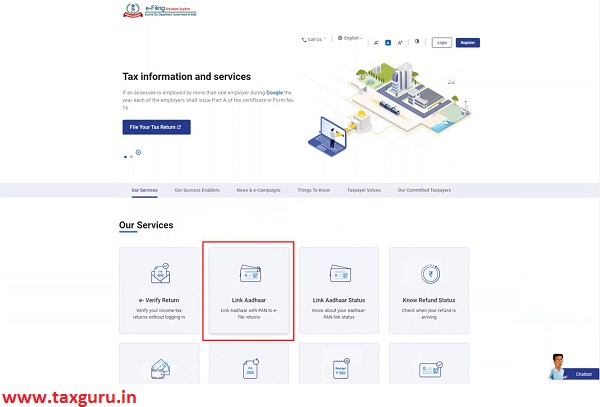

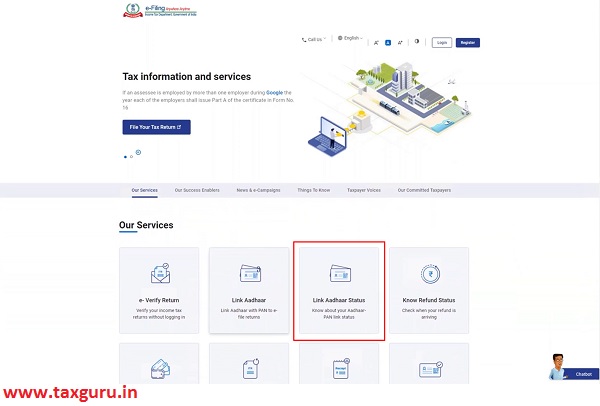

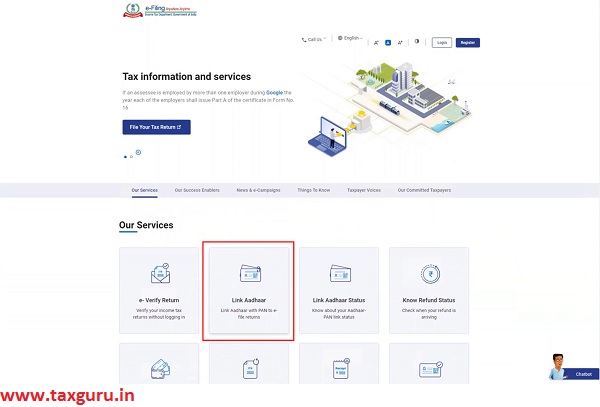

Both registered and unregistered users can link their Aadhaar and PAN on the e-Filing portal, even without logging in. You can use the quick link Link Aadhaar on the e-Filing homepage to link Aadhaar and PAN.

Q4. How to make prescribed fee payment for PAN-Aadhaar Linkage?

The fee payment for PAN-Aadhaar Linkage need to be made through e-Pay Tax functionality available on NSDL (now Protean) Portal. The prescribed fee must be paid under Major Head 0021 and Minor Head 500 and AY should be 2023-24 using Challan ITNS 280.

Q5. Payment for the PAN-Aadhaar Linking has already been made but e-Filing Portal is not allowing to proceed further. What to do in this scenario?

The payment made at NSDL (now Protean) takes few days to reflect at the e-Filing portal, so taxpayer is advised to attempt raising PAN-Aadhaar linking request after 4-5 days of making payment.

Q6. If taxpayer made the payment under Minor head 500 mistakenly, how to get the refund for the same?

As per the existing legal framework, there is no provision for refund for such payments made under the minor head 500.

Q7. What will happen if I don’t link Aadhaar and PAN?

Kindly, refer to the Circular No. 7/2022 dated 30/3/2022.

Q8. I cannot link my Aadhaar with PAN because there is a mismatch in my name / phone number / date of birth in Aadhaar and PAN. What should I do?

Correct your details in either PAN or Aadhaar database such that both have matching details. You can correct your PAN details on:

- The TIN-NSDLwebsite, or

- UTIITSL’s PANOnline

You can correct your Aadhaar details on the UIDAI website.

Q9. What should I do if my PAN becomes inoperative?

Kindly, refer to the Circular No. 7/2022 dated 30/3/2022.

(FAQs updated on 01.06.2022)

How to link Aadhaar and PAN on Income Tax Website – User Manual

1. Overview

The Link Aadhaar service is available to individual taxpayers (both registered and unregistered on e-Filing) who have a valid PAN and Aadhaar number. With this service, you can:

- Link Aadhaar with PAN on the e-Filing portal:

- Pre-login on the e-Filing homepage (for both registered and unregistered users)

- Post-login to the e-Filing portal (for registered users)

- View your Link Aadhaar status from the e-Filing homepage

2. Prerequisites for availing this service

- Valid PAN

- Aadhaar number

- Valid mobile number

3. Step-by-Step Guide

3.1 Link Aadhaar (Pre-Login and Post-Login)

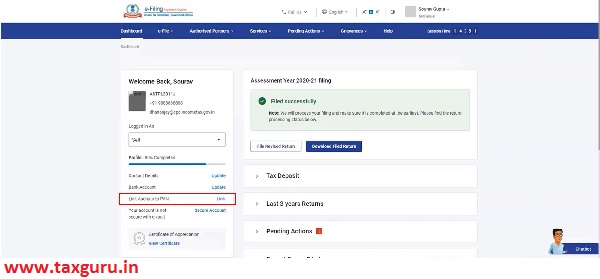

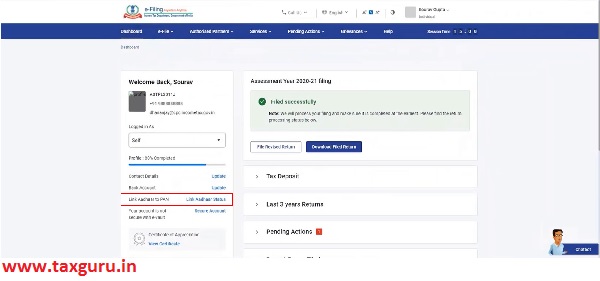

Step 1: Pre-Login: Go to the e-Filing portal homepage, and click Link Aadhaar. Step 1a: Post-Login: On your Dashboard, under the Link Aadhaar to PAN option, click Link Aadhaar.

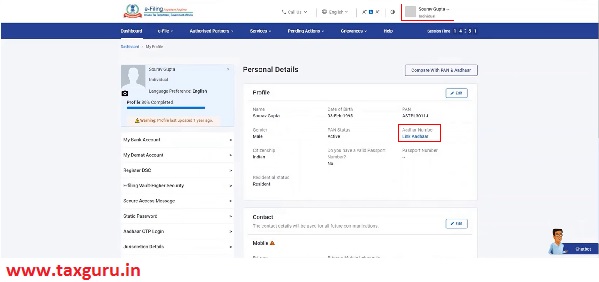

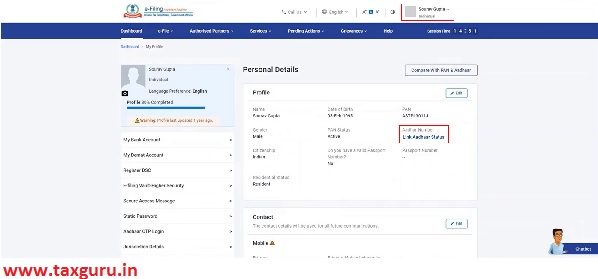

Step 1b: Post-Login: You can also access this service from My Profile > Link Aadhaar.

Step 1a: Post-Login: On your Dashboard, under the Link Aadhaar to PAN option, click Link Aadhaar.

Step 1b: Post-Login: You can also access this service from My Profile > Link Aadhaar.

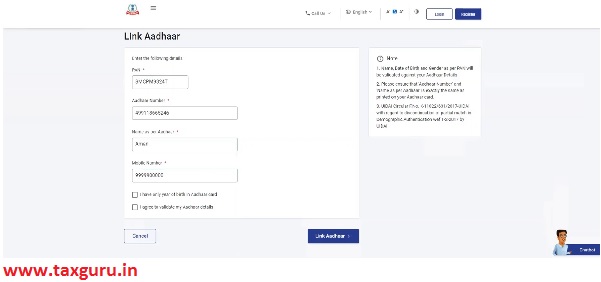

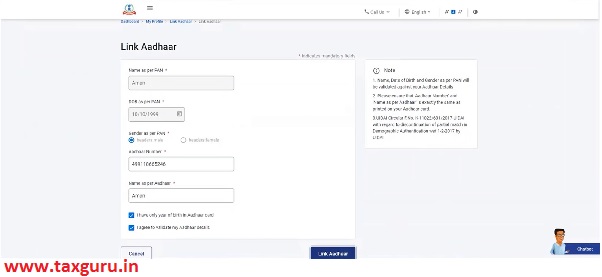

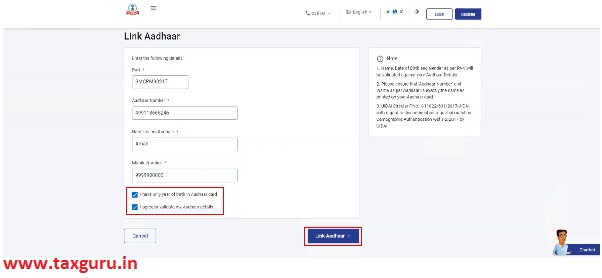

Step 2a: Pre-Login: On the Link Aadhaar page, enter your PAN, Aadhaar Number, Name as per Aadhaar and a valid Mobile Number.

Step 2b: Post-Login: On the Link Aadhaar page, your Name, Date of birth (DOB), and Gender as per PAN will be pre-filled and non-editable. Enter your Aadhaar Number and Name as per Aadhaar.

Step 3: If you have only year of birth in your Aadhaar card, click I have only year of birth in Aadhaar card. It is mandatory to select I agree to validate my Aadhaar details. Then, click Link Aadhaar.

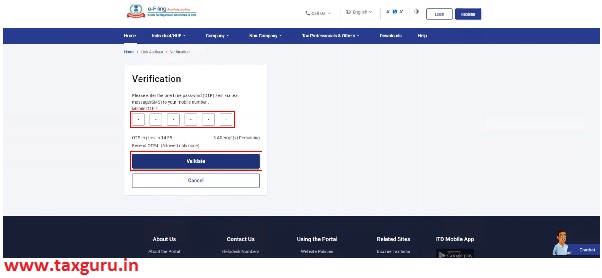

Step 4: Pre-Login: You will receive a 6-digit OTP on the mobile number you entered in Step 2a. On the Verification page, enter the Mobile OTP and click Validate. If you are using this service post-login, you won’t go through this step.

Note:

- OTP will be valid for 15 minutes only.

- You have 3 attempts to enter the correct OTP.

- The OTP expiry countdown timer on screen tells you when the OTP will expire.

- On clicking Resend OTP, a new OTP will be generated and sent.

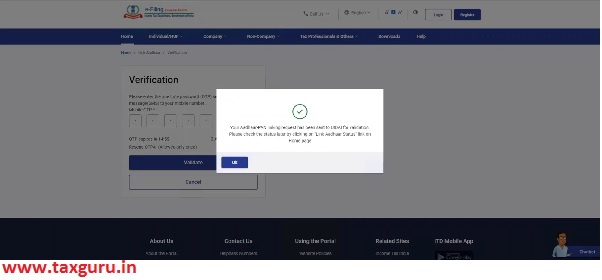

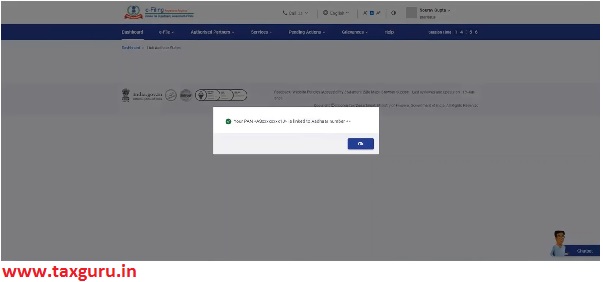

On success, you will get a message about your Aadhaar-PAN linking request being sent to UIDAI.

3.2 View Link Aadhaar Status (Pre-Login)

Step 1: On the e-Filing portal homepage, click Link Aadhaar Status.

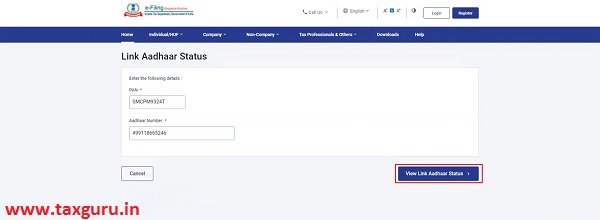

Step 2: Enter your PAN and Aadhaar Number and click View Link Aadhaar Status.

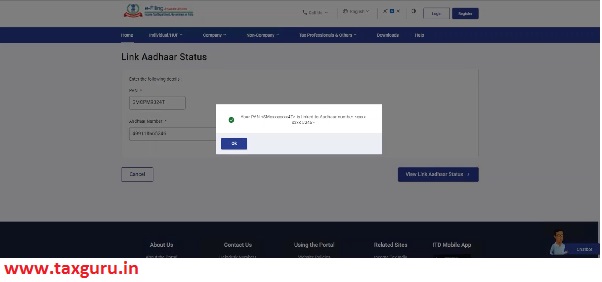

On successful validation, a message will display your Link Aadhaar status.

3.3 View Link Aadhaar Status (Post-Login)

Step 1a: On your Dashboard, click Link Aadhaar Status.

Step 1b: Alternatively, you can go to My Profile > Link Aadhaar Status.

Note:

- If the validation fails, click Link Aadhaar on the Status page, and you will need to repeat the steps to link your PAN and Aadhaar.

- If your request to link PAN and Aadhaar is pending with UIDAI for validation, you will need to check the status later.

- You may need to lodge a request (e-Nivaran) or contact the e-Filing Helpdesk to un-link Aadhaar and PAN if:

- your Aadhaar is linked with some other PAN

- your PAN is linked with some other Aadhaar

On successful validation, a message will display your Link Aadhaar status.

my wife is home maker and not paying any income tax. she has pan card. pl tell whether she has to link aadhar with pan.

thanks. and awaiting your reply.

kumar

I have already submitted my new pan and old for link to adhar but unfortunately never work done for my queries

1. Adhar linked with PAN in the old portal. Should it be linked again in the new portal?

2. Hope PAN will not be deactivated in the case of NRIs for not linking with Adhar? Information on this point is not explicit