What is crypto currency?

Crypto currency is a type of currency which uses digital files as money. Usually, the files are created using the same methods as cryptography – the science of encrypting information. It is claimed to be more secure than the real money.

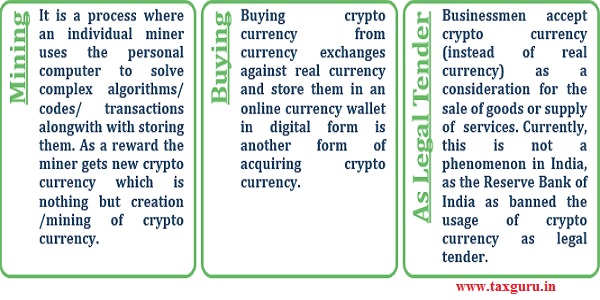

How is crypto currency acquired or generated?

Is Crypto currency taxed in India?

Concept of crypto currency is very new to the Indian market. Apparently, the government is yet to come up with the explicit provisions for taxability of income from transactions in crypto currencies under the Act. But regardless of the same, levy of tax on crypto currency cannot be skipped only because of the form of income in which it is received, as the purpose of income tax laws have always been to bring out possibilities to levy tax on income irrespective of its form. Therefore, the probability of tax on crypto currency can be looked upon under different heads of income by following the elimination method:

The outcome of the above elimination is that as of now under the Act, Income arrived from crypto currency can be taxed either under the head of Profits and Gains from Business or Profession or Income from Other Sources.

Let us understand the taxability of these transactions under the above heads of income as per the Act:

| Profits and Gains from Business or Profession | |

Crypto Currency received as consideration for sale of goods or supply of services:

|

Selling & purchasing of crypto currency as stock-in-trade:

|

–

| Income from Other Sources | |

Generation of crypto currency through Mining:

|

Receiving Crypto currency in the form of Gift:

1. From relatives |

Income from Other Sources

Dealing in crypto currency solely for the purpose of investment:

- When one hears the word “Investment”, the notion is that the profit on Investments will be taxed under the head of income “Capital Gain”. But for this, the particular investment should be defined as a “capital asset” under the Act. If the government comes up with an amendment defining cryptocurrency as capital asset, it may be taxed as follows:-

| Particulars | Type of Gain | Rate of Tax |

| Holding > 36 months | LTCG | Flat 20% |

| Holding < 36 months | STCG | At slab-rate |

- On the contrary, if IT authorities do not consider cryptocurrency as a capital asset, the provisions of capital gains will not come into the picture at all. Accordingly, it will have to be taxed under “Income from other sources” being the residual head of income.

- Under the head “Income from other sources”, the tax would be charged at individual slab rate only on the profit and not on sale value, as full purchase value of cryptocurrency can be claimed as a deduction under Section 57 of the Act.

Conclusion:

Even if there is not explicit mention of crypto currency in the Indian statutory laws which deals with taxation of income and other transactions of buying and selling, the current ambit of the Act covers almost all the scenarios. Also there may be various other scenarios in which crypto currency may come into picture but the taxability of the same would be solely dependent on future legalisation and the stand of Reserve Bank of India with respect to crypto currency.

(This article represents the views of the authors only and does not intent to give any kind of legal opinion on any matter)

Authors:

Vishal Kothari | Director | E-mail: vishal.kothari@masd.co.in

Rishabh Jain | Associate Consultant | E-mail: rishabh.jain@masd.co.in

Ashish Raithatha | Associate Consultant | E-mail: ashish.raithatha@masd.co.in

interesting article