Article explains Direct Tax Vivad Se Vishwas Bill, 2020 alongwith Further amendments proposed in the same in Cabinet Meeting on 12th February 2020 for which Notice also been given to Parliament subsequently. Article explains Key Dates under the Scheme, Definition of Appellant under Direct Tax Vivad Se Vishwas Scheme, Designated Authority, Declarant under the Scheme, Disputes Covered, Tax Arrear and Amount Payable, Filing of Declaration, Issues of certificate by designated authority, Provisions of refund, Scheme is not available in respect of persons covered and Overview on the issues not dealt by the scheme.

Key Dates under Direct Tax Vivad Se Vishwas Bill, 2020

Start date: Date on which the provisions of the Bill come into force

Last date: Date to be notified by the Government

Payment date: Pay by 31st March, 2020 to avoid higher payment

Eligibility cut off date: Appeals/writs/DRP cases /Revision u/s 264 pending or due date for filing the appeal has not expired on or before 31.01.2020.

Note: Appeal is pending does not means

Appellant 2(1)(a)

> A person in whose case an Appeal/writs/SLP is filed by him or by Income tax authority and such appeal is pending as on 31.01.2020 are eligible

> Orders for which time for filing appeal/SLP has not expired on 01.2020

> Objections filed before Dispute Resolution Panel (DRP) U/s 144C on 01.2020

> Cases where DRP issued direction by DRP U/s 144(5) on or before 31.01.2020 but no order U/s 144(13)has been passed by AO

> Cases where assessee filed R evision (Section 264) and such application is pending on or before 31.01.2020.

> Search case if the disputed tax is less than Rs. 5 Crore

DESIGNATED AUTHORITY “means an officer not below the rank of a Commissioner of Income-tax notified by the Principal Chief Commissioner for the purposes of this Act; (Section 2(1)(e))

DECLARANT “means a person who files declaration under section 4 (Section 2(1)(c))

(C) In a case where the order has been passed by the Assessing Officer on or before the specified date, and the time for filing appeal against such order has not expired as on that date, the amount of tax payable by the appellant in accordance with such order;

(D) In a case where objection filed by the appellant is pending before the Dispute Resolution Panel under section 144C of the Income-tax Act as on the specified date, the amount of tax payable by the appellant if the Dispute Resolution Panel was to confirm the variation proposed in the draft order;

(E) In a case where Dispute Resolution Panel has issued any direction under sub-section (5) of section 144C of the Income-tax Act and the Assessing Officer has not passed the order under sub-section (13) of that section on or before the specified date, the amount of tax payable by the appellant as per the assessment order to be passed by the Assessing Officer under sub-section (13) thereof;

(F) In a case where an application for revision under section 264 of the Income-tax Act is pending as on the specified date, the amount of tax payable by the appellant if such application for revision was not to be accepted:

Provided that in a case where Commissioner (Appeals) has issued notice of enhancement under section 251 of the Income- tax Act on or before the specified date, the disputed tax shall be increased by the amount of tax pertaining to issues for which notice of enhancement has been issued:

Provided further that in a case where the dispute in relation to an assessment year relates to reduction of tax credit under section 115JAA or section 115D of the Income-tax Act or any loss or depreciation computed there under, the appellant shall have an option either to include the amount of tax related to such tax credit or loss or depreciation in the amount of disputed tax, or to carry forward the reduced tax credit or loss or depreciation, in such manner as may be prescribed.

| Nature of case | Disputed Tax |

| Where appeal, writ petition or special leave petition is pending before the appellate forum on or before 31-01-2020 | Amount of tax (including surcharge and cess but excluding interest) payable if such appeal was to be decided against taxpayer |

| Where appeal, the writ petition has been passed on or before 31- 01-2020 and time limit for filing appeal against such order has not expired | Amount of tax (including surcharge and cess but excluding interest) payable by the taxpayer after giving effect to such order |

| Where objections are pending before the DRP | Amount of tax (including surcharge and cess but excluding interest) payable by the taxpayer if DRP was to confirm variation proposed in the draft order |

| Where DRP issued directions but the Assessing Officer didn't pass an order on or before 31-01-2020 | Amount of tax (including surcharge and cess but excluding interest) would have been payable by taxpayer had the order been passed by the Assessing Officer. |

| Where an application for revision under section 264 filed by the taxpayer is pending | Amount of tax (including surcharge and cess but excluding interest) payable by the taxpayer if the application was to be rejected |

| Where CIT(A) has issued an enhancement notice under section 251 | Amount of tax (including surcharge and cess but excluding interest) payable by the taxpayer in respect of enhancement proposed in additions to amount payable relating to the disputed issue. |

| In a case where the dispute in relation to an assessment year relates to reduction of tax credit under section 115JAA or section 115D of the Income-tax Act or any loss or depreciation computed there under, the appellant shall have an option either to include the amount of tax related to such tax credit or loss or depreciation in the amount of disputed tax, or to carry forward the reduced tax credit or loss or depreciation, in such manner as may be prescribed. | |

If Appeal Filed by Tax Payer

| Sr. No. | Tax Arrear (Sec. 2(1)(o)) | Amount Payable upto 31.03.2020 | Amount payable after 31.03.2020 till last date. |

| (i) | Disputed Tax+ Interest (chargeable or charged )+ Penalty levied or leviable (except search) | Disputed Tax | Disputed Tax+10% of Disputed Tax (Proviso 10% of DT > Interest+ Penalty) Excess Ignored |

| (ii) | Where Tax Arrears is determined in any Assessment on basis of search u/s 132 or 132A and disputed tax does not exceed Rs. 5 Crore. | Disputed Tax + 25% of Disputed Tax. The excess 25 % should be restricted to interest on penalty. | Disputed Tax + 35% of Disputed Tax. The excess 35 % should be restricted to interest on penalty. |

| (iii) | Disputed interest | 25% of Disputed Interest | 30% of Disputed Interest |

| (iv) | Disputed penalty | 25% of Disputed Penalty | 30% of Disputed Penalty |

| (v) | Disputed fee | 25% of Disputed Fee | 30% of Disputed Fee |

If Appeal Filed by Department

| Sr. No. | Tax Arrear (Sec. 2(1)(o)) | Amount payable upto 31.03.2020 | Amount payable after 31.03.2020 till last date. |

| Disputed Tax+ Interest (chargeable or charged )+ Penalty levied or leviable | 50% of Disputed Tax | 55% of Disputed Tax

(Proviso 5% of DT > Interest+ Penalty) Excess Ignored |

|

| Where Tax Arrears is determined in any Assessment on basis of search u/s 132 or 132A and disputed tax does not exceed Rs. 5 Crore. | 62.50% of Disputed Tax

(Proviso 12.50% of DT > Interest+ Penalty) Excess Ignored |

67.50% of Disputed Tax

(Proviso 17.50% of DT > Interest+ Penalty) Excess Ignored |

|

| Disputed interest | 12.50 % of Disputed Interest | 15 % of Disputed Interest | |

| Disputed penalty | 12.50 % of Disputed Penalty | 15 % of Disputed Penalty | |

| Disputed fee | 12.50 % of Disputed Fee | 15 % of Disputed Fee |

–

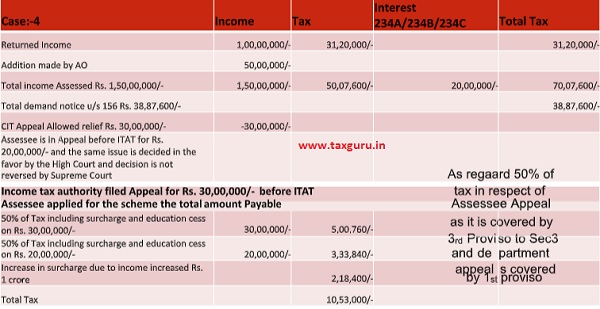

| Case:-1 | Income | Tax | Interest 234A/234B/ 234C | Total Tax |

| Returned Income | 1,00,00,000/- | 31,20,000/- | 31,20,000/- | |

| Addition made by AO | 50,00,000/- | |||

| Total income Assessed Rs. 1,50,00,000/- | 1,50,00,000/- | 50,07,600/- | 20,00,000/- | 7007600 |

| Notice of Demand u/s 156 Rs. 38,87,600/- | 38,87,600/- | |||

| CIT Appeal Allowed relief Rs. 30,00,000/- | -3000000 | |||

| Assessee is in Appeal before ITAT for Rs. 20,00,000/- before ITAT Income tax authority is in Appeal for Rs. 30,00,000/- before ITAT

Assessee applied for the scheme the total amount Payable |

||||

| 100% of Tax including surcharge and education cess on Rs. 20,00,000/- | 2000000 | 6,67,680/- | ||

| 50% of Tax including surcharge and education cess on Rs. 30,00,000/- | 3000000 | 5,00,760/- | The same is as per 1st proviso | |

| Increase in Surcharge as income is more than 1Crore | 2,18,400/- | Sec 3 | ||

| Total Tax | 13,86,840/- | |||

–

| Case:-2 | Income | Tax | Interest 234A/234B/234C | Total Tax |

| Returned Income | 1,00,00,000/- | 31,20,000/- | 31,20,000/- | |

| Addition made by AO | 50,00,000/- | |||

| Total income Assessed Rs. 1,50,00,000/- | 1,50,00,000/- | 50,07,600/- | 20,00,000/- | 70,07,600/- |

| Total demand notice u/s 156 Rs. 38,87,600/- | 38,87,600/- | |||

| CIT Appeal Allowed relief Rs. Nil | ||||

| Assessee is in Appeal before ITAT for Rs. 50,00,000/- Assessee applied for the scheme the total amount Payable | ||||

| 100% of Tax including surcharge and education cess on Rs. 50,00,000/- | 50,00,000/- | 16,69,200/- | ||

| Increase in Surcharge as income is more than 1Crore | 2,18,400/- | |||

| Total Tax | 18,87,600/- | |||

–

| Case:-3 | Income | Tax | Interest 234A/234B/234C | Total Tax |

| Returned Income | 1,00,00,000/- | 31,20,000/- | 31,20,000/- | |

| Addition made by AO | 5,00,00,00/- | |||

| Total income Assessed Rs. 1,50,00,000/- | 1,50,00,000/- | 50,07,600/- | 20,00,000/- | 70,07,600/- |

| Total demand notice u/s 156 Rs. 38,87,600/- | 38,87,600/- | |||

| CIT Appeal Allowed relief Rs. 30,00,000/- | -30,00,000/- | |||

| Assessee is in Appeal before ITAT for Rs. 20,00,000/- before ITAT | ||||

| Income tax authority does not file Appeal for Rs. 30,00,000/- before ITAT due to covered matter Assessee applied for the scheme the total amount Payable | ||||

| 100% of Tax including surcharge and education cess on Rs. 20,00,000/- | 20,00,000/- | 6,67,680/- | ||

| Increase in surcharge as income was more than Rs. 1 Crore | 2,18,400/- | |||

| Total Tax | 8,86,080/- | |||

–

–

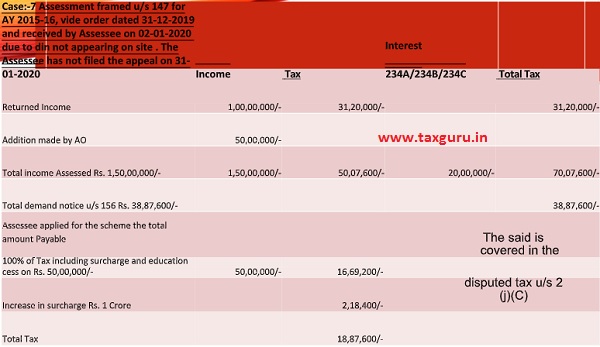

| Case:-5 | Income | Tax | Interest 234A/234B/234C | Total Tax |

| Returned Income | 1,00,00,000/- | 31,20,000/- | 31,20,000/- | |

| Addition made by AO | 50,00,000/- | |||

| Total income Assessed Rs. 1,50,00,000/- | 1,50,00,000/- | 50,07,600/- | 20,00,000/- | 70,07,600/- |

| Total demand notice u/s 156 Rs. 38,87,600/- | 38,87,600/- | |||

| Assessee is in appeal for Rs 50,00,000/- before CIT Appeal

Issue no. 1 Rs. 20,00,000/- is already decided by Tribunal in the favor of appellant and there is no decision by High Court and Supreme court for some other Assessment Year. |

||||

| Issue no. 2 Rs. 30,00,000/- is a fresh issue | ||||

| Assessee applied for the scheme the total amount Payable | The said is covered by 2nd proviso Sec 3 which is applied in case where appeal is filed before CIT Appeals | |||

| 50% of Tax including surcharge and education cess on Rs. 20,00,000/- | 20,00,000/- | 3,33,840/- | ||

| 100% of Tax including surcharge and education cess on Rs. 30,00,000/- | 30,00,000/- | 10,01,520/- | ||

| Increase in surcharge Rs. 1 Crore | 2,18,400/- | |||

| Total Tax | 15,53,760/- | |||

–

| Case:-6 AY 2015-16 CIT appeal passed the order on 26-01-2020 in which relief was given for Rs. 3000000/- | Income | Tax | Interest 234A/234B/234C | Total Tax |

| Returned Income | 1,00,00,000/- | 31,20,000/- | 31,20,000/- | |

| Addition made by AO | 50,00,000/- | |||

| Total income Assessed Rs. 1,50,00,000/- | 1,50,00,000/- | 50,07,600/- | 35,00,000/- | 85,07,600/- |

| Total demand notice u/s 156 Rs. 53,87,600/- | 53,87,600/- | |||

| Assessee applied for the scheme the total amount Payable | ||||

| 100% of Tax including surcharge and education cess on Rs. 20,00,000/- | 20,00,000/- | 6,67,680/- | covered in definition the of disputed tax u/s 2 (j)(B) | |

| Increase in surcharge Rs. 1 Crore | 2,18,400/- | |||

| Total Tax | 8,86,080/- | |||

–

|

SECTION 4 |

|

| The declaration shall be filed by the declarant in the prescribed form and verify in prescribed manner. Sec4(1) | Before designated authority |

| After filling the declaration the appeals pending before ITAT or CIT Appeal shall be deemed to have been withdrawn Sec4(2) | From the date on which certificate u/s 5 (1) is issued by department. |

| Where the declarant has filed any appeal/writ before the HC or SC against any order in respect of tax arrear, he shall withdraw such appeal or writ petition with the leave of the Court wherever required . Sec4(3) | after issuance of certificate under sub-section (1) of section 5 and furnish proof of such withdrawal along with the intimation of payment to the designated authority under sub- section (2) of section 5 |

| Any proceeding for arbitration, conciliation or mediation, or has given any notice thereof under any law or under any agreement entered into by India with any other country or territory outside India whether for protection of investment or otherwise, he shall withdraw the claim, if any, in such proceedings or notice. Sec4(4) | after issuance of certificate under sub-section (1) of section 5 and furnish proof of such withdrawal along with the intimation of payment to the designated authority under sub-section (2) of section 5.” |

| Without prejudice to the provisions of sub-sections (2), (3) and (4), the declarant shall furnish an undertaking waiving his right, whether direct or indirect, to seek or pursue any remedy or any claim in relation to the tax arrear which may otherwise be available to him under any law for the time being in force. Sec4(5) | in equity, under statute or under any agreement entered into by India with any country or territory outside India whether for protection of investment or otherwise and the undertaking shall be made in such form and manner as may be prescribed. |

| The declaration under sub-section (1) shall be presumed never to have been made if,—

(a) particular furnished in declaration are false at any stage; (b) violates any of the conditions ; (c) the declarant acts in any manner which is not in accordance with the undertaking given by him under sub-section (5) |

in such cases, all the proceedings and claims which were withdrawn under section 4 and all the consequences under the Income-tax Act against the declarant shall be deemed to have been revived. |

| No appellate forum or arbitrator, conciliator or mediator shall proceed to decide any issue relating to the tax arrear mentioned in the declaration. | in respect of which an order has been made under sub-section (1) of section 5 by the designated authority or the payment of sum determined under that section |

|

SECTION 5 |

|

| The designated authority shall with in 15 days for the receipt of declaration shall issue a certificate mentioning the amount payable by the declarant. | |

| The declarant shall pay the amount with in 15 days from receipt of certificate and shall also provide prof payment made along with prescribed font. The designated authority shall pass an order stating that the declarant has paid the amount. | |

| The order shall not be reopened under any proceeding of income tax act.

Explanation.–– For the removal of doubts, it is hereby clarified that making a declaration 19 under this Act shall not amount to conceding the tax position and it shall not be lawful for the income-tax authority or the declarant being a party in appeal or writ petition or special leave petition to contend that the declarant or the income-tax authority, as the case may be, has acquiesced in the decision on the disputed issue by settling the dispute.”. |

|

|

SECTION 6 |

|

| The designate authority after passing the order shall not issue proceeding in respect of an offence or impose penalty or charge interest. | |

|

SECTION 7 |

|

| Any amount paid on presence of declaration shall not be refunded.

In a case where declarant had paid any amount under Income Tax Act before filling the declaration than such amount shall be refunded but not be entitled to interest u/s 244A |

|

|

SECTION 8 |

|

| No immunity shall be provided other than the those in relation to which declaration has to be made. | |

|

Section 9 |

|

| Non applicability

a. Tax arrears in relation to i. Block assessment in search cases where the disputed tax more than Rs. 5 crore. ii. A year in respect which prosecution is initiated. iii. Undisclosed income located outside India. iv. Assessments based on information obtained under DTAAs. b. to any person in respect of whom an order of detention has been made under the provisions of the Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974 on or before the filing of declaration: c. to any person in respect of whom prosecution for any offence punishable under the provisions of the Unlawful Activities (Prevention) Act, 1967, the Narcotic Drugs and Psychotropic Substances Act, 1985, the Prevention of Corruption Act, 1988, the Prevention of Money Laundering Act, 2002, the Prohibition of Benami Property Transactions Act, 1988 has been instituted on or before the filing of the declaration or such person has been convicted of any such offence punishable under any of those Acts; (ca) to any person in respect of whom prosecution has been initiated by an Income-tax authority for any offence punishable under the provisions of the Indian Penal Code or for the purpose of enforcement of any civil liability under any law for the time being in force, on or before the filing of the declaration or such person has been convicted of any such offence consequent to the prosecution initiated by an Income-tax authority;” d. to any person notified under section 3 of the Special Court (Trial of Offences Relating to Transactions in Securities) Act, 1992 on or before the filing of declaration. |

|

–

|

ISSUES NOT DEALT BY SCHEME |

|

| Delay in filing of Appeal | A question arises for appeals which were filed before January 31, 2020; however, a delay exists in filing of the appeal as per the respective statutory provisions and the application for condonation of delay has not been disposed of. Can such cases avail the benefit of the Scheme.

According to speaker such cases must be covered within the ambit of the Scheme provided appeal was filled before 31.01.2020. |

| Set aside proceedings

An issue arises where the matter is remanded back to the Ld. Assessing Officer (‘AO’) by the Tribunal (mostly) for de novo proceedings, whether the same will be covered within the ambit of the Scheme.

|

Scenario 1 where all the issues were sent back to the AO. The declaration can not be filed has no Appeal is pending.

Scenario 2 where the all issues are remanded back to the CIT Appeal. The declaration can be filed. Scenario 3 where one issue was sent back to AO and part to the CIT. The bill has not covered this situation according to speaker the benefit will not be available. |

| Orders pronounced post effective date. | A question arises with respect to the matters which were heard before January 31, 2020 and the order has been passed after February 4, 2020. Will such cases be able to take advantage of this Scheme?

According to the speaker, such cases must be covered within the ambit of the Scheme. |

| Miscellaneous Application | Further, in the event a Miscellaneous application is filed against an order of the Tribunal, in a case which was heard before the cut off date but order has been passed after the budget speech. It must be understood that a Miscellaneous application revives the appeal which pending before the Tribunal and therefore such cases must be covered within the ambit of the Scheme. |

| Prosecution | With a view to clarify, availment of the Scheme for a particular appeal ensures that there is no prosecution launched for the particular year under consideration. |

| 263 Matters | Scenario 1

Scenario 2 |

THE DIRECT TAX VIVAD SE VISHWAS BILL, 2020

A

BILL

to provide for resolution of disputed tax and for matters connected therewith or

incidental thereto.

BE it enacted by Parliament in the Seventy-first Year of the Republic of India as follows:—

1. This Act may be called the Direct Tax Vivad se Vishwas Act, 2020.

2. (1) In this Act, unless the context otherwise requires,—

(a)”appellant” means the person or the income-tax authority or both who has filed appeal before the appellate forum and such appeal is pending on the specified date;

(i) a person in whose case an appeal or a writ petition or special leave petition has been filed either by him or by the income-tax authority or by both, before an appellate forum and such appeal or petition is pending as on the specified date;

(ii) a person in whose case an order has been passed by the Assessing Officer, or an order has been passed by the Commissioner(Appeals) or the Income Tax Appellate Tribunal in an appeal, or by the High Court in a writ petition, on or before the specified date, and the time for filing any appeal or special leave petition against such order by that person has not expired as on that date;

(iii) a person who has filed his objections before the Dispute Resolution Panel under section 144C of the Income-tax Act, 1961 (43 of 1961) and the Dispute Resolution Panel has not issued any direction on or before the specified date;

(iv) a person in whose case the Dispute Resolution Panel has issued direction under sub-section (5) of section 144C of the Income-tax Act and the Assessing Officer has not passed any order under sub-section (13) of that section on or before the specified date;

(v) a person who has filed an application for revision under section 264 of the Income-tax Act and such application is pending as on the specified date;”

(b)”appellate forum” means the Supreme Court or the High Court or the Income Tax Appellate Tribunal or the Commissioner (Appeals);

(c) “declarant” means a person who files declaration under section 4;

(d) “declaration” means the declaration filed under section 4;

(e) “designated authority” means an officer not below the rankof a Commissioner of Income-tax notified by the Principal Chief Commissioner for the purposes of this Act;

(f)”disputed fee” means the fee determined under the provisions of the Income-tax Act, 1961 in respect of which appeal has been filed by the appellant;

(g) “disputed income”, in relation to an assessment year, means the whole or so much of the total income as is relatable to the disputed tax;

(h) “disputed interest” means the interest determined in any case under the provisions of the Income-tax Act, 1961, where—

(i) such interest is not charged or chargeable on disputed tax;

(ii) an appeal has been filed by the appellant in respect of such interest;

(i) “disputed penalty” means the penalty determined in any case under the provisions of the Income-tax Act, 1961, where—

(i) such penalty is not levied or leviable in respect of disputed income or disputed tax, as the case may be;

(ii) an appeal has been filed by the appellant in respect of such penalty;

( j)”disputed tax”, in relation to an assessment year, means—

(i) tax determined under the Income-tax Act, 1961 in accordance with the following formula—

(A – B) + (C – D) where,

A = an amount of tax on the total income assessed as per the provisions of the Income-tax Act, 1961other than the provisions contained in section 115JB or section 115JC of the Income-tax Act, 1961(herein after called general provisions);

B = an amount of tax that would have been chargeable had the total income assessed as per the general provisions been reduced by the amount of income in respect of which appeal has been filed by the appellant;

C = an amount of tax on the total income assessed as per the provisions contained in section 115JB or section 115JC of the Income-tax Act, 1961;

D = an amount of tax that would have been chargeable had the total income assessed as per the provisions contained in section 115JB or section 115JC of the Income-tax Act, 1961 been reduced by the amount of income in respect of which appeal has been filed by the appellant:

Provided that where the amount of income in respect of which appeal has been filed by the appellant is considered under the provisions contained in section 115JB or section 115JC of the Income-tax Act, 1961 and under general provisions, such amount shall not be reduced from total income assessed while determining the amount under item D:

Provided further that in a case where the provisions contained in section 115JB or section 115JC of the Income-taxAct, 1961 are not applicable, the item (C – D) in the formula shall be ignored:

Provided also that in a case where the amount of income, in respect of which appeal has been filed by the appellant, has the effect of reducing the loss declared in the return or converting that loss into income, the amount of disputed tax shall be determined in accordance with the formula specified in sub-clause (i) with the modification that the amount to be determined for item (A – B) in that formula shall be the amount of tax that would have been chargeable on the income in respect of which appeal has been filed by the appellant had such income been the total income;

(j) “disputed tax”, in relation to an assessment year or financial year, as the case may be, means the income-tax, including surcharge and cess (hereafter in this clause referred to as the amount of tax) payable by the appellant under the provisions of the Income-tax Act, 1961 (43 of 1961), as computed hereunder:-

(A) in a case where any appeal, writ petition or special leave petition is pending before the appellate forum as on the specified date, the amount of tax that is payable by the appellant if such appeal or writ petition or special leave petition was to be decided against him;

(B) in a case where an order in an appeal or in writ petition has been passed by the appellate forum on or before the specified date, and the time for filing appeal or special leave petition against such order has not expired as on that date, the amount of tax payable by the appellant after giving effect to the order so passed;

(C) in a case where the order has been passed by the Assessing Officer on or before the specified date, and the time for filing appeal against such order has not expired as on that date, the amount of tax payable by the appellant in accordance with such order;

(D) in a case where objection filed by the appellant is pending before the Dispute Resolution Panel under section 144C of the Income-tax Act as on the specified date, the amount of tax payable by the appellant if the Dispute Resolution Panel was to confirm the variation proposed in the draft order;

(E) in a case where Dispute Resolution Panel has issued any direction under sub-section (5) of section 144C of the Income-tax Act and the Assessing Officer has not passed the order under sub-section (13) of that section on or before the specified date, the amount of tax payable by the appellant as per the assessment order to be passed by the Assessing Officer under sub-section (13) thereof;

(F) in a case where an application for revision under section 264 of the Income-tax Act is pending as on the specified date, the amount of tax payable by the appellant if such application for revision was not to be accepted:

Provided that in a case where Commissioner (Appeals) has issued notice of enhancement under section 251 of the Income-tax Act on or before the specified date, the disputed tax shall be increased by the amount of tax pertaining to issues for which notice of enhancement has been issued:

Provided further that in a case where the dispute in relation to an assessment year relates to reduction of tax credit under section 115JAA or section 115D of the Income-tax Act or any loss or depreciation computed thereunder, the appellant shall have an option either to include the amount of tax related to such tax credit or loss or depreciation in the amount of disputed tax, or to carry forward the reduced tax credit or loss or depreciation, in such manner as may be prescribed.

(ii) tax determined under the section 200A or section 201 or subsection (6A) of section 206C or section 206CB of the Income-tax Act, 1961 in respect of which appeal has been filed by the appellant.

(k) “Income-tax Act” means the Income-tax Act, 1961;

(l)”last date” means such date as may be notified by the Central Government in the Official Gazette;

(m) “prescribed” means prescribed by rules made under this Act;

(n) “specified date” means the 31st day of January, 2020;

(o) “tax arrear” means,—

(i) the aggregate amount of disputed tax, interest chargeable or charged on such disputed tax, and penalty leviable or levied on such disputed tax; or

(ii) disputed interest; or

(iii) disputed penalty; or

(iv) disputed fee,

as determined under the provisions of the Income-tax Act;

(2)The words and expressions used herein and not defined but defined in the Income tax Act shall have the meanings respectively assigned to them in that Act.

3. Subject to the provisions of this Act, where a declarant files under the provisions ofthis Act on or before the last date, a declaration to the designated authority in accordance with the provisions of section 4 in respect of tax arrear, then, notwithstanding anything contained in the Income-tax Act or any other law for the time being in force, the amount payable by the declarant under this Act shall be as under, namely:—

SI No. Nature of tax arrear Amount payable No. under this Act

or before the

31st day of.

March, 2020 Amount payable on under this Act on or after

the 1st day of April, 2020 but on or before the last date

(a) Where the tax arrear is the aggregate amount of the disputed tax, interest chargeable or charged on such disputed tax and penalty leviable or levied on such disputed tax. Amount of the disputed tax. The aggregate of the amount of disputed tax and ten percent of disputed tax:

Provided that where the ten percent of disputed tax exceeds the aggregate amount of interest chargeable or charged on such disputed tax and penalty leviable or levied on such disputed tax, the excess shall be ignored for the purpose of computation of amount payable under this Act.

(aa) where the tax arrear includes the tax, interest or penalty determined in any assessment on the basis of search under section 132 or section 132A of the Income-tax Act. The aggregate of the amount of disputed tax and twenty-five per cent of the disputed tax:

Provided that where the twenty-five per cent of disputed tax exceeds the aggregate amount of interest chargeable or charged on such disputed tax and penalty leviable or levied on such disputed tax, the excess shall be ignored for the purpose of computation of amount payable under this Act

The aggregate of the amount of disputed tax and thirty-five per cent. of disputed tax :

Provided that where the thirty-five per cent of disputed tax exceeds the aggregate amount of interest chargeable or charged on such disputed tax and penalty leviable or levied on such disputed tax, the excess shall be ignored for the purpose of computation of amount payable.

(b) Where the tax arrear relates to disputed interest or disputed penalty or dispute fee. Twenty-five percent of disputed interest or disputed penalty or disputed fee. Thirty percent of disputed interest or disputed penalty or disputed fee.

“Provided that in a case where an appeal or writ petition or special leave petition is filed by the income-tax authority on any issue before the appellate forum, the amount payable shall be one-half of the amount in the Table above calculated on such issue, in such manner as may be prescribed:

Provided further that in a case wherean appeal is filed before the Commissioner (Appeals) or objections is filed before the Dispute Resolution Panel by the appellant on any issue on which he has already got a decision in his favour from Income Tax Appellate Tribunal (where the decision on such issue is not reversed by the High Court or the Supreme Court) or the High Court (where the decision on such issue is not reversed by the Supreme Court), the amount payable shall be one-half of the amount in the Table above calculated on such issue, in such manner as may be prescribed:

Provided also that in a case where an appeal is filed by the appellant on any issue before Income Tax Appellate Tribunal on which he has already got a decision in his favour from the High Court (where the decision on such issue is not reversed by the Supreme Court), the amount payable shall be one-half of the amount in the Table above calculated on such issue, in such manner as may be prescribed.”.

4. (1) The declaration referred to in section 3 shall be filed by the declarant before the designated authority in such form and verified in such manner as may be prescribed.

(2) Upon the filing the declaration, any appeal pending before the Income Tax Appellate Tribunal or Commissioner (Appeals), in respect of the disputed income or disputed interest or disputed penalty or disputed fee and tax arrear shall be deemed to have been withdrawn from the date on which certificate under sub-section (1) of section 5 is issued by the designated authority.

(3) Where the declarant has filed any appeal before the appellate forum or any writ petition before the High Court or the Supreme Court against any order in respect of tax arrear, he shall withdraw such appeal or writ petition with the leave of the Court wherever required and furnish proof of such withdrawal alongwith the declaration referred to in sub-section (1).

(4) Where the declarant has initiated any proceeding for arbitration, conciliation or mediation, or has given any notice thereof under any law for the time being in force or under any agreement entered into by India with any other country or territory outside India whether for protection of investment or otherwise, he shall withdraw the claim, if any, in such proceedings or notice prior to making the declaration and furnish proof thereof alongwith the declaration referred to in sub-section (1).

(3) Where the declarant has filed any appeal before the appellate forum or any writ petition before the High Court or the Supreme Court against any order in respect of tax arrear, he shall withdraw such appeal or writ petition with the leave of the Court wherever required after issuance of certificate under sub-section (1) of section 5 and furnish proof of such withdrawal alongwith the intimation of payment to the designated authority under sub-section (2) of section 5.

(4) Where the declarant has initiated any proceeding for arbitration, conciliation or mediation, or has given any notice thereof under any law for the time being in force or under any agreement entered into by India with any other country or territory outside India whether for protection of investment or otherwise, he shall withdraw the claim, if any, in such proceedings or notice after issuance of certificate under sub-section (1) of section 5 and furnish proof of such withdrawal alongwith the intimation of payment to the designated authority under sub-section (2) of section 5.

(5) Without prejudice to the provisions of sub-sections (2), (3) and (4), the declarant shall furnish an undertaking waiving his right, whether direct or indirect, to seek or pursue any remedy or any claim in relation to the tax arrear which may otherwise be available to him under any law for the time being in force, in equity, under statute or under any agreement entered into by India with any country or territory outside India whether for protection of investment or otherwise and the undertaking shall be made in such form and manner as may be prescribed.

(6) The declaration under sub-section (1) shall be presumed never to have been made if,—

(a) any material particular furnished in the declaration is found to be false at any stage;

(b) the declarant violates any of the conditions referred to in this Act;

(c) the declarant acts in any manner which is not in accordance with the undertaking given by him under sub-section (5),

and in such cases, all the proceedings and claims which were withdrawn under section 4 and all the consequences under the Income-tax Act against the declarant shall be deemed to have been revived.

(7) No appellate forum or arbitrator, conciliator or mediator shall proceed to decide any issue relating to the tax arrear mentioned in the declaration in respect of which an order has been made under sub-section (1) of section 5 by the designated authority or the payment of sum determined under that section.

5. (1) The designated authority shall, within a period of fifteen days from the date of receipt of the declaration, by order, determine the amount payable by the declarant in accordance with the provisions of this Act and grant a certificate to the declarant containing particulars of the tax arrear and the amount payable after such determination, in such form as may be prescribed.

(2) The declarant shall pay the amount determined under sub-section (1) within fifteen days of the date of receipt of the certificate and intimate the details of such payment to the designated authority in the prescribed form and thereupon the designated authority shall pass an order stating that the declarant has paid the amount.

Filing of

(3) Every order passed under sub-section (1), determining the amount payable under this Act, shall be conclusive as to the matters stated therein and no matter covered by such order shall be reopened in any other proceeding under the Income-tax Act or under any other law for the time being in force or under any agreement, whether for protection of investment or otherwise, entered into by India with any other country or territory outside India.

Explanation.––For the removal of doubts, it is hereby clarified that making a declaration under this Actshall not amount to conceding the tax position and it shall not be lawful for the income-tax authority or the declarant being a party in appeal or writ petition or special leave petition to contend that the declarant or the income-tax authority, as the case may be, has acquiesced in the decision on the disputed issue by settling the dispute.

6. Subject to the provisions of section 5, the designated authority shall not institute any proceeding in respect of an offence; or impose or levy any penalty; or charge any interest under the Income-tax Act in respect of tax arrear.

7. Any amount paid in pursuance of a declaration made under section 4 shall not be refundable under any circumstances.

Explanation.––For the removal of doubts, it is hereby clarified that where the declarant had, before filing the declaration under sub-section (1) of section 4, paid any amount under the Income-tax Act in respect of his tax arrear which exceeds the amount payable under section 3, he shall be entitled to a refund of such excess amount, but shall not be entitled to interest on such excess amount under section 244A of the Income-tax Act.

8. Save as otherwise expressly provided in sub-section (3) of section 5 or section 6, nothing contained in this Act shall be construed as conferring any benefit, concession or immunity on the declarant in any proceedings other than those in relation to which the declaration has been made.

9. The provisions of this Act shall not apply—

(a) in respect of tax arrear,—

(i) relating to an assessment year in respect of which an assessment has been made under section 153A or section 153C of the Income-tax Act, if it relates to any tax arrear;

(i) relating to an assessment year in respect of which an assessment has been made under sub-section (3) of section 143 or section 144 or section 153A or section 153C of the Income-tax Act on the basis of search initiated under section 132 or section 132A of the Income-tax Act, if the amount of disputed tax exceeds five crore rupees;

(ii) relating to an assessment year in respect of which prosecution has been instituted on or before the date of filing of declaration;

(iii) relating to any undisclosed income from a source located outside India or undisclosed asset located outside India;

(iv) relating to an assessment or reassessment made on the basis of information received under an agreement referred to in section 90 or section 90A of the Income-tax Act, if it relates to any tax arrear;

(v) relating to an appeal before the Commissioner (Appeals) in respect of which notice of enhancement under section 251 of the Income-tax Act has been issued on or before the specified date;

(b) to any person in respect of whom an order of detention has been made under the provisions of the Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974 on or before the filing of declaration:

Provided that—

(i) such order of detention, being an order to which the provisions of section 9 or section 12A of the said Act do not apply, has not been revoked on the report of the Advisory Board under section 8 of the said Act or before the receipt of the report of the Advisory Board; or

(ii) such order of detention, being an order to which the provisions of section 9 of the said Act apply, has not been revoked before the expiry of the time for, or on the basis of, the review under sub-section (3) of section 9, or on the report of the Advisory Board under section 8, read with sub-section (2) of section 9, of the said Act; or

(iii) such order of detention, being an order to which the provisions of section 12A of the said Act apply, has not been revoked before the expiry of the time for, or on the basis of, the first review under sub-section (3) of that section, or on the basis of the report of the Advisory Board under section 8, read with sub-section (6) of section 12A, of the said Act; or

(iv) such order of detention has not been set aside by a court of competent jurisdiction;

(c) to any person in respect of whom prosecution for any offence punishable under the provisions of the Indian Penal Code, the Unlawful Activities (Prevention) Act, 1967, the Narcotic Drugs and Psychotropic Substances Act, 1985, the Prevention of Corruption Act, 1988, the Prevention of Money Laundering Act, 2002, the Prohibition of Benami Property Transactions Act, 1988 or for the purpose of enforcement of any civil liability has been instituted on or before the filing of the declaration or such person has been convicted of any such offence punishable under any of those Acts;

(c) to any person in respect of whom prosecution for any offence punishable under the provisions of the Unlawful Activities (Prevention) Act, 1967 (37 of 1967), the Narcotic Drugs and Psychotropic Substances Act, 1985 (61 of 1985), the Prevention of Corruption Act, 1988 (49 of 1988), the Prevention of Money Laundering Act, 2002 (15 of 2003), the Prohibition of Benami Property Transactions Act, 1988 (45 of 1988) has been instituted on or before the filing of the declaration or such person has been convicted of any such offence punishable under any of those Acts;

(ca) to any person in respect of whom prosecution has been initiated by an Income-tax authority for any offence punishable under the provisions of the Indian Penal Code (45 of 1860) or for the purpose of enforcement of any civil liability under any law for the time being in force, on or before the filing of the declaration or such person has been convicted of any such offence consequent to the prosecution initiated by an Income-tax authority;

(d) to any person notified under section 3 of the Special Court (Trial of Offences Relating to Transactions in Securities) Act, 1992 on or before the filing of declaration.

10. (1) The Central Board of Direct Taxes may, from time to time, issue such directions or orders to the income-tax authorities, as it may deem fit:

Provided that no direction or order shall be issued so as to require any designated authority to dispose of a particular case in a particular manner.

(2) Without prejudice to the generality of the foregoing power, the said Board may, if it considers necessary or expedient so to do, for the purpose of this Act, including collection of revenue, issue from time to time, general or special orders in respect of any class of cases, setting forth directions or instructions as to the guidelines, principles or procedures to be followed by the authorities in any work relating to this Act, including collection of revenue and issue such order, if the Board is of the opinion that it is necessary in the public interest so to do.

11. (1) If any difficulty arises in giving effect to the provisions of this Act , the Central Government may, by order, not inconsistent with the provisions of this Act , remove the difficulty:

Provided that no such order shall be made after the expiry of a period of two years from the date on which the provisions of this Act come into force.

(2) Every order made under sub-section (1) shall, as soon as may be after it is made, be laid before each House of Parliament.

12. (1) The Central Government may, by notification in the Official Gazette, make rules for carrying out the provisions of this Act.

(2) Without prejudice to the generality of the foregoing power, such rules may provide for all or any of the following matters, namely:—

(a) the form in which a declaration may be made, and the manner of its verification under section 4;

(b) the form and manner in which declarant shall furnish undertaking under sub-section (5) of section 4;

(c) the form in which certificate shall be granted under sub-section (1) of section 5;

(d) the form in which payment shall be intimated under sub-section (2) of section 5;

(da) determination of disputed tax including the manner of set-off in respect of brought forward or carry forward of tax credit under section 115JAA or section 115JD of the Income-tax Act or set-off in respect of brought forward or carry forward of loss or allowance of depreciation under the provisions of the Income-tax Act;

(db) the manner of calculating the amount payable under this Act.

(e) any other matter which is to be, or may be, prescribed, or in respect of which provision is to be made, by rules.

(3) Every rule made by the Central Government under this Act shall be laid, as soon as may be after it is made, before each House of Parliament, while it is in session, for a total period of thirty days, which may be comprised in one session or in two or more successive sessions, and if, before the expiry of the session immediately following the session or the successive sessions aforesaid, both Houses agree in making any modification in the rule or both Houses agree that the rule should not be made, the rule shall thereafter have effect only in such modified form or be of no effect, as the case may be; so, however, that any such modification or annulment shall be without prejudice to the validity of anything previously done under that rule.

STATEMENT OF OBJECTS AND REASONS

Over the years, the pendency of appeals filed by taxpayers as well as Government has increased due to the fact that the number of appeals that are filed is much higher than the number of appeals that are disposed. As a result, a huge amount of disputed tax arrears is locked-up in these appeals. As on the 30th November, 2019, the amount of disputed direct tax arrears is Rs. 9.32 lakh crores. Considering that the actual direct tax collection in the financial year 2018-19 was Rs.11.37 lakh crores, the disputed tax arrears constitute nearly one year direct tax collection.

2. Tax disputes consume copious amount of time, energy and resources both on the part of the Government as well as taxpayers. Moreover, they also deprive the Government of the timely collection of revenue. Therefore, there is an urgent need to provide for resolution of pending tax disputes. This will not only benefit the Government by generating timely revenue but also the taxpayers who will be able to deploy the time, energy and resources saved by opting for such dispute resolution towards their business activities.

3. It is, therefore, proposed to introduce The Direct Tax Vivad se Vishwas Bill, 2020 for dispute resolution related to direct taxes, which, inter alia, provides for the following, namely:—

(a) The provisions of the Bill shall be applicable to appeals filed by taxpayers or the Government, which are pending with the Commissioner (Appeals), Income tax Appellate Tribunal, High Court or Supreme Court as on the 31st day of January, 2020 irrespective of whether demand in such cases is pending or has been paid;

(b) the pending appeal may be against disputed tax, interest or penalty in relation to an assessment or reassessment order or against disputed interest, disputed fees where there is no disputed tax. Further, the appeal may also be against the tax determined on defaults in respect of tax deducted at source or tax collected at source;

(c) in appeals related to disputed tax, the declarant shall only pay the whole of the disputed tax if the payment is made before the 31st day of March, 2020 and for the payments made after the 31st day of March, 2020 but on or before the date notified by Central Government, the amount payable shall be increased by 10 per cent. of disputed tax;

(d) in appeals related to disputed penalty, disputed interest or disputed fee, the amount payable by the declarant shall be 25 per cent. of the disputed penalty, disputed interest or disputed fee, as the case may be, if the payment is made on or before the 31st day of March, 2020. If payment is made after the 31st day of March, 2020 but on or before the date notified by Central Government, the amount payable shall be increased to 30 per cent. of the disputed penalty, disputed interest or disputed fee, as the case may be.

4. The proposed Bill shall come into force on the date it receives the assent of the President and declaration may be made thereafter up to the date to be notified by the Government.

NEW DELHI; NIRMALA SITHARAMAN.

The 1st February, 2020.

PRESIDENT’S RECOMMENDATION UNDER ARTICLE 117 OF THE

CONSTITUTION OF INDIA

————

[Letter No. IT(A)/1/2020-TPL, dated 1.2.2020 from Smt. Nirmala Sitharaman, Minister of Finance and Corporate Affairs to the Secretary General, Lok Sabha]

The President, having been informed of the subject matter of the Direct Tax Vivad se Vishwas Bill, 2020, recommends under clause (1) and (3) of article 117, read with clause (1) of article 274 of the Constitution of India, the introduction of the Direct Tax Vivad se Vishwas Bill, 2020, in Lok Sabha and also recommends to Lok Sabha the consideration of the Bill.