The guide on the Assessment of Charitable and Religious Trusts and Institutions, prepared by the Directorate of Income Tax, unfolds across multiple chapters, each meticulously designed to provide a comprehensive understanding of the intricate landscape. The content spans from a global exploration of the non-profit sector’s ecosystem to a detailed examination of administrative structures, registration procedures, and provisions related to the taxability of income. Chapters delve into critical aspects such as conditions for claiming exemptions, the charitable purpose, and recent judicial decisions, offering a profound insight into income, donations, foreign contributions, and other financial considerations. The inclusion of important circulars issued by CBDT and annexures, featuring details from Charity Commissioners and key information for Assessing Officers, enhances the guide’s utility as a thorough and accessible resource. This structured approach ensures that the guide caters to the diverse needs of officials navigating the complexities of assessing charitable and religious trusts and institutions.

ASSESSMENT OF CHARITABLE AND RELIGIOUS TRUSTS AND INSTITUTIONS

INCOME TAX DEPARTMENT

Directorate of Income Tax (PR, P&P)

6 Floor, Mayur Bhawan, Connaught Circus,

New Delhi-110001

Page Contents

- Foreword by the Chairman, CBDT

- Foreword by the Member (IT&R)

- Foreword by the Pr. CCIT (Exemptions)

- Chapter-1

- The Ecosystem of NPOS In India And Worldwide

- Chapter-2

- Administrative Structure

- Chapter-3

- Registration Related Provisions

- Chapter-4

- Provisions Related To Taxability of Income

- 11. Conditions For Claiming Exemption

- 12. Charitable Purpose

- 13. Hon’ble Supreme Court Decision In New Noble Educational Society

- 14. Commercial Activities

- 15. Change of Objects of The Trust Or Institution

- 16. Income

- 17. Receipts From Incidental Objects

- 18. Donations

- 19. Foreign Donations Received By The Trust or Institution

- 20. Anonymous Donations

- 21. Corpus Donations

- 22. Borrowed Funds By Trust or Institution

- 23. Application of Income

- 24. Capital Expenses And Depreciation

- 25. Set-Off Of Losses Claimed

- 26. Application of Income Outside India Under Section 11(1)© )

- 27. Accumulation of Income

- 28. Transfer of Capital Asset

- 29. Modes of Investment

- 30. Books of Account By The NPOS

- 31. Return of Income

- 32. Audit

- Chapter-5

- Important Circular Issued By CBDT In The Recent Past

- Annexure-A

- Annexure-B

- Annexure-C

- Annexure-D

Foreword by the Chairman, CBDT

The Income Tax Department has undergone significant changes in recent times. One of the most significant steps taken by the Department is moving from the earlier assessment regime to the faceless assessment regime. There was a long-standing demand from the Faceless Assessing Officers to improve their capacity regarding the application of the provisions related to charitable and religious trusts and institutions. It is in the interest of all the stakeholders that the FAOs carrying out the assessment work comprehend the law with clarity so that they can frame assessments with sound reasoning. This will not only protect the interest of the revenue but also result in the avoidance of inconvenience to the genuine trusts and institutions and minimize the cost of litigation.

I compliment Exemptions Division to conceptualize and come out with an informative booklet that will help our FAOs to understand the latest position of law on different provisions related to charitable trusts and institutions. I feel that this will be quite helpful to the FAOs in making assessments with sound reasoning which can better test the appeal, if any. I wish all the best to the Assessing Officers and I am quite sure that they will make the best use of this endeavor.

Nitin Gupta

Chairman, CBDT

Foreword by the Member (IT&R)

Non Profit Organizations (NPOs) act as a significant partner of the Government in their endeavor to deliver public services. The Income-tax Act has historically recognized the contribution of the NPOs in the growth of India and, therefore, exempted their income subject to certain conditions. Income-tax Act, 1961 contains specific provisions related to NPOs working in the fields of education, medical relief, yoga, relief to the poor, preservation of environment and monuments, and other public utilities.

Provisions related to exemptions have always occupied a special significance. The last three Finance Acts have brought about fundamental changes in these provisions. Hon’ble Supreme Court has also delivered a few landmark decisions in the last few years. FATF is also undertaking a review of India at present and recommendation no. 8 of the FATF specifically focuses on NPOs. Comptroller & Auditor General of India in its recent report no. 12 of 2022 has made specific recommendations on the assessment of charitable and religious institutions.

Since the rollout of the faceless assessment scheme, the assessment of the NPOs has been carried out by the FAOs. Since the FAOs are carrying out a wide variety of assessments and the provisions related to exempt institutions are fundamentally different from the provisions related to the rest of the taxpayers, there was a long-felt need to educate and train the FAOs on the provisions related to NPOs. Though regular training programmes for the FAOs are being conducted by the NADT, RTIs, and Pr. CCIT (Exemptions), there was a need to document the provisions with the latest updates.

I am glad to see the booklet prepared by the Exemptions charge under the guidance of the Pr. CCIT(Exemptions). I hope this booklet will help the FAOs to be well-versed with the latest laws and legal pronouncements on the provisions related to NPOs. I compliment the Exemptions Division for putting in efforts to prepare a comprehensive guide for the Assessing Officers. I am really happy to see the points of verification on most of the topics which would be very helpful for the FAOs in understanding the issues and deciding the points of verification in cases assigned to them. I wish all the Assessing Officers all the best and hope that they will make the best use of this booklet.

Best wishes.

Pravin Kumar

Member (IT&R), CBDT

Foreword by the Pr. CCIT (Exemptions)

A Non Profit Organization (NPO) is one that is not driven by profit but by dedication to a charitable or religious purpose. NPOs work as an extended arm of the Government sharing the responsibility of the delivery of the public services. To promote and strengthen the NPOs, the Income-tax Act, 1961 provides exemption from income tax on their income subject to certain conditions.

The exemptions charge is a niche charge that is responsible for the supervision and monitoring of the NPOs. Provisions of the Act related to exemptions are quite different from the regular concepts of Income-tax like capital/revenue expenditure, application of income, deemed application, accumulation of income, etc. The interpretation of transactions appearing in the Income and Expenditure Statements of NPOs is counter-intuitive to the way financial transactions are interpreted in cases of business organizations. For example, in the case of a business entity, capital receipts get accounted directly to the Balance Sheet. In contrast, in the case of an NPO, it is to be reflected in the Income Statement with the qualification that it does not form part of the corpus. Similarly, on the expenditure side, all capital expenditures in the case of the business organization get reflected directly to the Balance Sheet with only depreciation being taken to the Profit & Loss Account whereas in the case of the NPOs, all the capital expenditures are part of the Expenditure Statement provided they are spent for the charitable purposes as per its objects.

It is difficult to expect an AO, looking after all classes of normal assesses, to suddenly change the way he examines financial statements while encountering the case of an NPO. It increases the chances of critical issues being missed while conducting assessments in the cases of NPOs by regular AOs in the current regime. Since the assessment of the NPOs is undertaken by the FAOs, this booklet is an endeavor to help the FAOs to understand the intricacies of the provisions related to charitable and religious trusts and institutions.

India’s Mutual Evaluation by FATF is presently underway and India is committed to complying with the standards of the FATF. Income-tax Department is one of the key agencies to regulate and monitor charitable trusts and institutions. The Income Tax Department carries out scrutiny assessment of selected cases of charitable trusts and institutions based on a risk assessment framework. This scrutiny assessment comprises a significant part of the supervision and monitoring of the NPO sector. The income-tax department carries out the in-depth monitoring and supervision of the charitable trusts and institutions to ensure that only those trusts and institutions that carry out genuine activities get an exemption.

The C&AG in its Report No. 12 of 2022 on NPO sector has noted at many places in its report that the charitable and religious institutions are required to be effectively monitored. Due to the exemption from tax and allowability of deduction u/s 80G, many fake organizations also try to get the benefit in the guise of charitable institutions and therefore there is a need for more effective monitoring of this sector, as highlighted by the C&AG. Given these recent developments, it is all the more necessary that the FAOs become well versed with the provisions related to charitable trusts and institutions.

Recently, Hon’ble Supreme Court in CIT (Exemptions) Vs. Ahmedabad Development Authority & Ors. has rendered a landmark judgment regarding charitable trusts and institutions. There have been many more such decisions from the Apex Court in the last 2 years which are required to be uniformly implemented throughout India.

Further, successive Finance Acts, especially the Finance Acts 2021, 2022, and 2023 have brought about significant changes in the provisions related to charitable and religious institutions. The Assessing Officers is required to refer the matter to the jurisdictional commissioner, in cases of specified violation, who is required to decide whether to cancel the registration of the trust or institution.

This booklet is an endeavor to provide a quick reference to the AOs of the latest position of law and also a few of the most important judicial pronouncements in the recent past. While all situations may not have been captured, an effort has been made to provide guidelines to the FAO’s to arrive at the best possible understanding of law, and minimizing any errors. Fair assessments are in the interest of all stakeholders.

I will compliment and appreciate the contribution of Vipul Agarwal, CIT(Hqrs.)(Exemptions) alongwith his team of officers in compiling this publication.

I hope that all officials will be able to make the best use of this booklet.

Mohanish Verma

Pr. CCIT (E)

Chapter-1

The Ecosystem of NPOS In India And Worldwide

1. Introduction

1.1 Non Profit Organizations (NPOs), whether public trusts, societies, or other non-profit entities

(including non-profit companies), perform a vital role in supplementing governmental efforts of promoting economic development and social welfare. There is a need for such organizations, not only because the resources at the command of the government are insufficient relative to need, but also because of their outreach and the wealth of local knowledge they possess, all of which can fruitfully be utilized for the benefit of society. NPOs exist in all countries, whether developed or developing. Tax administrations the world over recognize their voluntary efforts and provide incentives to genuine charitable organizations. Most often, this is done by either partially or fully exempting their incomes from tax, and also by providing tax incentives to donors to encourage them to contribute resources to such organizations. The Indian Income Tax Act, 1961 (the Act) also incorporates several provisions to extend tax breaks and incentives to such organizations and their donors.

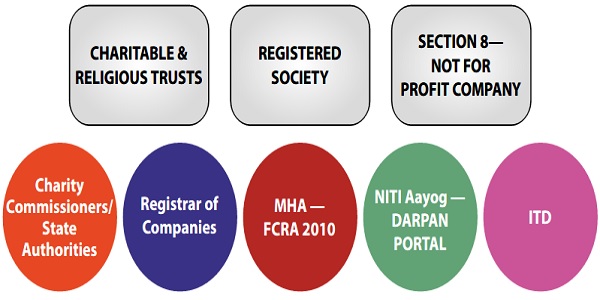

1.2 The NPOs in India are regulated by different agencies and the regulatory framework may be understood with the help of the following diagram:

AUTHORITIES ENGAGED IN INCOPORATION/REGISTRATION/REGULATION OF NPOs IN INDIA

1.3 Broadly, the NPOs have three different types of constitution:

a) Trusts registered under the Indian Trust Act, 1882/ various state trust Acts, etc.

b) Societies registered under the Society Registration Act, 1860/ various state registration acts, etc.

c) Section 8 companies registered under the Companies Act, 2013.

1.4 While the Ministry of Corporate Affairs regulates section 8 companies, the societies and trusts are registered with the state registrars.

1.5 Foreign Contributions Regulation Act, 2010 (FCRA) administered by the Ministry of Home Affairs (MHA) regulates the foreign contributions received by charitable entities for social, religious, or philanthropic purposes, and maintains data regarding the same.

1.6 DARPAN Portal administered by the NITI Aayog administers and regulates the disbursement of government grants to the NPO sector and registration on the portal is a mandatory condition for eligibility to avail government grants.

1.7 There are charity commissioners in a few states and the charitable or religious institutions must be registered with them to carry out charitable or religious activities.

2. Availability of Information With The Regulators

2.1 Availability of Information with Ministry of Corporate Affairs

Registrar of Companies (RoC) under the Ministry of Corporate Affairs maintains registration /incorporation details and also annual filing by the Non-Profit companies. Specifically, the following details are available:

A. One-Time Compliances for Section 8 Company

a) Receipt of share application money

b) Allotment of shares.

c) Transfer of shares.

d) Appointment/Resignation of Directors.

e) Appointment /Resignation of Managing Director/ Whole Time Director.

f) Executing agreements with related parties.

g) Any change in the Bank signatories.

h) Any change in the statutory auditor.

B. Annual Compliance

a) Form AOC-4 (within 30 days of AGM) Annual Financial Statement & CSR

b) MGT-15 (within 30 days of AGM) (Applicable for public companies only) Filing Report on AGM

Various information is to be displayed in the report which consists of the day, date, venue, and time of the AGM, components of the appointment of the chairman, information about the attendees of the meeting, confirmation of the quorum, business transacted at the meeting, and the decisions made thereof, details of any adjournment/postponement of the meeting, a fair summary of the proceedings of the meeting, etc.

c) Form MGT -7 (within 60 days of AGM)

I. The registered office, principal business activities, particulars of its holding, subsidiary, and associate companies;

II. The shares, debentures, other securities, and shareholding pattern of the company;

III. Indebtedness of the company;

IV. The members and debenture-holders along with alterations connected to them since the end of the previous financial year;

V. The promoters, directors, and key managerial personnel along with alterations connected to them since the close of the previous financial year;

VI. Meetings of members or a class thereof, Board and its various committees along with attendance details;

VII. Remuneration of directors and key managerial personnel;

VIII. Penalty or punishment imposed on the company, its directors or officers and details of compounding of offenses and appeals made against such penalty or punishment;

IX. The matters relating to certification of compliances and disclosures as may be prescribed;

X. Its shareholding pattern; and

XI. Such other matters as required in the form.

2.2 Availability of Information with State Governments/Charity Commissioners

There is a great deal of divergence in the procedure as well as information requirement between various state governments. Predominantly the data available with the state governments is in the manual mode and offline. The state-wise details and availability of data are enclosed as Annexure to this report (Annexure A).

2.3 Availability of Information with FCRA, MHA

(i) The annual return form under FCRA, Form FC-4 contains data about the registered NPOs. The details captured under Form FC-4 are as under:

1. (a) Name and address of person/association

(b) FCRA registration/ prior permission number and date

2. Details of receipt of foreign contribution:

(a) Foreign Contribution received in cash/ kind (value)

(b) Brought forward foreign contribution at the beginning of the year

(c) Income during the year:

(I) Interest

(ii) Other receipts from projects/activities

3. Donor wise details of foreign contributions received

4. Cumulative purpose-wise (social, cultural, educational, economic, religious, amount of all foreign contribution received)

5. Details of the utilization of foreign contribution

6. Administrative expenses as provided in Rule 5 of the Foreign Contribution (Regulation) Rules, 2011

7. Details of purchase of fresh assets

8. Details of unutilized foreign contribution

(ii) The other information of relevance within the domain of FCRA authorities are as under:

1. FCRA Registration Forms containing basic details

2. Darpan ID

3. Data about cancellation/any other punitive action on the NPO pertaining to FCRA

4. Designated FCRA bank accounts

2.4 Availability of Information with the DARPAN portal

a) NPOs enrolled with Unique Darpan IDs & their basic registration details

b) NPO contact person mobile, e-mail & PAN of NPO, FCRA registration of NPO, if available

c) Aadhar details of the key Member (President/ & Gen Secretary) of the NPO

d) Details of government grants received by participating NPOs

e) Utilization & monitoring of grants spent (work in progress)

f) Details of NPOs blacklisted by DARPAN

2.5 Availability of Information with Banks

a) Data on financial transactions, credit & debits, cash deposits, etc

b) KYC of key functionaries & their mobile numbers

c) Outward foreign remittances

d) Receipts in foreign currency

2.6 Availability of Information with the Income Tax Department

ITD has the most comprehensive database on the NPOs. The details are briefly mentioned as under:

a) PAN database, capturing basic details of the NPO

b) Application for Registration in Form 10A/Form 10AB, as the case may be

c) URN (Unique Registration Number) of the NPOs approved/registered under section 10(23C)/12AB, and the order of PCIT/CIT in Form 10AC/10AD registering the NPO

d) Database of applications rejected by PCIT/CIT in Form 10AC/10AD

e) Mandatory Annual Audit Report filed by the NPO in Form 10B/10BB

f) Annual Accumulation Report filed by the NPO in Form 9A/Form 10

g) Annual Statement of Donation in Form 10BD filed by donee NPO approved under section 80G

h) Annual Income Tax Return in ITR 7

i) Quarterly TDS Statements filed by the NPOs

j) Form 15CA/15CB filed by the NPOs for outward foreign remittance

k) Form 15CC received from banks & other authorized institutions for outward foreign remittances

l) Suspicious Transactions Reports (STRs) received from the Financial Intelligence Unit (FIU)

m) Information shared by other Law Enforcement Agencies (LEAs)

3. Prevention of Money-Laundering (Maintenance Of Records) Amendment Rules, 2023 Notification Dated 7th March 2023

3.1. Recently, Prevention of Money-laundering (Maintenance of Records) Amendment Rules have been amended to provide the following:-

“(9A) Every Banking Company or Financial Institution or intermediary, as the case may be, shall register the details of a client, in case of the client being a non-profit organization, on the DARPAN Portal of NITI Aayog, if not already registered, and maintain such registration records for a period of five years after the business relationship between a client and a reporting entity has ended or the account has been closed, whichever is later”.

3.2. The definition of a Non-Profit organization has also been aligned with the definition under the Act

“(cf) “Non-profit organization” means any entity or organization, constituted for religious or charitable purposes referred to in clause (15) of section 2 of the Income-tax Act, 1961 (43 of 1961), that is registered as a trust or a society under the Societies Registration Act, 1860 (21 of 1860) or any similar State legislation or a Company registered under the section 8 of the Companies Act, 2013 (18 of 2013);”

Verification from Darpan Portal

The amendment has a huge impact as now the information related to all the bank accounts of the NPOs shall be available on the DARPAN portal and such information is freely accessible. Therefore, the Assessing Officers may verify whether the NPO being assessed by them has any bank account that is not disclosed in the ITR or receipts whereof have not been accounted for in the books of account.

4. The Fatf Recommendations On NPOs

4.1 The Financial Action Task Force (FATF) is the global money laundering and terror financing watchdog. It sets international standards that aim to prevent these illegal activities and the harm they cause to society. The objectives of FATF are to set standards and promote effective implementation of legal, regulatory, and operational measures for combating money laundering, terror financing, and other related threats to ensure the integrity of the international financial system. FATF is a policy-making body that works to generate the necessary political will to bring about national legislative and regulatory reforms in these areas. FATF monitors progress in implementing its Recommendations through “peer reviews” (“mutual evaluations”) of member countries.

4.2 The risk of terror abuse in non-profit organizations (NPOs) is incorporated in the FATF Recommendation 8 which requires that countries to review their laws and regulations to ensure that NPOs cannot be abused for the terror financing. The FATF Recommendation 8 focuses on the non-profit organization (NPOs) sector and the potential use of the NPOs as vehicles for Money Laundering (ML) and Terror Financing (TF).

“Countries should review the adequacy of laws and regulations that relate to Non-Profit Organisations which the country has identified as being vulnerable to terrorist financing abuse. Countries should apply focused and proportionate measures, in line with the risk-based approach, to such non-profit organizations to protect them from terror financing abuse, including:

a) By terrorist organizations posing as legitimate entities;

b) By exploiting legitimate entities as conduits for terror financing, including for the purpose of escaping asset-freezing measures, and

c) By concealing or obscuring the clandestine diversion of funds intended for legitimate purposes to terrorist organizations”.

4.3 The FATF has established best practices, aimed at preventing the misuse of NPOs for TF while, at the same time, respecting legitimate actions of the NPOs. In Para 12 of the Best Practices Document on Combating the Abuse of NPOs, it is mentioned as under:

“12. While it is possible that NPOs, like their for-profit counterparts, may face numerous other risks relating to money laundering, fraud, corruption, and tax evasion. Recommendation 8 is only intended to address the particular vulnerability of NPOs to terrorist abuse. Yet risk mitigation measures to protect against other illicit financial threats, including money laundering, can be helpful in mitigating terror financing risks”.

4.4 Recommendation 8 encourages countries to identify the risk of misuse of NPOs for TF purposes. The Best Practices Paper does not prescribe a single methodology for assessing the risks of misuse of NPOs. It is recommended that countries should undertake a domestic review of their NPO sector or have the capacity to obtain timely information on its activities, size or other relevant features. Countries should also periodically reassess the sector by reviewing new information on the sector’s potential vulnerabilities to terrorist activities. An effective approach in identifying, preventing, and combating the misuse of NPO sector may involve all four of the following elements:

a) Outreach to the sector

b) Supervision or monitoring

c) Effective investigation and information gathering

d) Effective mechanism for international cooperation

FATF Report: Best Practices Combating the Abuse of Non-Profit Organizations (R. 8)

4.5 The relevant issues under each of these four elements are mentioned hereunder:

a. Outreach to the NPO sector concerning TF issues

(i) Countries should have clear policies to promote transparency, integrity and public confidence in the administration and management of all NPOs.

(ii) Countries should encourage or undertake outreach programmes to raise awareness in the NPO sector about the vulnerabilities of NPOs to terrorist abuse and TF risks, and the measures that NPOs can take to protect themselves against such abuse.

(iii) Countries should work with the NPO sector to develop and refine best practices to address TF risks and vulnerabilities and thus protect the sector from terrorist abuse.

(iv) Countries should encourage NPOs to conduct transactions via regulated financial channels, wherever feasible, keeping in mind the varying capacities of financial sectors in different countries and in different areas of urgent charitable and humanitarian concerns.

b. Supervision or monitoring of the NPO sector

Countries should take steps to promote effective supervision or monitoring of their NPO sector. In practice, countries should be able to demonstrate that the following standards apply to NPOs which account for a significant portion of the financial resources under control of the sector and a substantial share of the sector’s international activities:

(i) NPOs should maintain information on: (1) the purpose and objectives of their stated activities; and (2) the identity of the persons who own, control, or direct their activities, including senior officers, board members, and trustees. This information should be publicly available either directly from the NPO or through appropriate authorities.

(ii) NPOs should issue annual financial statements that provide detailed breakdowns of incomes and expenditures.

(iii) NPOs should be licensed or registered. This information should be available to competent authorities.

(iv) NPOs should have appropriate control in place to ensure that all funds are fully accounted for, and are spent in a manner that is consistent with the purpose and objectives of the NPO’s stated activities.

(v) NPOs should follow a “know your beneficiaries and associate NPOs” rule, which means that the NPO should make the best efforts to confirm the identity, credentials, and good standing of their beneficiaries and associate NPOs. NPOs should also undertake best efforts to document the identity of their significant donors and to respect donor confidentiality.

(vi) NPOs should maintain, for at least five years, records of domestic and international transactions that are sufficiently detailed to verify that funds have been spent in a manner consistent with the purpose and objectives of the organization, and should make these available to competent authorities upon appropriate authority. This also applies to information mentioned in paragraphs (i) and (ii) above.

(vii) Appropriate authorities should monitor the compliance of NPOs with the requirements of this Recommendation. Appropriate authorities should be able to apply effective, proportionate, and dissuasive sanctions for violations by NPOs or persons acting on behalf of these NPOs.

c. Effective information gathering and investigation

(i) Countries should ensure effective cooperation, coordination, and information-sharing to the extent possible among all levels of appropriate authorities or organizations that hold relevant information on NPOs.

(ii) Countries should have investigative expertise and capability to examine those NPOs suspected of either being exploited by or actively supporting, terrorist activity or terrorist organizations.

(iii) Countries should ensure that full access to information on the administration and management of a particular NPO (including financial and programmatic information) may be obtained during the course of an investigation.

(iv) Countries should establish appropriate mechanisms to ensure that when there is suspicion or reasonable grounds to suspect that a particular NPO:

(a) is a front for fund raising by a terrorist organisation;

(b) is being exploited as a conduit for TF, including for the purpose of escaping asset-freezing measures; or

(c) is concealing or obscuring the clandestine diversion of funds intended for legitimate purposes, but redirected for the benefit of terrorists or terrorist organizations, this information is promptly shared with relevant competent authorities, in order to take preventive or investigative action.

d. Effective mechanism for international cooperation

In the Best Practices Guidance, it has been stated that effective capacity to respond to international requests for information about an NPO of concern, consistent with recommendations on international cooperation, countries should identify appropriate points of contact and procedures to respond to international requests for information regarding NPOs suspected of TF or other forms of terrorist support.

Chapter-2

Administrative Structure

5. Administrative Structure And Authorities

5.1 The provisions relating to the trusts or institutions and entities claiming exemption under the direct tax laws are administered mainly by Pr. Chief Commissioner of Income Tax (Exemptions) and the Commissioner of Income Tax (Exemptions) in 14 charges, namely, Ahmedabad, Bengaluru, Bhopal, Chandigarh, Chennai, Delhi, Hyderabad, Jaipur, Kochi, Kolkata, Lucknow, Mumbai, Patna and Pune.

5.2 The hierarchy of central government authorities dealing with charitable and religious trusts and institutions under the I-T Act is briefly as follows:

(i) The Central Government;

(ii) The Central Board of Direct Taxes;

(iii) The Pr. Chief Commissioner of Income Tax (Exemptions);

(iv) The Commissioner of Income Tax (Exemptions);

(v) The Additional/Joint Commissioner of Income Tax (Exemptions);

(vi) The Deputy/Assistant Commissioner of Income Tax (Exemptions);

(vii) The Income Tax Officer (Exemptions); and

(viii) The Inspector of Income Tax.

Chapter-3

Registration Related Provisions

6. Registration of Charitable/Religious Trust or Institution

6.1 One of the key conditions for charitable/religious trusts or institutions seeking to claim exemption under Sections 11 and 12 of the Act is that such trust or institution should be registered under the Act. The first and second proviso to clause (23C) of section 10 as well as section 12A provide that the provisions of sub-clause (iv), (v), (vi), and (via) of clause (23C) of section 10 and section 11 and section 12, which provide for exemption of income to such trusts and institutions, will not be applicable unless such trust or institution has made an application in the prescribed form for registration and it has been registered.

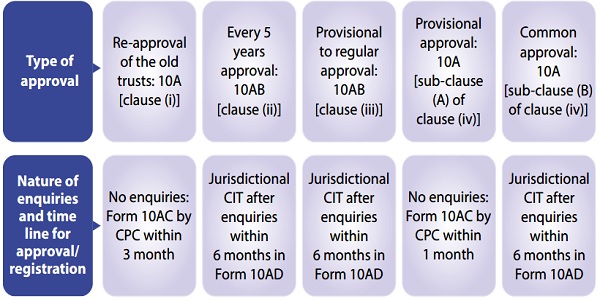

6.2 With the advent of technology, to improve the registration process, and keeping in mind the practical difficulties in obtaining registration, the Finance Act, 2020, inter alia, amended several provisions relating to the registration of charitable/religious trusts or institutions referred to in clause (23C) of section 10, 12A, 35 and 80G of the Act to provide:

a) Approval shall be granted for a period not exceeding five years at a time.

b) Re-registration of the existing charitable institutions.

c) Provisional registration of the first-time applicants for a period of 3 years or commencement of activities.

d) Statement of donations to be filed by the entities registered u/s 80G/35.

e) Issue of certificate by the donee to the donor for such donation.

6.3 The above amendments were to come into effect from 1st June 2020. However, given the crisis presented by the outbreak of the COVID-19 pandemic, vide Press Release dated 9th May 2020, the Ministry of Finance deferred the applicability of the new process of registration to 1st October 2020. Subsequently, given the persisting pandemic, the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020 further deferred the applicability to 1st April 2021.

6.4 Given the above, a notification was issued to provide a new procedure for the registration/approval/notification of the exempt entities covered under sections 10(23C), 12A, 35, and 80G of the Act by amending the Income-tax Rules, 1962 ( the Rules). Rule 2C, 5C, 5F, 11AA and 17A have been amended and new rules 5CA and 18AB have been inserted providing for:

a) Online process for filing of the application

b) Instant registration in case of provisional registration and re-registration

c) Instant generation of the Unique Registration Number (URN)

d) Cancellation of the registration, in case the same is procured by filing incomplete or wrong form or documents

e) Documents to be submitted along with the form

f) On-line processing of the applications and passing of the registration orders

g) Process for the online filing of the donation statements by the donee starting from the financial year 2021-22.

h) Process for furnishing the certificate of donation by the donee to the donor as per the procedure facilitated by the DG (Systems).

6.5 Further, old forms 10A, 10G, 56, 3CF-I, 3CF-II, and 3CF-III have been replaced with three new forms 10A, 10AB, and 3CF to reduce the compliance burden and improve the quality of the database.

First proviso to clause (23C) to section 10 and First proviso to sub-section (5) of section 80G

Clause (ac) of sub-section (1) of section 12A

6.6 While granting the registration, the PCIT/CIT satisfies himself with the following:-

a) The objects of the trust or institution, and

b) The genuineness of its activities.

6.7 The following points are ordinarily verified by the PCIT/CIT at the time of granting registration:-

a) There should be a legally existent entity which can be registered;

b) It should have a written instrument of creation or written document evidencing its creation;

c) All its objects should be charitable or religious;

d) Its income and assets should be applied exclusively to the objects mentioned in the object clauses, and the rules and by-laws;

e) No part of its income should be distributable or distributed, directly or indirectly, to its members, directors or founders, related persons or relatives, etc. claiming through them;

f) In case of dissolution, its net assets after meeting all its liabilities, should not be revertible or reverted to its founder, members, directors donors etc., but used for the objects by transfer to another trust/institution having objects of charitable/religious purpose.

Verification of commencement of activities:

a) The AO may verify whether regular registration has been granted by the CIT(E) and if not, whether the provisions of section 115TD are applicable.

b) The AO may also verify the date of commencement of activities. If the activities of the trust or institution have commenced but it has not applied for regular registration within 6 months of commencement of activities in form 10AB (or up to 30.09.23 as per Circular 06/23), provisions of section 115TD shall be attracted.

c) The AO may examine whether the registration/ approval is valid for the assessment year under consideration. The registration certificate. cate issued by the competent authority is valid w.e.f. assessment year mentioned in the certificate.

d) The AO may examine whether any modification cation has taken place in the objects of the trust or institutions registered with the Income-tax Department.

e) In case any modification cation has taken place, whether application as per the provision of section 12A(1)(ac) has been led by the assesssee.

f) The AO may examine whether the trust or institution has received registration u/s 12AB for the modification objects.

g) The AO may keep in mind that provisional registration/re-registration is granted by the CPC without detailed verification. CPC issues the certificates cates of registration in form 10AC while the CIT (Exemptions) issues the registration certificates in form 10AD. Therefore, if the trust or institution has only form 10AC till the date of scrutiny and no form 10AD has been issued, the AO needs to verify further whether the activities carried out by the trust or institution are within the scope of clause (15) of section 2.

h) There is a possibility that some ingenuine trust or institution has got the provisional registration/re-registration from CPC-based on false documents or by furnishing inaccurate particulars. The AO may examine to ensure that only genuine trusts or institutions get the bene t of exemption.

7. Commencement of Activities In Case of Provisional Registration

7.1 The trust or institution which gets provisional registration from CPC, needs to apply within six months of the commencement of the activities or at least six months prior to the expiry of period of provisional registration, whichever is earlier. The CIT(E) grants fresh approval/ registration after verification. If the trust or institution does not apply within the time limits for the regular registration, provision of section 115TD will be attracted and the trust or institution will have to pay tax on its accreted income. If the CIT(E) denies the regular registration and cancels the provisional registration, then tax has to be paid on the accreted income as per the provisions of section 115TD.

7.2 Trust or institutions registered under the old regime were required to furnish form 10AB by 30.09.2023 and the trust or institutions having provisional registration were also required to apply for regular registration by 30.09.2023 or within 6 months of commencement of activities, whichever is later. Where such application has not been received by 30.09.2023 or within 6 months from the commencement of activities and the trust or institution has claimed exemption for the previous year under scrutiny, it needs to be examined whether the trust or institution has a valid registration for the year.

7.3 The Finance Act, 2023, with effect from AY 2023-24, has amended the provisions of subsection (3) of section 115TD by providing that if a trust or institution fails to make an application for registration or re-registration within timelines, it shall pay taxes on its accreted income as per the provisions of section 115TD. Therefore, the following trusts or institutions-

a) which were registered/approved before 01.04.2021; or

b) which got provisional registration or approval and commenced their activities by 31.03.2023

but have not applied for registration in Form 10AB by 30.09.2023, will be subject to the provisions of section 115TD, and fair market value of their assets as on 30.09.2023 shall be taxable as per the provisions of section 115TD.

Verification of commencement of activities:

a) The AO may verify whether regular registration has been granted by the CIT(E) and if not, whether the provisions of section 115TD are applicable.

b) The AO may also verify the date of commencement of activities. If the activities of the trust or institution have commenced but it has not applied for regular registration within 6 months of commencement of activities in form 10AB (or up to 30.09.23 as per Circular 06/23), provisions of section 115TD shall be attracted.

8. Approval Under Section 80g

8.1 Apart from the exemption of income of the trust or institution itself under clause (23C) of section 10 or section 11 or 12 as described in the earlier paragraphs, a donor to such entities is also entitled to benefit of deduction from his own income on account of the donations made by him. The extent of deduction allowable is prescribed in Section 80G.

8.2 While contributions to certain funds/entities such as the Prime Minister’s National Relief Fund, contributions to a university or educational institution of national eminence, and to specified funds set up by state governments for disaster relief, etc. are entitled to 100 percent deduction, others are eligible for an exemption to the extent of 50 percent of the amount donated.

8.3 It may be noted here that donations exceeding Rs.2,000/- must be made other than in cash to be eligible for deduction. Section 80G(5) lays down the preconditions that must be satisfied cumulatively before a trust or institution can qualify for approval under Section 80G. These conditions are summarized as under:-

a) The income of the trust or institution should not be includible in its total income by provisions contained in clause (23AA) or clause (23C) of section 10 or section 11 or 12

b) As per the instrument under which the trust or institution was created and as per rules governing it, no part of its income or assets is transferable, or to be applied for any purpose other than charitable purposes. The charitable purpose here would not include religious purpose in view of Explanation 3 to Section 80G. However, sub-section (5B) of Section 80G permits the application of up to 5 per cent of the income for the year towards religious purposes;

c) The trust or institution is not expressed to be for the benefit of any particular religious community or caste;

d) It maintains regular books of account regarding its receipts and expenditures;

e) The trust or institution is either constituted as a public charitable trust, a society registered under the Societies Registration Act (or its equivalent legislation), a company registered under Section 8 of the Companies Act, or a statutory university or recognized educational institution, or an institution financed by the central or state government;

f) The trust or institution is approved by the PCIT/CIT in accordance with the rules made on this behalf.

8.4 The requirement for approval by the PCIT/CIT thus stems from the condition mentioned in (f) above.

9. Religious Activity By Trust Or Institution Approved U/S 80g

9.1 As per the provisions of sub-section (5) of section 80G, the benefits u/s 80G are available to the trust or institutions that are not religious. However, as per the provisions of sub-section (5B) of the section, any trust or institution that incurs expenditure, during any previous year, which is of a religious nature for an amount not exceeding five percent of its total income in that previous year shall be deemed to be an institution or fund to which the provisions of this section apply.

Verification of registration u/s 80G:

a) The AO shall verify whether the approval under section 80G needs to be withdrawn if as per the audit report expenditure on religious activity exceeds 5 %.

b) If expenditure on religious activities exceeds 5%, an intimation in this regard may be sent to the PCIT/CIT to cancel the approval u/s 80G.

10. Trust or Institution Under Section 80G (2)(B)

10.1 As per the provisions of explanation 3A and 3B to sub-section (1) of section 11 and explanation 1A and 1B to the 3rd proviso to clause (23C) of section 10, in case of any temple, mosque, gurdwara, church or other place notified under clause (b) of sub-section (2) of section 80G, any sum received by such trust or institution as a voluntary contribution for the purpose of renovation or repair of such temple, mosque, gurdwara, church or other place, may, at its option, be treated by such trust or institution as forming part of the corpus of the trust or the institution, subject to the condition that the trust or the institution-

(a) applies such corpus only for the purpose for which the voluntary contribution was made;

(b) does not apply such corpus for making contribution or donation to any person;

(c) maintains such corpus as separately identifiable; and

(d) invests or deposits such corpus in the forms and modes specified under sub-section (5) of section 11.

10.2 If the trust or institution violated any of these conditions then such sum shall be deemed to be income of the trust or institution.

Verification of section 80G(2)(b):

a) The AO may examine whether a notification has been issued by the Board and such notification is valid for the assessment year under consideration.

b) It is also required to be examined whether the notification was for specific repair and renovation and a specific period and whether the same is valid for the AY under scrutiny.

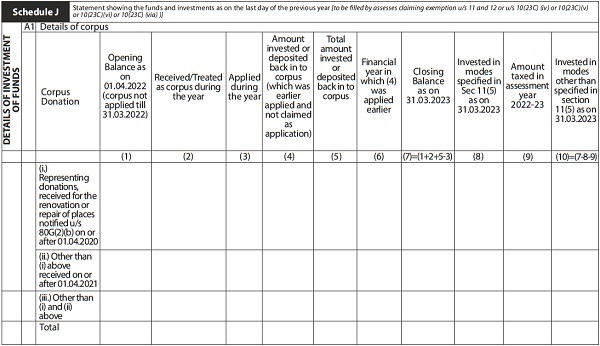

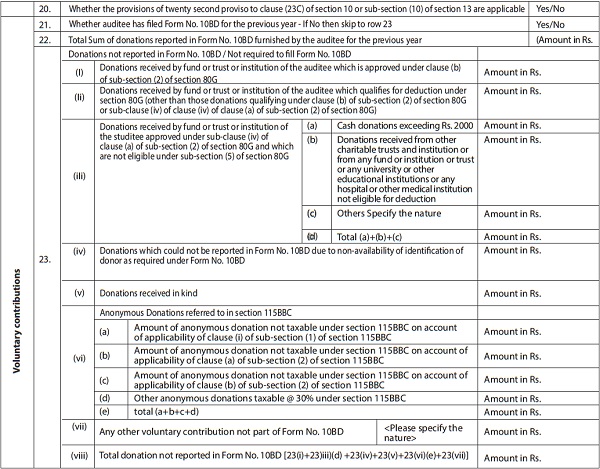

c) The details of such corpus are furnished separately in Schedule J of the ITR-7. The AO may verify whether all the conditions referred to above have been met by the trust or institution and if any of these conditions has been violated, it shall be deemed to be the income of the trust or institution.

Chapter-4

Provisions Related To Taxability of Income

11. Conditions For Claiming Exemption

11.1 Any trust or institution carrying out activities for charitable/religious purposes may claim exemption under sections 11 and 12 or under clause (23C) of section 10 of the Act. The trust or institution, to claim an exemption under these sections need to satisfy the following conditions:

a) It should be a public trust or society or a company registered under section 8 of the Companies Act, 2013 or any other entity specifically provided in the relevant provisions.

b) It should be formed with any one or more charitable or religious purposes.

c) It should be registered with the Income Tax Department. The authority competent to grant registration u/s 12AB (for claiming exemption u/s 11 and 12) and the second proviso to clause (23C) of section 10 is the PCIT/CIT or CPC.

d) It should fulfill the conditions laid down under clause (23C) of section 10 (referred to as first regime) or sections 11, 12, and 13 (referred to as second regime), as the case may be.

General Points of Verification-

General points of verification for the assessment of charitable or religious institutions are summarised here & have been explained in detail in the subsequent paragraphs:

a) Whether the trust or institution is registered/approved as per the provisions of section 10(23C)/12AB. (Para 6)

b) Whether the registration is valid for the AY under consideration. (Para 6)

c) Where the trust or institution gets provisional registration, it needs to apply for regular registration within 6 months of the commencement of activities or at least six months prior to expiry of period of provisional registration, whichever is earlier. Such provisional registration is valid for a maximum period of 3 years. (Para 7)

d) The AO needs to verify whether the registration has been canceled by the PCIT/CIT. (Para 34.4)

e) Where the trust or institution has received donations, whether all the donations are voluntary. (Para 18)

f) Whether the donations in kind have been duly accounted for. (Para 18)

g) Whether the anonymous donations have been offered for taxation as per the provisions of section 115BBC. (Para 20)

h) Whether the trust or institution is carrying out commercial activities and if so, whether the commercial activities are incidental to the objects of the trust and separate accounts are maintained. In case of any of these two violations, viz. carrying out non-incidental activities or carrying out incidental activities without separate books of account, it will be a specified violation, and a reference is required to be made to the PCIT/CIT for the cancellation of registration. (Para 14)

i) In case of GPU, whether the incidental commercial activities are within the range of 20% failing which the exemption is denied and the net income computed as per the provisions of 22nd and 23rd proviso to clause (23C) of section 10 or sub-section (10) and (11) of section 13 of the Act becomes taxable with effect from AY 2023-24 (upto AY 202223, exemption will be denied in such cases as per the provisions of 18th proviso to clause (23C) of section 10 or sub-section (8) of section 13 of the Act). (Para 14.3)

j) As per the decision of the Hon’ble Supreme Court in AUDA, any activity is a commercial activity, if the markup on the activity is above the nominal markup. (Para 14.2)

k) Hon’ble Supreme Court has also ruled in the AUDA case that the facts of each year are to be examined separately and therefore even if for a particular year, the courts have decided that the activities are not commercial, the facts of each of the year are to be examined separately. (Para 14.2)

l) Whether 85% of the income has been applied during the year for charitable or religious purposes in India as per the objects of the trust or institution. (Para 23)

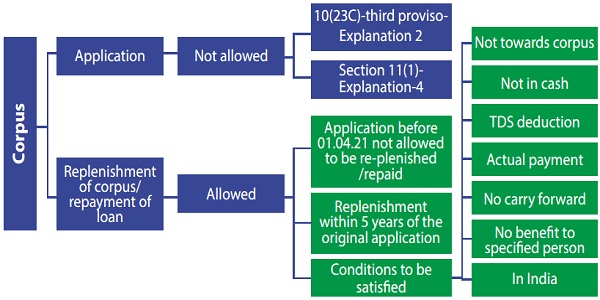

m) Corpus donations given by the donors with a specific instruction that such donations shall form part of the corpus, need not be applied. If any application is made by the trust or institution out of corpus, such application should not be considered for the computation of the mandatory 85% application out of current years ‘income (other than corpus). (Para 21)

n) Interest and other regular income on corpus is not corpus and needs to be applied. (Para 21)

o) Sometimes, an income received by the trust or institution is directly taken to the balance sheet and the trust or institution never applies such income. The AO needs to examine whether such funds are in the nature of the corpus. The same is required to be applied if found not to be in the nature of corpus . (Para 21)

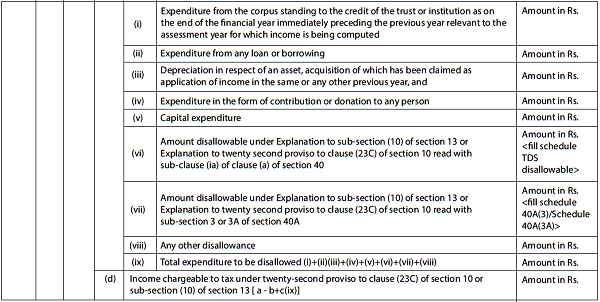

p) The application of income needs to satisfy the following conditions (similar provisions in first regime are elaborated in subsequent paragraphs) (Para 23)

i. Application should be in India [section 11(1)(a) and 11(1)(b)]

ii. Donation towards corpus not allowed [Explanation 2 to sub-section (1) of section 11] Finance Act, 2017 (wef AY 18-19)

iii. Donation to other trusts or institutions: only 85% allowed [Clause (iii) of Explanation 4 to sub-section (1) of section 11] Finance Act, 2023 (wef AY 24-25) (up to AY 2023-24, 100 % application shall be allowed).

iv. Section 40(a)(ia) (No TDS-30% application is disallowed) [Explanation 3 to subsection (1) of section 11] Finance Act, 2018 (wef AY 19-20)

v. Section 40A(3)/(3A): application in cash is disallowed >Rs.10,000 [Explanation 3 to sub-section (1) of section 11] Finance Act, 2018 (wef AY 19-20)

vi. No carry forward is allowed [Explanation 5 to sub-section (1) of section 11] Finance Act, 2021 (wef AY 22-23)

vii. Actual payment basis (Explanation to section 11) Finance Act, 2022 (wef AY 22-23)

viii. No benefit to specified persons [section 13(1)( c )]

q) Donation to any trust or institution which is not registered under clause (23C) of section 10 or section 12AB, or to a trust or institution which has different objectives shall not qualify as application. (Para 23)

r) No part of the income of the trust or institution shall be applied beyond the objects of the trust or institution. That is a specified violation and reference is required to be made to the PCIT/CIT. (Para 23)

s) No part of the income should be applied outside India except with the specific approval of the CBDT [clause (c.sub.) of sub-section 1 of section 11]. (Para 23)

t) If the trust or institution can not apply 85% of its income, it may accumulate for 1 year by filing form 9A or for 5 years by filing form 10. Form 9A does not apply to the first regime. (Para 27)

u) Such accumulated income (Form 10) is required to be applied in 5 years and if not applied within 5 years, the same is taxable as per the provisions of section 115BBI. (Para 34.2)

v) Donations can not be made out of the accumulated income. (Para 27)

w) The trust or institution shall not pass on any benefit to the related persons and if that is done, such amount is taxable as per the provisions of section 115BBI, and a penalty is required to be levied as per the provisions of section 271AAE with effect from AY 2023-24 [Upto AY 2022-23 exemption is not allowed in such cases as per the provisions of section 13(1)© )]. (Para 33)

x) The trust or institution should invest all the funds in the modes prescribed u/s 11(5) and any violation will make such amount taxable as per the provision of section 115BBI with effect from AY 2023-24 [up to AY 2022-23 exemptions is not allowed in such cases as per the provisions of section 13(1)(d)]. (Para 29)

y) The trust or institution should maintain the books of account prescribed under rule 17AA, failing which the exemption is denied and the net income computed as per the 22nd and 23rd proviso to clause (23C) of section 10 and sub-section (10) and (11) of section 13 of the Act becomes taxable with effect from AY 2023-24 [upto AY 2022-23 there was no specific provision to maintain books of account]. (Para 30)

z) The trust or institution should furnish the return of income within time, failing which the exemption is denied and the net income computed as per the 22nd and 23rd proviso to clause (23C) of section 10 and sub-section (10) and (11) of section 13 of the Act becomes taxable with effect from AY 2023-24 [upto AY 2022-23 exemptions is not allowed in such cases as per the provisions of clause (ba) of sub-section (1) of section 12A of the Act]. (Para 31)

aa) The trust or institution should get its accounts audited within time, failing which the exemption is denied and the net income computed as per the 22nd and 23rd proviso to clause (23C) of section 10 and sub-section (10) and (11) of section 13 of the Act becomes taxable with effect from AY 2023-24 [upto AY 2022-23 exemptions is not allowed in such cases as per the 10th proviso to clause (23C) of section 10 or clause (b) of sub-section (1) of section 12A of the Act]. (Para 32)

bb) The trust or institution approved under section 80G(5) also needs to furnish a statement of donation each year in form no 10BD as per clause (vii) of sub section (5) of section 80G of the Act. (Para 18)

cc) The trust or institutions are allowed to claim either the depreciation or cost of acquisition of the capital asset as application. (Para 24)

dd) The C&AG in its report on NPO sector in 2022 has given certain crucial findings. Executive summary of these findings is reproduced in Annexure-B.

12. Charitable Purpose

12.1 As per clause (15) of section 2 of the Act, “charitable purpose” includes:-

a) relief of the poor

b) education

c) yoga

d) medical relief

e) preservation of the environment (including watersheds, forests, and wildlife)

f) preservation of monuments or places or objects of artistic or historic interest, and

g) the advancement of any other object of General Public Utility (GPU).

12.2 Trusts of institutions can be formed with one or more of the charitable or religious purposes. Where a trust or institution has not been established under an instrument, the Assessing Officer should verify the objects for which the trust or institution has been created and whether those objects have been adhered to by the trust or institution. If the trust or institution carries out any activity beyond its objects, it will become a specified violation, and a reference is required to be sent to the PCIT/CIT for the cancellation of the registration of the trust or institution as per the provisions of sub-section (4) of section 12AB or the 15th proviso to clause (23C) of section 10 of the Act.

12.3 Reference to the PCIT/CIT is required to be made as per the provisions of the 2nd proviso to sub-section (3) of section 143 of the Act. Once such reference is made, time barring date for assessment will get covered under exclusion provisions as per clause (xiii) of the Explanation (1) to section 153 of the Act by a period commencing from the date on which the Assessing Officer makes a reference to the Principal Commissioner or Commissioner under the second proviso to sub-section (3) of section 143 and ending with the date on which the copy of the order under clause (ii) or clause (iii) of the 15th proviso to clause (23C) of section 10 or clause (ii) or clause (iii) of sub-section (4) of section 12AB, as the case may be, is received by the AO.

Verification of charitable purpose(s):-

a. The income of the trust or institution shall not be applied for the benefit of any particular religious community or caste.

b. If the income of the trust or institution is applied for the benefit of only those who are members of the trust or institution or to a select group of people, that may not be a public charitable or religious trust or institution.

c. Charitable or religious trusts or institutions are different from mutual benefit organizations that act for the benefit of their members. The income of mutual benefit organizations is not exempt as per the provisions of clause (23C) of section 10 or section 11/12.

d. The AO should examine whether the activities carried out by the trust or institution fall within clause (15) of section 2 of the Act, as well as the objects of the trust that have been approved or registered by the CPC/CIT as per the registration certificate in form 10AC/10AD.

e. Even if a particular activity carried out by the trust or institution is covered under clause (15) of section 2 of the Act but the same is not covered under the object clause of the registered trust deed/memorandum of the society/company, carrying out of such activity shall result in a specified violation and a reference for the cancellation of registration/approval is required to be made to the PCIT/CIT.

f. Hon’ble Supreme Court in Sole Trustee Loka Shikshana Trust vs Commissioner Of Income Tax has held that education means formal education and therefore, the AO should verify whether the courses conducted by the education institutions are approved by the regulators such as UGC/AICTE/CBSE/State Boards, etc.

g. AO should verify whether the trust or institution claiming exemption as GPU is a commercial enterprise running on the commercial lines. In such cases, the benefit of exemption shall not be allowed.

13. Hon’ble Supreme Court Decision In New Noble Educational Society

13.1 Sub-clause (vi) and (via) of clause (23C) contain a specific condition that it should exist solely for educational purposes/ philanthropic purposes and not for purposes of profit. The relevant sub-clauses are reproduced below:

“(vi) any university or other educational institution existing solely for educational purposes and not for purposes of profit, other than those mentioned in sub-clause (iiiab) or sub-clause (iiiad) and which may be approved by the Principal Commissioner or Commissioner or

(via) any hospital or other institution for the reception and treatment of persons suffering from illness or mental defectiveness or for the reception and treatment of persons during convalescence or of persons requiring medical attention or rehabilitation, existing solely for philanthropic purposes and not for purposes of profit, other than those mentioned in sub-clause (iiiac) or sub-clause (iiiae) and which may be approved by the Principal Commissioner or Commissioner”

13.2 Recently Hon’ble Supreme Court in the case of M/S NEW NOBLE EDUCATIONAL SOCIETY (civil appellate jurisdiction civil appeal no. 3795 of 2014 in the case of M/s New Noble Educational Society versus the Chief Commissioner of Income Tax) held as follows:

a. The requirement of the charitable institution, society trust or institution, etc., to ‘solely’ engage itself in education or educational activities, and not engage in any activity of profit, means that such institutions cannot have objects that are unrelated to education. In other words, all objects of the society, trust, etc., must relate to imparting education or be about educational activities.

b. Where the objective of the institution appears to be profit-oriented, such institutions would not be entitled to claim exemption under Section 10(23C) of the Act. At the same time, where surplus accrues in a given year or set of years per se, it is not a bar, provided such surplus is generated in the course of providing education or educational activities.

13.3 Therefore, in case of an educational or medical institution referred to under sub-clause (vi) and (via) of clause (23C) of section 10, the AO shall verify whether the activities of the trust or institution are being carried out solely for the purposes for which the trust or institution is approved and whether it is profit oriented.

14. Commercial Activities

14.1 There are 3 different provisions related to commercial activities:-

a) Commercial activities by GPU.

b) Incidental commercial activities (7th proviso to clause (23C) of section 10 or sub-section(4A) or section 11.

c) Commercial activities as per sub-section (4) of section 11.

14.2 Where the trust or institution is carrying out commercial activities, the following aspects are required to be examined:

a) As per the decision of the Hon’ble Supreme Court in AUDA [civil appeal no. 21762 of 2017 in the case of Assistant Commissioner of Income Tax (Exemptions) versus Ahmedabad Urban Development Authority], an activity is a commercial activity if the markup on the activity is above the nominal markup.

b) The Hon’ble Supreme Court has also ruled in the AUDA case that the facts of each year are to be examined separately and therefore, even if for a particular year, the courts have decided that the activities are not commercial, the facts of each of the year are to be examined separately.

14.3 Commercial activities by GPU

14.3.1 Proviso to clause (15) of section 2 provides that the advancement of any other object of a GPU shall not be a charitable purpose, if:

a) it involves the carrying on of any activity in the nature of trade, commerce, or business, or any activity of rendering any service about any trade, commerce, or business; and

b) such activity is for a cess or fee or any other consideration, irrespective of the nature of use or application, or retention, of the income from such activity, unless—

i. such activity is undertaken in the course of actual carrying out of such advancement of any other object of GPU; and

ii. the aggregate receipts from such activity or activities during the previous year, do not exceed twenty percent of the total receipts of the trust or institution undertaking such activity or activities, of that previous year;

14.3.2 Proviso to section 2(15) is also applicable in the cases of trust or institution registered under clause (23C) of section 10, as per 18th proviso to clause (23C) of section 10.

14.3.3 In the case of GPU, it needs to be examined whether the incidental commercial activities are within the range of 20%, failing which the exemption is denied and the net income computed as per the 22nd and 23rd proviso to clause (23C) of section 10 and sub-section (10) and (11) of section 13 of the Act becomes taxable. (up to AY 2022-23, exemption will be denied in such case as per the 18th proviso to clause (23C) of section 10 or sub-section (8) of section 13 of the Act).

14.4 Incidental commercial activities (7th proviso to clause (23C) of section 10 or sub-section(4A) of section 11

14.4.1 Where the trust or institution (whether GPU or any other trust or institution) carries out any business activity and such business is not incidental to the attainment of the objectives of the trust or institution business activity is incidental but or separate books of account are not maintained by such trust or institution, it shall be a specified violation as per the provisions of sub-section (4) of section 12AB or the 15th proviso to clause (23C) of section 10 of the Act and a reference is required to be sent to the PCIT/CIT for the cancellation of the registration of the Trust or institution.

14.4.2 Reference to the PCIT/CIT is required to be made as per the provisions of the 2nd proviso to sub-section (3) of section 143 of the Income-tax Act. Once such reference is made, time barring date for assessment will get covered under exclusion provision as per clause (xiii)of the Explanation (1) to section 153 of the Act by a period commencing from the date on which the Assessing Officer makes a reference to the Principal Commissioner or Commissioner under the second proviso to sub-section (3) of section 143 and ending with the date on which the copy of the order under clause (ii) or clause (iii) of the 15th proviso to clause (23C) of section 10 or clause (ii) or clause (iii) of sub-section (4) of section 12AB, as the case may be, is received by the AO.

14.5 Commercial activities as per sub-section (4) of section 11

14.5.1 Where the “property held under trust” includes a business undertaking so held, income from such business undertaking shall also be exempt subject to the conditions as per the provisions of sub-section (4) of section 11 of the Act. In such cases, the AO needs to compute the income of the business undertaking as per the provisions of the Act and where income so computed exceeds the income shown in the books of accounts of the trust or institution, such excess shall be taxable. The AO shall also verify whether separate books of account have been maintained by the trust or institution.

Verification of commercial activities:

a) The Assessing Officer may examine whether any TDS u/s 194C/J/H of the Act has been deducted in the case of the trust or institution. This information is available to the AO as per the AIS statement. TDS u/s 194C is deducted for carrying out contractual work and TDS u/s 194J is deducted for rendering professional services. If the trust or institution has disclosed certain receipts on which TDS under any of these sections has been deducted, then it needs to be verified whether these receipts are from any business activity or not and secondly, whether such business activity is incidental to the main activities of the trust or institution or not.

b) The Assessing Officer may examine whether separate books of accounts are maintained by the trust or institution for trade or business activities claimed to be incidental as required by section 11(4A) or 7th proviso to clause(23C) of section 10..

c) The Assessing Officer may examine whether the business activities carried out by the trust or institution are incidental to carrying out the main activities and are emanating from the main activities.

d) The Assessing Officer may examine whether the trust or institution is carrying out any activity like GPU. The AO should carefully examine the objects of trust or institution and whether charitable activities are actually being undertaken. Whether the activities are in the nature of the first six limbs of section 2(15) may also be examined by information available in the public domain, physical verifications, verifications from third parties such as the District Authorities where charitable activities were carried out or from different government agencies for whom projects were carried out by the trust or institution.

e) The PCIT/CIT while issuing the certificate of registration may specifically mention the category of charitable activities for which registration is granted. The AO should carefully go through the registration documents to examine whether the trust or institution has adhered to the nature of activities as per the registration document granted.

15. Change of Objects of The Trust Or Institution

15.1 Where there have been changes in the objects of the trust or institution during the previous year, the Assessing officer needs to verify whether such amended objects have been approved by the PCIT/CIT from which date such amendments are effected and whether those objects have been adhered to by the trust or institution. If the trust or institution carries out any activity beyond its objects, it will become a specified violation, and a reference is required to be sent to the PCIT/CIT for the cancellation of the registration of the trust or institution as per the provisions of sub-section (4) of section 12AB or the 15th proviso to clause (23C) of section 10 of the Act.

16. Income

16.1 The term “income” has been defined under clause (24) of section 2 of the Act to include several specified things. It is noteworthy that the definition, although very wide in scope, is still only an inclusive one, and not an exhaustive or exclusive one. In other words, in addition to the things specifically mentioned under Section 2(24), such other things which the word signifies in natural or common usage will also fall within the meaning of “income”.

Verification of Income:

a) The Assessing Officer may examine whether any income has been directly credited to the balance sheet in Reserve and Surplus. Some examples may be development fees, membership fees etc directly taken to the balance sheet. 85% of the entire income is required to be applied and any shortfall, unless accumulated as per the provisions of the Act, is taxable.

b) The Assessing Officer may examine whether income arising out of investments has been directly taken to the balance sheet and added to the investment. Such income also needs to be applied for charitable purposes.

c) The Assessing Officer may examine whether any income has been reported to the Income Tax Department, by any reporting entity, that has not been disclosed by the trust or institution in its computation of income. Such information can be accessed through AIS information in the ITBA/ITD system.

d) The AO should examine whether all the assets of trust/institutions are being used for charitable purposes especially immovable properties. A list of immovable properties may be called for. There may be instances where the trust properties are occupied/used by the trustees or their relatives for their personal use or running their businesses etc. At times such properties may not be visible from the balance sheet since they may have been received as donations in kind and may not have been recorded in the books of account.

e) The AO should examine whether the resources of the trust/institution have been used for the personal benefits of trustees or other specified persons. There may be instances where the employees of trust are used for the personal benefit of trustees. Recording of statements of such persons may reveal their actual usage.

17. Receipts From Incidental Objects

17.1 Where the trust or institution has declared substantial receipts from incidental objects in the schedule AI of ITR, the AO may verify whether the receipts are from a business which is incidental to the attainment of the objects of the trust or institution and whether the exemption claimed on account of the same is correct.

17.2 If a trust or institution has applied any income for any purpose other than the purpose for which the trust or institution is registered, it shall be a specified violation. Further, if a trust or institution has any income from business activities that are not incidental to the attainment of its objectives, it shall also be a specified violation. A reference in cases of specified violations is required to be sent to the PCIT/CIT for the cancellation of the registration of the trust or institution as per the provisions of sub-section (4) of section 12AB or the 15th proviso to clause (23C) of section 10 of the Act.

17.3 Reference to the PCIT/CIT is required to be made as per the 2nd proviso to sub-section (3) of section 143 of the Act. Once such reference is made, time barring date for assessment will get covered under exclusion provisions as per clause (xiii)of the Explanation (1) to section 153 of the Act by a period commencing from the date on which the Assessing Officer makes a reference to the Principal Commissioner or Commissioner under the second proviso to subsection (3) of section 143 and ending with the date on which the copy of the order under clause (ii) or clause (iii) of the 15th proviso to clause (23C) of section 10 or clause (ii) or clause (iii) of sub-section (4) of section 12AB, as the case may be, is received by the AO.

18. Donations

18.1 As per the provisions of sub-clause (iia) of clause (15) of section 2 of the Act, voluntary contributions (donations) received by these entities from their donors shall form part of their income. The Act deals with such voluntary contributions which are deemed to be the income of the trust or institutions under sub-clause (iia) of clause(24) of section 2 of the Act primarily in three ways.

a) Firstly, anonymous contributions (if any) out of these are dealt with in the manner provided under 16th proviso to clause(23C) of Section 10 or Section 13(7) and section 115BBC.

b) Secondly, voluntary contributions which are in the nature of corpus donations are eligible for exemption (i.e., rules regarding the extent of application or accumulation of income do not apply to corpus donations) under Explanation 1 to the 3rd proviso to clause (23C) of Section 10 or Section 11(1)(d).

c) Thirdly, voluntary contributions, which are neither anonymous nor corpus donations,

are eligible for exemption under the other provisions of clause(23C) of section 10 or Section 11, subject to the fulfillment of conditions specified therein.

Verification of Donations:

a) The Assessing Officer may examine whether all voluntary contributions have been shown as income by the trust or institution. The donation register/receipt register may be examined in this regard. Examination of bank statements may also reveal some receipts that have not been accounted for by the trust or institution.

b) A report by banks of charitable institutions is also filed with FIU. In appropriate cases, request may be made to FIU regarding the bank accounts maintained by the trust or institution which may reveal some undisclosed accounts.

c) The Assessing Officer may examine whether the receipts, declared as voluntary contributions, are in the nature of donations or receipts for carrying out some work or rendering services. In case, the receipts are for rendering services, the applicability of provisions of sections 11(4), 11(4A) and proviso to section 2(15) need to be examined. In case TDS has been deducted on such transactions under section 194C/J, the same would be reflected in Form 26AS which is available to AO as a part of AIS.

d) Copy of grant letters and agreements may also be examined to ascertain the true nature of receipt.

e) The Assessing Officer may examine whether the records with respect to the identity of the donors are maintained by the trust or institution. In case such records are not maintained, donations may be anonymous donation taxable u/s 115BBC as per the provisions of section 115BBC in the case of charitable institutions. In some cases, donations may not have been given by such a person. AO may verify such cases on a sample basis by sending notices to the donors.

f) In case of suspicious foreign donations, a request may be made to the FT&TR Division of CBDT to get information from respective countries about the genuineness of donations.

g) Trusts or institutions are required to furnish form 10BD providing the details of all the donors. Form 10BD may be reconciled with the donations disclosed by the trust or institution as income.

19. Foreign Donations Received By The Trust or Institution

19.1 Where the trust or institution has received foreign donations during the current year, whether the trust or institution received foreign contribution/ donation in compliance with the provisions of the Foreign Contribution Regulatory Act, 2010 may be verified. The tax treatment of the same may also be examined.

19.2 If a trust or institution has not complied with the provisions of the Foreign Contribution Regulation Act and the order, direction, or decree, holding that such non-compliance has occurred, has either not been disputed, or has attained finality, it shall be a specified violation. A reference in cases of specified violations is required to be sent to the PCIT/CIT for the cancellation of the registration of the trust or institution as per the provisions of subsection (4) of section 12AB or 15th proviso to clause (23C) of section 10 of the Act.

19.3 Reference to the PCIT/CIT is required to be made as per the provisions of the 2nd proviso to sub-section (3) of section 143 of the Act. Once such reference is made, time barring date for assessment will get covered under exclusion provisions as per clause (xiii)of the Explanation (1) to section 153 of the Act by a period commencing from the date on which the assessing officer makes a reference to the Principal Commissioner or Commissioner under the second proviso to sub-section (3) of section 143 and ending with the date on which the copy of the order under clause (ii) or clause (iii) of the 15th proviso to clause (23C) of section 10 or clause (ii) or clause (iii) of sub-section (4) of section 12AB, as the case may be, is received by the AO.

20. Anonymous Donations

20.1 If the trust or institution (other than a religious institution) is receiving donations and does not maintain a record of the identity indicating the name and address of the person making such donation, such donation will be treated as anonymous donation which is taxable as per the provision of section 115BBC of the Act.

20.2 As per the provisions of section 115BBC, anonymous donations received in excess of the higher of the following, are taxable:—

a. five percent of the total donations received by the trust or institution; or

b. one lakh rupees, and

20.3 Anonymous donations are not taxable if they are received by:-