As we all are aware that after the Income Tax Return is processed by CPC, taxpayer receives an Intimation at their registered email ID. But sometimes it might happen that some of the assesses not received any intimation or they request it to be resend it.

Process of request for re-sending of CC-Intimation u/s 143(1)/154 –

1. The option is available once you login into you account on https://incometaxindiaefiling.gov.in/e-Filing/UserLogin/LoginHome.html

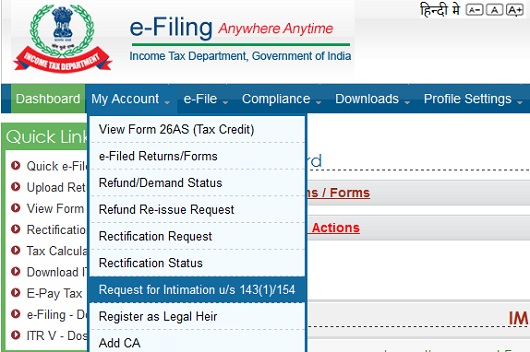

2. After login click -> My Account -> Request for intimation U/s. 143(1)/ 154 as shown in picture below:-

3. After click on Service request You have to inputs the details as depicted in picture below i.e. as follow:

3. After click on Service request You have to inputs the details as depicted in picture below i.e. as follow:

- Return Type

- Assessment Year

- Category

- Sub- Category

- Fields marked with asterisk(*) are mandatory.

- A request for Intimation u/s 143(1) or Rectification Order u/s 154 can be raised for the 5 Assessment Years.

- Select the appropriate sub-category provided in the dropdown.

- The Intimation/Rectification Order is sent to the registered E-mail ID.

- A new request for an Assessment Year can be submitted only after the previous request is processed.

Assessment Year * – Currently Facility is available from 2009-10 to 2014-15.

Category * – Category includes the following-

Rectification Order U/s. 154 – You need to mention CPC reference number also.

Intimation U/s. 143 (1)

4. Click ‘Submit’ and then check status

Republished with Amendments

Dear Sir ,

On that day of filing IT return i paid Rs 7000/- through challan 280 before submitting ITR form . But this self assessment amount was not reflected in TDS certificate by the time i filed IT return . So i got Demand notice to pay Rs 6810/- for AY 2018-19 . Through e-portal i submit Rectification under 154 , Disagree with Demand and uploaded soft copy of CIN & challan 280 receipt . Now IT dept. again reverted back saying , that challan no. is not in their records . Because IT dept is still using old TDS certificate to validate their records. Now what should i do ? I see another option of Disagree with demand , where i need to upload challah copy, latest TDS, letter requesting rectification copy and indemnity bond etc. For this I am not aware about the whole process. Please explain , how can it be done . — Thanks

Hi

There is no any option in income tax login for request for intimation u/s 143 (1)/(154). so please suggest me how can i apply for this.

SIR

CPC BANGALUR

pan: BJQPS6976P

AY: 2013-2014

Reference Number: CP15000621366

please, send me the CPC number and refund sequence number.

I have received one sms message on FEB- 23rd and two messages on march 21st from DM-ITDCPC saying for PAN – BMRPS1918K demand is outstanding the details are send to your registered e-mail id. Please take the necessary action. But so far I have not received any e-mail. Kindly give the details of this message.

Refund has not been paid stating no such address. I’m not able to do a refund reissue request as refund sequence number is not available in the CPC order letter. Please assist

One of my client received refund order with wrong account number.We have returned the cheque to bank.In refund request the CPC reference no.comming as wrong.

PAN : ANSPG2573M

IF YOUR A/C NUMBER IS CORRECT AND WANT ANY TYPE INCOME TAX REFUND CALL-8273980693

IF YOU WANT YOUR REFUND AND ANY OTHER ITR REFUND CALL ACHIN-8273980693

CALL ME AN Y INCOME TAX REFUND PROBLE I WILL HELP YOU SOLVE YOUR PROBLEM ACHIN-8273980693

CALL ME FOR YOUR INCOME TAX PROBLEM

ANY TYPE INCOME TAX REFUND HELP CALL-8273980693

Dear sir,

Return was filed manually so how can I have demand sequence no. and CPC reference no. for refund reissue request. I have only itr acknowledgement.

Sir please suggest.

sir,

I got my refund for year AY 10-11 this week. I had done a manual filing and had to run around to get my refund. I am not sure what the amount that got credited as this is little less than what i was supposed to get. How can i get an assessment sheet from the IT department?

Please advise

Sir,

PAN NO. ACTPV8444L

ASSESSMENT YEAR 2015-16

ACKNOWLEDGEMENT NUMBER; 805112650190915

ITR-4S FILED ONLINE

REFUND VALUE : 51600/-

MASSAGE SHWON ON ITR DISPLAY SITE : 27/10/2015 ITR PROCESSED REFUND DETERMINED AND SENT OUT TO REFUND BANKER

BUT STILL I HAVN’T RECEIVED REFUND AMOUNT

Sir,

PAN NO. ACTPV8444L

ASSESSMENT YEAR 2013-14

ACKNOWLEDGEMENT NUMBER; 637307420270613

ITR-4 FILED ONLINE

REFUND VALUE : 8860/-

REFUND UNPAID/FAILED DUE TO BANK ACCOUNT HAS BEEN CLOSED AS PER STATUS

REQUEST PROVIDE CPC COMMUNICATION REFERENCE NUMBER FOR RE-REFUND REQUEST

SIR CPC BANGALORE PAN: ANVPR4150Q AY: 2015-2016 PLEASE SEND MY CPC COMMUNICATION REFERENCE NUMBER AND REFERENCE SEQUENCE NUMBER CPC ORDER – See more at: https://taxguru.in/income-tax/apply-online-sending-cpcintimation-1431154-refund.html#sthash.CjFw50MO.dpuf

PAN: ANRPG4153G AY: 2015-2016 PLEASE SEND MY CPC COMMUNICATION REFERENCE NUMBER AND REFERENCE SEQUENCE NUMBER CPC ORDER

Dear Sir,

I am P. vijay Kumar, work for BSNL, TDS is deducted and remitted by the Accounts Officer. TAN – HYDB00979G

Recently, I found a discrepancy for financial year of 2008-09 and its Assessment year 2009-10 with a Demand pending for Rs 10289/-. And the latest submitted return is termed as defective citing the Outstanding amount.

I lost the Form 16 and the return acknowledge period AY 2008-09. My accounts office says they could not provide me another From 16 and I requested for the salary break and they issued. It shows the tax deducted of Rs. 3579/- where as the Demand from the CPC (143(1)) shows of Rs. 10290/-.

I met the ward officer and he insist me to get the 'Form 16' and showed him the attested salary break issued by my Accounts Officer. He still insists me to pay the total demand amount.

Please suggest how to correct the demand amount.

Thank you

P. Vijay Kumar

Dear Sir,

I am P. vijay Kumar, work for BSNL, TDS is deducted and remitted by the Accounts Officer. TAN – HYDB00979G

Recently, I found a discrepancy for financial year of 2008-09 and its Assessment year 2009-10 with a Demand pending for Rs 10289/-. And the latest submitted return is termed as defective citing the Outstanding amount.

I lost the Form 16 and the return acknowledge period AY 2008-09. My accounts office says they could not provide me another From 16 and I requested for the salary break and they issued. It shows the tax deducted of Rs. 3579/- where as the Demand from the CPC (143(1)) shows of Rs. 10290/-.

I met the ward officer and he insist me to get the ‘Form 16’ and showed him the attested salary break issued by my Accounts Officer. He still insists me to pay the total demand amount.

Please suggest how to correct the demand amount.

Thank you

P. Vijay Kumar

Sir,

PAN NO. AIMPN0423G

ASSESSMENT YEAR 2013-14

REFUND REFERENCE NUMBER 1385481865

ITR V FILED OFFLINE

REFUND VALUE 2723

REFUND DECLINED DUE TO INCORRECT ACCOUNT NUMBER AS PER STATUS

REQUEST PROVIDE CPC COMMUNICATION REFERENCE NUMBER FOR RE-REFUND REQUEST

SIR CPC

BANGALORE

PAN: AINPL5426G

DOB : 31/03/1990

AY: 2015-2016

PLEASE SEND MY CPC COMMUNICATION REFERENCE NUMBER AND REFERENCE SEQUENCE NUMBER CPC ORDER

SIR CPC

BANGALORE

PAN: AINPL 5426 G

AY: 2015-2016

PLEASE SEND MY CPC COMMUNICATION REFERENCE NUMBER AND REFERENCE SEQUENCE NUMBER CPC ORDER

Sir,

PLz send cpc communication and reference number for assessment year 2010-11 according my PAN AIBPJ1158K

Sir,

Iwant to cpc communication and reference number for assessment year 2013-14 according my PAN ABLPY1268D.

Respected Sir/Madam,

MY PAN NO BDHPA1560L, IN THE YEAR 14-15 TAX DEDUCTED BUT IN ITR ACKNOWLEDGMENT FORM SHOWS THAT TAX PAYABLE IS RS 4440/- AND I GET THE ACKNOWLEDGMENT FORM HOW CAN GET THE ITR V FORM. PLEASE SEND MY CPC AND REFERENCE SEQUENCE NUMBER PLEASE HELP ME

Respected Sir/Madam,

My Pan Card NO is BLVPD5483P . In Assessment year 2014-15 my Tax deducted Rs.12796. But in Income Tax Return Verification form ITR-V it shows that Net Tax Payable is Rs5083. In ITR-V It shows that Rs.7710 is Refund . But when i Select refund reissue option in there CPC Communication refrence number and Refund sequence number ask(as per CPC Order ) My question is that how CPC Communication refrence number and Refund sequence number.

Yours faithfully,

Rahul Harihar Davare

Dear Sir,

I have received Intimation for failure of refund processed. (Communication reference No: /CPC/1516/G3/15102115268) . In this letter there is no “Refund Sequence No” which is asked when I am requesting for Refund Re-issue Request.I have not received 143(1) Please let me know how/where to find /get refund sequence number

plz help me

SIR CPC

BANGALORE

PAN: BRUPB0626F

AY: 2013-2014

PLEASE SEND MY CPC COMMUNICATION REFERENCE NUMBER AND REFERENCE SEQUENCE NUMBER CPC ORDER

Dear Sir,

I have received Intimation for failure of refund processed. (Communication reference No: CPC/1516/G3/15102239865) . In this letter there is no “Refund Sequence No” which is asked when I am requesting for Refund Re-issue Request. Please let me know how/where to find /get refund sequence number

PAN AAAHP3198Q

Refund reflecting in 26AS

Intimation for failure of refund processed at CPC received but order u/s 143(1) not received

hence difficult to process request online in absence of refund req ref no.& ref sequence no. mentioned in order

PAN , Bank details filled properly in the return.

Assessment Year 2015-16. PAN ABSPJ9588K.

I do not see any CPC reference, etc after I login.However, my refund is stuck because Bank details, etc are not given. I have given those details in ITR2A when I filed.Can you give me my CPC ref/date, etc

Thanks

Dear Sir,

PAN No. – ABUPS3815Q

We have not received the refund amount for assessment year 2011-2012, 2012-2013, 2013-2014, 2014-2015. We do not have the CPC number for the above mentioned assessment year.I have also checked online status of refund amount for the AY-2012-2013, 2013-2014, 2014-2015 where it is mentioned that “Your assessing officer has not sent this refund to Refund Banker” and for the AY 2011-2012 the status showed “No such Address – Refund voucher cancelled. The instrument returned undelivered by the speed post as the address provided by the assessee is not complete/ non existent”

Kindly guide us how can we get our refund amount for these years (AY 2011-2012, 2012-2013, 2013-2014, 2014-2015)

Regards,

Paramjit Singh

Sir

Please send me CPC reference number

My pan no-ABAPA8844P

A.Y-2013-14

DOB-10-04-1959

Sir

Please send me CPC reference number

My pan no-CCSPP7771D

A.Y-2014-15

DOB-26-05-1993

plz sir mujhe 2013-14 ka refund nhi huaa hai . online status par no demand no refund likha huaa aa rha hai so plz mujhe cpc no to mil gaye hai lakin refund sequence no. nhi mile hai so plz mujhe ye number kaishe find karte hai or refund ke liya kya karna chahiye. plz help me.

Dear Sir

I have lost the intimation and i dont even remember the CPC ref no.. Please suggest me how can i get new one.

My PAN no -AMWPN4356Q

Sir,

CPC Bangular

PAN AKVPC4316J

A.Y 2015-2016

Please Send My CPC Communication referance number and referance sequence number cpc order

FROM

TRILOK CHAND

Sir

CPC BANGULAR

PAN NO. AKVPC4316J

A Y 2015-16

Please Send My CPC Communication Referance Number And Referance Sequence Number CPC Order

FROM

TRILOK CHAND

SIR,

CPC, BANGALORE

PAN : ADSPP2184K

A.Y 2011-12

PLEASE SEND MY CPC COMMUNICATION REFERENCE NUMBER AND REFERENCE SEQUENCE NUMBER CPC ORDER

FROM.

Hemant N. Patel

sir,my boss’s income tax return for A.Y.2012-13 is manually submitted , and a outstanding demand is uploaded by CPC under section 1431a showing outstanding demand of Rs.107160 in his e-account.Being a Govt. employee,he had paid all taxes as per the form 16. How to deal with this ? pls guide

I have submitted my itr 2015-16 but i a=have to correct some particulars. But when i try to rectify, it needs latest cpc order number. Plz guide me how to get cpc order number?

Hello,

I have submitted a refund request which got rejected due to incorrect bank a/c #, I am trying to do resubmit it but when I input the CPC reference number and reference number in those fields it says incorrect details and also the reference # says it should be 10 digit long, I can see something that is 11 digit, please assist

sir,my itr v of yr 13-14 pan no- BHXPS8891Q & acknowledgement no is 729092470020813 not refunded due to incorrect a/c no but i have been paid f0r yr 14-15 in same a/c of sbi 10698746710. plz refund in same a/c. i m unable to view cpc comunication reference no and refund sequence no. plz don’t ask such no, in refund re-issue. once u r having pan & acknoledgement. plz refund my mony in above a/c no.

dear sir

how many days 143(1) order will be issued

Dear sir,

My refund for 2013-14 has been processed but because of wrong a/c number it’s unpaid.I have lost my cpc reference number.I have requested for it under 143.Is it ok??& Sir i have gave my 11 digit bank a/c number.Did i missed anything??please help me to get my refund.

I have two intimations pending of AY 2011-12 and 2012-13. How can i get these intimations again if these returns are not filled online. Please help me as soon as possible.