Annual Information Statement (AIS) is a crucial component of income tax compliance in India, designed to streamline the reporting process for taxpayers and tax authorities. Under Section 285BB of the Income-tax Act, AIS offers a comprehensive overview of a taxpayer’s financial transactions, TDS/TCS details, demand and refund data, and more. Explore the types of information covered, how to access AIS, and why it simplifies the tax return filing process for both taxpayers and authorities. Don’t miss this guide to better understand the AIS and its implications on your tax compliance.

Page Contents

Annual Information Statement (AIS)

Annual Information Statement (AIS) is a statement that provides complete information about the prepaid taxes and prescribed financial transactions entered into by taxpayer for a particular financial year. A taxpayer can access AIS information by logging into his income-tax e-filing account.

What is Annual Information Statement (AIS)?

Section 285BB of the Income-tax Act provides that the Income-tax authority or any other person authorized on this behalf shall make available an Annual Information Statement to the assessee containing information on various financial transactions made by him during the year. AIS has been introduced in the Income-tax Act to enlarge the scope of information to be made available to the assessee for filing of return of income. This information, on one hand, will be useful for the Assessing Officers to cross-check the details furnished in return for income by taxpayers. On the other hand, taxpayers would be able to easily compute their tax liability and file returns as all information would be pre-filled on basis of AIS.

Which types of information are covered in AIS?

Section 285BB read with rule 114-I of the Income-tax Rules, 1962 provides that the Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems) or any person authorised by him shall upload such annual information statement which contains the following information in respect of an assessee for a particular financial year:

a) Information relating to TDS and TCS;

b) Information relating to Specified Financial Transactions (SFT);

C) Information relating to the payment of taxes;

d) Information relating to demand and refund;

e) Information relating to pending proceedings;

f) Information relating to completed proceedings;

g) Information received from any officer, authority, or body performing any functions under any law or information received under an agreement referred under section 90 or section 90A;

h) Information relating to GST return;

i) Foreign remittance information reported in Form 15CC;

j) Information in Annexure-II of the Form 24Q TDS Statement of the last quarter;

k) Information in the ITR of other taxpayers;

l) Interest on Income Tax Refund;

m) Information in Form 61/61A where PAN could be populated;

n) Off Market Transactions Reported by Depository/Registrar and Transfer Agent (RTA);

o) Information about dividends reported by Registrar and Transfer Agent (RTA);

p) Information about the purchase of mutual funds reported by Registrar and Transfer Agent (RTA); and

q) Information received from any other person to the extent it may be deemed fit in the interest of the revenue.

The CBDT has authorised the Director General of Income-tax (Systems) to upload information relating to points (h) to (p) in the AIS within 3 months from the end of the month in which the information is received by him.

How to access AIS?

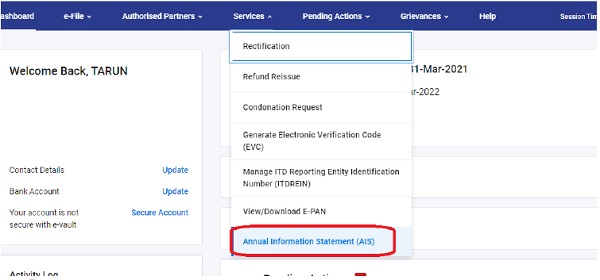

An assessee can access AIS information by logging into his income-tax e-filing account. If he feels that the information furnished in AIS is incorrect, duplicated, or relates to any other person, etc., he can submit his feedback thereon.

–

An assessee can access and respond to AIS information either directly from the income-tax e-filing portal or he can also use an offline utility.

Important Points on Annual Information System

1. Annual Information Statement (AIS) is a statement that provides complete information about a taxpayer for a particular financial year. It contains information about taxpayers’ incomes, financial transactions, tax details, income-tax proceedings, etc.

2. Section 285BB read with rule 114-I of the Income-tax Rules, 1962 provides that the Principal Director General of Income-tax (Systems) or the Director General of Income-tax (Systems) or any person authorised by him shall upload certain specified information as available with them in the annual information statement.

3. Annual Information statement contains the following information in respect of an assessee about all the above-mentioned options i.e., TDS and TCS, Dividends reported by Registrar and Transfer Agent (RTA), and Specified Financial Transactions (SFT) for a particular financial year.

4. The CBDT has authorised the Director General of Income-tax (Systems) to upload information relating to points (h) to (p) given above in the AIS within 3 months from the end of the month in which the information is received by him. Such points include information relating to foreign remittance information reported in Form 15CC.

5. An assessee can access AIS information by logging into his income-tax e-filing account on e-Filing website (https://www.incometax.gov.in/iec/foportal/). If he feels that the information furnished in AIS is incorrect, duplicated, or relates to any other person, etc., he can submit his feedback thereon.

6. An assessee can access and respond to AIS information either directly from the income-tax e-filing portal or he can also use an offline utility.

While AIS is supposed to HELP Tax payer , to whom do I complain / report about a FALSE

INFORMATION in SFT-17 ? The info indicates

Rs 49. 93 Lacs , for purchase of securities in the quarter July -Sept. of FY 2023, which DOES NOT PERTAIN to me. My Demat agency also declares NO SUCH TRANSACTION has

happened in my account .