SEZ : Overview

Special Economic Zones (SEZ) in India is a specially delimited enclave. Most importantly, the economic laws in this geographical area are different from the prevailing laws in other parts of India. An SEZ is deemed as a Foreign Territory for matters that relate to the Trade Tariffs, Duties, and Operations.

To instill confidence in investors and signal the Government’s commitment to a stable SEZ policy regime thereby generating greater economic activity and employment through the establishment of SEZs, a comprehensive SEZ policy was Introduced.

SEZ Introduction :

India was one of the first in Asia to recognize the effectiveness of the Export Processing Zone (EPZ) model in promoting exports, with Asia’s first EPZ set up in Kandla in 1965.

With a view to overcome the shortcomings experienced on account of the multiplicity of controls and clearances; absence of world-class infrastructure, and an unstable fiscal regime and with a view to attract larger foreign investments in India, the Special Economic Zones (SEZs) Policy was announced in April 2000.

As an export promotion scheme entitled ‘Special Economic Zone’ (SEZ) was introduced in the Export and Import (EXIM) Policy which came into effect from 1.4.2000.

This policy intended to make SEZs an engine for economic growth supported by quality infrastructure complemented by an attractive fiscal package, both at the Centre and the State level, with the minimum possible regulations.

SEZs in India functioned from 1.4.2000 to 09.02.2006 under the provisions of the EXIM / Foreign Trade Policy and fiscal incentives were made effective through the provisions of relevant statutes.

SEZ Act & Rules

The Special Economic Zones Act, 2005, was passed by Parliament in May, 2005 which received Presidential assent on the 23rd of June, 2005.

After extensive consultations, the SEZ Act, 2005, supported by SEZ Rules, came into effect on 10th February, 2006, providing for drastic simplification of procedures and for single window clearance on matters relating to central as well as state governments.

It was based on the SEZ model in China, which is quite successful in terms of export competitiveness, employment generation, GDP growth, and attracting foreign investment.

The SEZ Act 2005 envisages key role for the State Governments in Export Promotion and creation of related infrastructure. A Single Window SEZ approval mechanism has been provided through a 19 member inter-ministerial SEZ Board of Approval (BoA).

The SEZ Rules. 2006 provide for:

“Simplified procedures for development, operation, and maintenance of the Special Economic Zones and for setting up units and conducting business in SEZs

The Main Objectives of the SEZ Act are:

> Generation of Additional Economic Activity

> Promotion of Exports of Goods and Services

> Promotion of Investment From Domestic and Foreign Sources

> Creation of Employment Opportunities

> Development of Infrastructure Facilities

It is expected that this will trigger a large flow of foreign and domestic investment in SEZs, in infrastructure and productive capacity, leading to generation of additional economic activity and creation of employment opportunities.

The Salient Features of the SEZ scheme are:

> A designated duty-free enclave to be treated as a territory outside the customs territory of India for the purpose of authorised operations in the SEZ.

> No licence required for import.

> Manufacturing or service activities allowed.

> The SEZ unit shall achieve Positive Net Foreign Exchange to be calculated cumulatively for a period of five years from the commencement of production.

> Domestic sales subject to full customs duty and import policy in force.

> SEZ units will have freedom for subcontracting.

> No routine examination by customs authorities of export/import cargo.

> SEZ Developers /Co-Developers and Units enjoy Direct Tax and Indirect Tax benefits as prescribed in the SEZs Act, 2005.

Incentives for SEZs to Enhance Exports and Promote FDI

> Duty free import/domestic procurement of goods for development, operation, and maintenance of SEZ units.

> 100 percent income tax exemption on export income for SEZ units under Section 10AA of the Income Tax Act for first five years, 50 percent for the next five years, and 50 percent of the ploughed back export profit for the next five years. (Sunset Clause for Units become effective from April 1, 2020.)

> Considering the impact of COVID-19 and lockdown restrictions across India, the government has extended timeline for newly established units in SEZs to claim tax incentives to September 30th, 2020 provided the letter of approval has been issued on or before 31st March 2020.

> Tax holiday for SEZ developers in a block of 10 years in 15 years under Section 80-IAB of the Income Tax Act. (Sunset Clause for Developers has become effective from 01.04.2017)

> Tax exemption for offshore banking units in SEZ.

> Exemption from Central Sales Tax, Service Tax, and State Sales Tax. These have now been subsumed into the Goods and Services Tax (GST) and supplies to SEZs are zero rated under the IGST Act, 2017.

> Single window clearance for Central and State level approvals.

> Exemption from minimum alternate tax (MAT) under section 115JB of the Income Tax Act. (withdrawn w.e.f. 1.4.2012).

> Exemption from capital gains tax – Subject to Conditions.

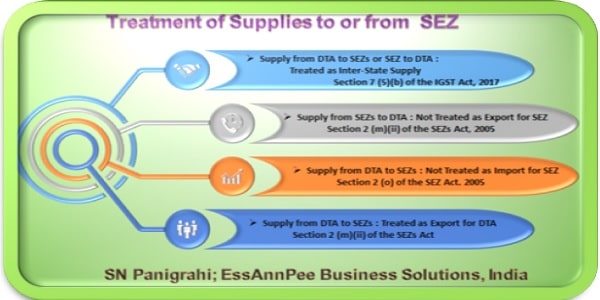

Supply from DTA to SEZs : Treated as Export for DTA

According to Section 2 (m)(ii) of the SEZs Act, 2005 supplying goods, or providing services, from the Domestic Tariff Area (DTA) to a Unit or Developer shall be treated as export.

Supply from DTA to SEZs : Not Treated as Import for SEZ

As per Section 2 (o) of the SEZ Act Supply from DTA to SEZs is Not Treated as Import from SEZ point of view.

Supply from SEZs to DTA : Not Treated as Export for SEZ

Section 2 (m)(ii) of the SEZs Act, 2005, is Not considers Supply from SEZs to DTA as Export for SEZ.

Supply from DTA to SEZs or SEZ to DTA : Treated as Inter-State Supply

Section 7 (5)(b) of the IGST Act, 2017 says – Supply of goods or services or both made to or by a Special Economic Zone developer or a Special Economic Zone unit shall be treated to be a supply of goods or services or both in the course of inter-State trade or commerce.

According to the above said provisions supply made to or supply made by SEZ unit shall always be treated as inter-state supply.

Contrary Provisions

As per Circular No. 48/22/2018-GST; Dated the 14th June, 2018 : Supplies from DTA to SEZ is Always Treated as Inter-State Supply.

However, as per Advance Ruling No. KAR ADRG 2/2018; 21/03/2018;

In Re Gogte Infrastructure Development Corporation Ltd. (AAR Karnataka)

The Hotel Accommodation & Restaurant services being provided by the Applicant, within the premises of the Hotel, to the employees & guests of SEZ units, cannot be treated as supply of goods & services to SEZ units in Karnataka & hence the supply is treated as intra state supply and are taxable accordingly.

In another Advance Ruling No. KAR ADRG 37/2019; 16/09/2019; In re Carnation Hotels Private Limited (GST AAR Karnataka) following Ruling was made which is contrary to the other Ruling mentioned above.

a. Whether accommodation service proposed to be rendered by the applicant to SEZ units are liable to CGST and SGST or IGST?

The accommodation service proposed to be rendered by the applicant to SEZ units are covered under the IGST as it is an inter-State supply as per section 7(5)(b) of the Integrated Goods and Services Act, 2017.

b. If the accommodation service to SEZ are covered under IGST Act, can these be treated as zero rated supplies and the invoice be raised without charging Tax after executing LUT under section 16?

Since the accommodation service supplied to an SEZ are covered under IGST Act, the same can be treated as zero rated supplies and the invoice can be raised without charging Tax after executing LUT under section 16.

Zero Rated Supply:

As per Sec 2(23) of IGST Act: “zero-rated supply” shall have the meaning assigned to it in section 16;

Sec 16. (1) of IGST Act : “zero rated supply” means any of the following supplies of goods or services or both, namely:––

(a) export of goods or services or both; or

(b) supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit.

Whether Any Supply to SEZ is Treated as Zero Rated?

In the advance ruling of Coffee Day Global Ltd; AAR-Karnataka dated 26-07-2018, it has been ruled that “Supply of goods, which are not being covered under authorized operations as sanctioned to SEZ unit, shall not be done at Zero Rate”.

In this regard, the provisions of section 4(2) and section 15(9) of the SEZ Act, 2005 are referred to which provide that each SEZ Unit is allowed to carry out predefined activities which are certified by the proper office of the SEZ (termed as ‘Authorized Operations’) to be eligible to avail the benefits of being in the Special Zone.

Though the IGST Act, in section 16(1)(b) does not categorically say that the supplies of goods and services should be for authorized operations, it is implicit therein when it says that the supplies are for the SEZ Developer or SEZ Unit.

SEZ Authorized Operations

SEZ unit or developer can undertake ‘Authorized operations’ which are specified in the Letter of Approval issued by Development Commissioner of SEZ.

As per Sec 2 (C’) of SEZ Act,

“Authorised Operations” means operations which may be authorised under sub-section (2) of section 4 and sub-section (9) of section 15;

Sec 4 (2) of SEZ Act

After the appointed day, the Board may, authorise the Developer to undertake in a Special Economic Zone, such operations which the Central Government may authorise.

Sec 15 (9) of SEZ Act

The Development Commissioner may, after approval of the proposal referred to in sub-section (3), grant a letter of approval to the person concerned to set up a Unit and undertake such operations which the Development Commissioner may authorise and every such operation so authorised shall be mentioned in the Letter of Approval.

Authorized operations include setting up, operation, maintenance and expansion of Unit. Goods for construction of building for setting up unit can be included in letter of approval. Any question as to whether any goods are required for authorized operation or not shall be decided by Development Commissioner – MC&I (DC) Instruction No. 3; (F No. 5/1/2006-EPZ) dated 24-3-2006.

Default Authorized Operations:

The BOA was appraised that Consequent to Implementation of GST Act, some State Governments are not extending the benefits of IGST exemption for Default Services. Since SEZs are Exempt from IGST and the matter was placed before 80th BoA meeting held on 17th Nov’2017. The Boa after deliberations, approved the Reiteration of the Default Authorized Operations which were earlier approved vide Ministries Letter No: D.12/25/2012- SEZ dated 16thth Sep’2013 and subsequent letter of Even Number dated 19th Nov’2013, 19th June, 2014 and July, 2014 vide which a List of 66 Services were permitted as Default Authorized Services.

Ministry of Commerce & Industry, Department of Commerce (SEZ Section) Vide F.No. D.12/19/2013-SEZ; Dated 2nd Jan’2018, Approved the 66 Default Authorized Operations.

GST Registration for SEZ:

Persons Liable for GST Registration – SECTION 22 CGST Act & Rule 8 of CGST Rules

Registration provisions under GST Law shall be applicable to SEZ unit the same provisions as applicable to the Regular Tax Payer.

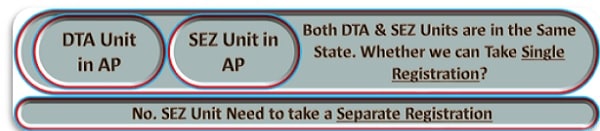

Both DTA & SEZ Units are in the Same State. Whether we can Take Single Registration?

Second Proviso to section 25(1) of CGST Act, inserted vide CGST (Amendment) Act, 2018 w.e.f. 1-2-2019

A person having a unit in a Special Economic Zone or being a Special Economic Zone developer shall have to apply for a separate registration, as distinct from his place of business located outside the Special Economic Zone in the same State or Union territory

GST Registration for Supplier to SEZ

Compulsory GST Registration In Certain Cases – SECTION 24 of CGST Act

Notwithstanding anything contained in Section 22(1) of CGST Act, the following categories of persons shall be required to be registered under the GST Act,–

(i) persons making any Inter-State Taxable Supply;

(ii) ………..

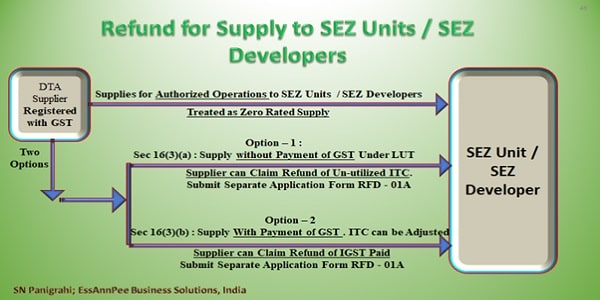

Refund of Taxes for Supply to SEZ Units / SEZ Developers

The Registered Supplier to SEZ has Two Options –

1. Option – 1 : Without Payment of GST under LUT and then Claim Unutilized ITC Refund as per Sec 16(3)(a) of IGST Act.

2. Option – 2 : With Payment of GST and then Claim Refund of IGST Paid as per Sec 16(3)(b) of IGST Act.

The first Option pertains to refund of unutilised ITC for which the registered person has to supply under Bond/LUT (as prescribed in Rule 96A of CGST Rules)and in the second Option supply has been made after payment of Tax (IGST). In both the cases, refund can be applied under Section 54 of the CGST Act, 2017 read with Rule 89 or Rule 96 , as the case may be, of the CGST Rules, 2017.

SEZ unit / developers shall not claim any refund against ITC :

The Hon’ble Appellate Authority, GST, Andhra Pradesh, in Re: Vaachi International Pvt. Ltd. [Order No. 4990 of 2020 dated February 10, 2020] held that the SEZ unit/developers shall not claim any refund against input tax credit (ITC) involved in supplies received by them from non-SEZ suppliers and GST Law facilitates eligibility for refund claim to suppliers who made supplies to SEZ unit/developers with payment of tax as zero rated supply under Section 16(1) of the Integrated Goods and Services Tax Act, 2017 (IGST Act).

Rule 89(1), the second proviso unambiguously stipulates that in respect of supplies to SEZ units/developers, the refund “SHALL” be claimed by suppliers of goods to the SEZ unit or developer only. Further, Rule 89(2)(f) prescribes that SEZ unit/developers shall not avail input tax credit on the supplies received by them from non SEZ suppliers and refund would be claimed by supplier to SEZ unit/developer only.

Thus, a conjoint reading of all the above provisions undoubtedly point towards a conclusion that SEZ unit/developers shall not claim any refund against the ITC involved in supplies received by them from non SEZ suppliers. The Act facilitates eligibility for refund claim to the suppliers who made supplies to SEZ unit/developers with payment of tax. The AA has rightly adhered to these provisions and rejected the refund claim in legitimate manner. In addition to this, it is to be observed that the appellant contentions of their eligibility regarding refund against the zero-rated supplies received by them, is found to be not tenable.

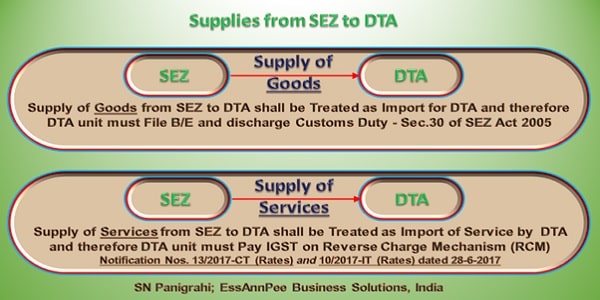

Supply of Goods from SEZ to DTA

Sec.30 of SEZ Act 2005 provides that any goods removed from Special Economic Zone to the Domestic Tariff Area shall be chargeable to duties of customs including anti-dumping, countervailing duty and safe-guard duties under the Customs Tariff Act 1975, similar to levy of customs duty on such goods imported.

Further, Sec. 53 of the Act provides that the Special Economic Zone shall be deemed outside the customs territory of India for the purpose of undertaking the authorized operations.

Hence, the goods cleared from SEZ to DTA, which is deemed as import to India, is Charged to Customs duty under Customs Tariff Act, 1975, which includes Integrated Tax in terms of Sec 3 (7) of the said Act.

The Custom Department is empowered to charge IGST as is leviable under section 5 of the IGST Act, 2017. In this respect section 3 (7) of The Customs Tariff Act is reproduced as under:

Any article which is imported into India shall, in addition, be liable to integrated tax at such rate, not exceeding forty per cent. as is leviable under section 5 of the Integrated Goods and Services Tax Act, 2017 on a like article on its supply in India, on the value of the imported article as determined under sub-section (8).

Thus, goods removed from SEZ to DTA are liable to custom duty and integrated tax (IGST) according to provisions as stated in SEZ Act and Customs Tarif Act.

Goods Supplied from SEZ to DTA is considered as import for the DTA unit, therefore the DTA has to File Bill of Entry with Customs at SEZ and Pay the relevant Customs Duties to clear the Goods.

Supply of Services from SEZ to DTA

Sub-section (1) of Section 53 of the SEZ Act, 2005 provide that “A Special Economic Zone shall, on and from the appointed day, be deemed to be a territory outside the customs territory of India” for the purposes of undertaking the authorised operations. Thus, any Supply of Services from SEZ to DTA shall be Treated as Import of Services by the DTA.

Definition: Import of Services under GST Law

Section 2(11) of IGST Act 2017 defines Import of Services as follows:

Import of services means the supply of any service where-

(i) The supplier of service is located outside India

(SEZ in this case which deemed to be a territory outside the customs territory of India)

(ii) The recipient of service is located in India (DTA); and

(iii) The place of supply of service is in India;

Import of services attracts GST under Reverse Charge Basis. Notification Nos. 13/2017-CT (Rates) and 10/2017-IT (Rates) dated 28-6-2017

Disclaimer : The views and opinions; thoughts and assumptions; analysis and conclusions expressed in this article are those of the authors and do not necessarily reflect any legal standing.

Author : SN Panigrahi, GST & Foreign Trade & Project Consultant, Practitioner, International Corporate Trainer, Mentor & Author.

Authorized Training Partner (ATP) Instructor, PMI (USA)

Author can be Reached @ snpanigrahi1963@gmail.com; Mobile : 9652571117

Dear sir ,

From pondicherry we supply glass material to sez thada sri city .

so we will not put the GST 18 % . in our invoice .

client is selling that to kerala cochin ship yard limited which is government based concern .

For this case does Bill of exports required to be submitted by my client .

my client is providing DTA and sez entry .

pls clarify .

Regards ,

Devakumar .v

We are importing RM in our DTA unit with payment of applicable customs duty and we are supplying semi finished SEZ unit.

Is there any way to claim the import duty refund for supplied goods to SEZ ?

If any bank located in GIFTCITY (Sez) providing services to NRI customer (individual) or overseas company and tacking charge on services, in this case gst is applicable or not.

A COMPANY IN SEZ SUPPLY GOODS TO A COMPANY IN DTA WHICH IS EXPORTING AS WELL AS SUPPLYING TO DTA COMPANIES. CAN SEZ COMPANY TAKE IT AS EXPORT? PLEASE CLARIFY.

nil

Sir, we are providing security services to companies working under SEZ in same state of Kerala with zero taxation.so while entering the invoices in GSTR-1, in which section, ie, 6A or 6B to be considered?

Can SEZ unit raise service invoice to entity located in taxable territory with charging GST?

I have the same question : If i have purchased raw material from sez to make goods that are exported. can i take my import duty back paid on purchases from sez?

sir , we are DTA unit and supply the material to SEZ unit on 31.01.2022 under LUT BOND

subsequently the material was rejected by them but not returned to us and on 25.03.2022 their unit is converted in to DTA from SEZ.

Now they are returning the material and ask us raise fresh invoice with Tax ( Practically material will not move, rejection is only on paper ). In short asking for as fesh supply by raising invoice with tax to DTA unit.

what will be our liablity in this case? can we proceed what he says? pl guide us in this matter.

hello sir,

If i have purchased raw material from sez to make goods that are exported. can i take my import duty back paid on purchases from sez?