Sponsored

Article explains GST Implication related to Sale of Goods outside India with a Practical Case Study. Article has considered Advance Ruling of AAR Maharashtra in the case of INA Bearing India Private Limited, in which applicant has raised the question that Whether the sale of goods, which are located outside India, would be liable to tax in India under section 7(5) (a) of Integrated Goods and Services Tax Act, 2017? Article also considered Advanced ruling in the case of Synthite Industries Ltd (AAR Kerala); Order No. CT/2275/18-C3; 26/03/2018.

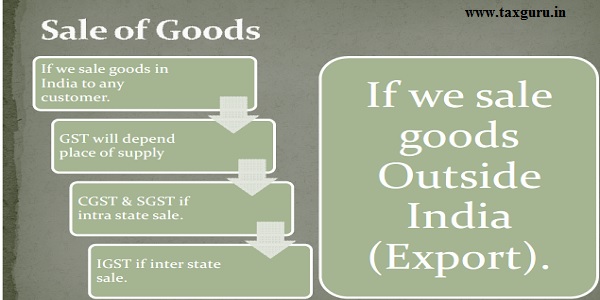

GST implication?

INA Bearing India (P) Ltd.

- An Indian Company engaged in business of supply of bearings and tools.

- They have received order from Indian customer for tool.

- In turn, they have placed order to foreign vendor for manufacture of tool.

- Tool was manufactured & were in possession of foreign vendor.

- Foreign vendor raised invoice on INA Bearing India (P) Ltd.

- At that time, INA Bearing India (P) Ltd. have raised invoice on Indian Customer.

- As per Section 7(5)(a) of the IGST Act, provide that export or import of goods and/or services should be treated as inter-State transaction.

- Section 7(2) of the IGST Act, supply of goods imported into the territory of India till they cross the customs frontier shall be treated as supply of goods in the course of inter-State trade or commerce.

- The proviso to section 5(1) of the IGST Act states that provided that the integrated tax on goods imported into India

shall be levied and collected in accordance with the provisions of section 3 of the Customs Tariff Act, 1975 on the value as determined under the said Act at the point when goods crosses custom frontier. - The ownership of the said goods get transferred to the applicant without any physical movement of the goods from Germany to India.

- In this way, the imported goods sold from and to a nontaxable territory, though they are clearly in the nature of inter-State supply, would come in the category of exempt supply as no duty is leviable on them.

Conclusion

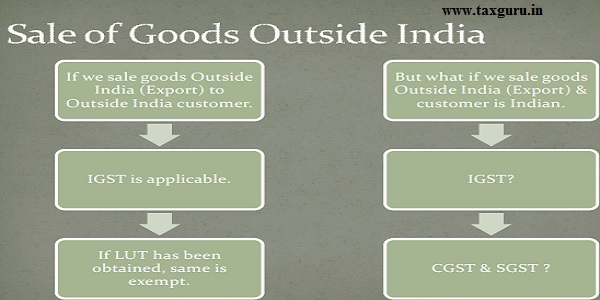

- Cross-border transactions are being covered under Inter-State supply.

- It covers under Zero rated supply.

- Hence, not taxable under GST as per GST/ARA/04/2018-19/B-60.

Synthite Industries Ltd.

- Goods procured from one country (China)

- supplied to another country (USA)

- Synthite Industries Ltd. (India)

- Place of Supply ?

- As goods are not imported into India at any point of time, GST is not applicable as per order no. CT 12275/18-C3.

Access Denied! Only Regstered Users Can Download The File "GST on Sale of Goods outside India". Register Here or Login

Sponsored

Kindly Refer to

Privacy Policy &

Complete Terms of Use and Disclaimer.

If we have raise service invoice to foreign party so please inform me GST applicable or not applicable