Relevant date of which GSTR-2A is used to calculate Restriction on Input tax credit of 10%

FORM GSTR-2A being a dynamic document, So the question arise here is that what would be the amount of input tax credit that is admissible to the taxpayers for a particular tax period in respect of invoices/debit notes whose details have not been uploaded by the suppliers?

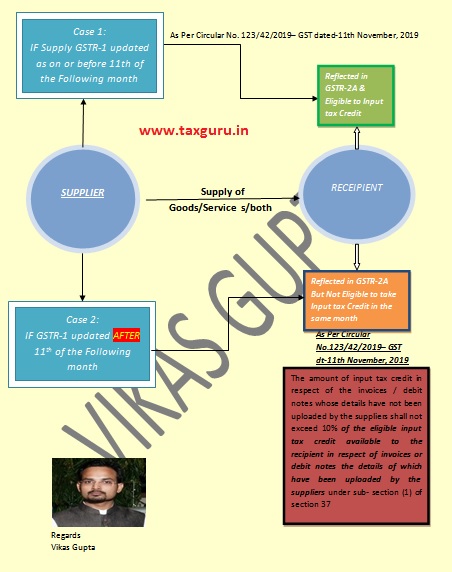

The amount of input tax credit in respect of the invoices / debit notes whose details have not been uploaded by the suppliers shall not exceed 10% of the eligible input tax credit available to the recipient in respect of invoices or debit notes the details of which have been uploaded by the suppliers under sub- section (1) of section 37 as on the due date of filing of the returns in FORM GSTR-1 of the suppliers for the said tax period ie 11th of the Following Month. The taxpayer may have to ascertain the same from his auto populated FORM GSTR 2A as available on the due date of filing of FORM GSTR-1 under sub-section (1) of section 37.