A. FAQs on Provisional Assessment and Release of Security under GST

Q.1 What is Provisional Assessment?

Ans: If taxpayer is unable to determine either the value or tax rate or both for the goods/ services dealt in by him/her, then he/ she can file an application for provisional assessment to the Tax Official.

Q.2 What are the steps involved in filing application for provisional assessment and release of security?

Ans: Steps for filing application for provisional assessment and release of security is explained below:

1. Filing of application for provisional assessment by taxpayer in Form GST ASMT-01

2. Issue of notice for seeking additional information by Tax Official in Form GST ASMT-02, if needed

3. Furnishing of reply by taxpayer in Form GST ASMT-03 to the notice issued in Form GST ASMT-02

4. Issue of order accepting the Provisional Assessment in Form GST ASMT-04 prescribing security and bond therein or to Reject the application

5. Furnishing of security and bond by taxpayer in Form GST ASMT-06 & taxpayer to physically handover the Bank Guarantee and bond to Tax official

6. Acceptance of security by Tax Officer, Process of correction of security, Resubmission of Security

7. Taxpayer can start selling the goods or providing the services as per Provisional Assessment Order and pay the tax amount as per rate or valuation mentioned in Provisional Assessment Order.

8. After period of provisional assessment is over, notice for seeking clarification in Form GST ASMT-06 to be issued to seek clarification for issue of final assessment order

9. Seeking extension of AC/JC for a period of six months if order is not issued within six months of issue of provisional order in Form GST ASMT-04

10. Further extension of Commissioner can be sought if order is not being issued within extended period

11. Issue of Final Assessment order in Form GST ASMT-07

12. Taxpayer to apply for release of security in Form GST ASMT-08

13. Issue of order for release of security in Form GST ASMT-09

14. Tax Official to physically handover the Bank Guarantee and bond to taxpayer

Q.3 From where can I file an application for Provisional Assessment?

Ans: Navigate to Services > User Services > My Applications > Provisional Assessment ASMT-01 > NEW APPLICATION option.

Q.4 From where can I view filed application for Provisional Assessment?

Ans: Navigate to Services > User Services > My Applications > Provisional Assessment ASMT-01 > SEARCH > Click ARN option.

Q.5 From where can I view notice issued for Provisional Assessment?

Ans: Navigate to Services > User Services > View Additional Notices/ Orders > NOTICES option

Q.6 From where can I reply to notice issued for Provisional Assessment?

Ans: Navigate to Services > User Services > View Additional Notices/ Orders > REPLIES option.

Q.7 Does a taxpayer get any intimation about the notice or order issued to them?

Ans: Taxpayer will get intimation of all notices and orders issued to him/her though SMS and e-mail.

Q.8 Can I apply for provisional assessment of more than one good/ service with one application?

Ans: Yes, you can apply for provisional assessment of more than one good/ service with one application.

Q.9 In which situations, Tax Official can ask for Resubmission of Security and Submission of Additional Security?

Ans: If Tax Official finds some discrepancies in security furnished by taxpayer i.e. bank guarantee amount is not sufficient as required in provisional assessment order or reference number is not valid or time duration of bond/guarantee has expired or for any other reason, then he may ask for re-submission of security or submission of additional security amount.

Q.10 Provisional Assessment Order can be issued by which date?

Ans: If Tax Official accepts the application for Provisional Assessment, then ‘Provisional assessment order’ will be issued within 90 days of filing application to pay tax on provisional basis and Tax Official will specify the amount of bond/ surety required to be furnished.

If Tax Official rejects the application, then order of rejection will be issued.

Q.11 If Provisional Assessment Order is issued, does a taxpayer needs to submit the security in offline mode?

Ans: In case, application is accepted and provisional assessment order is issued, taxpayer need to capture the details of security online on GST Portal and also submit it manually to the authority/ Tax Official (both online and offline) and can start making payment of tax on the value/tax rate on provisional basis as specified in the order.

Q.12 By which date Final Assessment Order can be issued by Tax Official?

Ans: Final assessment order needs to be issued within 6 months from date of issue of provisional order.

Period of 6 months may be extended by Additional Commissioner /Joint Commissioner (AC/JC) for a further period not exceeding 6 months and by Commissioner/ Competent authority for such further period not exceeding 4 years.

Q.13 What a taxpayer needs to do in case final assessment order determines higher rate/ value than provisionally assessed values?

Ans: If final assessment order determines higher rate/ value than provisionally assessed values, then the taxpayer need to deposit the differential tax along with applicable interest.

Q.14 What a taxpayer needs to do in case final assessment order determines lower rate/ value than provisionally assessed values?

Ans: If final assessment order determines lower rate/ value than provisionally assessed, then the taxpayer can apply for refund of the excess amount paid by him on the subject goods and /or services supplied by him during pendency of provisional assessment proceedings.

Q.15 When can a taxpayer file for release of security?

Ans: After finalization of provisional assessment process with the issue of final assessment order, taxpayer can file application for release of security. Tax Official will verify the request and check whether the purpose for which security was furnished has been accomplished. If the purpose is not accomplished, an intimation will be sent to the taxpayer that security cannot be released and order for rejecting the application will be issued. If purpose is accomplished, then release order will be issued after seeking approval of competent authority and Tax Official will handover the security to taxpayer.

Q.16 What will happen after release of security?

Ans: Once the security is released by Tax Official, online Release order will be generated and intimation of issue of order will be sent via email and SMS to taxpayer. Order will also be available at the dashboard of taxpayer for view, print and download.

Q.17 From where can I furnish the security for Provisional Assessment?

Ans: Navigate to Services > User Services > My Applications > Provisional Assessment ASMT-01 > SEARCH > SECURITY option.

Q.18 From where can I apply for release of security for Provisional Assessment?

Ans: Navigate to Services > User Services > My Applications > Provisional Assessment ASMT-01 > SEARCH > SECURITY option.

Q.19 What are the various statuses for Provisional Assessment?

Ans: Various statuses for Provisional Assessment updated automatically by GST Portal are:

1. Pending for action by tax officer: Status of ARN when application is submitted successfully by taxpayer and is in list of applications received for provisional assessment in queue of tax officer

2. Pending for reply by taxpayer: Status of ARN upon issue of notice to taxpayer to seek clarification

3. Reply furnished, Pending for provisional order: Status of ARN upon reply received from taxpayer and pending for order by tax official

4. Reply not furnished, pending for order: Status of ARN, if person does not attend PH/ furnish explanation on date specified in SCN or Extended date and pending for order by tax official

5. Rejected: Status of ARN upon rejection of application by tax official

6. Provisional order issued, security pending: Status of ARN upon issue of provisional assessment order by tax official & subject to furnishing of security

7. Security furnished, pending approval: Status of ARN upon furnishing of security and pending for approval by tax official

8. Security furnished: Status of ARN if Adjudicating Authority accepts the security furnished by taxpayer

9. Security furnished: Status of ARN if Adjudicating Authority accepts the modified details of security furnished by taxpayer

10. Pending for re-submission of security: Status of ARN if A/A has asked for re-submission of security to the taxpayer

11. Pending for final reply by taxpayer: Status of ARN upon issue of notice to taxpayer, for final clarification, for finalizing the provisional assessment

12. Reply furnished, pending for final order: Status of ARN upon reply given by taxpayer and pending for order by tax official

13. Final order issued: Status of ARN upon finalization of provisional assessment by tax official by issuance of an order

Q.20 What are the various statuses for Release of Security?

Ans: Various statuses for Release of Security updated automatically by GST Portal are:

1. Pending for action by tax officer on Release: Status of ARN when an application is submitted by taxpayer for release of security

2. Pending for reply by taxpayer on Release notice: Status of ARN upon issue of notice to taxpayer to seek clarification on his application for release of security

3. Reply furnished, pending for order: Status of ARN upon reply received from taxpayer and pending for order by tax official

4. Approval granted, pending for release order: Status ofARN/Case id if approval is granted by Commissioner/ Competent authority for release of security and is pending for order by tax official

5. Proposal for release rejected: Status of ARN/Case id if approval is not granted by Commissioner/ Competent authority for release of security

6. Order for release of security issued: Status of ARN/Case id upon issue of order for release of security

7. Reply not furnished, pending for order: Status of ARN/ Case id and RFN, if taxpayer does not attend PH/ furnish explanation on date specified in SCN or Extended date and pending for order by tax official

B. Manual on Provisional Assessment and Release of Security under GST

How can I file an application for Provisional Assessment?

To file an application for Provisional Assessment, perform following steps:

A. File an Application for Provisional Assessment

B. Open the Application’s Case Details screen by searching for your filed Application in My Applications page or from View Additional Notices/Orders page

C. Take action using APPLICATIONS tab of Case Details screen: View your Filed Application

D. Take action using NOTICES tab of Case Details screen: View issued Notice related to that Application

E. Take action using REPLIES tab of Case Details screen: View/Add your replies to the issued Notice related to that Application

E (1). Replying to Additional Information GST ASMT-02

E (2). Replying to Additional Information GST ASMT-06

E (3). Replying to Additional Information for Release Security

F. Take action using ORDERS tab of Case Details screen: View issued Orders related to that Application

G. Take action using SECURITY tab of Case Details screen: Deposit/ Resubmit/ Modify/ Release security related to that Application

G (1). Furnishing of Security Amount

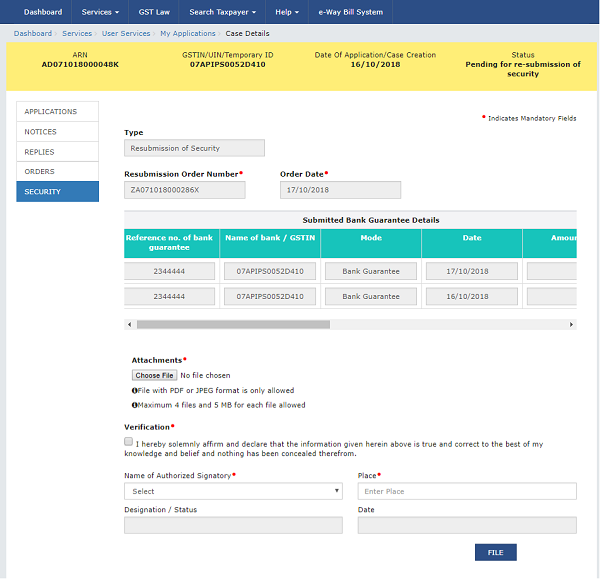

G (2). Resubmitting of Security Amount

G (3). Submission of Modified Security Amount

G (4). Releasing of Security Amount

A. File an Application for Provisional Assessment

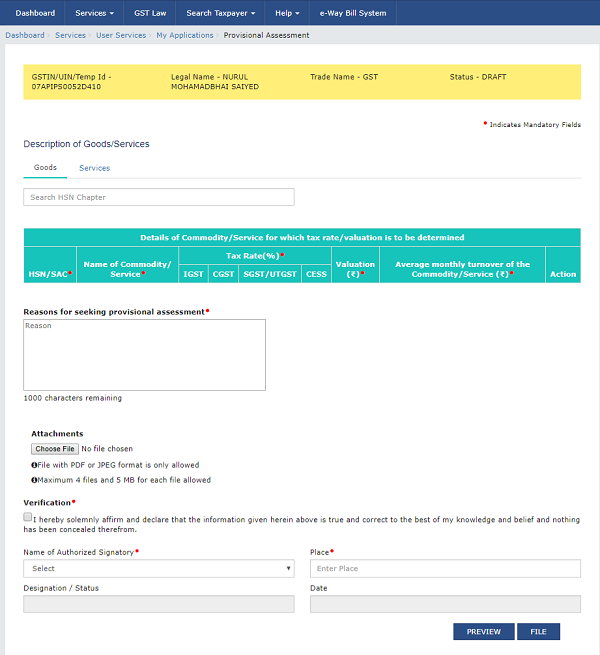

To file an application for Provisional Assessment, perform following steps:

1. Access the www.gst.gov.in URL. The GST Home page is displayed.

2. Login to the portal with valid credentials.

3. Dashboard page is displayed. Click Services > User Services > My Applications option

4. The My Applications page is displayed.

5. Select “Provisional Assessment ASMT-01” in the Application Type field.

6. Click the NEW APPLICATION button.

7. The Provisional Assessment page is displayed.

8. Under Goods tab, in the Search HSN Chapter field, enter the details of goods for which tax rate or valuation is to be determined.

9. HSN/SAC and Name of Commodity/Service fields gets auto-populated. Enter the Tax Rate, Valuation and Average monthly turnover of the Commodity.

10. Under Services tab, in the Search SAC field, enter the details of services for which tax rate or valuation is to be determined.

11. HSN/SAC and Name of Commodity/Service fields gets auto-populated. Enter the Tax Rate, Valuation and Average monthly turnover of the Service.

12. In Reasons for seeking provisional assessment field, enter reason for filing this application for seeking provisional assessment.

13. Click Choose File to upload the document(s) related to this application, if any. This is not a mandatory field.

Note: You can upload file with PDF or JPEG format with maximum 4 files of 5 MB for each file.

14. Select the Verification check-box.

15. Select the Name of the Authorized Signatory from the drop-down list.

16. Enter the name of the Place where you are filing this application.

17. Click PREVIEW to download and review your application.

18. The application is downloaded in PDF format.

19. Once you are satisfied, click the FILE button.

20. The Submit Application page is displayed. Click SUBMIT WITH DSC or SUBMIT WITH EVC.

SUBMIT WITH DSC:

a. Select the certificate and click the SIGN button.

SUBMIT WITH EVC:

a. Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VERIFY button.

21. The Acknowledgement page is displayed with the generated ARN. You will also receive an SMS and email on your registered mobile number & email id respectively, intimating you of the generated ARN and successful filing of the application.

To download the filed application, click the Click here hyperlink or click CREATE NEW APPLICATION to go back to My Applications page.

Note: Once the application is filed, Status of the application gets updated to “Pending for action by tax officer”.

C. Take action using APPLICATIONS tab of Case Details screen: View your Filed Application

To view Application Details, based on which this case was created, perform following steps:

1. Navigate to Services > User Services > My Applications option.

2. The My Applications page is displayed.

3. Select “Provisional Assessment ASMT-01” in the Application Type field.

4. Select the From and To Date using the calendar.

5. Click the SEARCH button.

6. The search results are displayed. Click ARN/RFN link.

7. On the Case Details page of that particular application, select the APPLICATIONS tab, if it is not selected by default. This tab provides you an option to view the filed application in PDF mode.

8. Click the View hyperlink to download and view the application in PDF mode.

To view issued notices issued by Tax Official, perform following steps:

1. On the Case Details page of that particular application, select the NOTICES tab. This tab displays all the notices issued by Tax Official.

2. Scroll to the right to view the document name(s) in the Attachments section of the table and click them to download into your machine.

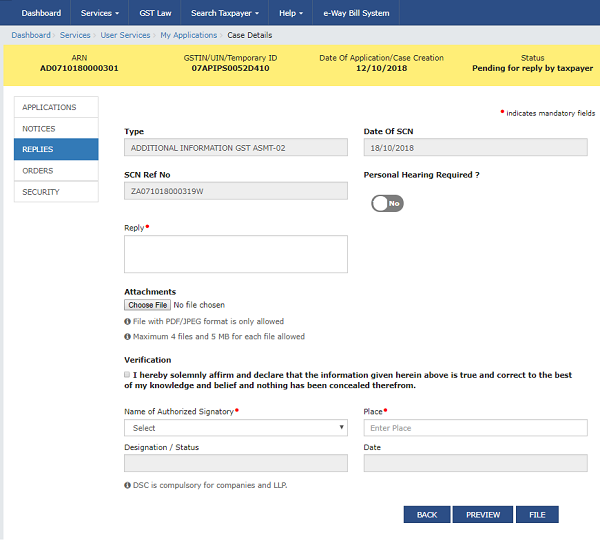

E (1). Replying to Additional Information GST ASMT-02

To view or add your replies to the issued notice for additional information, perform following steps:

1. On the Case Details page of that particular application, select the REPLIES tab. This tab will display the replies you will file or already file reply against the Notice issued by Tax Official. To add a reply, click ADD REPLY and select ADDITIONAL INFORMATION GST ASMT-02.

2. The Additional Information page is displayed.

3. In the Personal Hearing Required? field, select Yes or No.

Note: This button is visible in only those applications where the Tax Official has not already called for a personal hearing in the issued notice.

4. In Reply field, enter details of your reply to the issued notice.

5. Click Choose File to upload the document(s) related to your reply, if any. This is not a mandatory field.

6. Enter Verification details. Select the declaration check-box and select the name of the authorized signatory. Based on your selection, the fields Designation/Status and Date (current date) displayed below gets auto-populated. Enter the name of the place where you are filing this application.

7. Click PREVIEW to download and review your application.

8. The application is downloaded in PDF format.

9. Once you are satisfied, click FILE.

10. Submit Application page is displayed. Click SUBMIT WITH DSC or SUBMIT WITH EVC.

SUBMIT WITH DSC:

a. Select the certificate and click the SIGN button.

SUBMIT WITH EVC:

a. Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VERIFY button.

11. The Notices and Orders page is displayed with the generated Reference number. To download the filed reply, click the Click here hyperlink.

12. The filed reply is downloaded in the PDF format.

13. Click OK.

14. The updated REPLIES tab is displayed, with the record of the filed reply in a table and with the Status updated to “Reply furnished, pending for order by tax officer”. You can also click the documents in the Attachments section of the table to download them.

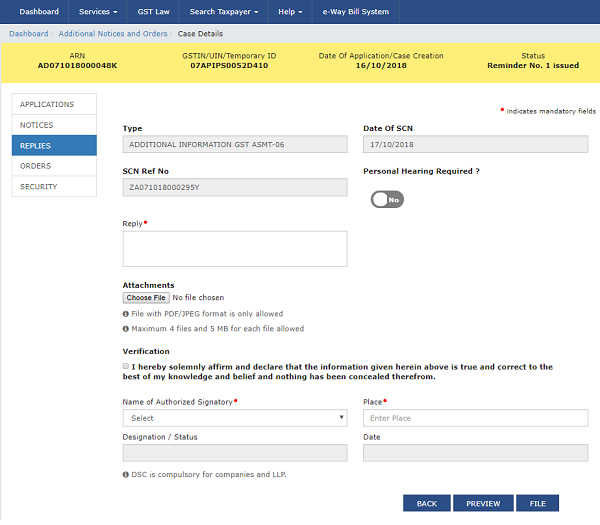

E (2). Replying to Additional Information GST ASMT-06

To view or add your replies to the issued notice for additional information, perform following steps:

1. On the Case Details page of that particular application, select the REPLIES tab. This tab will display the replies you will file or already file reply against the Notice issued by Tax Official. To add a reply, click ADD REPLY and select ADDITIONAL INFORMATION GST ASMT-06.

2. The Additional Information page is displayed.

3. In the Personal Hearing Required? field, select Yes or No.

Note: This button is visible in only those applications where the Tax Official has not already called for a personal hearing in the issued notice.

4. In Reply field, enter details of your reply to the issued notice.

5. Click Choose File to upload the document(s) related to your reply, if any. This is not a mandatory field.

6. Enter Verification details. Select the declaration check-box and select the name of the authorized signatory. Based on your selection, the fields Designation/Status and Date (current date) displayed below gets auto-populated. Enter the name of the place where you are filing this application.

7. Click PREVIEW to download and review your application.

3. In the Personal Hearing Required? field, select Yes or No.

Note: This button is visible in only those applications where the Tax Official has not already called for a personal hearing in the issued notice.

4. In Reply field, enter details of your reply to the issued notice.

5. Click Choose File to upload the document(s) related to your reply, if any. This is not a mandatory field.

6. Enter Verification details. Select the declaration check-box and select the name of the authorized signatory. Based on your selection, the fields Designation/Status and Date (current date) displayed below gets auto-populated. Enter the name of the place where you are filing this application.

7. Click PREVIEW to download and review your application.

8. The application is downloaded in PDF format.

9. Once you are satisfied, click FILE.

10. Submit Application page is displayed. Click SUBMIT WITH DSC or SUBMIT WITH EVC.

SUBMIT WITH DSC:

a. Select the certificate and click the SIGN button.

SUBMIT WITH EVC:

a. Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VERIFY button.

11. The Notices and Orders page is displayed with the generated Reference number. To download the filed reply, click the Click here hyperlink.

12. The filed reply is downloaded in the PDF format.

13. Click OK.

14. The updated REPLIES tab is displayed, with the record of the filed reply in a table and with the Status updated to “Reply furnished, pending for order by tax officer”. You can also click the documents in the Attachments section of the table to download them.

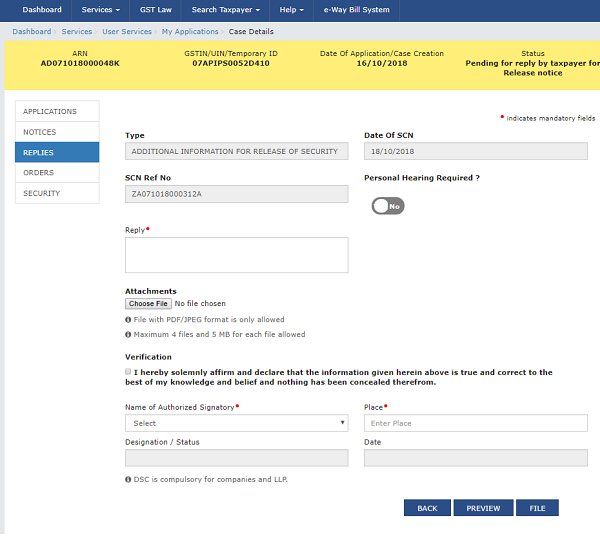

E (3). Replying to Additional Information for Release Security

To view or add your replies to the issued notice for additional information for release security, perform following steps:

1. On the Case Details page of that particular application, select the REPLIES tab. This tab will display the replies you will file or already file reply against the Notice issued by Tax Official. To add a reply, click ADD REPLY and select ADDITIONAL INFORMATION FOR RELEASE SECURITY.

2. The Additional Information for security release page is displayed.

3. In the Personal Hearing Required? field, select Yes or No.

Note: This button is visible in only those applications where the Tax Official has not already called for a personal hearing in the issued notice.

4. In Reply field, enter details of your reply to the issued notice.

5. Click Choose File to upload the document(s) related to your reply, if any. This is not a mandatory field.

6. Enter Verification details. Select the declaration check-box and select the name of the authorized signatory. Based on your selection, the fields Designation/Status and Date (current date) displayed below gets auto-populated. Enter the name of the place where you are filing this application.

7. Click PREVIEW to download and review your application.

8. The application is downloaded in PDF format.

9. Once you are satisfied, click FILE.

10. Submit Application page is displayed. Click SUBMIT WITH DSC or SUBMIT WITH EVC.

SUBMIT WITH DSC:

a. Select the certificate and click the SIGN button.

SUBMIT WITH EVC:

a. Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VERIFY button.

images 49

11. The Notices and Orders page is displayed with the generated Reference number. To download the filed reply, click the Click here hyperlink.

12. The filed reply is downloaded in the PDF format.

13. Click OK.

14. The updated REPLIES tab is displayed, with the record of the filed reply in a table and with the Status updated to “Reply furnished, pending for order by tax officer”. You can also click the documents in the Attachments section of the table to download them.

To download order for provisional assessment, perform following steps:

1. On the Case Details page of that particular taxpayer, click the ORDERS tab. This tab provides you an option to view the issued order, with all its attached documents, in PDF mode.

2. Click the document(s) in the Attachments section of the table to download them.

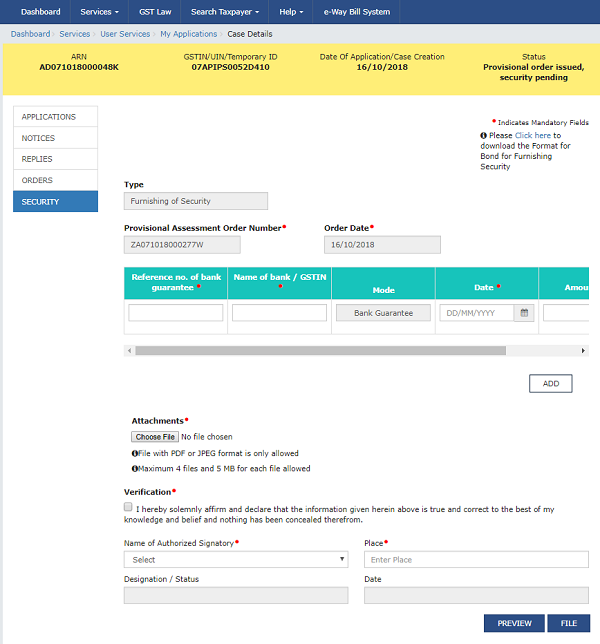

G (1). Furnishing of Security Amount

To furnish the security along with bond for provisional assessment, perform following steps:

1. On the Case Details page of that particular taxpayer, click the SECURITY tab.

2. To furnish the security, click FILE and select FURNISH OF SECURITY.

3. The Furnish of Security page is displayed.

4. Click the Click here to download the format for bond for furnishing security.

5. Enter the Reference no. of bank guarantee, Name of bank/GSTIN and Date.

6. Scroll to the right to enter more details.

7. Enter the amount furnished.

Note: You can click the ADD button to add more details.

8. Click Choose File to upload the document(s).

9. Enter Verification details. Select the declaration check-box and select the name of the authorized signatory. Based on your selection, the fields Designation/Status and Date (current date) displayed below gets auto-populated. Enter the name of the place where you are filing this application.

10. Click PREVIEW to download and review your application

11. The application is downloaded in PDF format.

12. Once you are satisfied, click FILE.

13. Submit Application page is displayed. Click SUBMIT WITH DSC or SUBMIT WITH EVC.

SUBMIT WITH DSC:

a. Select the certificate and click the SIGN button.

SUBMIT WITH EVC:

a. Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VERIFY button.

14. Notices and Orders page is displayed with the generated Reference number. To download the filed application, click the Click here hyperlink.

15. The application is downloaded in the PDF format.

16. Click OK.

17. The updated ORDERS tab is displayed, with the record of the filed application in a table and with the Status updated to “Security furnished, pending approval”. You can also click the documents in the Attachments section of the table to download them.

G (2). Resubmitting of Security Amount

To file application for resubmitting the security, perform following steps:

1. On the Case Details page of that particular taxpayer, click the SECURITY tab.

2. To resubmit the security, click FILE and select RESUBMIT OF SECURITY.

3. The Resubmit of Security page is displayed.

4. Enter the Reference no. of bank guarantee, Name of bank/GSTIN and Date.

5. Scroll to the right to view more details.

6. Click Choose File to upload the document(s).

7. Enter Verification details. Select the declaration check-box and select the name of the authorized signatory. Based on your selection, the fields Designation/Status and Date (current date) displayed below gets auto-populated. Enter the name of the place where you are filing this application.

8. Click FILE.

9. Submit Application page is displayed. Click SUBMIT WITH DSC or SUBMIT WITH EVC.

SUBMIT WITH DSC:

a. Select the certificate and click the SIGN button.

SUBMIT WITH EVC:

a. Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VERIFY button.

10. Notices and Orders page is displayed with the generated Reference number. To download the filed application, click the Click here hyperlink.

11. The application is downloaded in the PDF format.

12. Click OK.

13. The updated ORDERS tab is displayed, with the record of the filed application in a table and with the Status updated to “Security Resubmitted, pending approval”. You can also click the documents in the Attachments section of the table to download them.

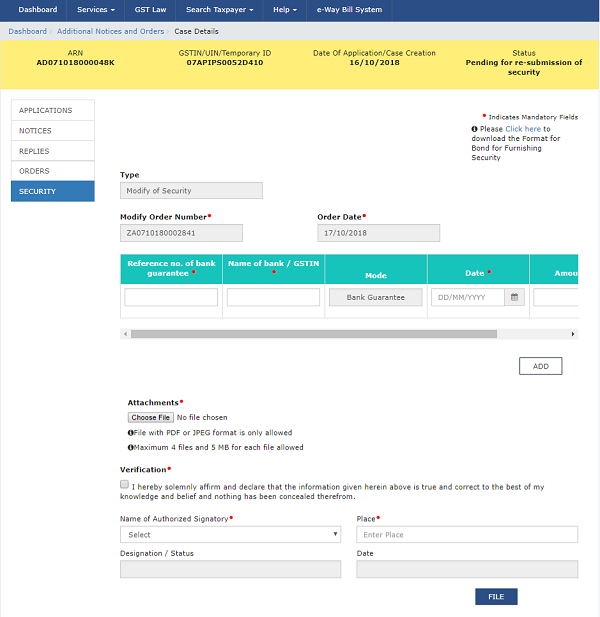

G (3). Submission of Modified Security Amount

To file application for submitting the modified security, perform following steps:

1. On the Case Details page of that particular taxpayer, click the SECURITY tab.

2. To modify the security, click FILE and select SUBMISSION OF MODIFIED SECURITY.

3. The Modify of Security page is displayed.

4. Enter the Reference no. of bank guarantee, Name of bank/GSTIN and Date.

5. Scroll to the right to view more details.

6. Enter the modified amount.

Note: You can click the ADD button to add more details.

7. Click Choose File to upload the document(s).

8. Enter Verification details. Select the declaration check-box and select the name of the authorized signatory. Based on your selection, the fields Designation/Status and Date (current date) displayed below gets auto-populated. Enter the name of the place where you are filing this application.

9. Click FILE.

10. Submit Application page is displayed. Click SUBMIT WITH DSC or SUBMIT WITH EVC.

SUBMIT WITH DSC:

a. Select the certificate and click the SIGN button.

SUBMIT WITH EVC:

a. Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VERIFY button.

11 Notices and Orders page is displayed with the generated Reference number. To download the filed application, click the Click here hyperlink.

12. The application is downloaded in the PDF format.

13. Click OK.

14. The updated ORDERS tab is displayed, with the record of the filed application in a table and with the Status updated to “Security Modified, pending approval”. You can also click the documents in the Attachments section of the table to download them.

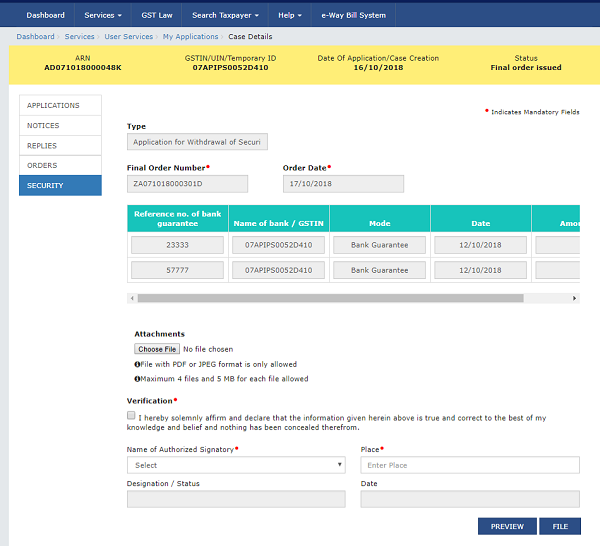

G (4). Releasing of Security Amount

To file application for releasing of security, perform following steps:

1. On the Case Details page of that particular taxpayer, click the SECURITY tab.

2. To release the security, click FILE and select RELEASE OF SECURITY.

3. The Release of Security page is displayed

4. Click Choose File to upload the document(s).

5. Enter Verification details. Select the declaration check-box and select the name of the authorized signatory. Based on your selection, the fields Designation/Status and Date (current date) displayed below gets auto-populated. Enter the name of the place where you are filing this application.

6. Click PREVIEW to download and review your application.

7. The application is downloaded in PDF format.

8. Once you are satisfied, click FILE.

9. Submit Application page is displayed. Click SUBMIT WITH DSC or SUBMIT WITH EVC.

SUBMIT WITH DSC:

a. Select the certificate and click the SIGN button.

SUBMIT WITH EVC:

a. Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VERIFY button.

10. Notices and Orders page is displayed with the generated Reference number. To download the filed application, click the Click here hyperlink.

11. The application is downloaded in the PDF format.

12. Click OK.

13. The updated ORDERS tab is displayed, with the record of the filed application in a table and with the Status updated to “Pending for action by tax officer for Release”. You can also click the documents in the Attachments section of the table to download them.

(Republished with amendments)

****

Disclaimer: The contents of this article are for information purposes only and does not constitute an advice or a legal opinion and are personal views of the author. It is based upon relevant law and/or facts available at that point of time and prepared with due accuracy & reliability. Readers are requested to check and refer relevant provisions of statute, latest judicial pronouncements, circulars, clarifications etc before acting on the basis of the above write up. The possibility of other views on the subject matter cannot be ruled out. By the use of the said information, you agree that Author / TaxGuru is not responsible or liable in any manner for the authenticity, accuracy, completeness, errors or any kind of omissions in this piece of information for any action taken thereof. This is not any kind of advertisement or solicitation of work by a professional.

Source- gst.gov.in