The Ministry of Finance has reported a robust performance in Goods and Services Tax (GST) revenue collection for May 2024, reflecting significant economic activity and efficient tax administration. The gross GST revenue for the month of May 2024 stood at ₹1.73 lakh crore, marking a 10% increase from the same period last year. This growth is largely attributed to a 15.3% rise in domestic transactions, indicating a healthy domestic market, although imports saw a 4.3% decline. After accounting for refunds, the net GST revenue for May 2024 amounted to ₹1.44 lakh crore, demonstrating a 6.9% year-on-year growth.

Breaking down the figures, the Central Goods and Services Tax (CGST) collection was ₹32,409 crore, the State Goods and Services Tax (SGST) amounted to ₹40,265 crore, and the Integrated Goods and Services Tax (IGST) reached ₹87,781 crore, including ₹39,879 crore collected on imported goods. Additionally, the cess collected was ₹12,284 crore, with ₹1,076 crore from imported goods.

For the fiscal year 2024-25, up to May 2024, the cumulative gross GST revenue touched ₹3.83 lakh crore, an 11.3% increase over the previous year. This period saw a 14.2% surge in domestic transactions and a marginal 1.4% rise in imports. The net GST revenue, after refunds, totaled ₹3.36 lakh crore, up by 11.6% from the same period last year. The distribution of collections for this period included ₹76,255 crore for CGST, ₹93,804 crore for SGST, ₹1,87,404 crore for IGST, and ₹25,544 crore for cess.

Inter-governmental settlements in May 2024 saw the Central Government allocating ₹38,519 crore to CGST and ₹32,733 crore to SGST from the net IGST collected. Overall, the figures underscore a positive trend in GST collections, reflecting economic resilience and improved compliance.

Ministry of Finance

Gross GST revenue collection in May 2024 stands at ₹1.73 lakh crore; Records 10% y-o-y growth

₹3.83 lakh crore gross GST revenue collection in FY2024-25 (till May 2024) records 11.3% y-o-y growth

Net Revenue (after refunds) grows 11.6% in FY 2024-25 (till May 2024)

Domestic Gross GST Revenue grows 15.3% in May, 2024

The gross Goods and Services Tax (GST) revenue for the month of May 2024 stood at ₹1.73 lakh crore. This represents a 10% year-on-year growth, driven by a strong increase in domestic transactions (up 15.3%) and slowing of imports (down 4.3%). After accounting for refunds, the net GST revenue for May 2024 stands at ₹1.44 lakh crore, reflecting a growth of 6.9% compared to the same period last year.

Breakdown of May 2024 Collections:

- Central Goods and Services Tax (CGST): ₹32,409 crore;

- State Goods and Services Tax (SGST): ₹40,265 crore;

- Integrated Goods and Services Tax (IGST): ₹87,781 crore, including ₹39,879 crore collected on imported goods;

- Cess: ₹12,284 crore, including ₹1,076 crore collected on imported goods.

The gross GST collections in the FY 2024-25 till May 2024 stood at ₹3.83 lakh crore. This represents an impressive 11.3% year-on-year growth, driven by a strong increase in domestic transactions (up 14.2%) and marginal increase in imports (up 1.4%). After accounting for refunds, the net GST revenue in the FY 2024-25 till May 2024 stands at ₹3.36 lakh crore, reflecting a growth of 11.6% compared to the same period last year.

Breakdown of collections in the FY 2024-25 till May, 2024, are as below:

- Central Goods and Services Tax (CGST): ₹76,255 crore;

- State Goods and Services Tax (SGST): ₹93,804 crore;

- Integrated Goods and Services Tax (IGST): ₹1,87,404 crore, including ₹77,706 crore collected on imported goods;

- Cess: ₹25,544 crore, including ₹2,084 crore collected on imported goods.

Inter-Governmental Settlement:

In the month of May, 2024, the Central Government settled ₹38,519 crore to CGST and ₹32,733 crore to SGST from the net IGST collected of ₹67,204 crore. This translates to a total revenue of ₹70,928 crore for CGST and ₹72,999 crore for SGST in May, 2024, after regular settlement.

Similarly, in the FY 2024-25 till May 2024 the Central Government settled ₹88,827 crore to CGST and ₹74,333 crore to SGST from the net IGST collected of ₹154,671 crore. This translates to a total revenue of ₹1,65,081 crore for CGST and ₹1,68,137 crore for SGST in FY 2024-25 till May 2024 after regular settlement.

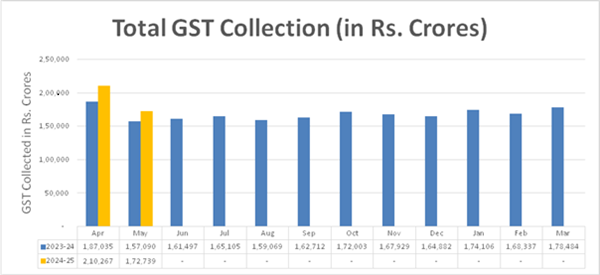

The chart below shows trends in monthly gross GST revenues during the current year. Table-1 shows the state-wise figures of GST collected in each State during the month of May, 2024 as compared to May, 2023. Table-2 shows the state-wise figures of post settlement GST revenue of each State for the month of May, 2024.

Chart: Trends in GST Collection

Table 1: State-wise growth of GST Revenues during May, 2024[1]

| State/UT | May-23 | May-24 | Growth (%) |

| Jammu and Kashmir | 422 | 525 | 24% |

| Himachal Pradesh | 828 | 838 | 1% |

| Punjab | 1,744 | 2,190 | 26% |

| Chandigarh | 259 | 237 | -9% |

| Uttarakhand | 1,431 | 1,837 | 28% |

| Haryana | 7,250 | 9,289 | 28% |

| Delhi | 5,147 | 7,512 | 46% |

| Rajasthan | 3,924 | 4,414 | 13% |

| Uttar Pradesh | 7,468 | 9,091 | 22% |

| Bihar | 1,366 | 1,521 | 11% |

| Sikkim | 334 | 312 | -7% |

| Arunachal Pradesh | 120 | 98 | -18% |

| Nagaland | 52 | 45 | -14% |

| Manipur | 39 | 58 | 48% |

| Mizoram | 38 | 39 | 3% |

| Tripura | 75 | 73 | -3% |

| Meghalaya | 214 | 172 | -20% |

| Assam | 1,217 | 1,228 | 1% |

| West Bengal | 5,162 | 5,377 | 4% |

| Jharkhand | 2,584 | 2,700 | 4% |

| Odisha | 4,398 | 5,027 | 14% |

| Chhattisgarh | 2,525 | 2,853 | 13% |

| Madhya Pradesh | 3,381 | 3,402 | 1% |

| Gujarat | 9,800 | 11,325 | 16% |

| Dadra and Nagar Haveli and Daman & Diu | 324 | 375 | 16% |

| Maharashtra | 23,536 | 26,854 | 14% |

| Karnataka | 10,317 | 11,889 | 15% |

| Goa | 523 | 519 | -1% |

| Lakshadweep | 2 | 1 | -39% |

| Kerala | 2,297 | 2,594 | 13% |

| Tamil Nadu | 8,953 | 9,768 | 9% |

| Puducherry | 202 | 239 | 18% |

| Andaman and Nicobar Islands | 31 | 37 | 18% |

| Telangana | 4,507 | 4,986 | 11% |

| Andhra Pradesh | 3,373 | 3,890 | 15% |

| Ladakh | 26 | 15 | -41% |

| Other Territory | 201 | 207 | 3% |

| Center Jurisdiction | 187 | 245 | 30% |

| Grand Total | 1,14,261 | 1,31,783 | 15% |

Table-2: SGST & SGST portion of IGST settled to States/UTs in

May (Rs. in crore)

| Pre-Settlement SGST | Post-Settlement SGST[2] | |||||

| State/UT | May-23 | May-24 | Growth | May-23 | May-24 | Growth |

| Jammu and Kashmir | 178 | 225 | 26% | 561 | 659 | 17% |

| Himachal Pradesh | 189 | 187 | -1% | 435 | 436 | 0% |

| Punjab | 638 | 724 | 14% | 1,604 | 1,740 | 8% |

| Chandigarh | 48 | 54 | 12% | 168 | 178 | 6% |

| Uttarakhand | 411 | 476 | 16% | 666 | 714 | 7% |

| Haryana | 1,544 | 1,950 | 26% | 2,568 | 3,025 | 18% |

| Delhi | 1,295 | 1,477 | 14% | 2,539 | 2,630 | 4% |

| Rajasthan | 1,386 | 1,506 | 9% | 3,020 | 3,315 | 10% |

| Uttar Pradesh | 2,384 | 2,736 | 15% | 5,687 | 6,848 | 20% |

| Bihar | 623 | 695 | 11% | 2,058 | 2,298 | 12% |

| Sikkim | 31 | 26 | -15% | 84 | 66 | -21% |

| Arunachal Pradesh | 60 | 45 | -26% | 187 | 152 | -19% |

| Nagaland | 21 | 19 | -9% | 83 | 79 | -4% |

| Manipur | 23 | 32 | 35% | 77 | 107 | 39% |

| Mizoram | 21 | 22 | 3% | 79 | 77 | -3% |

| Tripura | 40 | 36 | -9% | 135 | 138 | 2% |

| Meghalaya | 56 | 52 | -7% | 158 | 154 | -3% |

| Assam | 488 | 511 | 5% | 1,170 | 1,280 | 9% |

| West Bengal | 1,952 | 2,030 | 4% | 3,407 | 3,628 | 6% |

| Jharkhand | 653 | 735 | 13% | 976 | 1,135 | 16% |

| Odisha | 1,255 | 1,415 | 13% | 1,676 | 2,068 | 23% |

| Chhattisgarh | 583 | 661 | 14% | 833 | 1,033 | 24% |

| Madhya Pradesh | 987 | 1,028 | 4% | 2,580 | 2,555 | -1% |

| Gujarat | 3,371 | 3,526 | 5% | 5,156 | 5,233 | 2% |

| Dadra and Nagar Haveli and Daman and Diu | 47 | 58 | 23% | 92 | 80 | -13% |

| Maharashtra | 7,621 | 8,711 | 14% | 10,952 | 12,397 | 13% |

| Karnataka | 3,022 | 3,441 | 14% | 5,704 | 6,062 | 6% |

| Goa | 182 | 190 | 4% | 324 | 321 | -1% |

| Lakshadweep | 0 | 1 | 478% | 7 | 5 | -35% |

| Kerala | 1,040 | 1,209 | 16% | 2,387 | 2,497 | 5% |

| Tamil Nadu | 3,101 | 3,530 | 14% | 4,829 | 6,014 | 25% |

| Puducherry | 36 | 41 | 13% | 99 | 106 | 7% |

| Andaman and Nicobar Islands | 15 | 18 | 17% | 41 | 44 | 5% |

| Telangana | 1,448 | 1,636 | 13% | 3,024 | 3,239 | 7% |

| Andhra Pradesh | 1,048 | 1,240 | 18% | 2,116 | 2,597 | 23% |

| Ladakh | 14 | 8 | -43% | 34 | 24 | -27% |

| Other Territory | 16 | 17 | 8% | 83 | 66 | -20% |

| Grand Total | 35,828 | 40,265 | 12% | 65,597 | 72,999 | 11% |

****