Introduction: The Goods and Services Tax Network (GSTN) is pleased to announce a significant development: the Central Board of Indirect Taxes and Customs (CBIC) will migrate to the GSTN Back Office effective June 1, 2024. This transition marks a pivotal step in streamlining tax processes and enhancing administrative efficiency. The migration process will involve assigning new registration applications to state tax administrations during a specified period, which may impact workload distribution among state agencies.

Migration Overview

Starting June 1, 2024, CBIC will operate through the GSTN Back Office. This migration aims to unify and streamline tax processes under a single administrative framework, promoting efficiency and coherence in tax administration across the country.

Impact on Registration Applications

During the migration period from May 25 to May 31, 2024, all new registration applications will be managed by state tax administrations. This decision ensures a seamless transition while CBIC integrates into the GSTN Back Office. As a result, state tax departments will experience a temporary increase in registration applications, necessitating additional preparations to manage the increased workload effectively.

Assignment of Taxpayers

The taxpayers whose applications are processed during the migration period will remain assigned to the respective state tax administrations permanently. This measure ensures continuity and stability in tax administration, even after the migration is complete. Consequently, state tax departments should anticipate and prepare for an enduring increase in their responsibilities.

*****

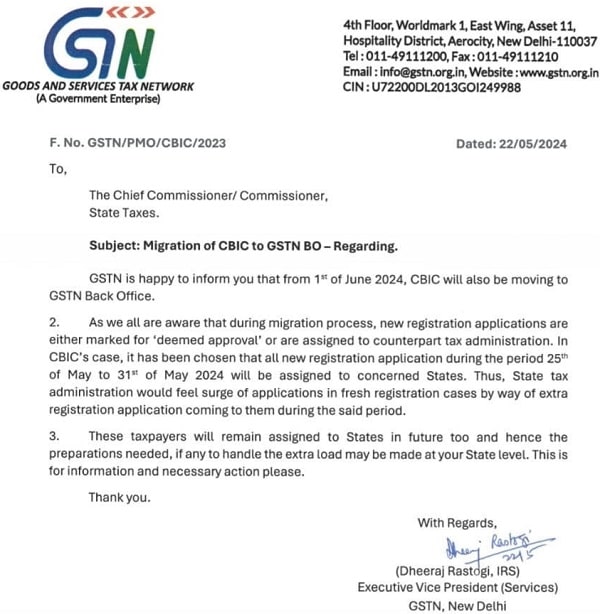

GOODS AND SERVICES TAX NETWORK

(A Government Enterprise)

4th Floor, Worldmark 1, East Wing, Asset 11,

Hospitality District, Aerocity, New Delhi-110037

Tel: 011-49111200, Fax: 011-49111210

Email:info@gstn.org.in, Website:www.gstn.org.in

CIN: U72200DL2013GOI249988

F.No. GSTN/PMO/CBIC/2023 Dated: 22/05/2024

To,

The Chief Commissioner/ Commissioner,

State Taxes.

Subject: Migration of CBIC to GSTN BO-Regarding.

Dated: 22/05/2024

GSTN is happy to inform you that from 1st of June 2024, CBIC will also be moving to GSTN Back Office.

2. As we all are aware that during migration process, new registration applications are either marked for ‘deemed approval’ or are assigned to counterpart tax administration. In CBIC’s case, it has been chosen that all new registration application during the period 25 of May to 31st of May 2024 will be assigned to concerned States. Thus, State tax administration would feel surge of applications in fresh registration cases by way of extra registration application coming to them during the said period.

3. These taxpayers will remain assigned to States in future too and hence the preparations needed, if any to handle the extra load may be made at your State level. This is for information and necessary action please.

Thank you.

With Regards,

(Dheeraj Rastogi, IRS)

Executive Vice President (Services)

GSTN, New Delhi