Sponsored

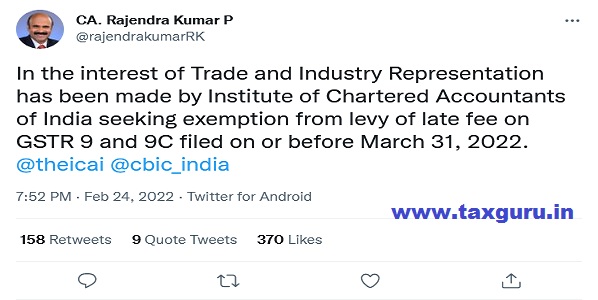

CA. Rajendra Kumar P has informed on twitter that In the interest of Trade and Industry Representation has been made by Institute of Chartered Accountants of India seeking exemption from levy of late fee on GSTR 9 and 9C filed on or before March 31, 2022.

Currently due Due date of GSTR-9 and GSTR-9C for Financial Year 2020-21 is 28th February 2022.

Sponsored

Kindly Refer to

Privacy Policy &

Complete Terms of Use and Disclaimer.

Sir,

In my view, for delayed filing of Statement on 9-C, there is no provision of charging Late fee u/s 49, GST Act.

I request the ICAI to clarify the position after detailed analysis of the relevant provisions..

CA Om Prakash Jain s/o J.K.Jain

Tel:9414300730