Introduction

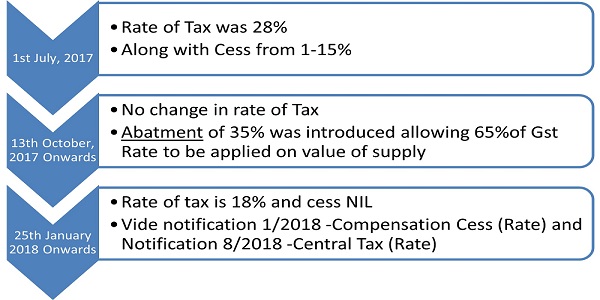

The introduction of the Goods and Services Tax (GST) on 1st July 2017 marked a significant shift in India’s taxation system. The initial phase saw the taxation of used motor vehicles at a hefty 28%, compounded with a cess. This pricing structure hampered the growth of the used car market. Recognizing the consequential slowdown, the GST Council, in a commendable move on January 18, 2018, revised the rates to revitalize the second-hand vehicle sector.

Changes in Rate of Tax of Motor Vehicles

- The given illustration depicts the Change in Rates from the beginning till the date.

Abatement for the Supply of Used Cars

The concept of Abatment came into existence from 13th October,2017 by which there were no changes in rate but a deduction in rate was provided. An abatment of 35% of Tax was allowed.

- The conditions to be satisfied for availing the Abatment are:

1. The supplier of the motor vehicle should be registered under the GST Act

2. And such supplier had purchased the Motor Vehicle before date of 1st July 2017 and has not availed credit of input tax of Central Excise Duty, Value Added Tax, or any other taxes paid which was paid by him on such vehicles.

3. The Motor Vehicles were purchased by the lessor before the date of 1st July 2017 (i.e when GST came into existence) and supplied on the lease again before 1st July 2017.

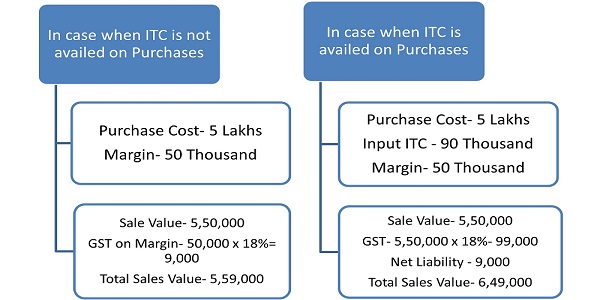

Taxable Value as per Rule 32(5) of CGST RULE 2017

The Rate may have been changed since the GST came into existence in India but the calculation for Taxable Value remains the same.

Rule 32(5) of CGST Rules 2017 talks about valuation in case of second-hand goods. In terms of Rule 32(5) –

a. Where a taxable supply is provided by a person dealing in buying and selling of second-hand goods i.e., used goods as such or after minor processing which does not change the nature of such goods.

b. Where no input tax credit has been availed on the purchase of such goods

c. Value of supply of such second-hand goods would be the difference between the selling price and the purchase price.

d. Where the value of such supply is negative, it is ignored for the purpose of valuation of such supply.

Conclusion

For enhanced marketability and customer affordability, it’s imperative for used car dealers to levy GST on the margin amount rather than the complete taxable value. This approach not only encourages sales but also upholds the spirit of GST – fostering growth while ensuring equity.

Authors:

Gaurav Anand, Associate Consultant, gaurav.anand@masd.co.in

Sachin Ostwal, Associate Consultant, sachin.ostwal@masd.co.in

Car was Purchased for 12 Lakhs during 2015. without claiming ITC. Now intends to sale for 3 lakhs. what will be liability of GSTN holder on sale of car.

Kindly reply.