Chargeability of GST on Food served to Employees

1. GST is leviable on all forms of supply unless exempted exclusively [Sec. 9(1)]

2. Supply includes all forms of supply made or agreed to be made for a consideration by a person in the course or furtherance of business [Sec. 7(1)(a)]

3. Supply also includes the activities specified in Schedule-I, made or agreed to be made without consideration [Sec. 7(1)(c)]

4. Activities to be treated as supply of goods or services or both even if made without consideration between related persons or distinct persons as specified in Sec. 25, when made in the course or furtherance of business (Clause 2 of Schedule-I)

5. Employer and employee shall be deemed as related persons [Exp. (a)(iii) to Sec. 15(5)].

Conclusion: After reading the above provisions till now, we can say that since employer and employee are related persons as per GST law, hence, GST is leviable on any goods or services are provided by the company to their employees at free of cost or at concessional rate. We need to analyze it further on case to case basis to see the actual taxability

Page Contents

Serving of Food in Canteen is Goods or Services??

1. If certain activities and transactions constitute as “Supply” as per section 7(1) then those supplies shall be treated as either Goods or Services as specified in Schedule-II [Sec. 7(1A)]

2. Composite supply of service of any goods, being food or any other article for human consumption or any drink (excluding alcoholic liquor for human consumption) shall be treated as supply of services (Clause 6(b) of Schedule-II)

3. It is clarified by the GST council that supply of food in cafeteria is covered under the definition of “Restaurant Service” (Circular No. 164/20/2021-GST dated 06th Oct, 2021)

4. The GST rate on “Restaurant Service” is 5% without ITC (Notification No. 20/2019-Central Tax (Rate) dated 30th Sept. 2019)

Taxable Value of Food served to Employees

1. The taxable value of a supply of Goods or Services or both shall be the “transaction value”, where supplier and recipient are not related and price is the sole consideration [Sec. 15(1)]

2. As discussed in earlier para, employer and employee are related persons as per Exp. (a)(iii) to Sec. 15(5), hence, we cannot take “transaction value” as “taxable value” for the purpose of calculating GST

3. Where the supplier and recipient (employer and employee in our case) are related persons then the “taxable value” of Goods or Services or both shall:

i. be the open market value [Rule 28(a)]

ii. if the open market value is not available then the value of Goods or Services of similar kind and quantity [Rule 28(b)]

iii. if it is not determinable as per above both methods then it shall be 110% of cost of production/manufacture or cost of acquisition of such Goods or Services (Rule 30)

iv. if it is not possible to determine with any of the above methods then it shall be such value which is reasonable and consistent with the provisions of GST law (Rule 31)

Various Models adopted by Companies

a. Business Catering Model

b. Corporate Social Event Modal

c. Cash & Carry Model

d. Outdoor Catering Service Model

e. Coupon Based Model

a. Business Catering Model

Under this model food facility procures by the company from outside caterer and provides to their employees at free of cost or at nominal amount which recovers latter from employees, where it is mandatory/not mandatory for the company to provide such facility under any law in force (Generally mandatory u/s 46 of Factories Act, where number of employees are more than 250).

ITC Availability:

1. If mandatory on the part of company to provide food facility to their employees under any law in force and company procures such facility from caterer – ITC Available [Proviso to Sec. 17(5)(b)(iii)]

However, contrary Rulings have been given, where it has decided that ITC would not be available even if it is mandatory under any law to provide such canteen facility (Advance Ruling No. HAR/HAAR/R/2019-20/18 dated February 4, 2020 in the case of M/s. Musashi Auto Parts Pvt. Ltd. and ADVANCE RULING NO. GUJ/GAAR/R/39/2021 in the case of Tata Motors Ltd.)

2. If not mandatory on the part of company to provide food facility to their employee as per any law in force – ITC not Available [Proviso to Sec. 17(5)(b)(i)]

GST applicability on outward supply to employees:

GST is chargeable at the rate of 5% by the company on the value which is to be determined as per section 15(5) r.w.r. 28, 29, 30 and 31 of CGST Rules, 2017 (Refer Hon’ble AAAR of KERALA vide Order No. CT/7726/2018-C3 dated 25th Sept, 2018 in the case of M/s. Caltech Polymers Pvt. Ltd. and Hon’ble AAR or Gujarat vide Advance Ruling No. GUJ/GAAR/R/50/2020, dated 30th July, 2020 in the case of M/s Amneal Pharmaceuticals Pvt. Ltd.)

However, contrary Ruling has been given, where it has decided that GST is not leviable on nominal amount recovered from employees (ADVANCE RULING NO. GUJ/GAAR/R/39/2021 in the case of Tata Motors Ltd.)

b. Corporate Social Event Model

Under this model caterer provides catering and allied banquet services at internal events hold at company’s premises against consideration receives from the company or their employees who are responsible for the event, as the case may be.

ITC Availability:

Is company eligible to avail the ITC on all the supplies made by caterer?? – ITC available on all the supplies except supply of food

GST applicability on outward supply to employees:

GST is chargeable at the rate of 5% by the company on the food value which is to be determined as per section 15(5) r.w.r. 28, 29 and 30 (Refer previous slides)

However, contrary Ruling has been given, where it has decided that GST is not leviable on nominal amount recovered from employees (ADVANCE RULING NO. GUJ/GAAR/R/39/2021 in the case of Tata Motors Ltd.)

Note: There is no question of ITC eligibility to the company if the whole consideration is paid by employees to caterer directly without any involvement of the company in the whole transaction.

c. Cash & Carry Model

Under this model caterer provides food facility directly to company’s employees and receives the consideration directly from employees without any involvement of company in the whole transaction.

ITC Availability:

There is no question of ITC to the company since amount is directly paid by employees to caterer without any transaction with the company

ITC would not be available to caterer also since it is blocked u/s 17(5)(b)(i)

GST applicability on outward supply to employees:

GST is chargeable at the rate of 5% on the transaction value which is actually paid by employees to caterer as caterer and employees are not related persons.

d. Outdoor Catering Service Model

This model is more or less similar to “Business Catering Model”. Under this model food facility provided to employees by outside caterer and caterer raise invoice in the name of company. Company deducts the whole amount from employees’ salary.

ITC Availability:

1. If mandatory on the part of company to provide food facility to their employees under any law in force and company procures such facility from caterer – ITC available [Proviso to Sec. 17(5)(b)(iii)]

2. However, contrary Rulings have been given, where it has decided that ITC would not be available even if it is mandatory under any law to provide such canteen facility (Advance Ruling No. HAR/HAAR/R/2019-20/18 dated February 4, 2020 in the case of M/s. Musashi Auto Parts Pvt. Ltd. and ADVANCE RULING NO. GUJ/GAAR/R/39/2021 in the case of Tata Motors Ltd.)

3. If not mandatory on the part of company to provide food facility to their employee as per any law in force – ITC not Available [Proviso to Sec. 17(5)(b)(i)]

GST applicability on outward supply to employees:

GST is chargeable at the rate of 5% by the company on the value which is to be determined as per section 15(5) r.w.r. 28, 29, 30 and 31 of CGST Rules, 2017 (Refer Hon’ble AAAR of KERALA vide Order No. CT/7726/2018-C3 dated 25th Sept, 2018 in the case of M/s. Caltech Polymers Pvt. Ltd. and Hon’ble AAR or Gujarat vide Advance Ruling No. GUJ/GAAR/R/50/2020, dated 30th July, 2020 in the case of M/s Amneal Pharmaceuticals Pvt. Ltd.)

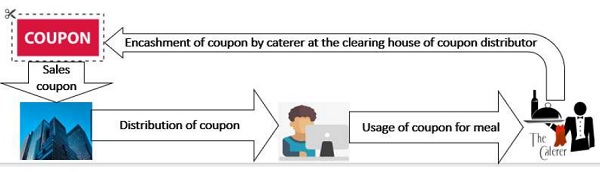

e. Coupon Based Model

Company distributes coupons to their employees specifying the manner of its usage i.e. for meal in canteen or other outlet only and recovers partial or full amount from the employees.

ITC Availability:

There is no question of ITC since coupon directly uses by employees at caterer counter without involvement of company in the whole transaction

GST applicability on outward supply to employees:

If no amount is recovered from the employees by the company then no GST would be chargeable.

However, if any amount whether partial or full is recovered from the employee then the value of coupon will be the taxable value for the purpose of calculating GST.

Other Relevant Provisions under GST

Q.(1) Whether free tea/coffee/food provided to employees in office premises under the terms of employment contract is chargeable to GST??

Ans. No, as per Press Release dated 10th July, 2017, no GST would be leviable on any services provided by employer to employee if the same is in terms of contractual agreement entered into between employer and employee

Q. (2) Is it possible for companies or caterer to pay GST at the rate of 18% instead of 5% and avail the ITC??

Ans. No, the GST rate 5% without ITC is not optional but is mandatory, hence, supplier of food service shall have to charge GST at the rate of 5% only without availing ITC

Q. (3) What precautions a company should take to avoid un-necessary litigation while providing canteen services to their employees??

Ans. The below practice can be adopted by corporates to avoid litigation

i. Any canteen facility provided by the company under any model should be written in contractual agreement with the employee

ii. Company can adopt “Coupon Based Model” with no recovery from employee

iii. Company should not avail any ITC on catering services received from the caterer

iv. Company should check the valuation rules 28, 29, 30 and 31 for determining taxable value

Very useful

Thank you!!