Vide Notification No 62/2020 – Central Tax dated 20th August, 2020, CBIC made probably the most significant change in the GST Registration process since its inception. The amended GST Registration Process as detailed below shall be applicable with effect from 21st August, 2020:

> Part A of FORM GST REG-01 (PAN Validation with CBDT Database and verification of mobile no. and mail id through OTP) – No changes have been made vide the above stated notification.

> Part B of FORM GST REG-01 (Main Registration Form)

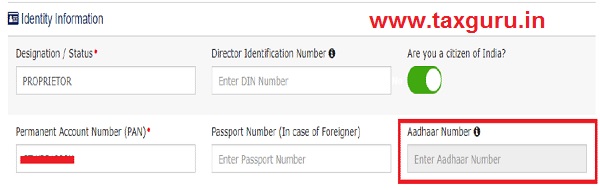

In Part B of FORM GST REG-01, in the table “Promoter / Partners”, the field “Aadhaar Number” has been disabled and cannot be filled up anymore, although it was not compulsory to fill this field earlier also. An altogether new table “Aadhaar Authentication” has been added in the GST Registration process.

The column, where we used to fill up the Aadhaar number would show the pop up “A separate process of Aadhaar authentication has been implemented. You are requested to provide your Aadhaar through the link sent at your Mobile No. and e-mail (furnished with registration details) on submission of the registration application”.

Screenshot of the same are as below:

> Further, most importantly, now the applicant would have 2 options to choose from, as stated below:-

♦ Option 1:

- Applicant can opt for authentication of Aadhaar number

(Which means completion of Aadhaar Authentication through the link provided on mobiles / e-mails of promoters / partners / proprietors / directors / authorized signatories. Such Aadhaar Authentication shall be and can be done only after the submission of registration application as the link would be received only after the submission of registration application). - Applicant shall undergo “authentication of Aadhaar number” after the submission of registration application.

- “Date of submission of the application” (such term would be used repetitively in this article) in “Option 1” shall be considered as the earlier of “the date of authentication of the Aadhaar number” or “15 days from the date of submission of the registration application”.

- The “date of submission of the registration application” can be different from the “date of authentication of the Aadhaar number” because the process of the authentication of the Aadhaar number shall start only after the applicant receives the links for Aadhaar verification on mail id & mobile no. provided during registration process and such link shall be received only after the submission of registration application. So for instance, the applicant may do the actual authentication through links even say after 3-4 days of the submission of registration application. So both dates can be different in any given case.

- If the application done is found to be in order by proper officer then he / she shall approve the application within 3 working days from the date of submission of the application;

- If the application is found to be deficient by proper officer, then he may issue a notice within 3 working days from the date of submission of the application for seeking clarification. Then the applicant shall furnish such clarification within 7 working days from the date of the receipt of such notice;

- If the proper officer is satisfied with the clarification, he may approve, else he may reject the registration application within 7 working days from the date of the receipt of such clarification.

♦ Option 2:

- Applicant either “does not opt for authentication of Aadhaar number” or “fails to undergo authentication of Aadhaar number post registration”, the registration shall be granted only after the physical verification of the place of business by the proper officer in the presence of the said person.

[Difference between “Not opting for authentication of Aadhaar number” and “failing to undergo authentication of Aadhaar number”:

“Not opting for authentication of Aadhaar number” – It means that the applicant has not opted for this new process of Aadhaar authentication altogether and is following the same registration process which we used to follow till 20th August, 2020.

“failing to undergo authentication of Aadhaar number” – It means that at the time of filing registration application, the applicant has opted for the Aadhaar Authentication which he / she was supposed to complete it post registration. Now either applicant does not authenticate the same or forgets to do the same or has failed to do the same as the mobile no. provided during registration application is not linked to the Aadhaar number, then in such cases, it shall be considered as “failing to undergo authentication of Aadhaar number”.]

After physical verification, the Proper Officer shall upload the verification report along with the other documents, including photographs in FORM GST REG-30 on the common portal within 15 working days following the date of such verification. Instead of physical verification, proper officer may carry out the verification of such documents as he may deem fit after the approval of an officer not below the rank of Joint Commissioner and after recording the reasons in writing;

- Under such Option 2, if the application is found to be deficient by proper officer, then he may issue a notice within 21 days instead of usual 3 working days from the date of submission of the application (For 21 days, it is 21 days and not 21 working days, whereas for 3 days, it is 3 working days and not 3 days);

- As such, there is no specific time limit provided for the physical verification by the officer under the above stated notification but the time limit for issuing “notice for seeking clarification” has been prescribed as 21 days. Further, as discussed in this article further, if the proper officer fails to take any action within 21 days from the date of submission of the application, then the application shall be deemed

- After receiving the notice, the applicant shall furnish such clarification within 7 working days from the date of the receipt of such notice.

- If the proper officer is satisfied with the clarification, he may approve, else he may reject the registration application within 7 working days from the date of the receipt of such clarification

> Aadhaar Authentication under Option 1

♦ While filling Part B of the registration application form, in the table “Aadhaar Authentication”, just before the last “Verification” table, the portal would ask the applicant “Would you like to opt for Aadhaar authentication of Promoters/ Partners, Authorized Signatories?”

♦ If applicant selects “Yes”, then he will get the below pop up:

After clicking on “Save and Continue”, below pop up would be generated.

Further, most importantly make sure that the email and mobile numbers of Promoters/ Partners, Authorized Signatories provided by you are correct because the Aadhaar validation links shall be forwarded on such emails / mobile nos. Also ensure that such mobile numbers are linked with the Aadhaar number provided because the entire further authentication process is dependent on the correctness of the mobile no. and mail id provided by you. In case the mobile no. and mail id provided by the applicant are different from those linked with the Aadhaar Card, the Aadhar authentication would fail.

♦ Once the application has been submitted, the actual authentication of Aadhaar shall start. The applicant would receive a link on the mail id and mobile no. (Provided during the registration process) after the submission of registration application. The applicant shall then visit on the link for the further verification of his Aadhaar. Screenshot of the same is as below

♦ Above, we have discussed what would happen if the applicant has chosen Option 1.

Now, If the applicant opts for Option 2 and selects “No” to the question “Would you like to opt for Aadhaar authentication of Promoters/ Partners, Authorized Signatories?”, then he will get the below pop ups:

“You have selected ‘No’ for Aadhaar Authentication, therefore, approval of your registration application may include site verification of the business premises by the tax office and/ or request to submit additional documents. You will receive further communication from the tax office.”

“If you select ‘No’ the facility of deemed approval within 3 working days shall not be available and the Registration shall be issued only after the site verification and approval of the officer.”

Below are the Screenshots of both:

> Deemed Approval of GST Application:

| Provisions till 20th Aug, 2020 | Provisions from 21st Aug, 2020 onwards – Option 1 | Provisions from 21st Aug, 2020 onwards – Option 2 |

| 1. If the proper officer fails to take any action within 3 working days from the date of submission of the application; or | 1. If the proper officer fails to take any action within 3 working days from the date of submission of the application; or | 1. If the proper officer fails to take any action within 21 days from the date of submission of the application (It is not 21 working days but it is 21 days) |

| 2. If the proper officer fails to take any action within 7 working days from the date of the receipt of the clarification furnished by the applicant after the notice issued by him or her | 2. If the proper officer fails to take any action within 7 working days from the date of the receipt of the clarification furnished by the applicant after the notice issued by him or her | 2. If the proper officer fails to take any action within 7 working days from the date of the receipt of the clarification furnished by the applicant after the notice issued by him or her |

> Further, Rule 9(4) says that where no reply is furnished by the applicant in response to the notice issued by the proper officer for the clarification or the proper officer is not satisfied with the clarification, he “may”, for reasons to be recorded in writing reject such application.

Earlier, till 20th Aug, 2020, instead of “may” the word was “shall” which used to reflect the compulsion on proper officer to reject the application which may not be the case anymore.

> Conclusion:

Unless opted for the Aadhaar Authentication and thereafter completed the same successfully, the limit of 3 working days shall not be applicable anymore for the “Approval of application” or “Receiving Notice for clarification” or “Deemed Approval of application”. In such cases, the applicant may have to even wait for up to 21 days to get the “Approval of application” or “Receiving Notice for clarification” or “Deemed Approval of application”.

Further, we would no more be able to give the so called commitment of “3 working days” for either the approval or getting the notice from the Department.

The existing limit of 3 working days shall be applicable only if the applicant has opted for Aadhaar Authentication and the same has been completed successfully by him.

In fact, even after opting for Option 1 and selecting “Yes” for the authentication process, ensure the correctness of the mobile no. and mail id and make sure that the same are linked to Aadhaar number because the authentication will fail in such cases and you would again fall in Option 2. Further, some consultants used to provide their mobile number and mail id for OTP and other verification purposes which shall no longer be in practice if Option 1 as stated above is opted because the applicant will have to provide only that mobile no. and mail id which are linked to the Aadhaar Number of the promoters / partners / proprietors / directors / authorized signatories.

So effectively, in the nutshell, if you opt for Option 1, that will increase the efforts and practical difficulties to a greater extent in getting a GST Number and if you opt for Option 2, that will increase the time for getting a GST Number.

*****

Disclaimer:- This information is intended for knowledge sharing purpose only. All efforts have been made to ensure the accuracy of information. The information contained in this Article is being circulated for the knowledge of the recipient but is not to be relied upon as authoritative or taken as legal opinion by any means. While due care has been taken in the preparation of this Article and information contained herein, but its author will not be responsible for any errors that may have crept in inadvertently and do not accept any liability whatsoever, for any direct or consequential loss howsoever arising from any use of this Article or its contents or otherwise arising in connection herewith. In case of any discrepancy, reader is advised to refer the original source of content.