Process of aadhar authentication while applying for new GST registration in GST common portal

The new facility for submission of new application form for registration under GST based on Aadhar Authentication is now available for new taxpayers / applicants. Given below is a brief look at the process.

1. As we know, while applying for a new registration, the applicant is required to fill up the application form in two parts:

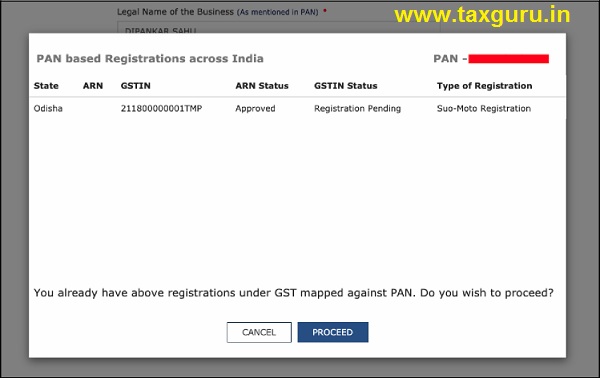

a. Part A: Providing PAN, email ID, Mobile Number for verification and confirmation. Once this information is saved and submitted, the portal shows an alert to the taxpayer, if he has any other registration pending or approved or cancelled in the same PAN as can be seen from below.

b. The applicant may choose to proceed further if he desires to file another application for registration.

c. After successful verification, the applicant will receive the TRN.

d. The applicant is now required to use the TRN to login and complete the Part B of the application form starting from the screen as shown belo.

e. After proceeding to the main application form, the applicant is required to fill up the details including the Aadhar Number in the personal details page. However, the Aadhar Number box will be inactive and by clicking on the info icon, the following message will be shown.

f. The Aadhar Numbers of the Proprietor, Partner, Directors, Authorised Signatories etc. will have to be provided in a separate process. Once the applicant saves and submits the application, emails / SMSs will be sent to all such persons and they will have to provide their aadhar themselves. Once all the aadhars are provided and verified successfully, ARN will be generated for successful submission of the Aadhar by all such persons related to the applicant.

g. Now, there is a separate TAB provided for Aadhar Authentication Process as can be seen from below.

h. Now the applicant has to select yes on the top and click on “SAVE & CONTINUE”. The following message will be shown.

i. The applicant now is required to click on “OK” and proceed to save and submit after completing the “Verification” TAB of the application form.

j. After the application is submitted successfully, email / SMS will be sent by the GST Common Portal for Aadhar Authentication.

k. It is important to note that only after successful aadhar authentication by all such persons for one application, the process of submitting the application for new registration will be completed.

Aadhaar Authentication (E-KYC) by the Applicant / PAC etc.

Once the applicant has opted “Yes” for Aadhaar authentication while registering on the GST Portal and registration application is submitted, an authentication link will be shared on GST registered mobile number and e-mail IDs of the Promoters/ Partners and Authorized Signatories.

They are now required to follow the steps given below to complete the Aadhar Authentication Process.

1. Click the authentication link received on GST registered mobile number and e-mails IDs of the Promoters/ Partners, Authorized Signatories. Select the Consent for Authentication. Enter your VID or Aadhaar Number.

(VID: VID or Virtual ID is a temporary, revocable 16-digit random number mapped with the Aadhaar number. VID can be used in lieu of Aadhaar number whenever authentication or e-KYC services are performed.)

2. Enter the OTP received on your mobile number and e-mails ID registered with the Aadhaar. Click VALIDATE OTP.

3. A success message is displayed when Aadhaar is successfully verified for e-KYC authentication. Click

Note:

- Aadhaar authentication link received on e-mail IDs of the Promoters/ Partners or Authorized Signatories mentioned in the application is valid only for 15 days.

- If Aadhaar authentication link is used once for authentication, same authentication link cannot be accessed again.

- Navigate to My Saved Applications > Aadhaar Authentication Status > RESEND VERIFICATION LINK, to resend the authentication link to mobile number and e-mails IDs of the Promoters/ Partners or Authorized Signatories mentioned in the application. You need to verify your Aadhaar details within 15 days of the generation of the TRN.

Source- Social Media and GST Department Officers.

I have given other mobile no and email I’d while filling partner’s details as compared to adhhar.now how will I do adhaar verication

i have a error on Aadhaar authentication and ARN generated. can i regenerate Aadhaar authentication. if possible or not