Under the New GST Return Form, taxpayers are given an option to file returns on a monthly or quarterly basis. For quarterly return filing, the taxpayer may opt for Form GST RET-01 (Normal), Form GST RET-02 (Sahaj), or Form GST RET-03.

Even though the taxpayer opts to file a return on a quarterly basis, he has to pay tax on a monthly basis. Such tax liability is to be discharged by filing Form GST PMT-08.

GST PMT-08 is a form that needs to be filed by a small taxpayer in order to make payment of tax on a monthly basis. This form is used to make payment of self assessed tax by the small taxpayers filing returns on a quarterly basis under the new GST return system.

PMT 08 form is to be filed for the first two months of the quarter for which the main return is to be filed. In the third month of the quarter, the main return, i.e., Form GST RET-01/ 02/ 03, is to be filed for assessment of final tax liability for the respective quarter.

Example – For the quarter April to June, Form GST PMT-08 shall be filed for the month of April and May, whereas Form GST RET-01/ 02/ 03 shall be filed for the month of June.

Liability paid or input tax credit adjusted through Form GST PMT-08 for April and May shall be adjusted while filing a main return for June.

Page Contents

Who Needs to File GST PMT – 08?

The taxpayers who opt to file tax returns on a quarterly basis have to make tax payments on a monthly basis though form GST PMT – 08. Such payment of tax depends upon the supplies made during a particular month.

When to File GST PMT – 08 ?

The taxpayer must make the payment of self assessed liabilities through GST PMT – 08 by the 20th of the month succeeding the month for which tax is to be paid.

Salient features of Form PMT 08

(a) Details of taxable value are not required to be declared anywhere in Form GST PMT-08.

(b) Details of only “eligible” input tax credit is to be declared in this form; Any ineligible input tax credit shall be excluded while updating details in Table 3 and Table 4 of this Form. Details of the ineligible input tax credit shall be directly reported in the main return, i.e., Form GST RET-01/ 02/ 03.

(c) Negative values are accepted, i.e., in case of credit note value is more than the invoice value than negative balance may be reported.

(d) Interest shall be levied on any short liability declared or excess input tax credit availed.

(e) This form is to be filed even if no supplies are made during the period for which the return is to be filed.

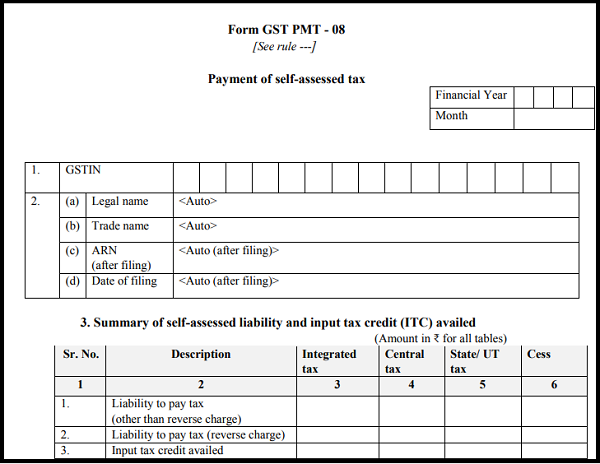

GST PMT-08 Format

Detailed Analysis of PMT 08 Tables

Table 1 GSTN of the registered taxpayer who is filing the return shall be auto-updated

Table 2 The legal name and trade name of the registered taxpayer shall be auto-updated. Acknowledgement Receipt Number and date of filing of return shall be auto-generated after the form is filed.

Table 3 This table requires a summary of tax payable and input tax credit availed through PMT 08 form. Tax payable is supposed to be classified under IGST, CGST, SGST, and Cess.

Table 3.1 requires details of tax payable on outward supply, including exports, SEZ supplies. Any tax payable on account of imports of goods or services may also be declared here.

Table 3.2 requires details of liability, i.e., tax payable on account of reverse charge. Thus, tax payable on any inward supplies liable to reverse charge may be declared here.

Table 3.3 requires details of the total input tax credit that is available to the registered taxpayer.

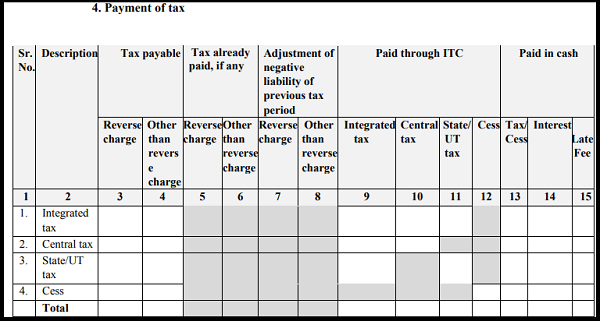

Table 4 – This table is for the final settlement of tax liability. It states whether the liability is paid through an input tax credit or through cash in case input tax credit is insufficient.

Coloum 2 Tax type is bifurcated into IGST, CGST, SGST, and Cess

Column 3 and column 4 require details of tax payable on account of reverse charge and reverse charge, respectively. These details shall match with that declared in Table 3 above.

Column 5 and column 6 require details of tax already paid on account of reverse charge and other than reverse charge, respectively.

Column 7 and column 8 are for adjustment of negative liability that may be related to the previous month pending adjustment. This section is also bifurcated into a negative liability for reverse charge and other than reverse charge.

Column 9, Column 10, and column 11 give details of the set-off of tax liability through the utilization of input tax credit. The total of input tax credit utilized balance shall not exceed the total of input tax credit available.

An input tax credit will be utilized as per set off rules existing for availing of an input tax credit.

Column 13 represents the payment of tax in cash. This is when the liability of tax is more than the input tax credit available for utilization.

Any interest or late fee payable on account of a delay in discharge of liability shall be declared in column 14 and column 15, respectively, of Table 4.4

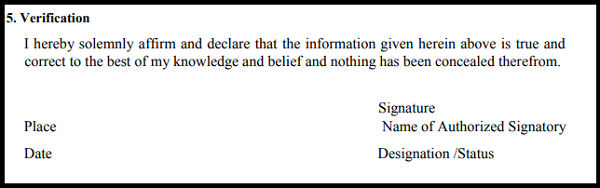

Table 5 – It is verification saying that details declared above by the taxpayer are true and correct.

Note : Form GST PMT-08 cannot be prepared on an ad-hoc basis as any short liability declared or excess credit claimed may attract interest.

Author can be approached at caanitabhadra@gmail.com.