Pizza toppings costlier than pizza

For most of us, a soft crust creamy pizza with loaded cheese, with some spicy rich toppings like jalapenos, corns, bell peppers, sprinkled with love, oregano & chilly flakes, gives us an enriched mouth watering experience , which is just enough to tickle our taste buds and make for a wishful cheat day!

But what if you have to shell out more bucks for these exuberant toppings, than a pizza itself!

Yes you read that absolutely right, this decision has been taken on March 10 2022 by Haryana Appellate Authority for Advance Ruling (AAAR) that a pizza topping is not a pizza and hence should be classified differently and a GST of 18% should be levied.

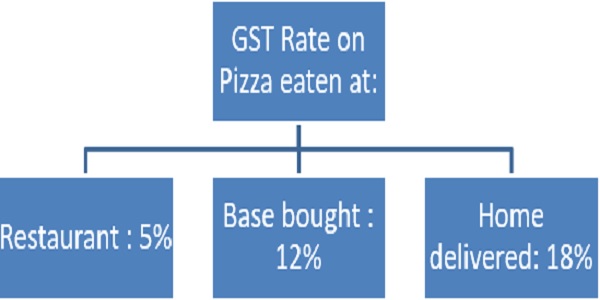

Now let us analyse the different rates levied as per the ways in which you can relish a pizza:

But the question is whether to classify the toppings as cheese or as any other classification.

Now taking a decision on GST Rate, one has to consider 3 tests as per the GST Act, 2017:

1. Common parlance i.e how a statement is pertained in a layman sense

2. End use test i.e what is the end use of the product

3. Ingredients test i.e what ingredients are principally used in the preparation

So rates could differ on how a product is categorized. Here the pizza toppings could either be classified as cheese toppings or food preparation as it contains vegetable fats.

Thus AAAR ruled that pizza topping contains vegetable fat as a substantial portion being 22% of the ingredients and hence it does not qualify to be categorized as processed cheese or a type of cheese. Thus pizza topping would merit classification as “food preparation”.

Now how would this impact the pizza dealers and restaurants?

Suppose a restaurant sells a pizza to its customers. Now to buy these pizza toppings it will have to cough up 18% GST however it’ll be able to sell the pizza with 5% GST only. This could impact the margins of pizza companies.

Though Advance rulings are applicable only on the applicant and on the question being put, it would be interesting how the industry would react if this is accepted as a practice.

Conclusion: This ruling reiterates a fact that classification under GST is a factor of various principles viz. end use, key ingredients , common parlance etc and hence a complex process. Its upon the authorities to decide upon the weightage to be given to each factor

The author can be reached at jainrashi2008@gmail.com.

DISCLAIMER: The views expressed are strictly of the author. The contents of this article are solely for informational purpose. It does not constitute professional advice or recommendation of firm. Neither the author nor firm and its affiliates accepts any liabilities for any loss or damage of any kind arising out of any information in this article nor for any actions taken in reliance thereon.

Probably the Government/Officers will also tax the Chairs and the tables and the spoon and forks as service. Jai Ho. May the mouth, tongue and Individuals also may be taxed.

Keep it up.

Thanks for an ‘eye opening’ ruling update.