Introduction: Have you ever wondered how YouTubers make money and if YouTube can be a viable career option? In this comprehensive guide, we will explore the various ways YouTubers earn, including advertisements, affiliate marketing, and subscription-based content. Additionally, we will delve into the subject of GST on YouTubers’ income, answering important questions and discussing the necessary compliance requirements.

First of all, where is YouTube earning from?

Yes, the correct answer is Advertisements placed by the advertisers. Though the conversion rates of the people seeing YouTube ads into those actually ending up visiting the hosted brand is a meagre 1%, nonetheless, multinationals have started placing immense trusts & money into the world of YouTube.

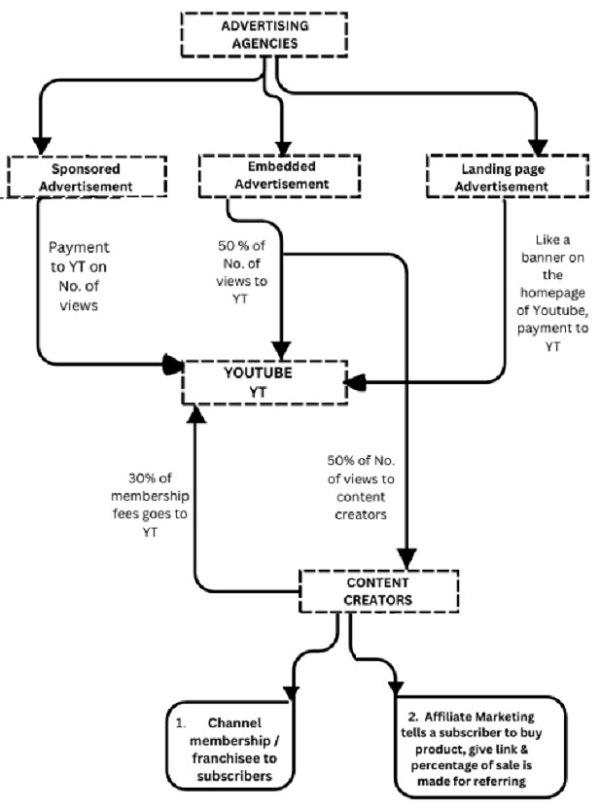

Now the crux or outline here is that YouTube gets paid by the advertising companies and then in turn pays a share of its income to the content creators or youtubers who have crossed an outreach of certain thousands or lakhs.

Now we have to understand how does a content creator or youtuber earn?

So this non-exhaustive list comprises of

1. Advertisement income – Embedded ads/Banner ads/Sponsored ads: Few kinds of ads exist on youtube. For instance, embedded ads are the ones which are placed in the video &can be skipped after a few seconds. Banner advertisements are placed like a banner on the home page of the YouTube. And Sponsored advertisements are those which are paid based on number of views on the video.

2. Affiliate marketing: You must have seen youtubers promoting a product of a particular brand on their channel& buying from their given link from the description box could fetch you a coupon code having a discount. A portion of those sales go straight up to the content creator/youtuber. This is called affiliate marketing.

3. Subscription based content marketing: Here, watching or exploring their content is monetized with some monthly subscription-based charges.

4. Selling listed franchise products: Promoting their store on their YouTube page to directly fetch customers for their products.

All of this can be illustratively be explained as below:

From the above incomes, the advertisement companies pay to YouTube and based on the number of impressions on the video, YouTube makes 45% payment to the content creator & rest is kept by YouTube. So, it is simply the game of number of views & per thousand views YouTube videos can be said to be monetized.

Now depending upon the reach of the youtuber, per 1000 views fetch considerable dollars for it to be considered a full time career option. It purely depends upon the targeted audience it caters to & wide reach of the channel.

Now if we ponder with respect to Indian youtubers, they can get paid either in Indian currency or in foreign currency from advertising agencies/companies. Will GST be leviable on this income?

For this firstly all of the below questions need to be answered one after another:

1. Could income from YouTube be considered a supply?

⇓

2. If yes, is GST Registration mandatory for them?

⇓

3. Does it fall under export of services, if consideration received in Foreign exchange?

⇓

4. What rate of GST is applicable on this service?

⇓

5. What are the GST compliances to be done by the youtubers?

Section 7 of the CGST act 2017 includes all forms of supply of goods, services, or both such as sale, transfer, barter, exchange, license, rental, lease made for a consideration by a person in the course or furtherance of business.

Service is also described in the CGST act 2017 to mean anything excluding goods, money, and securities. The same includes the activities along with money, or its conversion is charged individually for some consideration.

Youtubers supply services by posting the videos and the content on their channel with the monetization and furnishing the platform for advertising. Thus, YouTubers are to be considered as the suppliers of services.

Now the GST registration is needed by the YouTubers, where the total PAN-based turnover exceeds Rs.20 lakh for a financial year.

However, you must remember that when the location of service provider is different w.r.t the location of recipient the supply is then said to be the interstate supply and is responsible for the enrollment irrespective of the turnover limit.

So if both supplier and recipient are located in India, then it will be an intra state supply on which CGST/SGST will be leviable.

However, if the payment is received in foreign currency, it will be treated as export of services ONLY if ALL the following conditions are fulfilled:

- Location of recipient is outside India – If the advertising agency is located outside India, this condition is satisfied

- Location of supplier is in India – If Youtuber is located in India, this condition is satisfied.

- Place of supply is outside India – Content creation on YouTube is classified as an OIDAR(Online Information and Database Access Retrieval)Services, and it is location of recipient So, if location of recipient is outside India, then this condition is satisfied.

- Not merely establishments of distinct persons

- Consideration is received in foreign exchange – If consideration received in forex, this condition also holds good

In this case the youtuber will make a zero rated supply without charging IGST or with IGST and will issue an invoice to the advertisers.

So basically 18% GST rate is leviable on these content driven services & GSTR1 (Return for Outward supplies) & GSTR3B(Net tax liability return) need to be filed if

Conclusion: YouTube has evolved from a mere hobby to a prominent source of livelihood for many individuals. It is crucial for YouTubers to understand the various ways they can earn through YouTube, including advertisements and affiliate marketing. Additionally, they must be aware of the GST implications on their income and comply with the necessary requirements. By considering these aspects, YouTubers can navigate the complexities of YouTube earnings and ensure they meet the required compliances.

******

The author deals in the matters of international taxation, direct & indirect taxation can be reached at jainrashi2008@gmail.com for any further assistance.