GST on international freight has all along been one of the complicated and contentious issues under GST laws. While, inbound air freight (air freight on imports of goods) is exempted from GST, outbound freight (freight on export of goods) was earlier exempted from GST, which was discontinued from October 01, 2022.

Applicability of GST on outbound air freight and inbound/ outbound ocean freight depends on the location of supplier/ recipient and place of supply.

Finance Act 2023 brought some substantial changes related to the place of supply and applicability of GST on International freight which will impact importers, exporters and freight forwarders. These changes were made effective from October 1, 2023.

Since the rules for place of supply are different depending on whether the location of service provider and receiver are in India or outside, the changes are explained under two different heads.

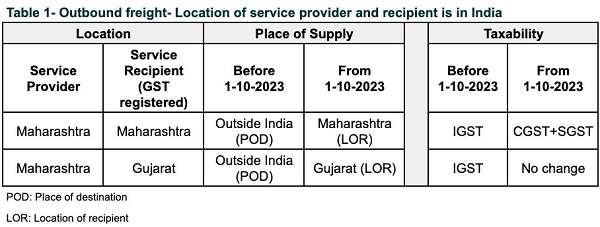

Case 1:- Location of service provider and recipient are in India

Background

In terms of section 12(8) of the IGST Act, In case of supply of service by way of transport of goods, place of supply is the location of the service recipient. In case of unregistered recipients of service, It is the place at which the goods were handed over for their transportation. However, subsequently (w.e.f. 01-02-2019) a proviso was added to this subsection and it was provided that in case of outbound freight, the place of supply will be the place of destination of goods. Therefore, even though the service provider and the service recipient were located in the same state, in case of outbound freight, IGST was applicable.

What has changed?

Finance Act, 2023 removed the above referred proviso. The effective date of such amendment was notified as 1st October, 2023.

Therefore, from 1st October 2023 onwards, in this case, even for outbound freight, place of supply shall be the location of the recipient of service (assuming service recipient is registered under the GST provisions). Therefore, if the service provider and the service recipient are located in the same state, CGST and SGST would be applicable and if they are located in the different states, IGST would be applicable.

In case of inbound freight, GST applicability, under this case, would remain unchanged. That means for inbound air freight it will continue to be exempt and inbound ocean freight would continue to be taxable, as earlier.

Impact of the change, under various scenarios, is summarised in table 1.

Case 2:- Location of service provider or the service recipient is outside India

Background

In terms of section 13(9) of the IGST Act, In case of services of transportation of goods, other than through mail and courier, place of supply was the destination of goods.

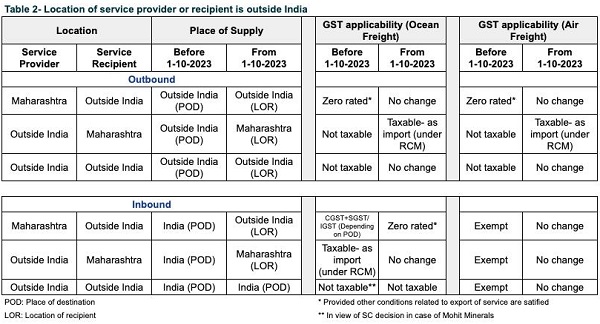

Therefore, in case of outbound freight, both air and ocean, if the service provider was located in India and the service recipient was located outside India, it was considered as an export of service if other conditions related to export of service were satisfied. However, in case of inbound ocean freight, since the place of supply was in India, it was not considered as an export of service.

On the other hand, in case of outbound freight, if the service provider was located outside India and the service recipient was located in India, GST was not applicable. In case of inbound ocean freight, the service was considered as import of service and GST was applicable under reverse charge. Inbound air freight, being an exempted service, was not taxable under both the cases.

Finance Act, 2023 removed subsection 9 to section 13. The effective date of such amendment was notified as 1st October, 2023.

Therefore, from 1st October 2023 onwards, place of supply in such cases shall be the location of the recipient of services. So, in case of both inbound and outbound freight (except inbound air freight), if the service provider is located in India and the service recipient is located outside India, it will be considered as an export of service and will be zero rated if other conditions related to export of service are satisfied. However, if the service provider is located outside India and service recipient is in India, the service (except air inbound freight) will be considered as import of service and GST under reverse charge would be applicable.

Inbound air freight, being an exempted service, shall continue to be exempted under both the cases.

In case, both the service provider and service recipient are located outside India, in terms of Supreme Court’s judgement in the case of Mohit Minerals and recently issued notifications, ocean freight is not chargeable to GST in India.

Impact of the changes, under various scenarios, is summarised in table 2.

(Information in this article is intended to provide only general information of the subjects covered. It should neither be regarded as comprehensive nor sufficient for making decisions. Author can be reached at mra@manishragarwal.in)

sir you have elaborate it quite nicely. There is one quiery plese mention this : A inbound ocean/air freight service provided by freight forwarder (residing in taxable territory) to another Freight Forwarder / Importer (residing in taxable territory) .

what will be GST implications?