List of All New changes in GST and Income Tax being applicable from 1 October 2023

As we enter October 2023, significant changes in both the Goods and Services Tax (GST) and Income Tax are set to come into effect. The Central Board of Indirect Taxes and Customs (CBIC) has issued a series of notifications that will impact businesses and taxpayers across India. In this article, we’ll provide a detailed analysis of these changes including the changes related to TCS under Income Tax, their implications, and what you need to know to stay compliant.

Changes in GST

Section 137 to Section 162 (except Section 149- 154) of Finance Act 2023 has been made effective from 1.10.2023. Section 149 to section 154 has been made effective from 1 August 2023.

1. Amendment in Section 10 of CGST Act 2017

Composite supplier is allowed w.e.f. 1.10.2023 to make intra State supply of Goods through E-commerce Operator.

Retrospective effect from 1/7/2017:

Section 23(2): “Notwithstanding anything to the contrary contained in sub-section (1) of section 22 or section 24, the Government may, on the recommendations of the Council, by notification, subject to such conditions and restrictions as may be specified therein, specify the category of persons who may be exempted from obtaining registration under this Act”

Government vide Notification No. 34/2023- Central Tax has notified an Supplier who is exempt from obtaining GST registration: That Supplier is : Supplier making supply of good through E-commerce Operators , subject to some conditions.

Liability on hand of E-commerce operator due to above amendment

Section 122(1A) : new subsection has been inserted which reads as below:

An E-commerce operator who

i) Allows a supply of goods or services or both through it by an unregistered person other than a person exempted from registration by a notification issued under this Act to make such supply;

ii) allows an inter-State supply of goods or services or both through it by a person who is not eligible to make such inter-State supply; or

iii) fails to furnish the correct details in the statement to be furnished under sub-section (4) of section 52 of any outward supply of goods effected through it by a person exempted from obtaining registration under this Act,

shall be liable to pay a

a) penalty of ten thousand rupees, or

b) an amount equivalent to the amount of tax involved had such supply been made by a registered person other than a person paying tax under section 10,

whichever is higher.”

2. Amendment in Section 16(4) of CGST Act 2017:

16 (4) A registered person shall not be entitled to take input tax credit in respect of any invoice or debit note for supply of goods or services or both after the 6[thirtieth day of November] following the end of financial year to which such invoice or debit note pertains or furnishing of the relevant annual return, whichever is earlier.

Provided that the registered person shall be entitled to take input tax credit after the due date of furnishing of the return under section 39 for the month of September, 2018 till the due date of furnishing of the return under the said section for the month of March, 2019 in respect of any invoice or invoice relating to such debit note for supply of goods or services or both made during the financial year 2017-18, the details of which have been uploaded by the supplier under sub-section (1) of section 37 till the due date for furnishing the details under sub-section (1) of said section for the month of March, 2019.]

Amendment: For ITC reversal, in case supplier is not paid within 180 days from the date of invoice:

a. Reversal of ITC can be done through GSTR3B or DRC-03.

b. To reclaim ITC, Payment should be done to supplier only. Payment made to other than supplier shall not be eligible for reclaim.

3. Amendment in Section 17(3) of CGST Act 2017:

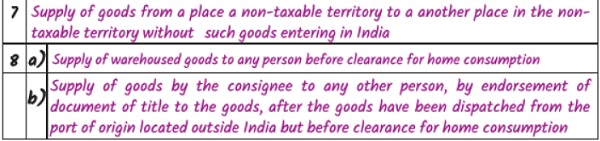

Section 17 (3): Non-taxable supply in Schedule III Para 8: “Supply of warehoused goods to any person before clearance for home consumption “ shall be included in definition of exempt supply.

Section 2(47): Earlier Exempt supply included:

a) Nil rated supply

b) Wholly Exempt supply

c) Non-taxable supply

Addition in Exempt supply by Section 17(3):

i) Supply under RCM

ii) Transaction in securities ( 1% of sale value)

iii) Sale of land and building ( Stamp duty value)

It does not include:

a) Interest/discount income except in case bank/FI

b) Value of supply (VOS) by way of transportation of goods by vessel from custom port in India to Outside India

c) VOS of duty scrips

4. Amendment in Section 17(5) of CGST Act 2017:

New blocked ITC defined by this amendment

Section 17(5)(f)(a): “goods or services or both received by a taxable person, which are used or intended to be used for activities relating to his obligations under corporate social responsibility referred to in section 135 of the Companies Act, 2013 (18 of 2013)”

It means: ITC on goods or services for CSR activities are blocked credit. ITC will not be available on such expenditure.

5. Amendment in Section 30 of CGST Act 2017:

Section 30: Revocation of cancellation on registration:

Earlier 30 days revocation time was there. Now, Inserted new Rule 23: 30 days limit has now been extended to 90 days for revocation of cancellation of registration. It has been provided that further extension of additional 90 days is possible provided there is sufficient cause.

6. Amendment in Section 37(5) of CGST Act 2017:

Section 37 (5) : “A registered person shall not be allowed to furnish the details of outward supplies under sub-section (1) for a tax period after the expiry of a period of three years from the due date of furnishing the said details:

For example : for GSTR1 of August 2023 period can be filled up to 3 years from 20/9/2023 i.e. till 20/9/2026 and not later than that.

Same amendment has been done in following sections:

a. Section 39 for GSTR 3B

b. Section 44 for GSTR 9

c. Section 52 for GSTR 8

It means that no any returns under GST can now be filed if 3 years from the due date of that return has been expired.

7. Amendment in Section 56 of CGST Act 2017:

Section 56 deals with interest payment on refund from government if there is delay in payment of refund in excess of 60 days. It has been amended now w.e.f 1.10.2023 to exclude the period of delay caused due to assessee in computing period of 60 days for calculation of interest on payment of refund.

8. Amendment in Section 62 of CGST Act 2017

Time limit for filing of return post assessment order has been increased from 30 days to 60 days.

An additional late fee of Rs. 100 will be levied for each day of delay beyond 60 days. This is in addition to interest payment u/s 50.

9. Amendment in Section 54 of CGST Act 2017

Provisional Refund of ITC in case of Export is omitted.

10. Amendment in Section 132 of CGST Act 2017

For prosecution , Minimum threshold increased to 2 cr from 1 crore ( except for fake billing) and further change in penalty is announced.

11. Amendment in Section 158 of CGST Act 2017

Section 158A:”Consent based sharing of information furnished by taxable person.— (1) Notwithstanding anything contained in sections 133, 152 and 158, the following details furnished by a registered person may, subject to the provisions of sub-section (2), and on the recommendations of the Council, be shared by the common portal with such other systems as may be notified by the Government, in such manner and subject to such conditions as may be prescribed.

vide Notification No. 32/2023-Central Tax, it has been notified that consent based sharing of information furnished by taxpayers will be done from portal to Account Aggregators.

12. Clarification on applicability Para 7 and Para 8 of Schedule III

Schedule III: para 7 and para 8 : they will be effective from 1.7.2017.

If tax has been collected on these supply already, no refund shall be there.

13. Amendment for Invoicing rules

HSN code Mandatory:

1. Aggregate Turnover > 5 crore: 6 digits in their E-invoices/E-way bill

2. Aggregate Turnover < 5 crore: 4 digits in their E-invoices/E-way bill.

14. Amendment in Section 10 of IGST ACT 2017

New clause has been inserted for place of supply to Unregistered person:

“[(ca) where the supply of goods is made to a person other than a registered person, the place of supply shall, notwithstanding anything contrary contained in clause (a) or clause (c), be the location as per the address of the said person recorded in the invoice issued in respect of the said supply and the location of the supplier where the address of the said person is not recorded in the invoice.”

“Explanation.—For the purposes of this clause, recording of the name of the State of the said person in the invoice shall be deemed to be the recording of the address of the said person;]”

Amendment in TCS in Income Tax Act 1961

Income tax TCS rate will be applicable from 1.oct.23 vide circular 10 of 2023.

Earlier and new TCS rates are summarised as under:

| Nature of payment

(1) |

Earlier rate before Finance Act, 2023(2) |

New rate w.e.f. 1st October, 2023(3) |

| LRS for education, financed by loan from financial institution | Nil upto Rs 7 lakh 0.5% above Rs 7 lakh | Nil upto Rs 7 lakh 0.5% above Rs 7 lakh |

| LRS for Medical treatment/ education (other than financed by loan) |

Nil upto Rs 7 lakh 5% above Rs 7 lakh | Nil upto Rs 7 lakh 5% above Rs 7 lakh |

| LRS for other purposes | Nil upto Rs 7 lakh 5% above Rs 7 lakh | Nil upto Rs 7 lakh 20% above Rs 7 lakh |

| Purchase of Overseas tour program package | 5% (without threshold) | 5% till Rs 7 lakh, 20% thereafter |

*Note: (i) TCS rate mentioned in column 2 shall continue to apply till 30 September, 2023.

Conclusion

These changes in GST and Income Tax are substantial and will have a significant impact on businesses and individuals. Staying informed and compliant with these amendments is crucial to avoid penalties and ensure a smooth transition. As the changes take effect from October 1, 2023, taxpayers should take the necessary steps to understand and adapt to the new regulations to avoid any disruptions in their financial activities.