Case Law Details

Shamhu Saran Agarwal And Company Vs Additional Commissioner Grade-2 And 2 Others (Allahabad High Court)

The Allahabad High Court, in Shamhu Saran Agarwal vs. Additional Commissioner Grade-2, ruled against the penalty order dated December 20, 2020. The article explores the court’s judgment, highlighting key arguments and legal implications.

Introduction: A writ petition under Article 226 challenges a penalty order dated December 20, 2020, and an appeal order dated September 17, 2021, related to the detention of goods on grounds of under-valuation. The petitioner, Shamhu Saran Agarwal And Company, sought relief from the Allahabad High Court against the penalty imposed by the Commercial Tax Officer and affirmed on appeal.

Detailed Analysis: The show cause notice of December 19, 2020, revealed that the goods were detained for under-valuation, a decision upheld by the appellate authority. However, a crucial circular issued by the Commissioner, Commercial Tax, Uttar Pradesh, on May 9, 2018, explicitly stated that goods should not be detained solely based on under-valuation.

Counsel for the petitioner, Mr. Suyash Agarwal, referred to a Kerala High Court judgment in Hindustan Coca Cola Private Limited vs. Assistant State Tax Officer. The Kerala High Court’s perspective on bonafide disputes and limitations on squad officers in detention cases served as a legal precedent supporting the petitioner.

In this case, all relevant documents, including the invoice and e-way bill, accompanied the goods. Despite no discrepancies in the goods’ description, the only ground for detention was the alleged incorrect valuation as per the invoice. The article argues that this is not a valid ground for detention, especially when the detaining officer lacks competence for such judgments.

The analysis underscores the procedural requirements under Sections 73 or 74 of the Uttar Pradesh Goods and Service Tax Act, 2017, for addressing under-valuation issues. It emphasizes the need for specific notices and adherence to proper procedures rather than arbitrary detentions.

The Allahabad High Court’s stance against imposing a penalty under Section 129 of the Act based on speculative under-valuation is discussed in detail. The lack of authority for officers to detain goods without due process is highlighted, emphasizing the court’s commitment to preventing arbitrary detentions.

Conclusion: In conclusion, the Allahabad High Court quashed and set aside the impugned orders dated December 20, 2020, and September 17, 2021. The article concludes by asserting the importance of adhering to legal procedures, citing specific sections of the Act, and applauds the court’s commitment to preventing arbitrary detentions based on inadequate grounds. The ruling serves as a significant precedent in challenging penalty orders related to GST under-valuation.

FULL TEXT OF THE JUDGMENT/ORDER OF ALLAHABAD HIGH COURT

1. This is a writ petition under Article 226 of the Constitution of India wherein the petitioner is aggrieved by the penalty order dated December 20, 2020 passed by the respondent No.2/Commercial Tax Officer, Mobile Squad-6, Agra and the order dated September 17, 2021 passed in appeal by the Additional Commissioner Grade-II (Appeal)-II, State Tax, Agra.

2. I have heard Mr. Suyash Agarwal, counsel appearing on behalf of the petitioner, Mr. Ravi Shanker Pandey, Additional Chief Standing Counsel appearing on behalf of the respondents and perused the materials on record.

3. Upon a perusal of the show cause notice dated December 19, 2020, it is clear that the goods were detained on the ground of under valuation. Subsequently in appeal, the appellate authority affirmed the penalty order on the ground that the goods were under valued.

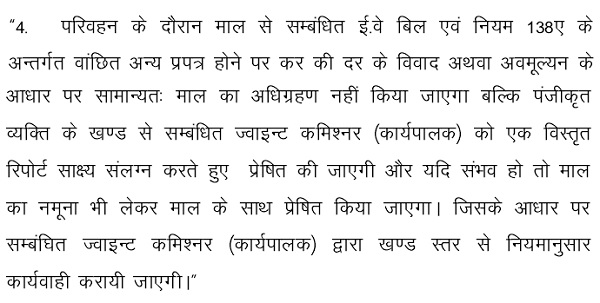

4. It is evident from the circular issued by the Commissioner, Commercial Tax, Uttar Pradesh dated May 9, 2018 that the goods are not to be detained on the ground of under valuation. The relevant paragraph of the aforesaid circulate is extracted below:-

5. Furthermore, Mr. Agarwal, appearing for the petitioner, has relied upon a judgment of the Kerala High Court in the case of Hindustan Coca Cola Private Limited vs. Assistant State Tax Officer reported in 2020 NTN (73)-58 wherein the Kerala High Court held as follow:-

“7. From the perusal of the aforementioned findings, it is irresistibly concluded that in case of a bonafide dispute with regard to the classification between a transistor of the goods and the squad officer, the squad officer may intercept the goods and detain them for the purpose of preparing the relevant papers for effective transmission to the judicial assessing officers and nothing beyond. In the present case, it is a case of bonafide miscalculation as to whether the goods would be exigible to 12% or 28%. The judgment cited in N.V.K Mohammed Sulthan Rawtger’s case (supra) was also a case where the petitioner firm was a manufacturer of ‘Ground Betel Nuts (Arecanuts)’ and registered with the Tamil Nadu under the Goods and Service Tax Act. The goods were intercepted by the inspecting authority to be in contravention of the misbranding. By relying upon the decision in J.K Synthetics Limited V. Commercial Taxes Officer, 1994 (4) SCC 276, it was held that the charging provisions must be construed strictly but not the machinery provisions which would be construed like any other statute.”

6. In the present case, there is no dispute that the invoice, e-way bill and all other relevant documents were accompanied with the goods. Furthermore, there was no mismatch in the description of the goods with the The only ground for detention of the goods was that the valuation of the goods as per the invoice was not correct. In my view, this is not a valid ground for detaining the goods as the officer concerned was not competent to carry out such detention.

7. In the event of under valuation, appropriate notice under Sections 73 or 74 of the Uttar Pradesh Goods and Service Tax Act, 2017 (hereinafter referred to as “the Act”) is required to be issued as per the procedure provided therein. If the Court holds such a detention to be valid, it would be open to the authorities to carry out detention on their whims and fancies. The detention of the goods in such a scenario is not envisaged under the Act and the officers have not been vested with such a power to detain the goods and thereafter impose penalty under Section 129 of the Act. Specific provisions have been provided for detection of under valuation and the GST officials have to adhere to the same. It is to be noted that only after issuance of notice under Sections 73 or 74 of the Act, if the goods are found under valued, penalty can be imposed.

8. Accordingly, imposition of penalty under Section 129 of the Act on the speculation that the goods are under valued cannot be allowed.

9. In light of the above, impugned orders dated December 20, 2020 and September 17, 2021 are quashed and set-aside. Consequential reliefs to In the event any deposit has been made by the petitioner to the authorities, the same shall be returned to the petitioner within four weeks from date.

The writ petition is, accordingly, allowed.