₹1,57,090 crore gross GST revenue collected for May 2023; clocks 12% Year-on-Year growth

The gross Good & Services Tax (GST) revenue collected in the month of May, 2023 is ₹1,57,090 crore of which CGST is ₹28,411 crore, SGST is ₹35,828 crore, IGST is ₹81,363 crore (including ₹41,772 crore collected on import of goods) and cess is ₹11,489 crore (including ₹1,057 crore collected on import of goods).

The Government has settled ₹35,369 crore to CGST and ₹29,769 crore to SGST from IGST. The total revenue of Centre and the States in the month of May, 2023 after regular settlement is ₹63,780 crore for CGST and ₹65,597 crore for the SGST.

The revenues for the month of May, 2023 are 12% higher than the GST revenues in the same month last year. During the month, revenue from import of goods was 12% higher and the revenues from domestic transactions (including import of services) are 11% higher than the revenues from these sources during the same month last year.

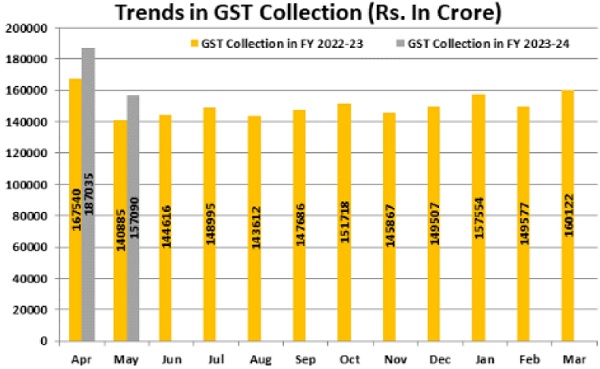

The chart below shows trends in monthly gross GST revenues during the current year.

CBIC rolls out Automated Return Scrutiny Module

CBIC rolls out Automated Return Scrutiny Module for GST returns in ACES-GST backend application for Central Tax Officers

During the recent review of the performance of the Central Board of Indirect Taxes & Customs (CBIC), Union Minister for Finance and Corporate Affairs Smt. Nirmala Sitharaman had given directions to roll out an Automated Return Scrutiny Module for GST returns at the earliest.

In order to implement this non-intrusive means of compliance verification, CBIC rolled out the Automated Return Scrutiny Module for GST returns in the ACES-GST backend application for Central Tax Officers. This module will enable the officers to carry out scrutiny of GST returns of Centre Administered Taxpayers selected on the basis of data analytics and risks identified by the System.

In the module, discrepancies on account of risks associated with a return are displayed to the tax officers. Tax officers are provided with a workflow for interacting with the taxpayers through the GSTN Common Portal for communication of discrepancies noticed under FORM ASMT-10, receipt of taxpayer’s reply in FORM ASMT- 11 and subsequent action in form of either issuance of an order of acceptance of reply in FORM ASMT-12 or issuance of show cause notice or initiation of audit / investigation.

Implementation of the Automated Return Scrutiny Module has commenced with the scrutiny of GST returns for Financial Year 2019-20, and the requisite data for the purpose has already been made available on the officers’ dashboard.

All-India Drive against Fake Registration

During the National Co-ordination Meeting of State and Central GST officers in New Delhi on 24.04.2023, the issue of unscrupulous elements misusing others’ identities to obtain fake or bogus GST registrations was discussed. These fraudulent registrations are used to illegally pass on input tax credit by issuing invoices without any underlying supply of goods or services or both. This problem of fake registrations and bogus invoices has caused significant revenue loss to the Government due to complex and dubious transactions.

During the meeting, it was acknowledged that while various system-based and policy measures are being taken to address this issue, concerted and coordinated action is needed by both Central and State tax authorities to tackle this problem more effectively. A nation-wide Special Drive was proposed to be launched on an All-India basis to detect suspicious and fake registrations and to conduct necessary verifications for timely remedial action. Common guidelines were also suggested to ensure uniformity in the actions taken by field formations and to facilitate effective coordination and monitoring during this Special Drive.

Accordingly, a Special All-India Drive has been launched by all Central and State Tax administrations for the period 16.05.2023 – 15.07.2023 to detect suspicious / fake GSTINs and to conduct requisite verification and further remedial action to weed out these fake billers from the GST eco-system and to safeguard Government revenue. The guidelines have also been issued vide Instruction No. 01/2023-GST dated 04.05.2023 for such concerted action on fake dealers/ fake billers in a mission mode.

A National Coordination Committee, headed by a Member (GST) from the Central Board of Indirect Taxes and Customs (CBIC), has been established to oversee a special drive. The committee includes Principal Chief Commissioners/Chief Commissioners of the Delhi and Bhopal CGST Zones, as well as Chief Commissioners/Commissioners of State Tax from Gujarat, West Bengal, and Telangana. The National Coordination Committee will monitor the progress of the special drive and the GST Council Secretariat will serve as the secretariat for the committee. The committee will receive assistance from the Goods and Services Tax Network (GSTN) and the Principal Commissioner of the GST Policy Wing, CBIC.

Notifications

Notification No. 05/2023 – Central Tax (Rate), Notification No. 05/2023-Union Territory Tax (Rate) and Notification No. 05/2023- Integrated Tax (Rate) dated 09.05.2023 issued to extend last date for exercise of option by GTA to pay GST under forward charge

The Central Government vide the said Notification No. 05/2023 – Central Tax (Rate) has made necessary amendments in Notification No. 11/2017-CT (Rate) dated 28.06.20 17 to extend the time for exercising option to opt for forward charge tax liability by Goods Transport Agencies (GTAs) for the Financial Year 2023-24. The new time line shall be on or before 3 1.05.2023, instead of 15.03.2023. The required declaration (in prescribed format) can now be filed up to 31.05.2023 before jurisdictional authorities.

Further, GTA who commences new business or crosses threshold for registration during any Financial Year, may exercise the option to itself pay GST on the services supplied by it during that Financial Year by making a declaration in Annexure V before the expiry of forty-five days from the date of applying for GST registration or one month from the date of obtaining registration, whichever is later.

Similar Notification has been issued under IGST / UTGST Acts vide Notification No. 05/2023-Union Territory Tax (Rate) and Notification No. 05/2023- Integrated Tax (Rate) dated 09.05.2023

Notification No. 10/2023 –Central Tax dated 10.05.2023 issued to implement e-invoicing for the taxpayers having aggregate turnover exceeding ₹ 5 Crores from 01 .08.2023.

The Central Government vide the said Notification has notified that the threshold limit for issuance of e-invoices shall stand reduced to ₹ 5 crore (presently ₹ 10 crore) w.e.f. 01.08.2023. Notification No. 13/2020-CT dated 21.03.2020 has been amended to this effect.

Notification No. 11/2023 – Central Tax dated 24.05.2023, Notification No. 12/2023- Central Tax dated 24.05.2023 and Notification No. 13/2023- Central Tax dated 24.05.2023 issued to extend the due date for furnishing FORM GSTR-1, GSTR-3B and GSTR-7 for April, 2023 for registered persons whose principal place of business is in the State of Manipur.

The Central Government vide the said Notifications has extended the due date of filing GSTR-1, GSTR-3B & GSTR-7 of April-2023 tax period till 31.05.2023 for all the taxpayers having principal place of business in the state of Manipur.

The Notification No. 11/2023 – Central Tax dated 24.05.2023, Notification No. 12/2023- Central Tax dated 24.05.2023 and Notification No. 13/2023- Central Tax dated 24.05.2023 shall be deemed to have come in force 11.05.2023, 20.05.2023 and 10.05.2023

respectively.

Instructions

Instruction No. 01/2023-GST dated 04.05.2023 issued regarding Guidelines for Special All-India Drive against fake registrations

The Government has decided to carry out a two month special drive to detect fake GST registrations and check fake input tax credit related frauds from 16.05.2023 to 15.07.2023. CBIC has issued guidelines vide the said Instructions for special drive against fake registrations under GST.

Following guidelines have been issued for such concerted action on fake dealers/ fake billers:

- Based on data analytics and risk parameters, GSTN will identify fraudulent GSTIN’s for Central / State Tax authorities and share the same for initiating verification drive. Various tax authorities would also supplement this list by data analysis at their own end using various available analytical tools like BIFA, ADVAIT,

NIC Prime, E-Way analytics, etc, as well as through human intelligence, Aadhar database, other local learnings and the experience gained through the past detections and modus operandi alerts. - Information sharing mechanism will be through designated nodal officers, appointed immediately by each of the Zonal CGST Zone and State to ensure seamless flow of data and for coordination with GSTN/ DGARM and

other Tax administrations. - Time bound verification shall be conducted by field formations which may even include examining the case for blocking of ITC. Action may also be taken to identify the masterminds/ beneficiaries behind such fake GSTIN’s for

further action, where ever required, and also for recovery of Government dues and/ or provisional attachment of property/ bank accounts, etc. as per provisions of section 83 of CGST Act. - An action taken report will be provided by each of the State as well as CGST Zones to GST Council Secretariat on weekly basis on the first working day after completion of the week

- There will be a National Coordination Committee headed by Member (GST), CBIC to monitor the drive. The unique modus operandi found during this special drive will be compiled by GST Council Secretariat and presented before National Coordination Committee, which will be subsequently shared with Central and State Tax administrations

across the country.

Instruction No. 02/2023-GST dated 26.05.2023 issued regarding Standard Operating Procedure for Scrutiny of Returns for Financial Year 2019-20 onwards

The Central Government vide the said Instruction has issued Standard Operating Procedure for scrutiny of returns for Financial Year 2019-20 onwards. DG Systems has introduced a new feature called “Scrutiny of Returns” in the CBIC ACES-GST application. This functionality allows for online workflow for scrutinizing returns.

Advisory No. 22/2023-Returns and a User Manual have been issued by DG Systems to provide detailed information about this feature. The GSTINs selected for scrutiny for the Financial Year 2019-20 are available on the scrutiny dashboard of proper officers.

The functionality includes a workflow for communication of discrepancies found in returns to registered persons, receiving replies from the registered persons, issuing orders, or taking further actions such as issuing show cause notices, conducting audits, or investigations. The Directorate General of Analytics and Risk Management (DGARM) selects GSTINs for scrutiny based on risk parameters. The details of selected GSTINs will be made available by DGARM through DG Systems on the scrutiny dashboard of the concerned proper officer of Central Tax on ACES-GST application.

Proper officers conduct the scrutiny using various sources of information, relying on data available on the system and additional risk parameters identified by DGARM. In addition to these parameters, proper officer may also consider any other relevant parameter, as he may deem fit, for the purpose of scrutiny. They issue notices to registered persons through the ACES-GST application, specifying discrepancies and seeking explanations. Registered persons may acecept the discrepancy and pay the tax, interest and any other amount arising from such discrepancy and inform the same or may furnish an explanation for the discrepancy within the prescribed time period. The proper officers may conclude the proceedings based on the response received or initiate further actions as required.

Scrutiny of returns is to be conducted in a time bound manner, so that the cases may be taken to their logical conclusion and that too`expeditiously. The details of action taken is monitored through MIS reports available on the scrutiny dashboard. The requirement of compiling and sending the Monthly Scrutiny Progress Report by the CGST zones to DGGST is hereby dispensed with for the Financial Year 2019-20 onwards. However, the CGST zones will continue to send Monthly Scrutiny Progress Reports to DGGST in respect of the Financial Years 2017-18 and 2018-19 till the completion of scrutiny of returns for these financial years, as per the timelines mentioned in Instruction No. 02/2022-GST dated 22.03.2022

It is also clarified that since the scrutiny functionality has been provided on ACESGST application only for the Financial Year 20 19-20 onwards, the procedure specified in Instruction No. 02/2022 dated 22.03.2022 shall continue to be followed for the scrutiny of returns for the Financial Year 2017-18 and 2018- 19.

Overall, the online scrutiny functionality aims to boost the efforts of the department to leverage technology & risk-based tools to encourage self-compliance and to conduct scrutiny of returns with minimal interaction with the registered person.

State Best Practices

Table card on Official Language Implementation and Short Video on “Click and Work in Hindi” released during the inaugural session of Hindi Workshop by CGST Chennai Zone

Sh. M. Srinivas, Principal Chief Commissioner, Chennai zone released Table card on Official Language Implementation and Short Video on “Click and Work in Hindi” during the inaugural session of Hindi Workshop. This initiative guides officers in voice to text typing, Phonetic typing and LILA App. These resources aim to enhance officers’ proficiency in using Hindi as a medium of communication, enabling them to carry out their work efficiently and effectively.

In the Pictures above: Sh. M. Srinivas, Pr. Chief Commissioner with other officials.

Also, the Officers of CGST Chennai Zone conducted an exclusive session on E-Way Bill for the members of AIEMA. AIEMA is one of the premier industry association representing major small scale industries in Ambattur Industrial Estate. Sh. Anukathir Surya, JC and Sh. Abdul Raheem, DC clarified the queries raised by taxpayers. Members of AIEMA participated actively in the Q& A session.

In the Picture above: Anukathir Surya, Joint Commissioner (left) and Sh. Abdul Raheem, Deputy Commissioner (Centre) addressing the queries raised by taxpayers.

GST Grievance Redressal Committee (GRC) meeting conducted jointly by CGST Kolkata zone and State Tax administration for Sikkim

GST Grievance Redressal Committee (GRC) meeting was conducted for Sikkim jointly by CGST Kolkata zone and State Tax administration at Gangtok on 02.05.2023. The recent GRC meeting served as a platform for taxpayers to voice their grievances, seek clarifications on GST matters, and discuss challenges they face in complying with GST regulations. The event witnessed the participation of officials from the CGST Kolkata zone, the State Tax administration, as well as representatives from trade and industry in Sikkim.

In the Picture above: Officials from CGST kolkata zone & state tax administration at Gangtok

In the Pictures above: Officials and stakeholders attending the meeting

GST Portal Updates

Advisory for Timely Filing of GST Returns

It has been observed that some taxpayers faced difficulty in filing GSTR-3B of March 23’ period on 20.04.2023’. On analysing the reasons, it was noted that large number of tax payers attempted to file GSTR-3B returns in the afternoon of the last day (20.05 lakhs GSTR-3B returns were filed on that day). This resulted in a waiting queue on GST system causing inconvenience to some of the taxpayers.

Around 45% of the returns filed on 20.04.2023 were either NIL returns (no tax liability and no ITC availment) or were such returns where no tax was paid in cash. These returns could easily have been filed earlier. Further, it is suggested that taxpayers may use SMS filing option to file NIL returns as it would be quicker and a more convenient way to file NIL returns and will also help to reduce queue on the GST system. Taxpayers are therefore advised to file their Form GSTR- 3B well in advance to avoid last day rush.

It has also been observed that some taxpayers are uploading large number of invoices (viz upto 27 lakhs) of the past period in one GSTR-1 on the due date of filing. Taxpayers are advised to inculcate a month-wise return filing discipline for all the B2B invoices for the month and avoid reporting invoices of the past period in one go, as such behaviour can adversely impact the queue (waiting time) on the GST system.

It can thus be seen that with better planning of return filing, the difficulty faced by the taxpayers due to last minute rush can be avoided and it would be of help to fellow taxpayers as well. It may also be noted that GSTN has considerably upgraded its infrastructure over a period of time.

Portal update on 04.05.2 023

Advisory: Deferment of Implementation of time limit on reporting old e-invoices

It has been decided by the competent authority to defer the imposition of time limit of 7 days on reporting old e-invoices on the e-invoice IRP portals for taxpayers with aggregate turnover greater than or equal to 100 crores by three months. In this regard, the link to the previously issued advisory dated 13.04.2023 may be referred at:

https://www.gst.gov.in/newsandupdates/read/578

It has also been informed that the next date of implementation would be shared with the taxpayers in due course of time.

Portal update on 06.05.2 023

Advisory on due date extension of GST Returns for the State of Manipur

The Government has extended the due date of filing GSTR-1, GSTR-3B & GSTR-7 of April-2023 tax period till 3 1.05.2023 for all the taxpayers having principal place of business in the state of Manipur vide Notification No. 11/2023 – Central Tax dated 24.05.2023, 12/2023 – Central Tax and 13/2023 – Central Tax, all dated 24.05.2023. The said changes have been implemented on the GST Portal from 27.05.2023 onwards.

It has been clarified that the late fee paid by the taxpayers who have filed their returns before 27.05.2023, shall be credited into their ledgers and the interest amounts, shown in the next return, if any, may be corrected by the taxpayers themselves, as it is an editable field.

Portal update on 28.05.2 023

Advisory on Filing of Declaration in Annexure V by Goods Transport Agency (GTA) opting to pay tax under forward charge mechanism

The GTAs, who commence business or cross registration threshold on or after 01.04.2023, and wish to opt for payment of tax under forward charge mechanism are required to file their declaration in Annexure V for the FY 2023-24 physically before the concerned jurisdictional authority.

The declaration may be filed within the specified time limits, as prescribed in the Notification. No. 05/2023-Central Tax (Rate), dated. 09.05.2023.

Portal update on 30.05.2 023

Legal Corner

Nemo judex in sua

The maxim “nemo judexcausa incausa sua” literally

means that a man should not be a judge in his own cause. The maxim has come to mean that the deciding authority must be impartial. This is known as the rule against bias. The principle that bias disqualifies an individual from acting as a judge flows from the following two maxims:

(i) No one should be a judge in his own cause; and

(ii) Justice should not only be done but also seen to be done.

The first maxim applies not only when the adjudicator is himself a party to the dispute he is deciding, but also when he has some interest therein. The interest may be pecuniary or personal or of some other type. According to the second maxim, it is not necessary to prove that a particular decision was actually influenced by bias

It is sufficient if there is a reasonable suspicion about the adjudicator’s fairness. The fountain of justice must not only be pure but it must also enjoy public confidence and credibility. The adjudicator must not only be free from bias, but there must not be even an appearance of bias.

An essential element of judicial process is that the judge has to be impartial and neutral, and be in a position to apply his mind objectively to the dispute before him. Proceedings before a judge may be vitiated if he is biased, or if there are factors which may influence him to improperly favour one party at the cost of the other party in the dispute.

In the matter of J. Mohapatra and Co. v. State of Orissa [AIR 1984 SC 1572], on the applicability of the doctrine of bias in adjudicatory proceedings, the Supreme Court has observed:

“nemo judex in causa sua, that is, no man shall be a judge in his own cause, is a principle firmly established in law. Justice should not only be done but should manifestly be seen to be done. It is on this principle that the proceedings in Courts of Law are open to the public except in those cases where for special reason the law requires or authorises a hearing in camera. Justice can never be seen to be done if a man acts as a judge in his own cause or is himself interested in its outcome.”

Depending upon different type of interest a person may have in the case, there are different types of bias which are: personal bias, pecuniary bias, bias as to subject matter, departmental bias and preconceived notion bias.

The principle of “nemo judex in causa sua ” is deeply rooted in the principles of natural justice and due process. It reflects a fundamental principle of justice that underpins the rule of law, guaranteeing that individuals are given a fair opportunity to present their case before an independent and impartial adjudicator. It ensures that fairness, impartiality, and objectivity prevail in legal proceedings, promoting trust and confidence in the justice system.

Quid pro quo

The Latin term “quid pro quo” is frequently used to describe a principle of reciprocity or an exchange of goods or services. This concept is deeply rooted in human interaction and reflects the idea that one party provides something of value with the expectation of receiving something of comparable worth in return. The concept of quid pro quo is widely used in various areas, including business, politics, and social interactions.

“Quid pro quo” means “something for something” that originated in the middle ages in Europe. It describes a situation when two parties engage in a mutual agreement to exchange goods or services reciprocally. In a quid pro quo agreement, one transfer is thus contingent upon some transfer from the other party. Quid pro quo can be explicit or implicit, depending on the circumstances and the nature of the exchange.

In business, quid pro quo often refers to negotiations or agreements between parties where each side gives and receives something in return. This can involve trades, contracts, or partnerships where both parties benefit from the exchange. In politics and diplomacy, quid pro quo describes a situation where one party offers certain concessions or benefits to another party, with the expectation of receiving something in return. These exchanges can occur between countries in areas such as trade agreements, alliances, or diplomatic negotiations. However, it is crucial to ensure that such agreements are conducted ethically and adhere to legal standards.

The key to a quid pro quo business agreement is a consideration, which may take the form of a good, service, money, or, financial instrument. Such considerations are attached to a contract in which something is provided and something of equal value is hence returned in exchange. Without such considerations, a court may find a contract to be invalid or nonbinding. Additionally, if the agreement appears to be unfair or overly one-sided, the courts may rule that the contract is null and void. Any individual, business, or other transacting entity should know what is expected of both parties to enter into a contract.

A bartering arrangement between two parties is an example of a quid pro quo business agreement where one exchanges something for something else of similar value. In other contexts, a quid pro quo may involve something along the lines of a more questionably ethical situation involving a “favour for a favour” arrangement rather than a balanced exchange of equally valued goods or services.

Source of Newsletter – https://gstcouncil.gov.in/