It is often said that the small and medium businesses are at the heart of Indian economies’ demand and supply market. To cater to these small businesses and to provide a simplified and hassle-free scheme for compliance requirements under GST, the concept of a composition levy scheme was introduced.

The composition scheme is almost similar to the composition schemes prevalent in previous VAT regimes. It allows the taxpayer to pay tax at a fixed rate specified in law without allowing credit of taxes paid on inputs and input services and reduced procedural compliances.

1. Advantages of composition scheme –

- Ease of compliance as no detailed accounts and records are required to be maintained and no tax invoices are required to be issued.

- Simplified quarterly tax return filing.

- Simplified payment of tax on a quarterly basis and at a lesser rate.

- Higher liquidity as composition taxpayer is required to pay tax at a lower rate compared to standard GST rate of 18% resulting in a lesser impact on its working capital.

- No issuance of regular tax invoices.

- In the case of NIL return, the same can be filed using the SMS facility.

2. Drawbacks of composition scheme –

- Cannot make inter-state sales resulting in restricted business expansion scopes.

- Cannot make sales through e-commerce operator. Considering e-commerce sales is the future of sales, it is a big disadvantage for any seller.

- The scheme is less suitable for wholesalers due to restriction on the transfer of input tax credit.

- Strict penal provisions in case of violation of composition scheme provisions.

- Payment of tax by the seller from its pocket can sometimes be disadvantageous for them.

3. Eligible taxpayers for Composition scheme –

- Manufacturer or trader with aggregate turnover of less than INR 1.5 crores (INR 75 lakhs for northeastern states and Himachal Pradesh).

- Restaurant service providers except those serving alcoholic liquor for human consumption.

- Service providers with aggregate turnover of less than INR 50 lakhs in preceding financial year (subject to exceptions as covered under ineligible taxpayers heading in point 4 below) (Notified vide CGST (Rate) Notification no 2/2019 dated 7 March 2019).

4. Ineligible taxpayers for composition scheme –

- Manufacturers of ice-cream, pan masala, or tobacco.

- Engaged in the supply of services (excluding the specific provisions allowing such supply of services as per defined limit)

- Businesses engaged in making inter-state supplies including stock transfer to own branches outside the state.

- Businesses registered as casual taxable person or non-resident taxable person.

- Businesses supplying goods through an e-commerce operator required to collect TCS under Section 52 of CGST Act 2017.

- Businesses engaged in supplies not leviable to tax under GST.

- A supplier who has purchased any goods or services from an unregistered supplier unless he has paid GST on such goods or services on reverse charge basis.

- Suppliers exceeding the aggregate turnover threshold limit specified for opting for a composition scheme.

Note: There is a restriction on making inter-state supplies but there is no restriction on procuring goods from inter-state suppliers.

5. Rate of tax under composition scheme –

| Sr No | Eligible taxpayers | Rate of tax (percentage of turnover in state or union territory) |

| 1 | Manufacturers, other than manufacturers of such goods as may be notified by the Government (Ice cream, Pan Masala, Tobacco products etc.) | 1 % (0.5 % CGST + 0.5 % SGST) |

| 2 | Services specified in clause (b) of Paragraph 6 of Schedule II i.e. restaurant services | 5 % (2.5 % CGST + 2.5 % SGST) |

| 3 | Traders or any other supplier eligible for composition levy | 1 % (0.5 % CGST + 0.5 % SGST) |

*Any person opting to pay tax under the above serial numbers may supply services (other than restaurant services) of value not exceeding higher of the following:

a) 10 % of the turnover in state or union territory; or

b) INR 5 lakhs

**For Serial Number 3, the rate of tax of 1% is calculated on turnover of taxable supplies of goods.

6. Conditions and restrictions for composition scheme (Rule 5 of CGST Rules 2017)

- Not a casual taxable person.

- Not a non-resident taxable person.

- Mentions ‘Composition taxable person, not eligible to collect tax on supplies’ at the top of the bill of supply issued by him.

- The goods held in stock by him have not been purchased from an unregistered supplier and where purchased, he pays the tax under the reverse charge mechanism.

- The goods held in stock by him on the appointed day have not been purchased in the course of inter-State trade or commerce or imported from a place outside India or received from his branch situated outside the State or from his agent or principal outside the State where registration under the Composition Scheme has been taken.

- Mention the words ‘composition taxable person’ on every notice or signboard displayed at a prominent place at his principal place of business and at every additional place or places of business.

7. Important FAQs pertaining to the Composition scheme

A. When can I opt for the Composition Levy?

In order to avail of this scheme, you need to file an online application to Opt for Composition Levy with the tax authorities. Taxpayers who can opt for this scheme can be categorized as below:

- New Taxpayers: Any person who becomes liable to register under GST Act, after the appointed day, needs to file his option to pay the composition amount in the Application for New Registration in Form GST REG-01 (Rule 3(2) of CGST Rules, 2017).

The effective date of registration, in this case, will be the date of grant of registration i.e. date of registration (Rule 4(2) of CGST Rules, 2017).

- Existing Taxpayers: Any taxpayer who is registered as a normal taxpayer under GST needs to file an application to opt for Composition Levy in Form GST-CMP-02 at GST Portal prior to the commencement of the financial year for which the option to pay tax under the aforesaid section is exercised (Rule 3(3) of CGST Rules, 2017).

The effective date of registration, in this case, will be the beginning of financial year (Rule 4(1) of CGST Rules, 2017).

B. Can the option to opt for the composition scheme exercised at any time during the year?

No, the option to opt for the composition scheme is required to be intimated in Form GST CMP-02 prior to the commencement of the relevant financial year.

C. How do I apply for Composition Scheme if I am already registered as a regular taxpayer?

To opt for the Composition Levy, perform the following steps on the GST portal:

- Log in to the Taxpayers’ Interface

- Go to Services > Registration > Application to Opt for Composition Levy

- Fill the form as per the form specification rules and submit

D. How do I convert from regular to composition scheme in GST?

Any taxpayer who is registered as a normal taxpayer under GST needs to file an application to opt for Composition Levy in Form GST-CMP-02 at GST Portal prior to the commencement of financial year for which the option to pay tax under the aforesaid section is exercised.

E. What are the ITC reversal requirements in case of a switch from regular to composition taxpayer?

- The registered taxpayer shall pay an amount equal to the input tax credit in respect of inputs in stock, and inputs contained in semi-finished or finished goods held in stock on the day immediately preceding the date of exercise of option of composition scheme.

- The ITC shall be calculated proportionately on the basis of invoices on which ITC has been availed on such inputs.

- ITC reversal in respect of capital goods shall be determined on a pro-rata basis using the remaining useful life of capital goods in months (assuming the useful life of 5 Years).

- The input tax credit shall be determined separately in respect of IGST, CGST and SGST/UTGST.

- The ITC reversal so calculated shall be paid either by debiting the electronic credit ledger where sufficient balance is available, otherwise, the balance amount shall be paid through electronic cash ledger.

- Any balance remaining in the electronic credit ledger after debiting the input tax credit in respect of stock and capital goods shall lapse.

- The details of ITC reversal so calculated needs to be furnished in Form GST ITC-03.

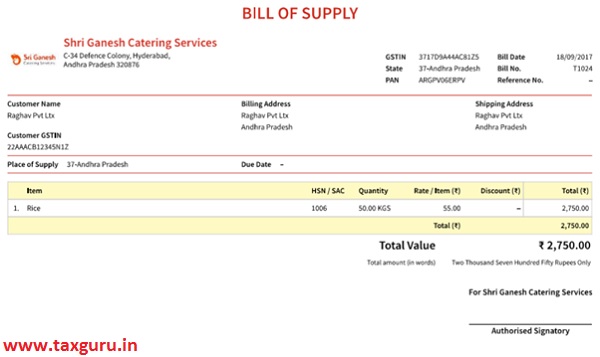

F. Can a composition dealer issue tax invoice?

No, a composition dealer cannot issue a tax invoice. This is because a composition dealer cannot collect the tax from its customers. A composition dealer issues a Bill of Supply for supplies made by it. Sample Bill of supply is provided below for ease of reference:

(Image source: Cleartax GST)

G. Can a supplier of inter-state supplies register under the composition scheme?

No, an inter-state supplies supplier cannot opt for the composition scheme.

H. Does the composition taxpayer have to pay tax?

Yes, the composition taxpayer has to discharge tax at specified rates on a quarterly basis while filing GST CMP-08 on or before the 18th day of the month succeeding the end of the quarter.

I. Can composition dealers claim the input tax credit?

No, the composition dealers are not allowed to claim ITC on purchases made by them. Further, in case of a switch from regular to composition taxpayer, they have to pay an amount equal to ITC in respect of inputs held in stock on the day immediately preceding the date of change in status. Any balance ITC in credit ledger after such payment will lapse.

J. Can a composition dealer continue under the scheme despite crossing the aggregate turnover limit anytime during the year?

No, the option to pay tax under the composition scheme will lapse on the day on which the dealer’s aggregate turnover crosses the specified threshold limit. The taxpayer has to file an intimation in Form GST CMP-04 within 7 days from the day on which the threshold limit is exceeded.

However, the taxpayer can claim ITC of inputs in stock, inputs contained in semi-finished and finished goods held in stock and capital goods held by him on the date of withdrawal from the scheme. Further, it will have to furnish a statement of ITC in respect of such stock within 30 days from the date of withdrawal in Form GST ITC-01.

As per Rule 40(1)(d) of CGST Rules, 2017, the details furnished in Form GST ITC-01 needs to be certified by a practicing CA or Cost Accountant where the aggregate of ITC claim exceeds INR 2 lakhs.

Note – As per Rule 40(2) of CGST Rules, 2017 read with Section 18(1)(c) of CGST Act, 2017, when a composition dealer switches to a regular taxpayer, ITC on capital goods is allowed to be claimed by the taxpayer but the same shall be reduced by 5% for every quarter or part thereof from the date of issue of invoice for such capital goods (part of the quarter shall be treated as a full quarter).

Example – Shyam Traders Limited, a composition dealer purchased machinery for INR 10,00,000 and paid GST of INR 1,80,000 on same. The machinery was purchased on 13th May 2019. Shyam Traders Limited crossed the registration threshold limit on 19th June 2020 and thus filed intimation in GST CMP-4 on 21st June 2020. The ITC that will be allowed on the machinery will be –

a. Number of quarters under composition scheme – 5 quarters (part of quarter to be treated as full quarter)

b. Total ITC on machinery – INR 1,80,000

c. Percentage reduction for each quarter – 5%

d. Total ITC reduction (b * c * a) -> 1,80,000 * 5% * 5 = 45,000/-

e. Net ITC eligible to be claimed (b – e) -> 1,80,000 – 45,000 = 1,35,000.

The taxpayer will start issuing normal tax invoices charging appropriate GST and complying with the return filing requirements applicable to a regular taxpayer i.e. GSTR-1 and GSTR-3B.

K. Can we switch from normal taxpayer to composition taxpayer from 1 year to another and vice-versa?

Yes, the taxpayer can switch between being a regular taxpayer or a composition dealer subject to the conditions of registration being met and fulfilling the other compliance requirements such as those related to ITC reversal. The declaration regarding the same can be submitted electronically on the GSTN portal.

L. What are returns required to be filed by a composition taxpayer?

A composition dealer is required to file Form GST CMP-08 on a quarterly basis on or before 18th day of the month immediately following the quarter to which such return related.

The annual return was required to be filed in Form GSTR-9A on or before 31st December following the end of financial year to which such return relates. The requirement to file GSTR-9A was waived off for FY 2017-18 and FY 2018-19.

Form FY 2019-20 onwards, the dealer has to file a return for the financial year in Form GSTR-4 on or before the 30th day of April following the end of financial year to which such return relates. Earlier, the requirement to file this return was quarterly but to simplify the compliance requirements it was subsequently notified to be filed annually.

M. Can a composition dealer make supplies to SEZ unit or developer?

No, supplies made to SEZ unit or SEZ developer from domestic tariff area (‘DTA’) are treated as inter-state supplies. A person paying tax under composition scheme cannot make inter-state outward supply of goods. Thus, for making supplies to an SEZ unit, a person needs to take registration as a regular taxpayer.

N. Will withdrawal from scheme in 1 state be applicable to all the other states as well?

Yes, intimation of withdrawal in respect of any state or union territory will be deemed to be an intimation of withdrawal in respect of all place of business with same PAN.

8. Consequences of violation of provisions of composition scheme

- In case of contravention of provisions of composition scheme is observed by proper officer or where the taxpayer has opted for the scheme despite not fulfilling the conditions, it may issue a notice in Form GST CMP-05 to submit within 15 days of receipt of notice as to why the option to pay tax under composition scheme should not be withdrawn.

Navigate to Services > User Services > View Notices and Orders option to view the notice and order issued by Tax Official

- The taxpayer has to submit its reply in Form GST CMP-06 to the proper officer.

- The proper officer within 30 days from the date of receipt of clarification from the taxpayer on SCN or 15 days if no reply is received from the taxpayer on SCN issued, whichever is earlier may take any of following action by issuing an order in Form GST CMP-07:

√ Drop proceedings

√ Withdraw composition levy of the taxpayer.

Note: In case, the taxpayer doesn’t submit clarifications within 15 days from date of issue of SCN, the Proper officer can only “Withdraw Composition levy of the taxpayer”.

- In case, the taxpayer ineligible to opt for the scheme had opted for the same, then, in addition to tax payable by him as per normal provisions, he shall also be liable to pay a penalty determined under section 73 or 74 of the CGST Act, 2017.

Note: Even where the proper officer has issued the order for withdrawal from the composition scheme, the taxpayer can claim ITC in respect of inputs, inputs in semi-finished and finished goods held in stock and capital goods as per the specified rules and provisions by filing Form GST ITC-01.

Considering India’s business structure and tax laws, there will always be a section of the business that find themselves burdened with the tax compliances and maintenance of detailed books of accounts and records. This is where the composition scheme comes to their safeguard to ensure timely and accurate compliances under the tax laws with fewer resources and time required.

This will provide them a hassle-free environment to operate while adhering to the tax laws of the land.

Disclaimer: The above article is based on the information provided in the tax laws, tax rules, various tax platforms and the author’s personal view of the tax law. Please refer to the latest law and consult the author before forming an opinion basis the information provided above as tax laws are subject to frequent changes. The author is not responsible for any issues arising as a result of opinion based on the above article without consultation.

Sir I cross my composition turnover on 10th March, 2023, i never intimate in form GST CMP-04, nor withdrawal Form GST ITC-01 due to lack of knowledge, But I apply for regular GST from 01/04/2023. So what I can do now?

After 3 months of gst registration as regular i opted for composition scheme…my inward supply during these 3 months is about 50 Lakh but outward supply is zero ……how much itc i should reverted…….

Hi Rajendra,

As per my understanding of the law, the taxpayer cannot switch from regular taxpayer to composition taxpayer during the year. If the taxpayer wants to opt for composition scheme for a particular financial year before the start of financial year.

On the assumption that you have validly switched from regular to composition scheme, please find below my response to your query –

When you switch from normal scheme to composition scheme, the taxpayer shall pay an amount equal to ITC in respect of inputs held in stock on the day immediately preceding the date of such switch. The balance of input tax credit after payment of such amount, if any, lying in the electronic credit ledger shall lapse.

I have doing Lodging business no restaurant in it. It’s annual turnover 20- 25 lakhs. is it required to do GSt registration or any other option.pls give guidance.

Hi Sachin,

I understand that the aggregate turnover of your business exceeds INR 20 lakhs. Consequently, you are required to obtain GST registration.

Since you turnover is only 20-25 lakhs, you can opt for QRMP scheme.

Can A Pvt Ltd company do business as a composition dealer in multiple states with seperate GST Number, while it’s Total turnover is more than thresh hold limit. If yes or no, please mention the notifications/ Circular or section.

Thanks a lot.

Hello Mayur,

As mentioned in the article, whether the taxpayer is eligible or not for registration is dependent on aggregate turnover, apart from other conditions and restrictions.

The aggregate turnover is the turnover of that particular PAN of the company. Individual GSTN wise turnover are not relevant for registration condition.

If your aggregate turnover is above the threshold limit (as you mentioned), you will not be eligible to register as a composition dealer (Refer Section 10(1) of CGST Act, 2017 wherein the maximum threshold limit allowed to be prescribed by the government is INR 1.5 crores).

If your turnover is below the threshold limit, then you will have to analyze the other conditions and ensure you are eligible to apply.

With Due Respect, this article has lot of WRONG informations, namely

1. as per Notification No. 01/2018 dated 01 Jan 2018 GST compsition rate on manufacturers is redueced to 1% ( not 2% as mensioned in this article, perhpas writer didn’t consider Notification No. 01/2018 , and wrote article based on Notification No. 08/2017 CT- dated 27 June 2017 only)

2.there is another error in the article that a person can’t be in composition scheme if he/she having “Businesses engaged in supplies not leviable to tax under GST”

it means composition dealer c an’t sell exempted goods ( for example cattle feed) or it means that a compostion dealer can’t sell the goods which is out of purview of GST ( for example Petrol,Diesel)

if your mean is that a composition dealer can’t sell exempted goods, you are again WRONG,refer Notification No. 01/2018 dated 01 Jan 2018

.3. Please also note that a composition dealer is liable to pay 1% only on TAXABLE SUPPLY OF GODDS ( and not on exempted goods)

Hi Devendra,

Tax laws are always up for interpretation basis the reader’s understanding of the tax law.

1. Yes, for manufacturers, the composition tax rate is 1% (0.5% CGST and SGST each).

2. As per updated Section 10(2)(b) – taxpayer engaged in the supply of goods or services not leviable to tax under GST are not eligible for composition scheme. The Notification No 1/2018 dated 1 January 2018 that you are referring to, only mentions about the updated composition tax rate in respect of manufacturers and applicability of 1% tax rate in case of other suppliers to turnover of taxable supply of goods.

I understand that there is confusion between exempt supplies and non-taxable supplies (petroleum products and supply of alcoholic liquor for human consumption) at your end. All exempt supplies are not non-taxable supplies under GST. Thus, if a taxpayer is engaged in supply petrol or diesel, such taxpayer will not be eligible for the composition scheme.

It is a humble request to please re-read the notification referred by you in your comment in point no 2 and let me know if it mentions exempt supplies anywhere.

3. Please note that the applicability of composition tax rate in respect of manufacturers and restaurant service providers is on ‘turnover in state or union territory. In respect of other traders, as per Notification No 1/2018-Central Tax, the tax rate is applicable to the turnover of taxable supplies of goods.

Thank you for your valuable comment.

Again With Due respect sir, in respect of my point no 2, I try to explain it with an example, suppose a businessman in composition scheme has total turnover of 50 lakh out of which 40 lakh turnover is of cattle feed( exempted goods) and 10 lakh turnover is of say cloths ( taxable goods) on which amount composition dealer will pay composition tax , on 10 lakh or on 50 lakh? and can he being a composition delaer sell exempted goods? explain it with quoting section/rule/notification.

With all due respect Devendra, you had highlighted in BOLD letters that I had written it WRONG when I mentioned that taxpayer engaged in Non-taxable supply is not allowed to register under composition scheme. However, as explained in my previous comment that it was not the case and the point I had mentioned in the restriction was in accordance with tax laws.

For easy understanding, I again reiterate that when I mentioned ‘businesses engaged in supplies not leviable to tax under GST’, it means non-taxable supplies and as per the combined reading of definitions of exempt supply and non-taxable supply you will understand that all non-taxable supplies are exempt supplies but the vice-a-versa scenario does not hold true.

Further, you may note that my article NOWHERE mentions that composition dealer cannot make exempt supplies.

Please find below my response to your query in the current comment along with reference to law:

1. The taxpayer is engaged in the supply of cloths and cattle feed. Cattle feed is taxable at NIL rate and thus the supply of cattle feed will be treated as exempt supply [as per definition of exempt supply (Section 2(47) of CGST Act, 2017 (defined as GST Act)).

2. As per the definition of aggregate turnover (Section 2(6) of GST Act), the aggregate turnover of the taxpayer will be INR 50 lakhs.

3. As per my reading and understanding of Section 10(1) and 10(2) read with restrictions specified in Rule 5 of CGST Rules, 2017 (defined as CGST Rules), the taxpayer engaged in the supply of taxable goods and exempt goods (other than non-taxable supply) is eligible for registration as a composition dealer.

4. As per Section 10(1)(c) of the GST Act, the taxpayer will fall under the composition scheme under other traders that are required to pay tax @ 1% (0.5% CGST and SGST each).

5. As per Rule 7 of CGST Rules, the taxpayer will have to discharge tax @ 1% and the turnover for discharging tax liability will be turnover of taxable supply of goods and services in the state. The taxable turnover of the taxpayer is INR 10 Lakhs only so the tax will be discharged on 10 lakhs.

So, to answer your queries, the turnover for discharge of composition tax will be INR 10 lakhs. As for supplies, a composition dealer can make exempt supplies but in case it is engaged in any of the non-taxable supply, it will have to move from composition to regular taxpayer registration.

Trust the above explanation in accordance with law suffice.

It would have better if govt had not introduced frequent changes in gst at regular intervals so that the businesses could have performed better & prepared themselves for compliances.In true way the complexities of gst haunted more than gst to the taxpayers.

Hi Sushil, despite 4 years of GST are on the horizon, it is still a relatively new law for the taxpayers when compared to excise, service tax, VAT or CST. It will evolve over a period of time. Yes, there have been frequent changes, amendments, technical glitches in the system but, no tax law is perfect in its entirety. It is always open to interpretation and changes with developing times and the need of the nation as we grow and expand.

Can a composition dealer make supply and provide service both in a single registration under composition?

Like in a Garage, can the dealer supply spare parts and charge service charges both in the same invoice and later pay gst at respective composition rates

Hi Paresh,

As per the second proviso to Section 10(1) of CGST Act, 2017, taxpayers covered under the composition scheme (refer to the table in point no 5 of the article above) can supply service up to value not exceeding higher of (a) 10% of the turnover in state or union territory in preceding FY or (b) INR 5 lakhs.

Further, as per new Section 10(2A) of CGST Act, 2017, the taxpayer not eligible under Section 10(1) or 10(2) and whose aggregate turnover in preceding FY does not exceed INR 50 lakhs, can opt for payment of tax @ 6% (3% CGST and SGST each). This also includes taxpayers engage in the supply of goods as well as services. However, it may be noted that this option will not be available in case the taxpayer is engaged in making non-taxable supplies or inter-state supplies.

Thus, the taxpayer under the composition scheme can supply goods as well as services under any of the above 2 sections.

Very well articulated.

But please confirm whether the turnover limit mentioned for opting to composition scheme is correct. I have read that it’s 75 Lacs for only states of Manipur, Meghalaya, Mizoram,Arunachal Pradesh, Nagaland,Tripura, Uttarakhand and Sikkim and rest of the states,it’s 1.5Cr.

Hi Akash,

There are 11 special category states while considering the aggregate turnover limit for various compliances under GST. These include Arunachal Pradesh, Assam, Jammu & Kashmir, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh and Uttarakhand. Out of these, for the purpose of the composition scheme, for Uttarakhand and J&K (now split into J&K and Ladakh), the aggregate turnover limit is INR 1.5 crore and not INR 75 lakhs.

Well articulated, beautiful structured informative article. 👍

Thank you Sir

Please clarify that GST rate on manufacture under composition scheme is 2% or 1%.

Response awaitted

Hi Raj, The revised rate of tax for manufacturers is 1% (0.5% CGST and SGST each) as per Rule 7 of CGST Rule, 2017 (amended).