1) Definition of Audit under the CGST Act 2017

Section 2(13) of the CGST Act 2017 States that 2(13) ‘audit’ means ( Exhaustive Definition)

1) the examination of records,

2) returns and

3) other documents

maintained or furnished by the registered person under this Act or the rules made thereunder or under any other law for the time being in force

To Verify The Correctness

of

1) turnover declared,

2) taxes paid,

3) refund claimed and

4) input tax credit availed,

5) and to assess his compliance with the provisions of this Act or the rules made there under;

- So here we can interpret that the above definition is an Exhaustive one and we need to Audit only the above documents and Scope is defined for the purpose of GST Audit.

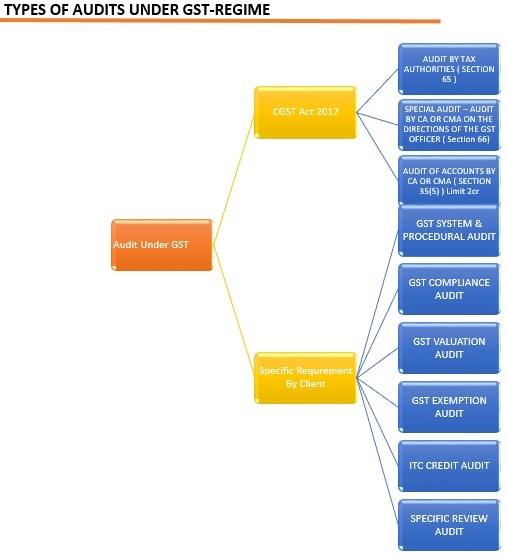

We will Deal in this video Basic Audit Guidelines & Procedures Regarding Audit Under Section 35(5).

TAXABLE TURNOVER UNDER GST-LAW

- One of the major Point of difference in GST Law and Our AFRF ( Applicable Financial Reporting Framework ) is that

- In GST Regime the Concept of Taxable Supply is used.

- In AFRF The turnover only considers the Total Revenue .

- And hence Transactions of the Financial Statements have to be categorized in accordance with GST law.

- Whether Discount Conditions have been full filled laid down in section 15, CGST Act 2017?

- Audit Program for Turnover Audit W.R.T to GST Law may generally include

1. Classification ,

2. Valuation under Section 15 and Rules From 27 to 35 ,

3. Exemption Availed & Conditions Compliance ,

4. Verification of other incomes ( since they may be supply under GST regime)

5. Provisions of TOS/POS

6. Goods Sent to Job Worker / Sale on approval basis ( Deemed Supply )

7. Rate ( Applicable rate /change in rate /etc)

8. Supply to related person is not included in turnover when accounts consolidated and hence check Branch Accounts.

9. There may be more areas not covered up here.

Disclaimer: This is not an Exhaustive list, but an inclusive list.

For Example : Following is an Illustration for the above purpose.

Details of Outward Supply can be Classified

1) To whom it is supplied. DTA/SEZ/Export/Related Person.

2) Rate Wise ( Right rate / Change in rate)

3) Exempt / Taxable Outward Supply

4) Inter – Intra

5) Composite/Mixed/Continuous Supply ( and proper treatment for it)

& Hence Proper Audit wrt to GST law regarding above to be done.

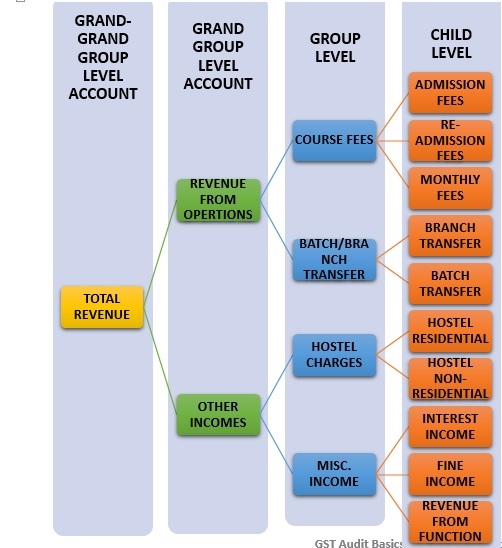

MERE ILLUSTRATION FOR PRIVATE COACHING CENTER ON BIFURCATION OF TAXABLE TURNOVER

Essence of illustration is that : The Taxable Supply is completely different from main business of operation . And Reconciliation of Aggregate Turnover & T/o in Financial Statement needs to be done.

Aggregate Turnover also include Both Statement of P&L and Balance Sheet Aspect.

A. INWARD SUPPLY ,ITC CLAIMED THEREON ,RCM.

- Check balance in ITC Ledger of GST Portal matches with Balances as on 31/03/2018

- Ensure that no blocked credit has been availed Section 17(5) .Example Check for Goods lost /stolen and credit to be reversed .

- Compliance with the provision of Section 17 read with Rule 38 , Rule 42( ITC on Input Goods/service) , Rule 43 ( ITC on capital Goods)

- Ensure that Conditions of Section 16 read with rule 36 to 37 to be compiled .Example

1. check for Prepaid Expenses in balance sheet ,Since as per Section 16(2) no ITC to be availed unless The Registered person has actually received goods/service ,therefore to be reversed.

2. Also in case of Insurance the Proportional amount to be reversed.

3. Payment for inward supply not made in 180 days ITC to be reversed. Check whether there exist any Outstanding Amount on account of Inward supply for more than 180 days?

- Reversal of ITC in case of Goods /Services used for non-business services.

make sure the expenses disallowed under Income Tax Act, 1961 on account of personal nature TAR can be considered. - Proper compliance of provisions of RCM

1. Section 9(4)( Supply from Unregistered Person) for the period 07.2017-12.10.2017

2. Notified Goods /Services Under Section 9(3) to be checked.

- Where GST liability has been Discharged at reduced rates make sure no ITC is claimed.

- Make sure on purchase of CG tax component has not been capitalized.

- Following Section Compliance also to be checked with respect to Availment of ITC

- Section 18 – Availability of credit in special circumstances ( New Reg / NTP to comp. / Exempt to Taxable)

- Section 19 – Taking input tax credit in respect of inputs and capital goods sent for job work

- Section 20 – Manner of distribution of credit by Input Service Distributor

- Section 21 – Manner of recovery of credit distributed in excess

it Is Advisable To Prepare Month Wise Statement Of Ineligible Credits With Corresponding Natural Accounts For Verification With Financial Accounts And Month Wise Statement Of Reversal Of Credit.

- The above points have been discussed not to address issues of any specific industry but an honest attempt has been made to prepare a checklist from GST point of view before Balance Sheet of a taxable person is finalized. The points/topics discussed above, will not only measure the GST preparedness of the Registered Taxable Person, but would also make the ‘taxable person’ ready with ground work for filing annual return, prepare reconciliation statement, GST Audit and GST assessment.

- There will be many other provisions Which maybe left out.

pleas Comment , so that can be added in the description.- Make sure Provisions WRT to Advances on Supply of Goods ( upto 14.11.2017) / Supply of services have been compiled.

Dear professional Colleagues , kindly correct me if anything is off track by commenting below.