Background

GST is a destination based tax on consumption of goods or services. It is also the policy of the Government of India to export the goods and/or services not the taxes out of India. This makes the exports cheaper and thus Indian products or services will be more competitive in the international markets. This is our 6th article on GST Updation, for our previous articles please refer earlier blogs on taxguru.

What is meant by Export of Services?

| S.No. | Export of service – Finance Act 1994 | Export of service – Model GST law |

| 1 | The provider of service is located in the taxable territory | The supplier of service is located in India |

| 2 | The recipient of service is located outside India including Jammu & Kashmir | The recipient of service is located outside India |

| 3 | The service is not a service specified in the section 66D (Negative List) of the Act | – |

| 4 | The place of provision of the service is outside India | The place of supply of service is outside India |

| 5 | The payment for such service has been received by the provider of service in convertible foreign exchange; | The payment for such service has been received by the supplier of service in convertible foreign exchange, |

| 6 | The provider of service and recipient of service are not merely establishment of a distinct person in accordance with item (b) of Explanation 2 of clause (44) of section 65B of the Act | The supplier of service and recipient of service are not merely establishments of a distinct person |

It may be noted that if a service is not an export of service under GST law then IGST shall require to be charged even if the place of supply is outside India and location of receiver is also outside India.

What is meant by Export of Goods?

In present scenario as well as in GST regime expression “Export of Goods” remain same which means taking goods out of India to a place outside India.“India” means,-

The territory of the Union as referred to in clauses (2) and (3) of Article 1 of the Constitution;

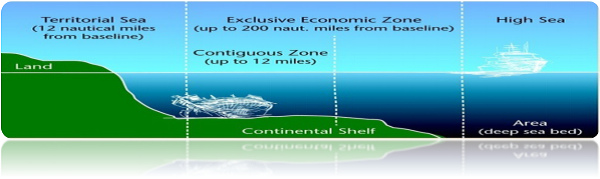

1. its territorial waters, continental shelf, exclusive economic zone or any other maritime zone as defined in the Territorial Waters, Continental Shelf, Exclusive Economic Zone and other Maritime Zones Act, 1976 (80 of 1976);

2. the seabed and the subsoil underlying the territorial waters;

3. the air space above its territory and territorial waters; and

4. the installations, structures and vessels located in the continental shelf of India and the exclusive economic zone of India, for the purposes of prospecting or extraction or production of mineral oil and natural gas and supply thereof;

Please note that in case of Export of Service, it is prerequisite that payment against services rendered must be in convertible foreign exchange but at the same time such condition do not exist in case of export of Goods.

Concept of Zero Rated Supply under GST:

As defined under IGST law, a “Zero Rated Supply” means any of the following supply of goods/services namely:-

(a) Export of goods/services; or

(b) Supply of goods /services to a SEZ developer or an SEZ unit

Supplier of zero rates goods/services can claim credit of input tax irrespective of the fact that such services/goods are notified as exempted supplies. Further, it is important to note that incase a service is not an export of service under the definition of export of services, then GST shall be chargeable since there is no exemption as such. However, in the present service tax law, a service is said to be non-taxable even if it is not an export of services i.e. in case place of provision of services outside India.

Option of Refund of Taxes under GST Law:

A registered taxable person exporting goods and/or services shall be eligible to claim refund under one of the following options:-

(a) a registered taxable person may export goods and/or services under bond, subject to such conditions, safeguards and procedure as may be prescribed in this regard, without payment of IGST and claim refund of unutilized input tax credit in accordance with provisions of section 48 of the CGST Act, 2016 read with rules made thereunder;

(b) a registered taxable person may export goods or services, subject to such conditions, safeguards and procedure as may be prescribed in this regard, on payment of IGST and claim refund of IGST paid on goods and services exported in accordance with provisions of section 48 of the CGST Act, 2016 read with rules made thereunder;

The SEZ developer or SEZ unit receiving Zero rated supply shall be eligible to claim refund of IGST paid by the registered taxable person on such supply.

Analysis: In the present law, the Central excise rules, 2002 provides for the above 2 options under rule 18 and 19 for export of goods. But there is no such mechanism for Bond/Refund options for export of services under service tax law. Now, as per the aforesaid provisions, an assessee providing export of service shall be required either to claim refund or file bond as may be prescribed. This will be a major hardship for service providers whose major revenue is from export of services.

Comparison with the current situation:

The position is same for the exporter of goods under the GST regime. But it brings surprise for the exporter of services. In the GST regime, for an exporter of goods and even for exporter of services, there will be 2 options either to pay and get the refund of IGST or bond option where refund of input tax credit is available. Further, SEZ developer or SEZ unit will not get the ab initio exemption. As per the section 16 of IGST law, only the refund option has been given to SEZ developer or SEZ unit i.e. first pay the IGST to the registered taxable person on supply received and then claim refund from the department.

Frequently Asked Question (FAQs):-

Q: 1 Whether Supply made to Jammu & Kashmir can be called as Export of goods under GST Regime?

Ans: No, Supply made to Jammu & Kashmir cannot be called as export of goods as jammu & Kashmir is a part of India and anything which is supplied within the geographical boundaries of india cannot be called as export of Goods.

Q: 2: Whether supply made to SEZ units or developers is export and whether refund can be claimed on such supply, if yes then by whom?

Ans: Yes, the refund of IGST shall be claimed by SEZ units or developers.

Q: 3 Whether a supplier of services would be required to file bond incase of export of services?

Ans: As per the provisions of section 16 of Model IGST law, a supplier of services will be required to file bond if such supplier does not opt for refund option.

Disclaimer: The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. The observations of the authors are personal view and this cannot be quoted before any authority without the written permission of the authors. This article is meant for general guidance and no responsibility for loss arising to any person acting or refraining from acting as a result of any material contained in this article will be accepted by authors. It is recommended that professional advice be sought based on the specific facts and circumstances. This article does not substitute the need to refer to the original pronouncements on GST.

(Authors – CA Neeraj Kumar and CA Deepak Arya, RAPG & Co. Chartered Accountants from Delhi and can be reached at info@rapg.in, 9999836182/9818449179)

What about Exports of goods make thru Merchant exporters

100,% export of services required to registered in gst ?