Sponsored

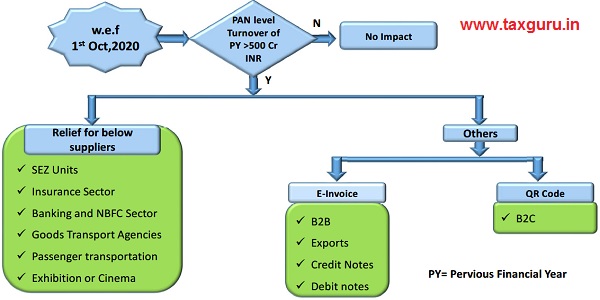

e-Invoicing under India GST is proposed to applicable from 1st October,2020.

Index Of Discussion topics

> What is an e-Invoice

> Applicability of e-invoice compliance

> Time limit for reporting invoice

> Current transaction flow

> New transaction flow

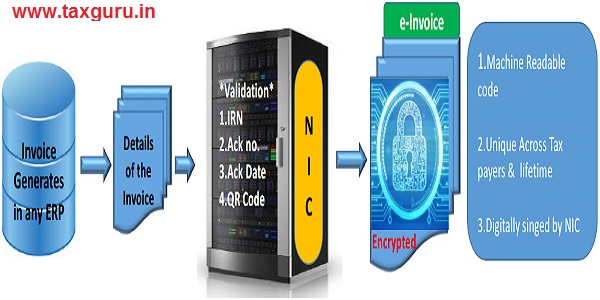

> Process of issuing e-invoice

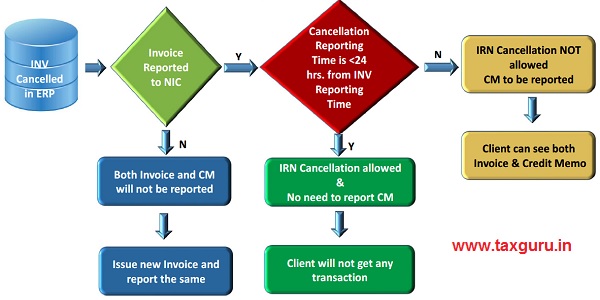

> e-invoice Cancellation process

> ERP Integration flow

What is an e-Invoice

Applicability of e-invoice compliance

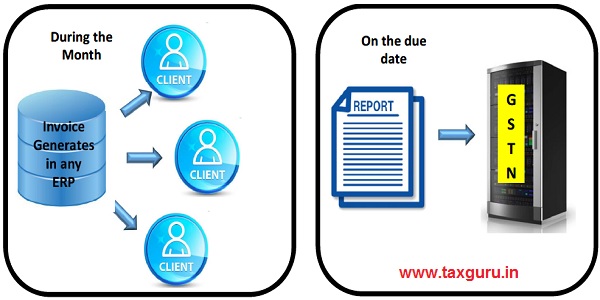

Current Transaction flow

New transaction process flow

T = Billing Date appearing on Invoice , NIC = National Informatic Center, GSTN =GST Network

Process of issuing e-invoice

Cancellation process

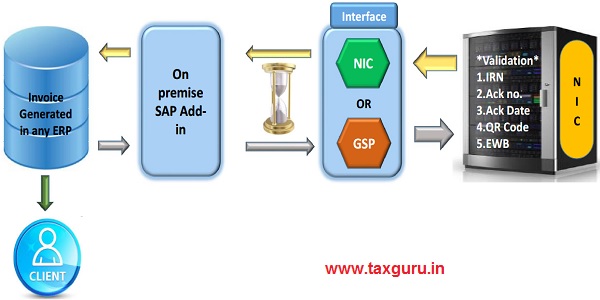

ERP Integration Flow

IRN =Invoice reference number, NIC=National Informatic Center, EWB=E-way bill, *GSP chargeable

Sponsored

Kindly Refer to

Privacy Policy &

Complete Terms of Use and Disclaimer.