43rd GST COUNCIL MEETING

AT A GLANCE

1. COVID RELIEF ITEMS :

No IGST shall be charged on certain items

like medical oxygen, oxygen storage, medical . .

. equipment, test kits, vaccines etc. till 31.08.2021.

↓

FM has also constituted

a group of ministers (GOM) who will

decide other COVID related individual items.

Also they have to submit there report by 08.06.2021.

Important Note: Exemption is available only if goods imported free of cost for free distribution.

RECOMMENDATION :

♦ IGST shall be charged on repair value of goods re – imported after repair.

♦ Services to education institution:

♦ Examination fees charged by national board of examination, similar central & state education board is exempt from GST.

♦ Provision related to land owner promoter :

♦ Supply of service to govt./local authority:

Condition : In this supply portion of goods < 25% of composite supply. If the above condition is not followed then GST is charged @ 5%.

♦ Provision Relating to Guarantee given by Govt. :

Guarantee given by government

to financial institution for providing

financial assistance to Govt. under taking/PSU

↓

Such services supplied by government to

their undertaking and PSU is exempt from GST

♦ 18% GST has been charged on rope way construction services provided to an Government entity.

♦ Measures to trade facilitation relief in late fees:

NOTE : Tax payer can file their previous period return from 01.06.2021 till 31.08.2021.

♦ Late fees u/s 47 :

- Provisions related to form GSTR – 4

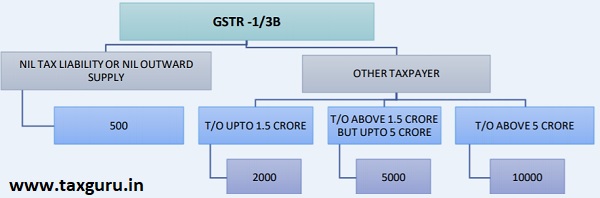

♦ Provisions related to form GSTR- 1/3B

> GSTR -7 : late fees = 50 rs. per day maximum upto rs. 2000.

♦ COVID -19 Related Relief :

- Provisions Related to Interest :

- Provisions Related to Late Fees:

- Provisions Related to CMP – 08:

♦ Provisions Related to MAY 2021 Return:

♦ Simplification Related to Annual Return :

- CA certification not required in FORM GSTR-9C from F.Y. 2020-21 onwards.

- The filing of annual return in FORM GSTR-9 / 9A for FY 2020-21 to be optional for taxpayers having aggregate annual turnover upto Rs 2 Crore.

- The reconciliation statement in FORM GSTR-9C for the FY 2020-21 will be required to be filed by taxpayers with annual aggregate turnover above Rs 5 Crore

Other COVID -19 related Relaxation :

- GSTR -1 due date extended by 15 days for MAY 2021Month.

- GSTR -4 (F.Y. 2020-21) due date extended till 31.07.2021.

- 36(4) will be cumulative applicable for the period april 2021 to june 2021 in JUNE 2021 return.

- ITC – 04 due date for march quarter extended till 31.07.2021.

- Allowing filing of returns by companies using Electronic Verification Code (EVC), instead of Digital Signature Certificate (DSC) till 31.08.2021.

If you have any suggestions regarding this knowledge series then please share with us.

For Any Query Related to taxation matters , you may contact us at: 9829760308