ALL ABOUT DEEMED EXPORT UNDER GST

In a layman language, deemed export means the goods when supplied, does not leave India and payment for which is received either in Indian rupees or in convertible foreign exchange, if such goods are manufactured in India. (Section 147 of CGST Act, 2017). By and large, all the provisions related to ‘export’, shall be applicable to ‘deemed export’,but following are the provisions which are applicable to deemed export under GST only.

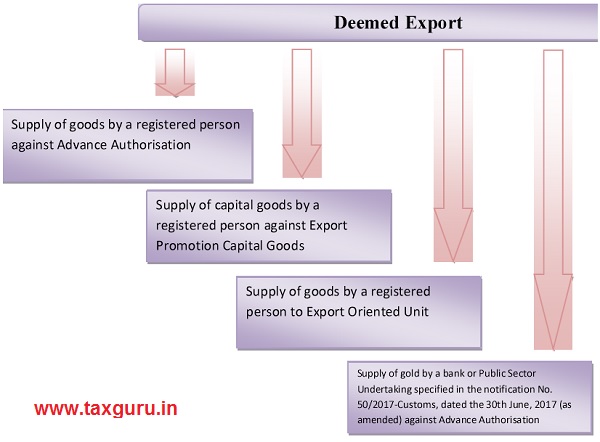

Not all goods which are covered under above definition comes under the category of deemed export. As per notification No. 48/2017, the Central Government, on the recommendations of the Council, notifies the following supplies of goods as deemed export:

Requirements by the supplier of deemed export

Since, deemed export is also an export, it also comes under refund category. As per Notification No. 49/2017- Central Tax, following are the evidences which are required to be produced by the supplier of deemed export supplies for claiming refund (Rule 89):

1. Acknowledgment by the jurisdictional Tax officer of the Advance Authorisation holder or Export Promotion Capital Goods Authorisation holder, as the case may be, that the said deemed export supplies have been received by the said Advance Authorisation or Export Promotion Capital Goods Authorisation holder, or a copy of the tax invoice under which such supplies have been made by the supplier, duly signed by the recipient Export Oriented Unit that said deemed export supplies have been received by it.

2. An undertaking by the recipient of deemed export supplies that no input tax credit on such supplies has been availed of by him

An undertaking by the recipient of deemed export supplies that he shall not claim the refund in respect of such supplies and the supplier may claim the refund.

3. Who can file the application for refund

As per notification No. 47/2017- Central Tax, the application may be filed by:

(a) the recipient of deemed export supplies; or

(b) the supplier of deemed export supplies in cases where the recipient does not avail of input tax credit on such supplies and furnishes an undertaking to the effect that the supplier may claim the refund

Further clarification, –

1. “Advance Authorisation” means an authorisation issued by the Director General of Foreign Trade under Chapter 4 of the Foreign Trade Policy 2015-20 for import or domestic procurement of inputs on pre-import basis for physical exports.

2. Export Promotion Capital Goods Authorisation means an authorisation issued by the Director General of Foreign Trade under Chapter 5 of the Foreign Trade Policy 2015- 20 for import of capital goods for physical exports.

3. “Export Oriented Unit” means an Export Oriented Unit or Electronic Hardware Technology Park Unit or Software Technology Park Unit or Bio-Technology Park Unit approved in accordance with the provisions of Chapter 6 of the Foreign Trade Policy 2015-20.

Associated links:

| Title | Notification No. | Date |

|---|---|---|

| Evidences required to be produced by supplier of deemed export for claiming refund | Notification No. 49/2017-Central Tax | 18/10/2017 |

| CBEC notifies certain supplies as deemed exports under CGST Act, 2017 | Notification No. 48/2017-Central Tax | 18/10/2017 |

| GST Refund of deemed exports supply can be claimed by either recipient or supplier | Notification No. 47/2017–Central Tax | 18/10/2017 |

About the Author:

C S Ekta Maheshwari is the Author of this article and she is a PRACTICING COMPANY SECRETARY in Delhi. The Author can be reached at [email protected]

Disclaimer:

The entire contents of this article is solely for information purpose and have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. It doesn’t constitute professional advice or a formal recommendation. The author has undertook utmost care to disseminate the true and correct view and doesn’t accept liability for any errors or omissions. You are kindly requested to verify & confirm the updates from the genuine sources before acting on any of the information’s provided herein above.

Respected,

i want to generate deemed exports bill and how ?

We are sale goods to our local dealer as deemed export sale and dealer export to Nepal we charge 0.10 %Please clarify this tax igst or cgst sgst

HI

Can u please guide me regarding one traction Under GST

Client based in foreign .we done corporate photography in gujarat (India)

We raised invoice in foreign with indian currency and cleitn which brance office paid money also in indian currency

we charges IGST but not understand which is this sales.

After notification no 48/17, can we supply without GST on LUT to 100% EOU unts

After Notification no 48/17, Can we supply without GST on LUT to 100 %EUO unit