Arjuna (Fictional Character): Krishna, there were so many important decisions recommended in the 23rd GST council meet. One of the important decisions is taken regarding Form GSTR – 3B. So, what is exactly form GSTR -3B?

Arjuna (Fictional Character): Krishna, there were so many important decisions recommended in the 23rd GST council meet. One of the important decisions is taken regarding Form GSTR – 3B. So, what is exactly form GSTR -3B?

Krishna (Fictional Character): Arjuna, GSTR 3B is a simple return form introduced by the CBEC. Each taxpayer must file a separate GSTR-3B for every month. Form GSTR – 3B is also known as Summary return.

Arjuna: Krishna, what are the main characteristics of Form GSTR – 3B?

Krishna: Arjuna, the main characteristics of Form GSTR – 3B are as follows:

- Form GSTR -3B is to be filed for every month before 20th of next month upto March, 2018.

- The concept of Form GSTR -3B is introduced for not to decrease the revenue of Government.

- Form GSTR -3B cannot be revised.

- After feeding all the information, tax liability will be calculated.

- For every month, tax is to be paid as per Form GSTR -3B.

Arjuna: Krishna, who needs to file the GSTR – 3B?

Krishna: Arjuna, All registered normal taxpayers and casual taxpayers are required to file the GSTR-3B for every month upto March, 2018. If there is no any transaction in the tax period, then also the taxpayers have to file return. But only to the taxpayers who are registered under composition scheme are not required to file Form GSTR – 3B.

Arjuna: Krishna, what information is to be given in Form GSTR -3B?

Krishna: Arjuna, Form GSTR -3B is summary return. The summarized information relating to outward supply, available ITC, tax liability, etc is to be given. In case of outward supplies the information relating to zero rated supplies, nil rated supplies, exempt supplies, taxable supplies, etc similarly, in case of ITC the information of available ITC, reversed ITC, net ITC and ineligible ITC is to be furnished.

In that, details of payment are also to be given. If the taxpayer is eligible for credit of TDS and TCS, then its details are also to be furnished. The HSN wise summary is required to be given by the taxpayer.

Arjuna: Krishna, what lesson the taxpayer should take from GST?

Krishna: Arjuna, hope that GST soon may became Good and Simple Tax, but currently due to frequent changes there is lot of confusion regarding filing returns and there due dates in the mind of taxpayers.

Sir in 3b instead of input credit i have shown in reverse charge inwards and submited and tax liability showing is more, pls tell me what can i do

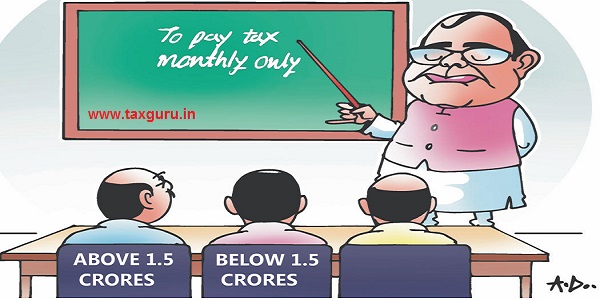

In last GSt council meeting, it was decided that businesses whose turnover is upto 1.5 crores need to file quarterly return and pay taxes also n quarterly basis and this things wud start from oct-dec quarter.

What is the exact status???

Whether it is quarterly payment or monthly payment for businesses having turnover upto 1.5 crores.

As said,by,my friend,R M SHAH,good number of Tax Payers,have committed,mistake,while putting amount.Small amount,may be got overruled.In case,big mistake,like,instead of putting,30,000.00,figure of 3,00,000,is put,how,can small,Tax Payer,may tolerate. Therefore for,technical mistakes committed,rectification,provision,needs to implemented.

There are no option of revising GSTR3B but if you have submitted with wrong tax liability than pay the same liability in that month. only option is to show that excess amount as input tax credit in next month.

at the time of departmental inquiry or audit you can explain the same and at the annual return it will get correct automatically

Krishna has said it very well about GSTR 3B to Arjuna.

yes , option to revise or edit of submitted 3 b must be provided, due to clerical mistake we put the tax in wrong column and the assessee is not able to pay the wrongly filed tax and we are unable to file the return for that month and for further period.

GST 3B is submitted ( NOT FILED). Error in putting tax amount. Instead of 30000, wrote as 310000. I m not able to edit since return is SUBMITTED. Dealer can’t pay tax also. HOW DO I RECTIFY ? July GST 3 B was open for rectification. SIMILARLY IT SHOULD BE ALLOWED TILL MARCH 18, since this is new law.

WE MUST REPRESENT THROUGH RECOGNIZED BODY.