Step by Step Guide for GST Enrolment for existing Central Excise / Service Tax Assessees

All existing Central Excise and Service Tax assessees will be migrated to GST starting 7th January 2017. To migrate to GST, assessees would be provided a Provisional ID and Password by CBEC.

Provisional IDs would be issued to only those assessees who have a valid PAN associated with their registration. An assessee may not be provided a Provisional ID in the following cases:

a. The PAN associated with the registration is not valid

b. The PAN is registered with State a Tax authority and Provisional ID has been supplied by the said State Tax authority.

c. There are multiple CE/ST registrations on the same PAN in a State. In this case only 1 Provisional ID would be issued for the 1st registration in the alphatebical order provided any of the above 2 conditions are not met

The assessees need to use this Provisional ID and Password to logon to the GST Common Portal (https://www.gst.gov.in) where they would be required to fill and submit the Form 20 along with necessary supporting documents.

Subsequent pages provide the Steps to be followed by each assessee to migrate to GST.

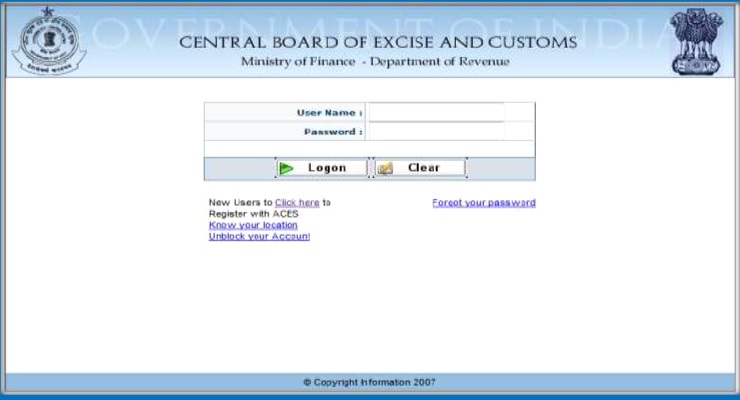

Step 1: Logon to ACES portal using the existing ACES User ID and Password

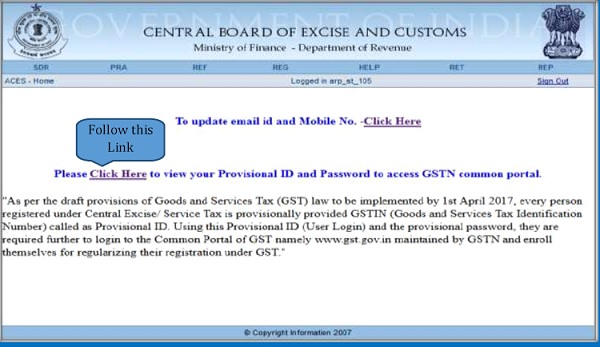

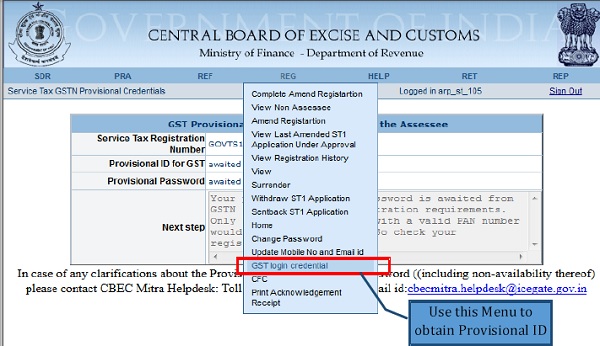

Step 2: Either follow the link to obtain the Provisional ID and Password OR navigate using the Menu

GST Login Credentials

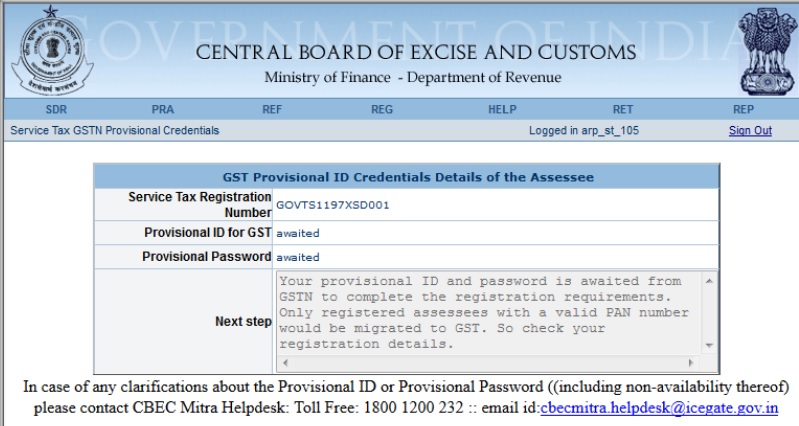

Step 3: Make a note of the Provisional ID and password that is provided. In case a Provisional ID is not provided, please refer the Next Step section. In case of further doubt please contact the CBEC Helpdesk at either 1800-1200-232 or email at cbecmitra.helpdesk@icegate.gov.in

Once you have obtained the Provisional ID and Password, logon to the GST Common Portal (https://www.gst.gov.in) using this ID and Password.

The GST Common Portal has made avilable a manual on how to fill the Form-20. It is available on www.gst.gov.in.

Sir,

We are registered with Central Excise and VAT.

We have enrolled in GST by using login credentials provided vat offices, still should we enroll in Central excise and Service tax

– See more at: https://taxguru.in/goods-and-service-tax/central-excise-service-tax-assessees-can-migrate-gst.html#comment-1934969

still provision id on service tax not received for assesses.. any one started migration of ST??

WE have registered VAT in Indore, M.P. We have 2 Units in Indore, having one VAT No. & separate Excise & Service Tax registration.

We enrolled for GST for VAT & Central Sales Tax. Received common Provisional ID. for both Unit.

Now we received email for GST registration Excise for our Unit-1 showing GST provisional ID & password for Unit-1 and Unit-2 showing AWAITED provisional ID & password.

Our problem that how we register our Unit 2 in Excise.

Today (10.01.2017) morning I tried. While navigating through -Home _ menu _ REG, ‘Provisional ID for GST’ is not displayed.

Has the Service Tax Assessee Migration actually started?

I do not see the Link for Provisonal ID etc after I log in onto my ACES account

Sir,

we are manufacurer and at present registerd with excise / service tax and with vat so far.

Now we intend register for GST under sales tax website since they have provided us Login on credentials.

Again am I to register under central excise for GST..

same way am to register for service tax under gst separately.

please detail to me.

thanks in advance

regards

mohan r

Mr Shamnath,

If you have already enrolled through VAT registration then there is no need to get your enrolled for excise and/or service tax. But State wise enrollment either as per VAT or Excise/Service Tax is must if you have place of business in different States.

The books or records like production register or RG23A part-1 part2 annexure4 etc to be maintained or not. Please clarify.

Sir,

We are registered with Central Excise and VAT.

We have enrolled in GST by using login credentials provided vat offices, still should we enroll in Central excise and Service tax