Case Law Details

In re Ms. Rich Dairy Products (India) Private Limited (GST AAR Tamilnadu)

Whether Carbonated Fruit Juice falls under Fruit Juices or Aerated drinks?

Waters with added carbon dioxide which may contain added preservatives and flavoring , sugars are separately classified under Para 2.10.6 as Carbonated Water’ and Category 14.1.1.2 as ‘table waters and soda waters’ which are different from ‘Carbonated Fruit Beverages or Fruit Drinks’ of Para 2.3.30 and Category ‘14.1.4.1’ of FSSAI regulations. As discussed in Para 6.2 above, the applicants products are classified under Para 2.3.30 of FSSAI and not para 2.10.6. It is evident that the ‘carbonated water’ described in Para 2.1.0.6 of FSSAI regulations are the ‘Aerated Waters’ covered under CTH 22021010. Therefore, the applicant’s products are not classifiable as ‘Aerated Waters’ under CTH 22021010. Therefore, the products are either classifiable under CTH 22021020 or CTH 22021090 depending on the flavours. The various flavours added by the applicant depend on the fruit juice orange or lemon and added natural and artificial flavours such as ‘orange’, ‘lemon/lime’, ‘cola’, ‘jeer soda’ under various brand names of ‘Richyaa Darner’ and ‘Licta’. ‘Richyaa Darner Lemon’ and ‘Licta Lemon are classifiable under CTH 22021020 as they are lemonade and all others i.e. Richyaa Darner Cola’, ‘Licta Cola’, ‘Richyaa Darner Jeera Soda’, ‘Licta Jeera Masala, Richyaa Darner Orange’ and ‘Licta Orange’ are classifiable as ‘Other’ under CTH 22021090.

The products to be supplied by the applicant are to be classified as ‘Richyaa Darner Lemon’ and ‘Licta Lemon’ are classifiable under CTH 22021020 and all others i.e. ‘Richyaa Darner Cola’, ‘Licta Cola’, ‘Richyaa Darner Jeera Soda’, ‘Licta Jeera Masala, ‘Richyaa Darner Orange’ and ‘Licta Orange’ are classifiable as ‘Other’ under CTH 22021090.

AAAR order-Carbonated beverages with fruit juice classifiable under CTH 22021020 or 22021090

FULL TEXT OF ORDER OF AUTHORITY OF ADVANCE RULING, TAMILNADU

Note: Any appeal against the advance ruling order shall be filed before the Tamil Nadu State Appellate Authority for Advance Ruling, Chennai under Sub-section (1) of Section 100 of CGST ACT/TNGST Act 2017 within 30 days from the date on which the ruling sought to be appealed against is communicated

At the outset, we would like to make it clear that the provisions of both the Central Goods and Service Tax Act and the Tamil Nadu Goods and Service Tax Act are the same except for certain provisions. Therefore, unless a mention is specifically made to such dissimilar provisions, a reference to the Central Goods and Service Tax Act would also mean a reference to the same provisions under the Tamil Nadu Goods and Service Tax Act.

M/s. Rich Dairy Products (India) Private Limited, SI No.341 & 342, Akkiyampatty Village, Sendamangapalam Post, Namakkal 637 409. (Hereinafter referred to as ‘Applicant’) is a manufacturer of fruit juices and also carbonated fruit juices. They are registered under GST vide GSTIN No. 33AADCR3175K1ZA. The Applicant has preferred an application seeking Advance Ruling on the following Question:

“Classification of goods manufactured – Whether Carbonated Fruit Juice falls under Fruit Juices or Aerated drinks?”

The Applicant has submitted the copy of application in Form GST ARA – 01 and also submitted a copy of Challan evidencing payment of application fees of Rs.5,000/- each under sub-rule (1) of Rule 104 of CGST rules 2017 and SGST Rules 2017.

2. The applicant has stated that

> they are manufacturers of Fruit juices and also Carbonated fruit juices.

> The GST rate @28% and Cess @12 % are applicable only for the goods with description as all goods including Aerated water containing added sugar or other sweetening materials or flavoured. Hence nowhere fruit juices are mentioned.

> Their product Carbonated fruit juices do not fall under the above description of Aerated water containing added sugar or sweetening materials. Nowhere in the description fruit juices are covered

> Also Nowhere the percentage of fruit juices content are given for determination of tax rates whether falls under 28% or 12%.

> In a similar issue during the VAT regime, the Honorable Supreme Court in the case of ‘Appy Fizz’ has given verdict saying that Appy Fizz belongs to fruit juices only and therefore KVAT @ 20% could not be demanded and since fruit juices were involved it can be taxed @ KVAT 12%. The judgment was given to Kerala Sales tax offices.

> The Government of India- Food Safety and Standards Authority of India (FSSAI) has also issued necessary amendment that if the quantity of fruit juice in the beverage is below 10%, but not less than 5% (2.5% in case of lime or lemon), the product shall be called carbonated beverage with fruit juice. Hence it is carbonated beverages with fruit juices only.

> The taxable goods descriptions do not include fruit juices and hence their product falls under the fruit juice only.

> Concentrate of fruit juices content in the carbonated fruit juices manufactured by them is as follows:

Lemon juice-2.5% as per FSSAI norms; other juice- 5% as per FSSAI Norms

3. The applicant was given an opportunity to be personally heard on 09.04.2019. The Authorised Signatory of the applicant appeared for the Hearing. The Assistant Commissioner (ST), Rasipuram also appeared for the hearing. The applicant submitted the written submission giving ingredients, manufacturing process, Composition, test report of FSSAI. They stated that as per FSSAI regulation of 2016, their products are ‘carbonated fruit based drinks’ to be classified under HSN 22029020, taxable at 12% GST. They stated that they will submit extract of 2011 Regulations under FSSAI and photographs of each products showing composition and description.

3.1 In the Written Submission, the applicant has furnished the Profile of the company, Process flow chart, ingredients used in the manufacture of carbonated fruit juices or fruit drinks along with test report, Write up on manufacturing process, Gazette notification issued by FSSAI and Complete set of case laws before the Supreme Court for VAT periods of similar commodity. They stated that the question being asked is whether carbonated fruit juices are classifiable under 22029920 with GST rate at 12%. Their drinks are fruit base drinks and Co2 wart is used for preservation purpose. Fruit pulps are in semi liquid form and fruit juice are in liquid form without any addition of sugar or other additives. There is no difference in the usage of fruit pulp or fruit juices used for manufacture of carbonated fruit juices. They submitted copy of Hon’ble Supreme court judgment in classification of ‘APPY FIZZ’ in case of M/s Parle Agro Ltd vs Commissioner of Commercial Taxes , Trivandrum in the VAT regime where the Hon’ble Supreme court ruled on the classification as per Kerala VAT notifications. They stated that fruit pulp or fruit juice based drinks should be classified under HSN 22029920.

Appy Fizz drink is being sold at 12 % GST and the same should be permitted for their drinks.

They submitted invoices for purchasing ‘Lime Clear Juice’ and ‘Kinnow Clear Juice’ which is classified under HSN 2009. They submitted product specifications of these two inputs indicating that they are of fruit juice (sulphited ) of lime and orange with no added sugar , water except KMS (potassium metabisulfite)

3.2 The Procedure for preparation of carbonated fruit juice submitted by the applicant is as follows:

SUGAR SYRUP UNIT: Few liters of water boiled in sugar syrup kettle, when boiling temperature reached at 70°C, pouring the sugar from the sugar bags in the kettle, after few minutes sugar dissolves then Passes to PHE plate through the filer (PHE plates reduce the temperature of sugar syrup to 35-45°C), to sugar storage tank, when production starts, sugar syrup transferred to blending tank via fine cloth filtration.

BLENDING UNIT: The applicant has planned to prepare each 4.0 KLD which was prepared as 2.0 KL as a single batch. Fruit juices carbonated drink prepared from the juice (Orange,, Lemon, Jeera and Cola). Orange, Lemon, Jeera and Cola consists of Fruit juices, sugar, chemicals and water. After the batch, fruits juice carbonated specification was checked by the quality controller. After that juice will be passed into storage tank through Chiller tank.

CHILLER UNIT: Chiller unit consists of maintaining the juice at less than 5°C temperature.

FILLING UNIT: Q.C. Department checks the temperature of the fruit juices carbonated Drink. After the bottles are sent to the warming tunnel for warming purpose of filled bottles and inspected by the Q.C the bottles are passed to the label machine of the labels. Then labeled bottles are printed to the printing machine (Hereby the Date, MRP, batch no. & Time of bottle Printed in printer) and checked by the Q.C department.

PACKING UNIT: Fruit juices carbonated drink bottles are packed in plastic roll packing (Shrink) and checked by Q.C. The packed bottles placed in trolleys and Transferred to dispatch area, maintain the record for dispatch.

Rinser: Before filling the pet bottle it is rinsed using the RO water.

3.3 The ingredients of the products are as follows:

| Product | Ingredients |

| 1 Lemon (Richyaaa Darner/ Licta) |

|

| Orange (Richya aa Damer/Licta) |

|

| Cloudy Lemon (Richyaaa Damer/Licta) |

|

| Cola (Richyaaa Damer/Licta) |

|

| Jeera Soda masala (Richyaaa Damer/Licta) |

|

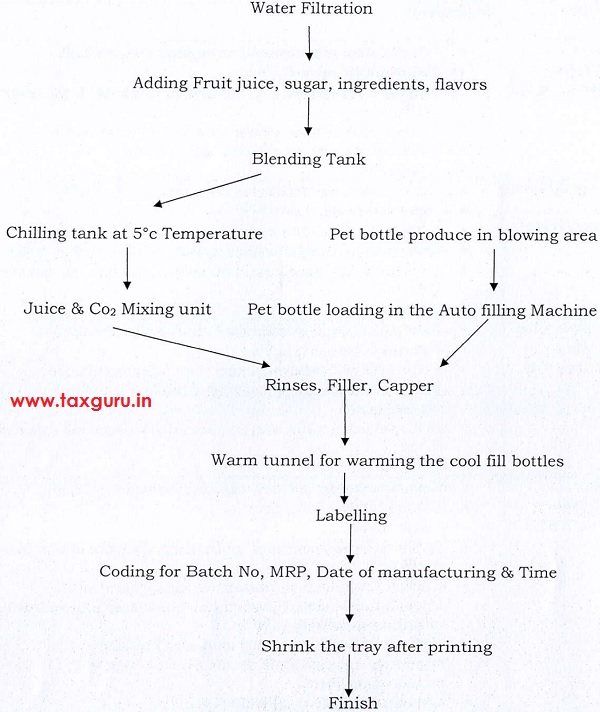

3.4 The process flow chart for preparation of carbonated fruit juice submitted by the applicant is given below:

CARBONATED FRUITS JUICE PREPARATION CHART

3.5 They submitted copies of test reports of a testing laboratory indicating energy, carbohydrate, total fat, protein, total sugars,. In respect of ‘Lieta Cloud Lemon Carbonate Beverage with Fruit Drink ‘ with fruit juice content is 3.6% ; ‘Richyaa Domer Cloud Lemon Carbonate Beverage with Fruit Drink ‘with fruit juice content is 3.8%; ‘Licta Jeera Soda Masala Flavour Carbonate Beverage with Fruit Drink ‘ with fruit juice content is 3.4%; ‘Licta Orange Carbonate Beverage with Fruit Drink ‘ with fruit juice content is 7.1%; ‘Licta Cola Carbonate Beverage with Fruit Drink ‘ with fruit juice content is 3.5%;’Licta Lemon Carbonate Beverage with Fruit Drink ‘ with fruit juice content is 3.9%;’Richyaa Darner Jeera Soda Masala Flavour Carbonate Beverage with Fruit Drink 1 with fruit juice content is 3.6%;%;’Richyaa Darner Lemon Carbonate Beverage with Fruit Drink ‘ with fruit juice content is 3.4%;’Richyaa Darner Cola Carbonate Beverage with Fruit Drink’ with fruit juice content is 3.2%; Richyaa Darner Orange Carbonate Beverage with Fruit Drink ‘ with fruit juice content is 7.1%; ‘Licta Cloud Lemon Carbonate Beverage with Fruit Drink ‘ with fruit juice content is 3.6%.

4. The applicant further submitted the following additional submissions on 29.04.2019 as undertook by them during the hearing:

a. Details of the content of the ingredients in each product wise

b. Copies of the product wise labels meant for affixture in the bottles in which the beverages is filled for sales, wherein the contents details are printed.

The labels all have the description “Contains Fruit”, and “Carbonated Beverage with fruit Juice” for the products-

-

-

- Richyaa Darner Lemon (200/300/600/1500 ml) – having Lemon juice concentrate (2.5%)

- Licta Lemon (200/300/600/1500 ml) – having Lemon juice concentrate/Lime juice (2.5%)

- Richyaa Darner Orange (200/1500 ml) – having Orange juice (5%)

- Licta Orange (200/300/600/1500 ml) – having Orange juice (5%)

- Richyaa Darner Cola (200/300/600/ 1500 ml) – having Lime Juice (2.5%)

- Licta Cola (200/300/600 ml) – having Lime Juice (2.5%)

- Richyaa Darner Jeera Soda (200/300/600/1500 ml) – having Lime/Lemon Juice (2.5%)

- Licta Jeera Masala (200/300/600/1500 ml) – having Lime /Lemon Juice (2.5%)

-

c. Food Safety and Standards (Food Products Standards and Food Additives) Regulations, 2011 dt.1.8.2011 effective from 5.08.2011

d. Food Safety Standards (Food Product and Food Additives) Eleventh Amendment Regulations, 2016 dt 25.10.2016

5.1 The Assistant Commissioner of State (ST), Rasipuram has furnished the comments on the questions raised by the applicant which is reproduced below:

> The product sold is termed as Carbonated Beverage with Fruit Juice (as per FSSAI regulation cited by them), the question raised in the application form for advance ruling is “Whether Carbonated Fruits Juices Falls under Fruit Juices or Aerated Drinks?” The terms Carbonated Fruits Juices and Carbonated Beverage with Fruit Juice denote different substances according to the very same FSSAI regulations. Thus, the question raised in the AAR pertains to a product different from that of the dealer’s.

> Are “Carbonated Beverage with Fruit Juice” same as “Juice”?

Under the Food Safety and Standards (Food Safety & Standards and Food Additives) Regulations, 2011, Regulation 2.3.6 defines Fruit Juices as follows.

Thermally Processed Fruits Juices: Thermally Processed Fruits Juices (Canned, Bottled, Flexible And/or Aseptically Packed) means unfermented but fermentable product, pulpy, turbid or clear, intended for direct consumption obtained by a mechanical process from sound, ripe fruit or the flesh thereof and processed by heat, in an appropriate manner, before or after being sealed in a container, so as to prevent spoilage. The juice may have been concentrated and later reconstituted with water suitable for the purpose of maintaining the essential composition and quality factors of the juice. It may contain salt. The product shall meet the following requirements:-

| Fruit Juices | Total Soluble Solid (%) |

| 1 .Apple Juice | 10 |

| 2.Orange Juice | |

| (a) Freshly expressed | 10 |

| (b) reconstituted from concentrate | 10 |

| 3. Grape fruit juice | 9 |

| 4.Lemon juice | 6 |

| 5.Lime juice | 5 |

| 6.Grape juice | |

| (a) Freshly expressed | 15 |

| (b) reconstituted from concentrate | 15 |

| 7. Pineapple juice | |

| (a) Freshly expressed | 10 |

| (b) reconstituted from concentrate | 10 |

| 8.Dlack currant | 11 |

| 9.Mango, Guava or any other pulp fruit | 15 |

| 10.Other fruit juices of single species-not very acidic | 10 |

| 11. Other fruit juices of single species- very acidic | 10 |

| 12. Other fruit juices of single species or combination thereof -not very acidic | 10 |

| 13. Other fruit juices of single species or combination thereof – very acidic | 10 |

Thus, the statutory regulations require a minimum of 10% fruit juice to be called a Fruit Drink.

> Are “Carbonated Beverage with Fruit Juice” same as “Fruit Beverages*’?

Under the Food Safety and Standards (Food Safety & Standards and Food Additives) Regulations, 2011, Regulation 2.3.10 defines Fruit beverages as follows.

Thermally Processed Fruit Beverages/Fruit Drink/ Ready to Serve Fruit Beverages: Thermally Processed Fruit Beverages/Fruit Drink/ Ready to serve fruit beverage (canned, Bottled, Flexible Pack And /Or Packed) means an unfermented but fermentable product which is prepared from juice or Pulp/Puree or concentrated juice or pulp or sound mature fruit. The substances that may be added to fruit juice or pulp are water, peel oil, fruit essences and flavors, salt, sugar, invert sugar, liquid, glucose, milk and other ingredients appropriate to the product and processed by heat, in an appropriate manner, before or after being sealed in a container so as to prevent spoilage. The product shall meet the following requirements:

| (i) Total soluble solid(m/m) | Not less than 10.0 percent |

| (ii) Fruit juice content | |

| (a) Lime/Lemon ready to save beverage | Not less than 5.0% |

| (b) All other beverage /drink | Not less than 10.0% |

Thus, the statutory regulations require a minimum of 10% fruit content to be called a Fruit Beverage.

> Thus, on a plain reading of regulations 2.3.6 and 2.3.10, the product cannot be considered as Fruits Juices or Fruit Beverages/Fruit Drink. In other words, fruit is not its primary, defining, unique quality.

> Are “Carbonated Beverage with Fruit Juice” same as “Carbonated Fruit Beverages or Fruit Drinks”?

Under the Food Safety and Standards (Food Safety & Standards and Food Additives) Regulations, 2011, Regulation 2.3.30 defines Carbonated Fruit Beverages or Fruit Drinks as follows.

Carbonated Fruit Beverages or Fruit Drinks: Carbonated Fruit Beverages or Fruit Drink means any beverage or drink which is purported to be prepared from fruit juice and water or carbonated water and containing sugar, dextrose, invert sugar or liquid glucose either singly or in combination. It may contain peel oil and fruit essences. It may also contain any other ingredients appropriate to the products.

It shall meet the following requirements

| (i) Total soluble solid(m/m) | Not less than 10.0 percent |

| (ii) Fruit content | |

| (a) Lime or Lemon Juice | Not less than 5.0% |

| (b) other Fruits | Not less than 10.0% |

> Under the food Safety and Standards (Food Safety & Standards and Food Additives) Regulations, 2011, Carbonated Beverage with Fruit Juice is defined as follows.

Carbonated Beverage with Fruit Juice: In case the quantity of fruit juice is below 10.0 per cent. But not less than 5.0 per cent, (2.5 Per cent, in case of lime or lemon), the product shall be called ‘carbonated beverage with fruit juice’ and in such cases the requirement of TSS (Total Soluble Solids) shall not apply and the quantity of fruit juice shall be declared on the label.

> The regulation 2.3.30 makes it clear that “Carbonated beverage with fruit juice” is not the same as “Carbonated Fruit Beverages or Fruit Drinks”. The dealer’s product cannot be termed as Carbonated Fruit Beverages or Carbonated Fruit Drinks. It can only be termed Carbonated Beverage with Fruit Juice. In other words, the primary quality of the product being that it is a Carbonated Beverage with miniscule quantity of fruit juice.

> As it has been already established that the primary quality of the product is it being that of a beverage, the HSN code 2202 90 20 which corresponds to that a fruit juice based drink wouldn’t be appropriate as it would amount to defining the product with its secondary character ignoring its primary character of it being a Carbonated Beverage,

> Why 2202 10 10 is the most appropriate? – Chapter 22 deals with Beverage, sprits and vinegar.

| 2202 | Waters, including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavoured, and other nonalcoholic beverages, not including fruit or vegetable juices of heading 2009 |

| 2202 10 | Waters, including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavoured |

| 2202 10 10 | Aerated waters |

| 2202 10 20 | Lemonade |

| 2202 10 90 | Other |

> The Fruit Products Order, 1955 in Part 11 (D) mentions the Specifications for sweetened aerated waters with no fruits juice or fruit pulp or containing less than 10 percent of fruit juice or fruit pulps as follows.

| Product | (Variety | Total Soluble | Definition and general characteristics |

| Flavored sweetened aerated water | Sweetened aerated water with single or composite flavors | Minimum 8% | Aerated water means potable water impregnated with carbon dioxide under pressure improperly scaled container and may contain any of the flowing single or in combination:- sugar liquid glucose dextrose honey monohydrate, invert sugar fructose, saccharine not exceeding 100 parts per million, fruit and vegetables extractives (less than 10% on weight to weight) |

Thus, it can be established that the FSSAI term “Carbonated Beverage with Fruit Juice” is best captured in the HSN Code as “Aerated Water” using the Fruit Products Order.

> The Appy Fizz case: In M/s Parle Agro (P) Ltd Vs Commissioner of Commercial taxes, Trivandrum the issue was whether Appy Fizz is a fruit juice. However, it is to be noted that the juice content of Appy Fizz is 12.7% m/m and Total solids content is 13%, which satisfy the conditions set out in the FSSAI regulations to qualify as a fruit juice. This amounts to a case of comparing apples with oranges.

Common Parlance Test: The common Parlance test has been used in various judgments like, Honorable Apex court in M/s United offset process Ltd Vs Assistant Collector of Customs (1989). In the Diebolt system Pvt. Ltd Vs the commissioner of Commercial Tax, the court held that if the goods are not technical in nature, the meaning associated to the goods in common parlance would be applied. In such a case a drink with fruit content as low 2.5% in case of lemon and 5% in others, would not be termed as a juice in Common Parlance, nor would a drink that is carbonated be termed as a juice.

> In the same chapter, beverages containing milk are taxed at 12% while tender coconut water is not taxed at all. Fruit pulp or fruit juice based drinks are taxed at 12% while aerated waters are taxed at 28% plus the imposition of cess. The logic and the spirit behind this classification is incentivizing healthy items must be taxed less while unhealthy products are discouraged with heavy taxation. Thus, providing the benefit of lower taxation to a product that contains as little as 5.0 percent of fruit (2.5 percent in case of lime or lemon) defeats the purpose. Hence, the product is to be classified under HSN 22021010 as “Aerated Water” and taxed accordingly.

5.2 The applicant is under the administrative jurisdiction of Commissioner of GST, Salem Commissionerate and no comments has been offered on the issue by them

6. We have carefully examined the oral and written submissions of the Applicant and also comments furnished by the Assistant Commissioner, Rasipuram Assessment Circle (ST). We find that the question raised seeking ruling is:

“Whether Carbonated Fruit Juice falls under Fruit Juices or Aerated drinks?”

6.1 From the submissions made by the applicant it is seen that the products manufactured by the applicant for which the classification is sought are having the names and labeling as listed in Para 4 (b) above with the ingredients as listed in Para 3.3 above. The labels all have the description “Contains Fruit”, and “Carbonated Beverage with fruit Juice” for the products. The products all have Reverse osmosis treated carbonated water at 92.5% proportion and sugar at 12-14%. As per the label, Richyaa Darner Lemon, Licta Lemon, Richyaa Darner Cola, Licta Cola, Richyaa Darner Jeera Soda, Licta Jeera Masala all have Lemon /Lime juice of 2.5% proportion. Richyaa Darner Orange and Licta Orange have Orange juice at 5% proportion. They also have specific added flavours and colours. Apart from the specific ingredients mentioned, the products contain Citric acid or sodium citrate as Acidity Regulators and Sodium Benzonate and potassium Sorbate Preservatives. From the test report submitted by the applicant the sample is described as ‘Richyaa Darner …Carbonated Beverage with Fruit Drink’, Licta……Carbonated Beverage with Fruit Drink’ with the fruit content varying slightly from the labels as indicated in Para 3.5 above. The inputs used for these products are ‘Lime juice clear (sulphited) and Kinnow (orange juice clear (sulphited). The issue is whether the product is classifiable under ‘CTH 2202 10 – Waters, including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavoured:’ or under ‘CTH 2202 90 20- Fruit pulp or fruit juice based drink’.

6.2 As per the Food Safety and Standards (Food Products Standards and Food Additives) Regulations, 2011 DT 01.08.2011 as amended, Para 2.3.6 states,

2.3.6: Thermally Processed Fruits Juices

1. Thermally Processed Fruits Juices (Canned, Bottled, Flexible And/or Aseptically Packed) means unfermented but fermentable product, pulpy, turbid or clear, intended for direct consumption obtained by a mechanical process from sound, ripe fruit or the flesh thereof and processed by heat, in an appropriate manner, before or after being sealed in a container, so as to prevent spoilage. The juice may have been concentrated and later reconstituted with water suitable for the purpose of maintaining the essential composition and quality factors of the juice. It may contain salt. One or more of the nutritive sweeteners may be added in amounts not exceeding 50 g/kg but not exceeding 200g/kg in very acidic fruits except in case of Apple Juice, Orange Juice (reconstituted from concentrate), Grape Juice, Pineapple Juice (reconstituted from concentrate).

It is seen from the above that as per the classification of FSSAI, Fruit juices are unfermented but fermentable product obtained by a mechanical process from sound, ripe fruit or the flesh thereof and processed by heat, in an appropriate manner, before or after being sealed in a container, so as to prevent spoilage and are intended for direct consumption. In the instant case, the product is made by adding fruit juices to large quantities of water along with other preservatives which then goes through a carbonation process. The juices are not meant for direct consumption here but are just one ingredient of the drinks.

Para 2.3.30 of the above Regulations states

2.3.30 Carbonated Fruit Beverages or Fruit Drinks:

1. Carbonated Fruit Beverages or Fruit Drink means any beverage or drink which is Purported to be prepared from fruit juice and water or carbonated water and containing sugar, dextrose, invert sugar or liquid glucose either singly or in combination. It may non fain peel oil and fruit essences. It, may also contain any other ingredients uppropriule to the products.

…………….

3A. in case the quantity of fruit juice is below 10.0 per cent. But not less than 5.0 per Cent. (2.5 per cent. In case of lime or lemon), the product shall be called ‘carbonated Beverages with fruit juice’ and in such cases the requirement of TSS (Total Soluble Solids) shall not apply and the quantity of fruit juice shall be declared on the label.

It is seen that the instant product fits into this category as it is a beverage which is prepared from fruit juice and carbonated water. The applicant has also labelled their products as ‘Carbonated Beverage with Fruit Drink’ as required in Para 2.3.30 (3A) above.

Further, as per Appendix A to these Regulations where there is a food category system, it is seen that fruit juices are classified under 14.1.2.1 as

14.1.2.1 Fruit juices

Fruit juice is the unfermented but fermentable liquid obtained from the edible part of sound, appropriately mature and fresh fruit or of fruit maintained in sound condition by suitable means. The juice is prepared by suitable processes, which maintain the essential physical, chemical, organoleptic and nutritional characteristics of the juices of the fruit from which it comes. The juice may be cloudy or clear, and may have restored (to the normal level attained in the same kind of fruit) aromatic substances and volatile flavour components, all of which must be obtained by suitable physical means, and all of which must have been recovered from the same kind of fruit. Pulp and cells obtained by suitable physical means from the same kind of fruit may be added. A single juice is obtained from one kind of fruit. A mixed juice is obtained by blending two or more juices or juices and purees, from different kinds of fruit. Fruit juice may be obtained, e.g. by directly expressing the juice by mechanical extraction processes, by reconstituting concentrated fruit juice (food category 14.1.2.3) with water, or in limited situations by water extraction of the whole fruit. Examples include orange juice, apple juice, black currant juice, lemon juice, and orange mango juice and coconut water.

And

14.1.4.1 Carbonated water-based flavoured drinks

Includes water-based flavoured drinks with added carbon dioxide with nutritive, non-nutritive and/ or intense sweeteners and other permitted food additives. Includes gaseous (water-based drinks with added carbon dioxide, sweetener, and flavour), and sodas such as colas, pepper-types, root beer, lemon-lime, and citrus types, both diet/light and reyulur types. These beverages may be clear, cloudy, or may contain particulate matter (e.g. fruit pieces). Includes so-called “energy” drinks that are carbonated and contain high levels of nutrients and other ingredients.

Therefore, it is seen from above that fruit juices and carbonated beverages with fruit drinks are distinct products in the FSSAI regulations and the products of the applicant axe covered under Para 2.3.30 of the regulations and Category 14.1.4.1 in the food category system in Appendix A to these regulations.

6.3 In terms of explanation (iii) and (iv) to Notification No. 1/2017 – Central Tax (Rate) dt. 28-06-2017, tariff heading, sub-heading, heading and chapter shall mean respectively a tariff item, sub-heading, heading and chapter as specified in the First Schedule to the Customs Tariff Act, 1975 and the rules for the interpretation of the First Schedule to the Customs Tariff Act, 1975, including the Section and Chapter Notes and the General Explanatory Notes of the First Schedule shall be applied for the interpretation and classification of goods.

6.4 The relevant entries of the Customs Tariff is given under for ease of reference:

Chapter 2009 of Customs Tariff covers fruit juices (including grape must) and vegetable juices, unfermented and not containing added spirit, whether or not containing added sugar or other sweetening matter.

Chapter Note 6 of Chapter 20 states “For the purposes of heading 2009, the expression “juices, unfermented and not containing added spirit” means juices of an alcoholic strength by volume (see Note 2 to Chapter 22) not exceeding 0.5% volume.”

HSN Explanatory Notes to Chapter 2009 states

The fruit and vegetable juices of this heading are generally obtained by pressing fresh, healthy and ripe fruit or vegetables. This may be done (as in the case of citrus fruits) by means of mechanical “extractors” operating on the same principle as the household lemon-squeezer, or by pressing which may or may not be preceded either by crushing or grinding (for apples in particular) or by treatment with cold or hot water or with steam (e.g., tomatoes, blackcurrants and certain vegetables such as carrots and celery).

The liquids thus obtained are then generally submitted to the following processes :

(a) Clarification, to separate the juice from most of the solids, by means of clarifying substances (gelatin, albumin, infusorial earth, etc.) or of enzymes, or by centrifuging.

(b) Filtration, often by means of filter plates faced with kieselguhr, asbestos, cellulose, etc.

(c) De-aeration, to eliminate oxygen which would spoil the colour and flavour.

(d) Homogenisation, in the case of certain juices obtained from very fleshy fruits (tomatoes, peaches, etc.).

(e) Sterilisation, to prevent fermentation. Various methods may be employed, for example, pasteurisation rolonged or “flash”), electric sterilisation in machines fitted with electrodes, steri isation by filtration, preservation under pressure using carbon dioxide, refrigeration, chemical sterilisation (e.g., by means of sulphur dioxide, sodium benzoate), treatment with ultra-violet rays or ion exchangers.

As a result of these various treatments the fruit or vegetable juices may consist of clear, unfermented liquids. Certain juices, however (in particular those obtained from pulpy fruits such as apricots, peaches and tomatoes) still contain part of the pulp in fincly divided fonn, either in suspension or as a deposit.

Provided they retain their original character, the fruit or vegetable juices Of this heading may contain substances of the kinds listed below, whether these result from the manufacturing process or have been added separately :

(1) Sugar.

(2) Other sweetening agents, natural or synthetic, provided that the quantity added does not exceed that necessary for normal sweetening purposes and that the Juices otherwise qualify for this heading, in particular, as regards the balance of the different constituents (see Item (4) below).

(3) Products added to preserve the juice or to prevent fermentation (e.g., sulphur dioxide, carbon dioxide, enzymes).

(4) Standardising agents (e.g., citric acid, tartaric acid) and products added to restore constituents destroyed or damaged during the manufacturing process (e.g., vitamins, colouring matter), or to “fix” the flavour (e.g., sorbitol added to powdered or crystalline citrus fruit juices). However, the heading excludes fruit juices in which one of the constituents (citric acid, essential oil extracted from the fruit, etc.) has been added in such quantity that the balance of the different constituents as found in the natural juice is clearly upset; in such case the product has lost its original character.

The vegetable juices of this heading may also contain added salt (sodium chloride), spices or flavouring substances.

However, the addition of water to a normal fruit or vegetable juice, or the addition to a concentrated juice of a greater quantity of water than is necessary to reconstitute the original natural juice, results in diluted products which have the character of beverages of heading 22.02. Fruit or vegetable juices containing a greater quantity of carbon dioxide than is normally present in juices treated with that product (aerated fruit juices), and also lemonades and aerated water flavoured with fruit juice are also excluded (heading 22.02).

It is seen from the above that fruit juices are extracted from fresh, healthy and ripe fruits through various processes followed by filtration to remove solids, aeration, homogenization and sterlisation. Such fruit juices to be classified under CTH 2009 can have added sugar, standardizing agent, preservatives as long as they retain their original character. However, addition of water to normal fruit juice or to a concentrated juice of a greater quantity of water than is necessary to reconstitute the original fruit juice results in diluted products excludes such products from CTH 2009 and are to be classified as beverages of heading 2202, In the instant case, water constitutes around 92% in all the products in question. The product is prepared by adding fruit juice, procured by the applicant (as per the input invoices submitted), to filter water. It is evident that this large quantity of water results in diluted products which as per the Explanatory Notes above get classified under CTH 2202.

Chapter 2202 of Customs Tariff covers

| 2202 | WATERS, INCLUDING MINERAL WATERS AND AERATED WATERS, CONTAINING ADDED SUGAR OR OTHER SWEETENING MATTER OR FLAVOURED, AND OTHER NON-ALCOHOLIC BEVERAGES, NOT INCLUDING FRUIT OR VEGETABLE JUICES OF HEADING 2009 |

| 2202 10 | – Waters, including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavoured : |

| 2202 10 10 | — Aerated waters |

| 2202 10 20 | — Lemonade |

| 2202 10 90 | — Other |

| 2202 91 00 | –Non alcoholic beer |

| 2202 99 | Other: |

| 2202 99 10 | —Soya milk drinks, whether or not sweetened or flavoured |

| 2202 99 20 | — Fruit pulp or fruit juice based drink |

| 2202 99 30 | — Beverages containing milk |

| 2202 99 90 | —Other |

HSN Explanatory Notes to Chapter 2009 states

22.02- Waters, including mineral wafers and aerated waters, containing added sugar or other sweetening matter or flavoured, and other non-alcoholic beverages, not including trim or vegetable jukes of heading 20.09.

2202.10 – Waters, including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavoured

– Other:

2202.91 — Non alcoholic beer

2202.99 – – Other

This heading covers non-alcoholic beverages, as defined in Note 3 ro this Chapter, not classified under other headings, particularly heading 20.09 or 22.01.

(A) Waters, including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavoured.

This group includes, inter alia :

(1) Sweetened or flavoured mineral waters (natural or artificial),

(2) Beverages such as lemonade, orangeade, cola. consisting of ordinary drinking water, sweetened or not, flavoured with fruit juices or essences, or compound extracts, to which citric acid or tartaric acid are sometimes added. They are often aerated with carbon dioxide gas, and are generally presented in bottles or airtight containers.

(B) Other non-alcoholic beverages, not including fruit or vegetable juices of heading 20.09.

This group includes, inter alia:

(1) Tamarind nectar rendered ready for consumption as a beverage by the addition of water and sugar and straining.

(2) Certain other beverages ready for consumption, such as those with a basis of milk and cocoa.

From the above, it is seen that, Waters, including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavoured, and Other Non-alcoholic beverages, not including fruit or vegetable juices of Heading 2009′ are covered under CTH 2202. Further, The Explanatory Notes classifies Waters, including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavoured’ under CTH 220210. As per the explanatory notes, this group include

(1) Sweetened or flavoured mineral waters (natural or artificial)

(2) Beverages such as lemonade, Orangeade, cola, consisting of ordinary drinking water, sweetened, flavoured with fruit juices/ compound extracts and often aerated with Carbon-di-oxide gas and presented in bottles or other airtight containers.

In the case at hand, the manufacturing process of the products involves addition of fruit juice (Lime/ Orange), sugar, ingredients, flavours to filtered water in a blending tank, which is chilled at 5°C in the Chilling Tank and then passed through Juice& CO2 Mixing Unit after which the same is bottled for supply in various quantities such as 200 ml, 300 ml, 600 ml, 1500 ml, etc. and are sold as ‘Carbonated Beverage with fruit juice’. These beverages fall squarely under the category mentioned in the Para (A) (2) of the Explanatory Notes above. That is they are classifiable under CTH 220210.

6.5 As per the First Schedule to Customs Tariff, CTH 22021010 covers ‘Aerated waters’. CTH 22021020 covers ‘Lemonade’ and CTH 22021090 covers ‘Others’. To further classify them, we may resort to the FSSAI regulations above to understand what aerated waters are.

Para 2.10.6 BEVERAGES NON-ALCOHOLIC – CARBONATED

1. CARBONATED WATER means water conforming to the standards prescribed for Packaged Drinking Water under Food Safety and Standard Act, 2006 impregnated with carbon dioxide under pressure and may contain any of the following singly or in combination:

Sugar, liquid glucose, dextrose monohydrate, invert sugar, fructose, honey, fruits and vegetables extractives and permitted flavouring, colouring matter, preservatives, emulsifying and stabilising agents, citric acid, numeric acid and sorbitol, tartaric acid, phosphoric acid, lactic acid, ascorbic acid, malic acid, edible gums such as guar, karaka, carobean, furcellaran, tragacanth, gum ghatti, edible gelatin, albumin, licorice and its derivatives, salts of sodium, calcium and magnesium, vitamins, Caffeine not exceeding 145 parts per million, Estergum (Glycerol ester of wood resin) not exceeding 100 parts per million, Gellan Gum at GMP level and quinine salts not exceeding 100 parts per million (expressed as quinine sulphate). It may also contain Saccharin Sodium not exceeding 100 ppm or Acesulfame-K not exceeding 300 ppm or Aspertame (methyl ester) not exceeding 700 ppm. Or sucralose not exceeding 300 ppm or Neotame not exceeding 33 ppm.

Category 14.1.1 of Appendix A to the regulations states

14.1.1 Waters

Includes natural waters (14.1.1.1) and other bottled waters (14.1.1.2), each of which may be noncarbonated or carbonated.

14.1.1.2 Table waters and soda waters

Includes waters other than natural source waters that may be carbonated by addition of carbon dioxide and may be processed by filtration, disinfection, or other suitable means. These waters may contain added mineral salts such as table water, bottled water with or without added minerals, purified water, seltzer water, club soda, and sparkling water. Carbonated and non-carbonated waters containing flavours are found in category 14.1.4

It is seen from the above that waters with added carbon dioxide which may contain added preservatives and flavoring , sugars are separately classified under Para 2.10.6 as Carbonated Water’ and Category 14.1.1.2 as ‘table waters and soda waters’ which are different from ‘Carbonated Fruit Beverages or Fruit Drinks’ of Para 2.3.30 and Category ‘14.1.4.1’ of FSSAI regulations. As discussed in Para 6.2 above, the applicants products are classified under Para 2.3.30 of FSSAI and not para 2.10.6. It is evident that the ‘carbonated water’ described in Para 2.1.0.6 of FSSAI regulations are the ‘Aerated Waters’ covered under CTH 22021010. Therefore, the applicant’s products are not classifiable as ‘Aerated Waters’ under CTH 22021010. Therefore, the products are either classifiable under CTH 22021020 or CTH 22021090 depending on the flavours. The various flavours added by the applicant depend on the fruit juice orange or lemon and added natural and artificial flavours such as ‘orange’, ‘lemon/lime’, ‘cola’, ‘jeer soda’ under various brand names of ‘Richyaa Darner’ and ‘Licta’. ‘Richyaa Darner Lemon’ and ‘Licta Lemon are classifiable under CTH 22021020 as they are lemonade and all others i.e. Richyaa Darner Cola’, ‘Licta Cola’, ‘Richyaa Darner Jeera Soda’, ‘Licta Jeera Masala, Richyaa Darner Orange’ and ‘Licta Orange’ are classifiable as ‘Other’ under CTH 22021090.

6.6 The Applicant has relied on the decision of Hon’ble Supreme Court in classification of ‘APPY FIZZ’ in case of M/s Parle Agro Ltd vs. Commissioner of Commercial Taxes, Trivandrum in the VAT regime. However, that ruling is not relevant here as the products are different and that ruling was based on the classification as per the Kerala VAT notifications. Under GST, classifications is based on First Schedule to the Customs Tariff Act, 1975.

7. In view of the foregoing, we rule as under:

RULING

The products to be supplied by the applicant are to be classified as ‘Richyaa Darner Lemon’ and ‘Licta Lemon’ are classifiable under CTH 22021020 and all others i.e. ‘Richyaa Darner Cola’, ‘Licta Cola’, ‘Richyaa Darner Jeera Soda’, ‘Licta Jeera Masala, ‘Richyaa Darner Orange’ and ‘Licta Orange’ are classifiable as ‘Other’ under CTH 22021090.