1. INTRODUCTION

1.1 Any person aggrieved by any decision or order passed by an adjudicating authority may appeal to Appellate Authority. An appeal is a request made to a higher judicial or quasi-judicial authority to review, uphold or and potentially overturn a decision made by a lower judicial or quasi-judicial authority. Tax law recognizes that on any given set of facts and laws, there can be different opinions or viewpoints/ interpretations hence, it is likely that the taxpayer may not agree with the “adjudication order” so passed by the tax officer. It is equally possible that the Department may itself not be in agreement with the adjudication order in some cases. It is for this reason that the statute provides further higher forums of appeal, to both sides. “Revisional Authority” means an authority appointed or authorised for revision of decision or orders as defined under Section 2(99) read with Section 108 of the CGST Act, 2017.

1.2 The relevant provisions for appeal and revision are contained in Chapter XVIII of the CGST Act, 2017, summary of which are as under-

| Sr. No. | Section/Rules | Provisions pertaining to |

| 1 | Section 2(8) | Definition of Appellate Authority |

| 2 | Section 2(99) | Definition of Revisional Authority |

| 3 | Section 107 | Appeals / Application to Appellate Authority |

| 4 | Section 108 | Powers of Revisional Authority |

| 5 | Section 109 | Constitution of Appellate Tribunal and Benches thereof |

| 6 | Section 110 | President and Members of Appellate Tribunal, their qualification, appointment, conditions of service, etc. |

| 7 | Section 111 | Procedure before Appellate Tribunal |

| 8 | Section 112 | Appeals to Appellate Tribunal |

| 9 | Section 113 | Orders of Appellate Tribunal |

| 10 | Section 115 | Interest on refund of amount paid for admission of appeal |

| 11 | Section 116 | Appearance by authorised representative |

| 12 | Section 117 | Appeal to High Court |

| 13 | Section 118 | Appeal to Supreme Court |

| 14 | Section 119 | Sums due to be paid notwithstanding appeal, etc. |

| 15 | Section 120 | Appeal not to be filed in certain cases |

| 16 | Section 121 | Non-appealable decisions and orders |

| 17 | Rule 108 | Appeal to the Appellate Authority |

| 18 | Rule 109 | Application to the Appellate Authority |

| 19 | Rule 109A | Appointment of Appellate Authority |

| 20 | Rule 109B | Notice to person and order of revisional authority in case of revision |

| 21 | Rule 109C | Withdrawal of Appeal |

| 22 | Rule 110 | Appeal to Appellate Tribunal |

| 23 | Rule 111 | Application to Appellate Tribunal |

| 24 | Rule 112 | Production of additional evidence before the Appellate Authority or the Appellate Tribunal |

| 25 | Rule 113 | Order of Appellate Authority or Appellate Tribunal |

| 26 | Rule 114 | Appeal to High Court |

| 27 | Rule 115 | Demand confirmed by the Court |

| 28 | Rule 116 | Disqualification for misconduct of an authorised representative |

| 29 | Rule 26 | Method of authentication |

1.3 Any person aggrieved by any decision or order passed under this Act by an adjudicating authority may appeal before the higher judicial/ quasi-judicial authority as prescribed. Under the Act, both the taxpayer and the department have been conferred with a right of remedies against the order passed by the adjudicating authority.

1.4 Appeals do not always originate from adjudication orders, but in taxation laws, people are often allowed to appeal, in court, against a communication of the decision made by executive bodies, which can be either the Commissioner(s)/ Commissionerate(s) or any other jurisdictional body. Appeals can be either discretionary or of right. A right of appeal of right is the one that the higher judicial or quasi-judicial authority must hear, if the losing party demands it, while a discretionary appeal is the one that the higher court may, but does not have to, consider.

1.5 Appeal is the right to get remedy guaranteed by law to each and every individual by our constitution and declining the same will render the whole process ultra vires to the constitutional provisions. In this way the losing party is able to have the decision reviewed by another independent authority or judge or judges. The judicial or quasi-judicial authority determining an appeal will correct errors by the primary quasi-judicial//judicial authority and the right of appeal ensures that, as far as possible, appellate authorities arrive at correct decisions. The decisions of appellate courts are fully reasoned and widely available.

1.6 A person who is aggrieved by a decision or order passed against him by an adjudicating authority, can file an appeal to the Appellate Authority within 3 months from the date of communication of the impugned order along with minimum 10% of disputed amount as pre-deposit.

1.7 The aggrieved person pursuing an appeal is called an appellant, while the person defending the ruling is called the respondent.

1.8 Deciding appeal under this Act is a quasi-judicial function of the authority. Hence, the Appellate Authority has to follow the principles of natural justice – such as hearing the appellant, allowing reasonable adjournments (not more than 3), permitting additional grounds (if found reasonable), etc. On conclusion of the appeal process, the Appellate Authority will pass his speaking order (Order-in-Appeal) which may confirm, modify or annul the decision or order appealed against. The Order-in-appeal has to be a “speaking order” i.e. it should state the points for determination, the decision thereon and the reasons for the decision.

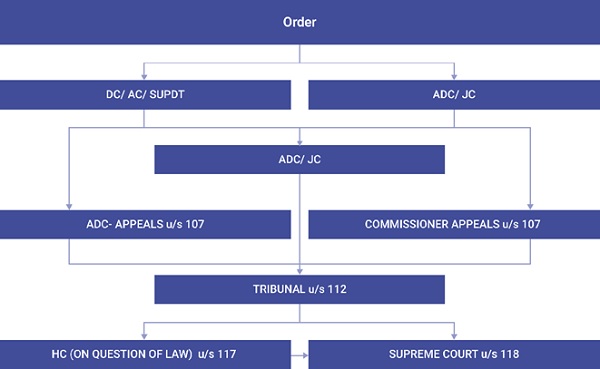

1.9 Appellate Stages: The Appellate remedy available for order passed by different adjudicating authorities is as follow: –

| Sr No | Order passed by | Appellate Authority | |

| 1 | All officers upto AC/DC | Joint/ Additional Commissioner (Appeals) (u/s 107) | |

| 2 | JC/ADC | Commissioner (Appeals) (u/s 107) | |

| 3 | All officers upto & including JC/ADC | Revisional Authority (u/s 108) | |

| 4 | ADC (Appeals) & Commissioner (Appeals) | Tribunal (to be formed) (u/s 112) | |

| 5 | Tribunal | High Court on question of law (u/s 117) | |

| Supreme Court (u/s 118) | |||

| 6 | High Court | Supreme Court (u/s 118) | |

FLOW CHART

* Amount of mandatory pre-deposit for fi ling appeal before Commissioner (Appeals) or ADC/ JC (Appeals) is equal to the admitted liabilities [S. 107 (6) (a)] and 10% of remaining amount of tax in dispute arising out of the impugned order subject to maximum of Rs. 25 Crores or/and 25% of penalty amount for the cases covered under Section 129(3) [S. 107 (6) (b)] and appeal by taxpayer should be fi led within 3 months [s. 107 (1)] and by department within 6 months [S. 107 (2)].

** Amount involved should not be less than Rs. 50,000/- at the discretion of the Appellate Tribunal [S. 112 (2)]. Amount of mandatory pre-deposit for fi ling appeal before Tribunal is equal to the admitted liabilities and 20% of remaining amount of tax in dispute arising out of the appellate order (over and above an amount of 10% already paid under S/ 107 (6)(b)), subject to maximum of Rs. 50 Crores [S. 112 (8) (b)] and appeal by taxpayer should be fi led within 3 months [S. 112 (1)] and by department within 6 months [S. 112 (3)] from the date of communication of the Order-in-Appeal.

*** As per Section 117 of CGST Act, 2017 an appeal shall lie to the High Court of any order passed by the Principal Bench/State Bench of Appellate Tribunal in cases wherein the Hon’ble High Court is satisfi ed that the case involves a substantial question of law.

**** As per Section 118 of CGST Act, 2017 an appeal shall lie to the Supreme Court of any order passed by the Principal Bench or State Benches of Appellate Tribunal or from judgement or order passed by the High Court in an appeal made under Section 117 of the Act.

Procedure Flow Chart

2. APPEAL AGAINST ADJUDICATION ORDER

2.1 GST law imposes certain obligation on the Taxpayer. The obligations are broadly of two types, viz., tax-related and procedure-related. The taxpayer’s compliance with these obligations is verified by the tax officer by various methods like scrutiny, audit, anti-evasion, etc. In this process sometimes situations of actual or perceived noncompliance arise. If the difference in views persists, it results into a dispute, which is then required to be resolved. The Act itself provides that the proper officer shall pass suitable adjudication order.

2.3 However, it is likely that the taxpayer may not agree with the “adjudication order” so passed by the tax officer. It is equally possible that the Department may itself not be in agreement with the adjudication order in some cases. It is for this reason that the statute provides further higher forums of appeal, to both sides.

2.4 The right to appeal is a statutory right. The time limits prescribed by the statute for filing of appeals and the requirement of pre-deposit of a certain sum, before the appeal can be heard by the competent authority, are examples of check mechanism /deterrent to prevent mis-use on the statutory right.

2.5 The Section 6(1) of the Act makes provisions for cross empowerment between CGST and SGST/ UTGST officers so as to ensure that if a proper officer of one Act (say CGST) passes an order with respect to a transaction, he will also act as the proper officer of SGST for the same transaction and issue the order with respect to the CGST as well as the SGST/UTGST component of the same transaction. However, Section 6(2) of the Act also provides that where a proper officer under one Act (say CGST Act) has passed an order, any appeal/review/revision/ rectification against the said order will lie only with the proper officers of that Act only (CGST Act, 2017). So also if any order is passed by the proper officer of SGST/UTGST, as the case may be, any appeal/review/revision/ rectification will lie with the proper officer of SGST/UTGST, as the case may be only.

3. APPELLATE MECHANISM

3.1 The Taxpayer or the Department if aggrieved by a decision or order passed by an adjudicating authority, can fi le an appeal to the Appellate Authority. It is important to note that only the aggrieved party can fi le the appeal and also, the appeal must be against a decision or order passed under this Act. The First Appellate Authority: –

(i) The fi rst appellate authority would be Joint/ Additional Commissioner (Appeals) where the adjudicating authority is Deputy or Assistant Commissioner or Superintendent. or

(ii) The fi rst appellate authority would be Commissioner (Appeals) where the adjudicating authority is Additional or Joint Commissioner.

3.2 It is to be noted that as per provisions contained in Section 121 of the CGST Act, 2017, no appeals, whatsoever, can be filed against the following orders:

(a) an order of the Commissioner or other authority empowered to direct transfer of proceedings from one officer to another officer; or

(b) an order pertaining to the seizure or retention of books of account, register etc.; or

(c) an order sanctioning prosecution under the Act; or

(d) an order passed under section 80 (payment of tax in instalments).

4. APPEAL BY THE TAXPAYER

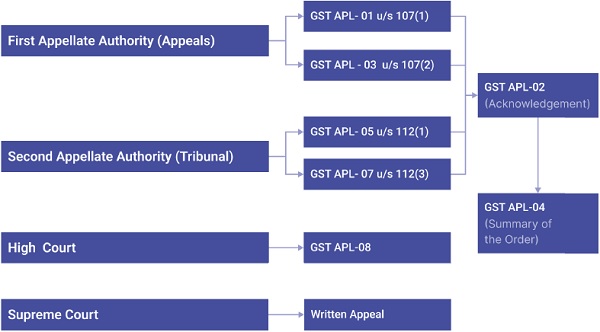

4.1 The taxpayer can file the appeal in FORM GST APL-01 along with the relevant documents within 3 months from the date of communication of the order of adjudicating authority [S.107 (1)], which can be further extended by, one month, on sufficient cause being shown [S.107 (4)]. On filing of the appeal a provisional acknowledgement shall be issued to the appellant. (Section 107(1) & (4) of CGST Act 2017)

4.2 The Ground of Appeal and the form of verification contained in FORM GST APL-01 shall be submitted electronically with digital signature certificate or through e-signature.

4.3 Certified copy of the decision or order shall be submitted within seven days of filing the appeal. The final acknowledgement indicating the appeal number shall be issued in FORM GST APL-02 by the Appellate Authority or the officer authorised by him.

4.4 The date of filing of the appeal shall be the date of issue of provisional acknowledgement where the certified copy of the decision/order is submitted within seven days and where the said copy is submitted after seven days, the date of filing of the appeal shall be the date of submission of such copy.

4.5 Besides the procedural part of appeal, the appellant (taxpayer) is required to pay entire amount of tax admitted with interest, fine and penalty [S.107 (6)(a)] and 10% of the remaining tax amount, subject to a maximum of Rs. 25 crores [S.107 (6)(b)], with exception of appeals under Section 129, where the amount required to be paid is 25%. These payments are known as pre-deposit. (Section107(6)(a)(b) and 129 of CGST Act 2017)

4.6 The recovery proceedings against the balance amount stands stayed, after making the pre-deposit while filing of appeal [S.107 (7)]. (Section 107(7) of CGST Act, 2017)

4.7 The principles of natural justice are of essential nature in all judicial proceedings and appeals are no different.

Hence, it is incumbent upon the appellate authority to grant personal hearing to the taxpayer, irrespective of whether he is appellant or respondent [S.107 (8)], and it can be extended on sufficient grounds [S.107 (8)], subject to a maximum of 3 adjournments [S.107 (9)]. (Section 107(8), (8)(a) & (9) of CGST Act 2017)

4.8 If the grounds of appeal contain any omission, which was neither wilful nor unreasonable, such omissions can be allowed to be added during but before completion of this process [S.107 (10)]. (Section 107(10) of CGST ACT 2017) (Section 107(12) & (13) of CGST Act 2017)

4.9 The appellate authority, wherever it is possible to do so, shall pass detailed and reasoned order in writing against the appeal [S.107 (12)], within one year of the appeal being filed [S.107 (13)], except for the instances where issuance of order is stayed by an order of a court or Tribunal, and the period of such stay shall be excluded in computing the period of one year.

5. HANDLING OF FIRST STAGE APPEAL MADE BY THE TAXPAYER

5.1 All decisions to file an appeal or to accept an order by the adjudicating authorities are taken at Headquarters of the Commissionerate, therefore, it is imperative upon the officers working in Appeal/ Review/ Legal Sections in the Headquarters to understand the need of urgency in appeal matter and act swiftly.

5.2 It is desirable that the Inspectors/ Superintendents, working in Appeal/ Review/ Legal sections, maintain register/s, which should contain the details available in the order, such as Name & address of the taxpayer, Designation of adjudicating authority, SCN number & date, OIO number & date, amount involved, date of receipt of order in HO, issue in brief & last date for filing of appeal. These details can be filled up immediately on receipt of the order in original.

5.3 Division office, Range Office and all concerned sections in the Commissionerate should send copies (either in physical or digital form) of SCN, taxpayers submissions, etc., as a matter of rule, so that no delay is caused in assimilating these vital documents.

5.4 The file shall be processed at the earliest by the officers, and put up to the next level, so as to make it available to the ‘Proper Officer’, at the earliest, for considering the merits of the case. Proposals/ suggestions, with regard to the next course of action should be logical, legal and keeping in mind the judicial pronouncements.

5.5 As soon as a decision is made about future course of action, an entry should be made in the ‘register’, as to whether the order has been accepted or is proposed to be appealed against. If it is decided to appeal against the order, the concerned section should be asked to immediately digitalize all the ‘original’ documents – specially the relied upon documents’ so that, the same could be presented before the forum, where it is being put up, in case need so arises. History of several failed appeals in past, has the ingredient of non-availability of original documents. A note should also be kept on the file, regarding the location of such digital records, so that, it can be easily traced when needed, and without any delay.

5.6 The officers in the section, should monitor, the process of filing appeal and as soon as the appeal is filed, make an entry in ‘the register’, showing the forum at which appeal is filed and date of filing of appeal.

5.7 Information from the taxpayer about having challenged an order, is accompanied by a copy of appeal. Immediately on receipt of a copy of the appeal, the officer concerned is required to conduct a primary check of date of filing of appeal & date of receipt of the order appealed against. If the appeal is time barred, it should be checked if any application has been filed by the taxpayer for condonation of delay. If not, then the appellate authority should be informed immediately about the delay, which will render the appeal liable for rejection.

5.8 The officer concerned should also go through the contents of the appeals, especially the section containing ‘facts of the case’ and if there is any misrepresentation of the facts, it should be categorically brought to the notice of the appellate authority.

5.9 At times, it is seen that some of the decisions of Tribunal, High Courts & Supreme Court are reversed at later stage. Therefore, case laws relied by the taxpayer in their appeal should be checked out to examine, understand and come to a conclusion as to whether those are still effective or have been ruled out by the Courts. Many a times, the courts have conflicting views of same matter. The taxpayer and their legal luminaries will rely only on such pronouncements which are in their favour. It is for the departmental officers to point out pronouncements which are in favour of department, so that, such orders can also be brought to the notice of the appellate authority, which will help in fair analysis of the situation and correct legal pronouncements.

5.10 If the decision in first stage appeal is against the department, similar exercise, which was carried out at the time of processing of file for first stage appeal, needs to be carried out with due approval of the competent authority.

6. APPEAL BY THE DEPARTMENT

6.1 The department has a period of 6 months from the date of communication of the decision or order of the adjudicating authority to file an appeal [S.107 (2)], which can be further extended by, one month, on sufficient cause being shown [S.107 (4)]. (Section 107(2) & (4) of CGST Act 2017)

6.2 The Commissioner, either suo-moto or under reference from equivalent officer of either State or Union Territory, call for the records of the case and examines the legality or propriety of the said decision or order. He may, by order, specifically determine the points arising out of the decision and direct any officer subordinate to him to apply to the Appellate Authority, by the officer so authorized by him. [S. 107 (3)]. (Section 107(3) of CGST Act 2017)

6.3 The Application is required to be filed in FORM GST APL-03, along with the relevant documents.

6.4 If the decision or order appealed against is uploaded on the common portal then a final acknowledgement indicating appeal number shall be issued in FORM GST APL-02 by the Appellate Authority or an officer authorised by him and the date of issue of the provisional acknowledgement shall be considered as the date of filing of appeal/application.

6.5 If the decision or order appealed against is not uploaded on the common portal, the appellant (Department) shall submit a self-certified copy of the said decision or order within a period of seven days from the date of filing of the application and a final acknowledgement, indicating appeal number, shall be issued in FORM GST APL-02 by the Appellate Authority or an officer authorised by him and the date of issue of the provisional acknowledgement shall be considered as the date of filing of appeal. In case the self-certified copy of the decision or order is not submitted within a period of seven days then the date of submission of such copy shall be considered as the date of filing of appeal.

7. WITHDRAWAL OF APPEAL

7.1 In terms of Rule 109C of CGST Rules, 2017, the appellant (either supplier or the Department) may, at any time before issuance of show cause notice under sub-section (11) of Section 107 or before issuance of the order under the said sub-section, whichever is earlier, file an application for withdrawal of the said appeal by filing an application in FORM GST APL-01/03W, as the case may be. (Section 107(11) of CGST Act, 2017 and Rule 109C of CGST Rules, 2017)

7.2 If the final acknowledgement in FORM GST APL-02 has been issued, the withdrawal of the said appeal would be subject to the approval of the appellate authority. The application made for withdrawal of the appeal shall be decided by the appellate authority within seven days of filing of such application.

7.3 Any fresh appeal filed by the appellant pursuant to such withdrawal shall be filed within three months or six months, as the case may be, specified in sub-section (1) or sub-section (2) of section 107. (Section 107(1)&(2) of CGST Act 2017)

8. ORDER OF APPELLATE AUTHORITY

8.1 The Appellate Authority shall pass the order, confirming, modifying or annulling the decision or order appealed against but shall not refer the case back (remand back) to the adjudicating authority that passed the said decision or order under section 107(11) of the Act.

8.2 An order enhancing any fee or penalty or fine in lieu of confiscation or confiscating goods of greater value or reducing the amount of refund or input tax credit shall not be passed unless the appellant has been given a reasonable opportunity of showing cause against the proposed order under first proviso under section 107(11) of the Act. (Section 107(11) of CGST Act 2017)

8.3 Where the Appellate Authority is of the view that any tax has not been paid or short-paid or erroneously refunded, or where input tax credit has been wrongly availed or utilised, the order requiring the appellant to pay such tax or input tax credit shall be passed only after the appellant is given notice to show cause against the proposed order and the order is passed within the time limit specified under section 73 or section 74 under second proviso to section 107(11) of the Act. (Section 73 & 74 of CGST Act, 2017)

8.4 The order of the Appellate Authority disposing of the appeal shall be a speaking order in writing and should provide a detailed reasoning for the points for determination and the decision thereon. [S. 107(12)]

8.5 The Appellate Authority shall, where it is possible to do so, hear and decide every appeal within a period of one year from the date on which it is filed. If the issuance of order is stayed by an order of a court or Tribunal then the period of such stay shall be excluded in computing the period of one year.

8.6 The Appellate Authority shall communicate the order passed to the appellant, respondent and to the adjudicating authority. A copy of the order shall also be sent to the jurisdictional Commissioner or the authority designated by him in this behalf and the jurisdictional Commissioner of State tax or Commissioner of Union Territory Tax or an authority designated by him in this behalf.

8.7 Every order passed under section 107(11) shall, subject to the provisions of section 108 or section 113 or section 117 or section 118 be final and binding on the parties. (Section 107(11) of CGST Act , 2017)

8.8 The Appellate Authority shall, along with its order under section 107(11) of the Act, issue a summary of the order in FORM GST APL-04, indicating the final amount of demand confirmed. [Rule 113(1)]

9. REVISION BY REVISIONAL AUTHORITY

9.1 ‘Revisional Authority’ has been defined under Section 2 (99) of the CGST Act, 2017, as an authority appointed or authorized for revision of decision or orders as referred in Section 108. The underlying principle for approaching the Revisional Authority, is that, subject to provisions of Section 121 of the Act and any rules made thereunder, the order under consideration should be ‘prejudicial’ to the interest of revenue [S. 108 (1)] and is illegal or improper or has not taken into account certain material facts, whether available at the time of issuance of the said order or not or in consequence of an observation by the Comptroller and Auditor General of India, he may, if necessary, stay the operation of such decision or order for such period as he deems fit and after giving the person concerned an opportunity of being heard and after making such further inquiry as may be necessary, pass such order, as he thinks just and proper, including enhancing or modifying or annulling the said decision or order. This underlying principle makes it clear that no tax-payer would be approaching this authority, as it is designated to cover only such cases, which are against the interest of revenue. (Section 2(99), 108 & 108(1) of CGST Act, 2017)

9.2 The CGST Act, 2017, provides for Revisional Authority (RA), to take cognizance of any order passed by an officer sub-ordinate to him is erroneous suo-moto or under reference from Commissioner(s), subject to the provisions of Section 121 of the Act, stay the operation of such decision or order for such period, as he deems fit and after giving the person concerned an opportunity of being heard and after making further inquiry, if necessary, pass order, as he thinks just and proper, including enhancing or modifying or annulling the said decision or order [S. 108 (1)], as prescribed in FORM GST RVN-01, after giving him a reasonable opportunity of being heard. (Section 121 & 108(1) of CGST Act, 2017)

9.3 However, RA shall not exercise these powers in cases where:-

– an appeal has already been filed against the order [S. 108 (2)(a)] or (Section 108(2)(a), (b), (c) & (d) of CGST Act, 2017)

– period of appeal has not expired or more than 3 years have lapsed since the issue of the order [S. 108 (2)(b)], or

– the order has previously been taken for revisions [S. 108 (2)(c)], or

– an order has already been passed under Section 108(1) [S. 108 (2)(d)].

An exception has been provided to these instances under proviso to Section 108 (2) (d) whereby the RA may pass an order on any point which has not been raised and decided in an appeal before the expiry of a period of one year from the date of the order in such appeal or before the expiry of a period of three years referred to in clause (b) of that sub-section, whichever is later.

9.4 Every order passed in revision under sub-section (1) of Section 108 of the Act shall, subject to the provisions of Section 113 or Section 117 or Section 118, be final and binding on the parties. There are some exceptions related to limitations as per sub-sections (4) & (5) to Section 108 where such order is stayed by the court or Appellate Tribunal. (Section 113, 117, 118 & 108(4) (5) of CGST Act 2017)

9.5 It is relevant to note that RA is totally different and distinct from the appellate authorities and has its task, jurisdiction and nature of work clearly cut out. In almost all cases, it is the revenue which would be approaching the Revisional Authority in cases of orders passed by officers subordinate to him is prejudicial in interest of revenue. An application has to be made before any appeal is filed against the order, against which the Revisional Authority is being approached. Once an appeal is filed, the proceedings become void.

9.6 Let’s consider a hypothetical situation, where the adjudicating authority, i.e., Superintendent or DC/ AC or ADC/ JC, passes an order–in-original, thereby setting aside the demand notice. In other words, if the case is decided in favour of a taxpayer it is natural that the taxpayer will not go in appeal. Legal parameters at the material time are such that the order appears to be correct even legally to the department, hence, it results in acceptance of the order–in–original. Say, after lapse of a year, there is a judicial pronouncement, which changes the legal principle and interpretation, relying on which benefit was extended to the taxpayer and demand was set-aside. In such instances, the Commissioner, can stay such order and revisit the entire issue, either on his own, or on any reference being made to him, in his capacity as being Revisional Authority, follow principles of natural justice, and then pass an order as per the legal provisions. The essence of having Revisional Authority, is that it can protect the department from potential revenue loss, upto 3 years from the date of issuance of orders by the adjudicating authority, whereas time limit to appeal before any of the appellate body is 180 days/ 90 days.

9.7 Notification No. 05/2020- Central Tax, dated 13th January, 2020, authorizes following officers as Revisional Authorities:

(a) Principal Commissioner or Commissioner of Central Tax for decisions or orders passed by the Additional or Joint Commissioner of Central Tax; and

(b) Additional or Joint Commissioner of Central Tax for decisions or orders passed by the Deputy Commissioner or Assistant Commissioner or Superintendent of Central Tax.

10. APPEALS TO APPELLATE TRIBUNAL – GSTAT (GOODS & SERVICES TAX APPELLATE TRIBUNAL)

10.1 The Appellate Tribunal is the second level of appeal, where appeal can be filed against the Order-in-Appeal passed by the first Appellate Authority or order in revision passed by Revisional Authority, by any person aggrieved by such an order-in-appeal/order in revision. If the taxpayer or department is aggrieved with order-in-appeal passed by the Appellate Authority, the aggrieved parties have a right to approach the Hon’ble Tribunal. Section 112 of the CGST Act, 2017 provides that any person aggrieved by an order passed against him under Section 107 or Section 108 of this Act may appeal to the Appellate Tribunal against such order within three months. (Section 107, 108 & 112 of CGST Act, 2017)

10.2 Sections 109, 110 & 111 of the CGST Act, 2017, lay down the constitution, composition, jurisdiction, qualification of the members of Tribunal, etc. (Section 109, 110 & 111 of CGST Act, 2017)

10.3 Appeal against order of Appellate Authority or Revisional Authority lies before Appellate Tribunal. Appellate Tribunal is a quasi-judicial authority.

10.4 The jurisdiction, powers and authority conferred on the Appellate Tribunal shall be exercised by the Principal Bench and the State Benches constituted under section 109(3) of CGST Act, 2017 and section 109(4) of CGST Act, 2017.(Section 109(3) & (4) of CGST Act, 2017)

10.5 The cases in which any one of the issues involved relates to the place of supply, shall be heard only by the Principal Bench (Section 109(5) of CGST Act, 2017). (Section 109(5) of CGST Act, 2017)

10.6 The matter will be heard by division bench when issue involved exceeds Rs. 50 lakhs or where question of law is involved (in such cases, the amount can be less than Rs. 50 lakhs).

10.7 Appeals, where the tax or input tax credit involved or the amount of fine, fee or pen¬alty determined in any order appealed against, does not exceed fifty lakh rupees and which does not involve any question of law may be heard by a single Member, and in all other cases, shall be heard together by one Judicial Member and one Technical Member (Section 109(8) of CGST Act, 2017). (Section 109(8) of CGST Act, 2017)

10.8 If, after hearing the case, the Members differ in their opinion on any point or points, such Member shall state the point or points on which they differ, and the President shall refer such case for hearing –

(a) where the appeal was originally heard by Members of a State Bench, to another Member of a State Bench within the State or, where no such other State Bench is available within the State, to a Member of a State Bench in another State

(b) where the appeal was originally heard by Members of the Principal Bench, to another Member from the Principal Bench or, where no such other Member is available, to a Member of any State Bench.

Such point or points shall be decided according to the majority opinion including the opinion of the Members who first heard the case. (Section 109(11) of CGST Act, 2017). (Section 109(11) of CGST Act, 2017)

10.9 Appellate Tribunal is not bound by Code of Civil Procedure but will be guided by principles of natural justice. Appellate Tribunal has same powers as civil court in specified matters – Section 111 (1) of CGST Act, 2017. (Section 111 (1) & (2) of CGST Act, 2017)

10.10 All proceedings before Appellate Tribunal are judicial proceedings.

10.11 The Tribunal has the powers to remand back the case to the Appellate Authority or the Adjudicating Authority, as the case may be.

10.12 GSTAT (Goods & Service Tax Appellate Tribunal) has been formed vide Notification S.O. 4073(E) dated 14.09.2023, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (ii), issued under F. No. A-50050/150/2018-CESTAT-DoR, and will have total 31 Benches, across the country.

10.13 The list of GSTAT Benches and state-wise locations are detailed below:-

| S No | State Name | No. of Benches | Location |

| 1 | 2 | 3 | 4 |

| 1 | Andhra Pradesh | 1 | Vishakhapatnam and Vijayawada |

| 2 | Bihar | 1 | Patna |

| 3 | Chhattisgarh | 1 | Raipur and Bilaspur |

| 4 | Delhi | 1 | Delhi |

| 5 | Gujarat | 2 | Ahmedabad, Surat and Rajkot |

| 6 | Dadra & Nagar Haveli & Daman & Diu | ||

| 7 | Haryana | 1 | Gurugram & Hissar |

| 8 | Himachal Pradesh | 1 | Shimla |

| 9 | Jammu and Kashmir | 1 | Jammu & Srinagar |

| 10 | Ladakh | ||

| 11 | Jharkhand | 1 | Ranchi |

| 12 | Karnataka | 2 | Bengaluru |

| 13 | Kerala | 1 | Ernakulum and Trivandrum |

| 14 | Lakshadweep | ||

| 15 | Madhya Pradesh | 1 | Bhopal |

| 16 | Goa | 3 | Mumbai, Pune, Thane, Nagpur, Aurangabad and Panaji |

| 17 | Maharashtra | ||

| 18 | Odisha | 1 | Cuttack |

| 19 | Punjab | 1 | Chandigarh and Jalandhar |

| 20 | Chandigarh | ||

| 21 | Rajasthan | 2 | Jaipur and Jodhpur |

| 22 | Tamil Nadu | 2 | Chennai, Madurai, Coimbatore and Puducherry |

| 23 | Puducherry | ||

| 24 | Telangana | 1 | Hyderabad |

| 25 | Uttar Pradesh | 3 | Lucknow, Varanasi, Ghaziabad, Agra and Prayagraj |

| 26 | Uttarakhand | 1 | Dehradun |

| 27 | Andaman & Nicobar Islands | 2 | Kolkata |

| 28 | Sikkim | ||

| 29 | West Bengal | ||

| 30 | Arunachal Pradesh | 1 | Guwahati, Aizawl (Circuit), Agartala (Circuit),

Kohima (Circuit) |

| 31 | Assam | ||

| 32 | Manipur | ||

| 33 | Meghalaya | ||

| 34 | Mizoram | ||

| 35 | Nagaland | ||

| 36 | Tripura |

Explanation- Locations shown as ‘Circuit’ shall be operational in such manner as the President may order, depending upon the number of appeals filed by suppliers in the respective States.

11. APPEALS FILED BY THE Taxpayer BEFORE TRIBUNAL

11.1 The taxpayer can file appeal before the tribunal against order of Appellate Authority (who may be ADC (Appeals) or Commissioner (Appeals); depending on the Order-in-original) or Revisional Authority. (Section 112(1) of CGST Act, 2017) (Section 112 (1) of CGST Act 2017)

11.2 The period to file an appeal before the Tribunal is within three months from the date on which the order sought to be appealed against is communicated to the taxpayer preferring the appeal.

11.3 Since the Tribunal was not constituted at the time of enactment of the Act, for all such orders passed by the Appellate Authority or Revisional Authority, which fall in the category of being appealed against at Appellate Tribunal level, the limitation time of three months will commence from the date on which the President or the State President, as the case may be, of the Appellate Tribunal after its constitution under Section 109, enters office.

[Refer CGST (Ninth Removal of Difficulties) Order, 2019 issued under Order No. 9/2019-C.T., dated 3.12.2019] [S.112 (1)]. (Section 112 (1) & (2) of CGST Act 2017)

11.4 The Tribunal has the discretion to refuse to admit any appeal where the amount involved is less than fifty thousand rupees. [S.112 (2)]

11.5 Besides the procedural part of appeal, the appellant (read taxpayer), is required to pay entire amount of tax admitted with interest, fine and penalty [S.112 (8)(a)], and 20% of the remaining tax amount, in addition to the amount paid under sub-section (6) of Section 107, (subject to maximum of Rs. 50 Crores) which is being subject to dispute [S.112 (8)(b)], by way of such appeal. These payments are known as pre-deposit. (Section 112 (8)(a) & (b) & 107(6) of CGST Act 2017)

11.6 The recovery proceedings against the balance amount stands stayed, after making the pre-deposit and filing of appeal. [S.112 (9)] (Section 112(9) of CGST Act, 2017)

11.7 An appeal to the Appellate Tribunal under sub-section (1) of Section 112 read with Rule 110(1) of the CGST Rules, 2017 shall be filed along with the relevant documents either electronically or otherwise, as may be notified by the Registrar, in FORM GST APL-05, on the common portal and a provisional acknowledgement shall be issued to the appellant immediately.

11.8 A memorandum of cross-objections to the Appellate Tribunal shall be filed either electronically or otherwise, as may be notified by the Registrar, in FORM GST APL-06.

11.9 Appellate Tribunal can condone delay in filing of appeal by the taxable person or applicant or departmental officer upto three months and cross objection upto 45 days, if it is satisfied that there was sufficient cause for not presenting it within specified period. (Section 112(6) of CGST Act, 2017) (Section 112(6) of CGST Act 2017)

11.10 A certified copy of the decision or order appealed against along with fees shall be submitted to the Registrar within seven days of the filing of the appeal and a final acknowledgement, indicating the appeal number shall be issued thereafter in FORM GST APL -02 by the Registrar. If the certified copy of the decision or order is submitted within seven days from the date of filing the FORM GST APL-05, the date of filing of the appeal shall be the date of the issue of the provisional acknowledgement and where the said copy is submitted after seven days, the date of filing of the appeal shall be the date of the submission of such copy.

11.11 The appeal shall be treated as filed only when the final acknowledgement indicating the appeal number is issued.

11.12 The fees for filing of appeal or restoration of appeal shall be one thousand rupees for every one lakh rupees of tax or input tax credit involved or the difference in tax or input tax credit involved or the amount of fine, fee or penalty determined in the order appealed against, subject to a maximum of twenty-five thousand rupees.

11.13 In case an amount paid by the appellant under Section 107(6) or Section 112(8) is required to be refunded consequent to any order of the Appellate Authority or of the Appellate Tribunal, interest at the rate specified under Section 56 shall be payable in respect of such refund, from the date of payment of the amount till the date of refund of such amount. (Section 115 of CGST Act, 2017) (Section 107(6), 112(8) & 115 of CGST Act 2017)

11.14 The Appellate Tribunal, after giving the parties an opportunity of being heard, pass such orders thereon as it thinks fit, confirming, modifying or annulling the decision or order appealed against or may refer the case back to the Appellate Authority or to Revisional Authority or to the original adjudicating authority, with directions for a fresh adjudication or decision, as the case may be, after taking additional evidence, if necessary. (Section 113(1) of CGST Act, 2017) (Section 113(1) of CGST Act 2017)

11.15 The Appellate Tribunal shall, where it is possible to do so, hear and decide every appeal within a period of one year from the date on which it is filed (Section 113(4) of CGST Act, 2017).

11.16 The Appellate Tribunal shall send a copy of every order passed to the Appellate Authority, or the Revisional authority or to the original adjudicating authority, as the case may be, the appellant, the jurisdictional Commissioner of CGST and the jurisdictional Commissioner or Commissioner of SGST/UTGST (Section 113(5) of CGST Act, 2017).

11.17 The Appellate Tribunal may amend any order passed by it under Section 113 (3) of Section 112 read with Rule11 (1), so as to rectify any error apparent on the face of record, if such error is noticed by it on its own accord, or is brought to its notice by the Commissioner or the other party to the appeal within a period of three months from the date of the order. Amendment which has the effect of enhancing an assessment or reducing a refund or input tax credit or otherwise increasing the liability of the taxpayer, shall not be made, unless the taxpayer has been given an opportunity of being heard. (Section 113 (3) of CGST Act 2017)

12. APPEALS FILED BY THE DEPARTMENT BEFORE TRIBUNAL

12.1 An application/appeal to the Appellate Tribunal under sub-section (1) of Section 112 read with Rule 11 (1) shall be filed along with the relevant documents either electronically or otherwise, as may be notified by the Registrar, in FORM GST APL-07, on the common portal and a provisional acknowledgement shall be issued to the appellant immediately. (Section 112 (1) of CGST Act 2017)

12.2 The CGST or SGST department has a period of 6 months to file an appeal against the order of the adjudicating authority [S.112 (3)]. The time of 6 months will commence from the date on which the President or the State President, as the case may be, of the Appellate Tribunal after its constitution under Section 109, enters office. [As per CGST (Ninth Removal of Difficulties) Order, 2019 issued under CBIC Order No. 9/2019-C.T., dated 3.12.2019] (Section 112(3) & 109 of CGST Act 2017)

12.3 The appeal is required to be filed, after the Commissioner, either suo-moto or under reference from equivalent officer of either state or union territory, calls for the records of the case and examines the legality or propriety of the decision or order. He may, by order, specifically determine the points arising out of the decision, direct any officer subordinate to him to apply to the Appellate Authority, by the officer so authorized by him. [S. 112 (3) & (4)] (Section 112 (3) & (4) of CGST Act 2017)

12.4 Memorandum of cross-objection is required to be filed within 45 days of receipt of notice that an appeal has been preferred under this section, by the party against whom the appeal has been preferred. [S. 112 (5)] (Section 112(5) of CGST Act 2017)

12.5 The Tribunal has power to admit appeal within 3 months of expiry of the period for appeal and also permit filing of memorandum of cross-objections within forty-five days after the expiry of the period, subject to the party showing sufficient cause for the delay. [S. 112 (6)] (Section 112(6) of CGST Act 2017)

12.6 The appeal is required to be filed in prescribed form, after due verification. No fees is payable in case of appeal by the Department.

12.7 The Department can file application for rectification of error or restoration of appeal or an application.

12.8 There shall be no fee for application made by the Department before the Appellate Tribunal for rectification of errors.

12.9 The Appellate Tribunal, after hearing both the parties, pass the orders, confirming, modifying or annulling the decision or order appealed against or may refer the case back (remand back) to the Appellate Authority or to Revisional Authority or to the original adjudicating authority, with directions for a fresh adjudication or decision, as the case may be, after taking additional evidence, if necessary. [Section 113(1)]

12.10 The Appellate Tribunal shall send a copy of every order passed to the Appellate Authority, or the Revisional authority or to the original adjudicating authority, as the case may be, the appellant, the jurisdictional Commissioner of CGST and the jurisdictional Commissioner or Commissioner of SGST/UTGST. (Section 113 (5) of CGST Act, 2017)

13. SECTION 115 -INTEREST ON REFUND OF AMOUNT OF AMOUNT PAID FOR ADMISSION OF APPEAL.

In the event of appeal filed by a taxpayer being decided in favour of the taxpayer, the amount of pre-deposit shall be refunded with interest at rate specified under Section 56 of the CGST Act, 2017. The period for payment of interest payable shall be computed from date of payment of pre-deposit till date of refund of the amount. (Section 115 & 56 of CGST Act 2017)

14. APPEALS BEFORE HON’BLE HIGH COURT

14.1 The law provides that either side (department or taxpayer), if aggrieved by any order passed by the Appellate Tribunal may file an appeal to the High Court within a period of one hundred and eighty days from the date of receipt of the order appealed against by the aggrieved person and the High Court may admit such appeal if it is satisfied that the case involves a substantial question of law. It is to be noted that on facts, the tribunal is the final authority. Appeals to High Court (HC) can be filed against any order passed by Tribunal, only if the case involves a substantial question of law. [S. 117(1)] (Section 117(3) of CGST Act 2017)

14.2 This means that cases involving interpretation of the statute or notification, will invariably land in the High Courts. Cases of clandestine removal, may go to HC, for appeal, if there is question of denial of evidences, process of natural justice, etc. [S. 117(3)]

14.3 The officers of legal section, should remain pro-active, in as much as, soon after receipt of the notice from taxpayer, regarding they approaching the HC, a detailed examination of the appeal should be done to come to a conclusion that there is question of law involved, and if there are no questions of law involved, efforts should be made to oppose the appeal at the stage of admission itself. (Section 117(1) of CGST Act 2017 & & Rule 114 (1) of CGST Rules, 2017)

14.4 An appeal to the High Court under Section 117(1) of the CGST Act, 2017, shall be filed in FORM GST APL-08.

14.5 The grounds of appeal and the form of verification as contained in FORM GST APL-08 shall be signed in the manner specified in Rule 26 of CGST Rules, 2017. (Rule 26 of CGST Rules, 2017)

14.6 The jurisdictional officer shall issue a statement in FORM GST APL-04 clearly indicating the final amount of demand confirmed by High Court.

14.7 Appeals before High Court should be filed within a period of 180 days. Appeals filed beyond the prescribed period may be entertained by the High Court, if sufficient cause is shown to explain the delay. [s. 117(2)]. (Section 117(2) of CGST Act 2017)

14.8 If the HC is satisfied that a substantial question of law is involved in the appeal, then such question shall be formulated and appeal shall be heard on such question of law.

14.9 The High Court and Supreme Court have absolute powers, and therefore, they have power to hear, for reasons to be recorded, the appeal on any other question of law, which was not formulated initially, if it is satisfied that such questions too are involved. [S. 117(3)] (Section 117(3) of CGST Act 2017)

14.10 Consequent to formulating question of law, the HC shall deliver such judgment containing the grounds on which the decision is founded. The HC has power to award cost, as it deems fit. [S. 117(4)] (Section 117(4) of CGST Act 2017)

14.11 The HC can determine any issue, which has either not been determined by the State Bench or Area Benches; or has been wrongly determined by the State Bench or Area Benches, by reason of a decision on such question of law. [S. 117(5)] (Section 117(5) of CGST Act 2017)

14.12 The appeal before HC shall be heard by a Bench of not less than two Judges of the High Court, and shall be decided in accordance with the opinion of such Judges or of the majority, if any, of such Judges. [S. (117)(6)] (Section 117(6) of CGST Act 2017)

14.13 In stalemate situation, the Judges shall state the point of law upon which they differ and the case shall then be heard upon that point only, by one or more of the other Judges of the High Court and such point shall be decided according to the opinion of the majority of the Judges who have heard the case including those who first heard it. [S. 117(7)] (Section 117(7) of CGST Act 2017)

14.14 Consequent to the judgment by HC, effect shall be given to such judgment by either side on the basis of a certified copy of the judgment. [S. 117 (8)] (Section 117(8) of CGST Act 2017)

14.15 The provisions of the Code of Civil Procedure, 1908, relating to appeals to the High Court shall apply in the case of appeals under Section 117 of the CGST Act, 2017. (Section 117 of CGST Act 2017)

15. APPEALS TO HON’BLE SUPREME COURT

15.1 The law provides for appeals to the Supreme Court from any judgment or order passed by the High Court, in any case which, on its own motion or on an oral application made by or on behalf of the party aggrieved, immediately after passing of the judgment or order, the High Court certifies to be a fit one for appeal to the Supreme Court. A direct appeal shall also lie to the Supreme Court from any orders passed by the Principal Bench of the Tribunal.

15.2 An appeal shall lie to the Supreme Court –

(a) from any order passed by the Principal Bench of Appellate Tribunal, or

(b) from any judgment or order passed by the High Court in an appeal made under Section 117 of the CGST Act, 2017 in any case which, on its own motion or on an application made by or on behalf of the party aggrieved, immediately after passing of the judg¬ment or order, the High Court certifies to be a fit one for appeal to the Supreme Court. (Section 117 of CGST Act 2017)

15.3 Appeals to Supreme Court can be filed against any order passed by Tribunal, or judgment or order passed by HC. [S. 118(1)] (Section 118 (1) of CGST Act 2017)

15.4 Consequent to the judgment by Supreme Court, effect shall be given to such judgment by either side on the basis of a certified copy of the judgment. [S. 118(3)] (Section 118(3) of CGST Act 2017)

15.5 Instructions issued by CBIC Board vide various circulars/Instructions on filing of Appeal before Hon’ble Supreme Courts, have to be strictly followed. Some of such Circular/Instructions are –

(a) Instruction No. S-29012/12/2017-ST-1-DoR, dated 27.11.2017

(b) Circular No. 1077/01/2021-CX, dated 19.01.2021

(c) Instruction F. No. 275/06/2022-CX.8A, dated 14.03.2022

16. SUMS DUETO BE PAID NOT WITHSTANDING APPEAL,ETC.

Section 119 of the CGST Act, 2017 stipulates that the Amount of tax, interest, penalty etc. due as payable, as a result of an order passed by the Principal Bench of the Appellate Tribunal under sub-section (1) of Section 113 or an order passed by the State Benches of the Appellate Tribunal under sub-section (1) of Section 113 or an order passed by the High Court under Section 117 (if appealed to Supreme Court), as the case may be, shall be payable in accordance with the order so passed, irrespective of the fact that an appeal has been preferred before High Court or Supreme Court. (Section 119, 113(1) & 117 of CGST Act 2017)

17. APPEAL NOT TO BE FILED IN CERTAIN CASES.

Appeals are to be filed by the revenue, subject to monetary limit fixed from time to time, as decided and communicated by the Board, on the recommendations of the Council [S. 120] (Section 120 of CGST Act 2017)

18. GENERAL GUIDELINES FOR APPEALS

18.1 Every order issued by the department is likely to be tested for its legality and propriety at appellate level, and hence, the preparations to counter the appeals by taxpayers as well as the possibility of the requirement of department going in appeal, should commence at the time of commencement of dispute itself, which can be either at the onset of an investigation against a taxpayer or conduct of audit on the records of the taxpayer.

18.2 The original documents resumed during the course of investigation, should be safely kept, and at the time of issue of demand notice, such documents should be carefully listed, paginated and handed over to the adjudicating authority. There have been many instances, where adjudication process has been vitiated due to non-availability of the original relied upon documents, which has resulted in either loss or locking up of precious Government revenue. Similarly, the original copies of statements of persons recorded during the course of investigation should be safe kept.

185 | Handbook of GST Law and Procedures

18.3 During the adjudication process, it is advisable and desirable that the adjudicating authority keeps all the original relied upon documents safe, or at least prepares and keeps digital copies of such documents, which will help in defending the orders. Original documents are important, which determines the final outcome of the appeals, especially in cases of clandestine removals, which involves huge Government revenue. The higher the revenue involved, higher are the chances of the defendants hiding behind the veil of technicalities.

18.4 The most important aspect is adhering to the time lines prescribed in the statutes. Therefore, as soon as the orders by adjudicating authorities or appellate bodies are received, it should be taken up for legal scrutiny notwithstanding the period available for filing of appeal. Last minute of processing the orders for filing of appeal can be hindered by technical glitches as well as unforeseen hindrances.

18.5 In so far as the departmental appeals are concerned, the courts on occasions have acceded to the request of condonation of delay, but many a times the courts have come down heavily on the department for long delays. One such case is the judgement passed by Hon’ble Supreme Court in July 2021, in the case of Union of India & Ors v/s M/s Vishnu Aroma Pouching Pvt. Ltd. & Anr. in SLP (CIVIL) Diary No(s). 1434/ 2021, wherein the Apex Court has come down heavily on the department for late filing of appeals. The department not only drew flak and criticism from the Hon’ble Supreme Court, but was also imposed costs of Rs.25,000/- to be recovered from the officers responsible for the delay and ordered the same to be deposited with the Supreme Court Advocates on Record Welfare Fund. Hon’ble Supreme Court further ordered to place a copy of the order before the Secretary, Ministry of Finance, Department of Revenue. In another incidence of delay, the Hon’ble Supreme Court in the order dated 19th December, 2022, imposed penalty of Rs. 1 lakh on UP Government, as cost.

18.6 In order to avoid such unpleasant situation, it is desirable that the files are processed in time, and hence, endeavours towards future course of action against any order should commence from the moment the order is received in the respective office, with first marking the date of receipt, then collecting all relevant documents.

18.7 In the quest to safeguard Government revenue, which is paramount objective, one should also be able to distinguish and differentiate that no frivolous appeals are filed. If the law is not in favour and the impugned order is judiciously correct and in line with previous judicial pronouncements, then, one should desist from going ahead with appeal in such cases, without looking at the ‘revenue’ implication, as it is the law which is the deciding factor and not the magnanimity of revenue.

18.8 Role of the department is not only limited to reviewing the orders and filing appeals, but it is also desirable from the officers of the executive Commissionerate that the appeals filed by the taxpayers are followed in right earnest. Many a times the taxpayer, knowingly/ unknowingly, deliberately/ unconsciously, mis-represents the facts of the case, especially those related to the facts of the matter, including the date of service of orders, etc. A copy of the appeal filed by the taxpayer, is always marked to the field officers. The field officers, immediately on receipt of the copies of the appeals, should examine the legality and propriety along with the facts of the case, as per available records and anomalies noticed, if any, should immediately be brought to the notice of the appellate authority.

18.9 The range officer can play an important role, if the law points raised in appeals are discussed with the concerned section/ officer handling the original adjudication of the appeals, as this will enable pointing out the correct legal position to the appellate authority and also weed out unnecessary citations relied upon by the taxpayer in their appeals. This will also help build a strong case for the department and if any new judgments/ pronouncements have come from SC/ HC or Tribunal, which impact the case in favour of revenue, same can be brought to the notice of the appellate authority.

19. ADDITIONAL EVIDENCES

19.1 All evidences should be normally submitted at the time of original hearing only. Additional evidence during appeal is normally allowed only in genuine cases. Any party cannot submit additional evidence, either oral or documentary, before Tribunal as a matter of right. The appellant shall not be allowed to produce before the Appellate Authority or the Appellate Tribunal any evidence, whether oral or documentary, other than the evidence produced by him during the course of the proceedings before the adjudicating authority or the Appellate Authority.

19.2 Additional evidence shall be permitted only in the following circumstances: –

(a) where the adjudicating authority or the Appellate Authority has refused to admit evidence which ought to have been admitted; or

(b) where the appellant was prevented by sufficient cause from producing the evidence which he was called upon to produce by the adjudicating authority or the Appellate Authority; or

(c) where the appellant was prevented by sufficient cause from producing before the adjudicating authority or the Appellate Authority any evidence which is relevant to any ground of appeal; or

(d) where the adjudicating authority or the Appellate Authority has made the order appealed against without giving sufficient opportunity to the appellant to adduce evidence relevant to any ground of appeal.

19.3 Additional evidence shall be admitted only after the Appellate Authority or the Appellate Tribunal records it in writing the reasons for its admission.

19.4 The Appellate Authority or the Appellate Tribunal shall not take any additional evidence unless the adjudicating authority or an officer authorised in this behalf by the said authority has been allowed a reasonable opportunity – [Rule 112(3) of the CGST Rules, 2017]

(a) to examine the evidence or document or to cross-examine any witness produced by the appellant.

(b) to produce any evidence or any witness in rebuttal of the additional evidence produced by the appellant.

*****

Source: Handbook of GST Law and Procedures for Departmental Officers issued by Ministry of Finance