Learn about Annexure V, a declaration form for Goods Transport Agencies (GTA) to opt for paying GST under forward charge, impacting tax liabilities and compliance procedures.

Annexure V –Form for exercising an option to pay GST by GTA under forward charge. With effect from July 18, 2022, a new structure for the payment of tax on GTA services has been introduced where the GTA if intends to opt to pay GST under forward charge will have to exercise the same before the beginning of the Financial Year.

If such an option is not exercised, the recipient must pay tax under reverse charge.

What is Annexure V:

When the Goods Transport Agency selects the option of paying tax under the forward charge mechanism, a declaration in Annexure V notified vide a CGST (Rate) Notification no. 03/2022 dated 13th July 2022 should be filed with the Jurisdictional Authority before the commencement of the financial year. [Options for GST rates available to GTA].

Importance:

In compliance of Notification No. 03/2022-Central Tax (Rate), dated 13th July, 2022, an option is being provided on the portal to all the existing taxpayers providing Goods Transport Agencies Services, desirous of opting to pay tax under the forward charge mechanism to exercise their option.

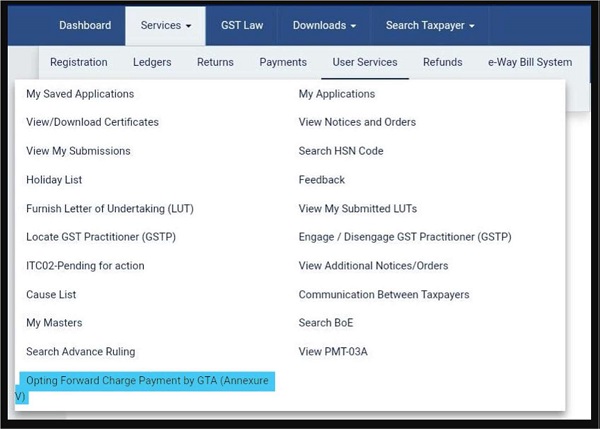

They can navigate Services User Services Opting Forward Charge Payment by GTA (Annexure V), after login, to submit their option on the portal.

Option in Annexure V FORM is required to be submitted on the portal by the Goods Transport Agencies every year before the commencement of the Financial Year.

The Option once filed cannot be withdrawn during the year and the cut-off date for filing the Annexure V FORM is 15th March of the preceding financial year.

Annexure V has been made available on the portal for GTA’s to exercise their option for the Financial Year 2023-24, which would be available till 15TH March 2023.

The declaration needs to be filed online:

Step-by-Step Process to Opt for Forward Charge and File Annexure V:

To opt to pay tax under forward charge, a GTA will need to follow these steps on the GST portal:

Step 1: Log in to the GST portal.

Step 2: Navigate to ‘Services’ -> ‘User Services’ -> ‘Opting Forward Charge Payment by GTA (Annexure V)’

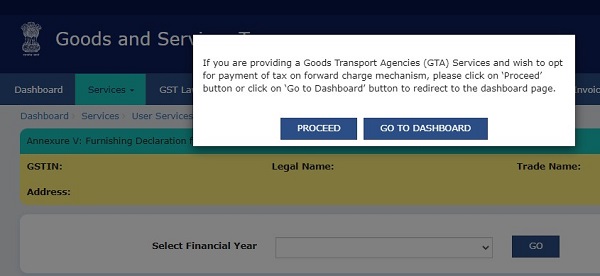

Step 3: A pop-up box opens on the screen, asking the user to confirm if they wish to opt to pay tax on a forward charge or return to the dashboard. Click on ‘Proceed’.

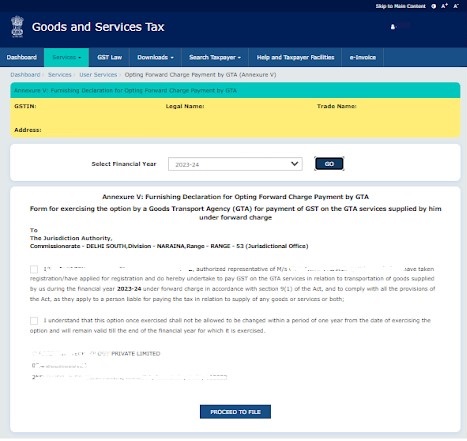

Step 4: Select the financial year and click on ‘Go’.

Step 5: Proceed to select the checkboxes against the two declarations and click on the ‘Proceed to file’ button at the bottom of the Annexure V form to submit.

Impact of Opting to Pay GST on Forward Charge

A GTA can opt to pay GST at 5% (without ITC) or 12% (with ITC) on their supplies. Some of the benefits of opting into the forward charge mechanism are:

- The GTA can be in control of their compliance and ensure that taxes are paid on their supplies.

- Opting into forward charge may have a positive impact on sales as the recipient of supplies is not burdened to calculate and pay the taxes.

- The GTA is given two different GST rates to choose from. In cases where their vendor base is non-compliant, they can opt for the 5% GST rate so that they do not need to deal with the hassles of claiming ITC.

CONCLUSION:

Once you opt for the forward charge for a financial year you cannot switch to the reverse charge mechanism. Declaration once filed cannot be withdrawn for that financial year.

******

The article is written by: Jeswin Priyanka [ Compliance Executive at NRSR & co]

Sir, we have filed Annexure V for the FY 2023-24 with in due date and my query is we wish to continue under FCM for the comming FY 2024-25, so whether we need to file Annexure V again for the FY 2024-25. If yes We have tryed for FY 2024-25, But messgae shown as message shown as ‘Declaration in Annexure V has already been filed for the selected Financial Year 2024-25 on dated 12/05/2023 and is still active. Click on Download Annexure V button to download the declaration’. But downloaded file is showing only FY 2023-24… Kindly advise me sir

I have taken registration on 14.08.2023. How can I file Annexure – V now as the due date has lapsed for FY 2023-24.

HOW TO KNOW GTA (TAXPAYER) FILE ANNEXURE V FORM FOR FORWARD CHARGE MECHANI (HOW TO DOWNLOAD ANNESURE V FORM AFTER FILLING )

I am Transporter at IOCL. Firstly i was in forward charge with12%(itc) and now because of not filling annnexure 5 i converted to reverse charge 5%. But i have around 5 lac in my credit ledger as itc now what to do with that balance. As now can i take refund of that unutilised itc??

Sir, Firstly we have to see section 18 whether operational. In our opinion, RCM need not be considered an exempt supply. In this case, liability is on the recipient. Hence you need not reverse the ITC. But you can’t claim the refund also. Because it is neither a zero-rated nor inverted duty structure. You can utilize the ITC in the subsequent year if you opt for FCM again.

GTA TO GTA ON RENTAL BASIS IS EXEMTED OF GST OR NOT???

The hiring of GTA service by another GTA is exempt. Entry 22(b) of notification no12/2017

The hiring of GTA service by another GTA is exempt. Entry 22(b) of notification no12/2017 in this case Annexure V is mandatry to file if all service provide to only GTA to GTA.

It is exempt sir. No RCM applicability at all.

MY ACCOUNTANT DIDN’T FILE ANNEXURE V ON 15 TH MARCH, NOW I GOT TO KNOW ABOUT THIS, WHAT CAN BE DONE NOW.

I AM IN FORWARD CHARGE MECHANISM ALREADY, IS IT MANDATORY?

There is no remedy specified in the notification. But in our view, this is a procedural lapse. Hence asap approach the jurisdictional officer and submit a manual Anx-V and take the acknowledgment.

It is mandatory sir.

Hello Sir , there is a notification issued 05/2023 dated 09-05-2023. Based on the notification you can file Annx-V for 23-24 till 31-05-2023. Hurry up and file Anx-V before the extended due date.

what is the remedy if assessee has missed filing the same?

There is no remedy specified in the notification. But in our view, this is a procedural lapse. Hence asap approach the jurisdictional officer and submit a manual Anx-V and take the acknowledgment.

Hello Sir , there is a notification issued 05/2023 dated 09-05-2023. Based on the notification you can file Annx-V for 23-24 till 31-05-2023. Hurry up and file Anx-V before the extended due date.

Good Article….

Also, is it required to file another declaration for coming out of forward charge in the subsequent year of exercising option?

There is no such clause. if we file the application once that will hold good for a year. After that again if you want to opt FCM then again you have to file anx-v for next FY. If you do not file AnxV then it will be deemed that you opted RCM.