The concept of Inward supply is present in current tax structure also. Inward supply literally means receiving goods or services or both.

In this write- up, all aspects related to Inward supply is being covered.

Introduction

As per section (67), ‘Inward Supply’ in relation to a person, shall mean receipt of goods or services or both whether by purchase, acquisition or any other means with or without consideration.

Manner of furnishing details of Inward supplies

Furnishing of details in FORM GSTR- 2 [Rule 2(1)]

Every registered person* is required to furnish the details of inward supplies of goods or services or both received during a tax period after the tenth day but on or before the fifteenth day of the month succeeding the tax period [Section 38(2)], on the basis of details contained in Part A, Part B and Part C of FORM GSTR-2A, prepare the details relating to outward supplies and credit or debit notes communicated under section 37(1) and credit or debit notes received by him in respect of such supplies that have not been declared by the supplier under section 37(1) and furnish the same in FORM GSTR-2 electronically through the Common Portal, either directly or from a Facilitation Centre notified by the Commissioner, after including therein details of such other inward supplies, if any, i.e. the details of inward supplies of taxable goods or services or both, including inward supplies of goods or services or both on which the tax is payable on reverse charge basis under this Act and inward supplies of goods or services or both taxable under the Integrated Goods and Services Tax Act or on which integrated goods and services tax is payable under section 3 of the Customs Tariff Act, 1975, and credit or debit notes received in respect of such supplies [as required to be furnished section 38(2)].

| *other than a person referred to in section 14 of the Integrated Goods and Services Tax Act, 2017. |

Furnishing of details in FORM GSTR- 2, in case of mismatching of details [Rule 2(2)]

Every registered person who have furnished the details, for any tax period [under section 38(2)] and which have remained unmatched under section 42 or section 43, shall, upon discovery of any error or omission therein, rectify such error or omission in the tax period during which such error or omission is noticed, shall furnish such details in FORM GSTR- 2.

Specifying the inward supplies in respect of ineligible ITC in FORM GSTR- 2, where such eligibility can be determined at the invoice level [Rule 2(3)]

The registered person shall specify the inward supplies in respect of which he is not eligible, either fully or partially, for input tax credit in FORM GSTR-2 where such eligibility can be determined at the invoice level.

Declaration of the quantum of ineligible ITC in FORM GSTR-2, where such eligibility cannot be determined at the invoice level [Rule 2(4)]

The registered person shall declare the quantum of ineligible input tax credit in FORM GSTR-2 on inward supplies which is relatable to non-taxable supplies or for purposes other than business and cannot be determined at the invoice level.

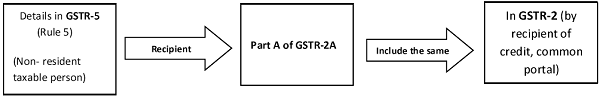

Furnishing of details of invoices in case of non-resident taxable person in FORM GSTR-2 [Rule 2(4A)]

The details of invoices furnished by an non-resident taxable person in his return in FORM GSTR-5 under rule 5 shall be made available to the recipient of credit in Part A of FORM GSTR-2A electronically through the Common Portal and the said recipient may include the same in FORM GSTR-2.

In nutshell:

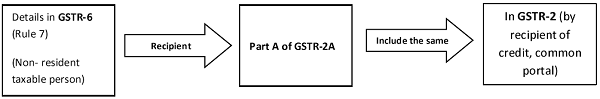

Furnishing of details of invoices in case of Input Service Distributor in FORM GSTR-2 [Rule 2(5)]

The details of invoices furnished by an Input Service Distributor in his return in FORM GSTR-6 under rule 7 shall be made available to the recipient of credit in Part B of FORM GSTR-2A electronically through the Common Portal and the said recipient may include the same in FORM GSTR-2.

In nutshell:

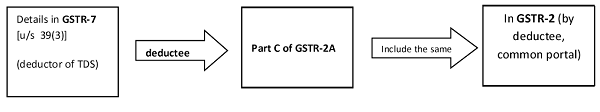

Furnishing of details of invoices in case of tax deducted at source furnished by the deductor [Rule 2(6)]

The details of tax deducted at source furnished by the deductor under sub-section (3) of section 39 in FORM GSTR-7 shall be made available to the deductee in Part C of FORM GSTR-2A electronically through the Common Portal and the said deductee may include the same in FORM GSTR-2.

In nutshell:

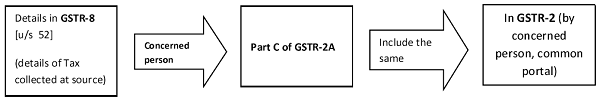

Furnishing of details of invoices in case of tax collected at source furnished by an e-commerce operator [Rule 2(7)]

The details of tax collected at source furnished by an e-commerce operator under section 52 in FORM GSTR-8 shall be made available to the concerned person in Part C of FORM GSTR-2A electronically through the Common Portal and such person may include the same in FORM GSTR-2.

In nutshell:

Details of inward supplies to be furnished in FORM GSTR-2

The details of inward supplies of goods or services or both furnished in FORM GSTR-2 shall include, inter alia, –

(a) invoice wise details of all inter-State and intra-State supplies received from registered persons or unregistered persons;

(b) import of goods and services made; and

(c) debit and credit notes, if any, received from supplier.

Hope this information will help you in your Professional endeavors. For further assistance/query, feel free to write back to us.

Author: CS Ekta Maheshwari is the Author of this article and is Company Secretary by profession. The Author can be reached at csektamaheshwari14@gmail.com

Disclaimer:

The entire contents of this article is solely for information purpose and have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation.. It doesn’t constitute professional advice or a formal recommendation. The author has undertook utmost care to disseminate the true and correct view and doesn’t accept liability for any errors or omissions. You are kindly requested to verify & confirm the updates from the genuine sources before acting on any of the information’s provided herein above.

hi can uyou please share where i can check the validity date of the Inward gsy permit

I have entered and submitted my inward supplies in gstr1. So how can i proceed further for july month

Madam,

In your article relating to inward supply, you have mentioned in the case of ISD, in the diagram followed, it has been mentioned GSTR-6 as Non-resident taxable person whereas it should be ISD and again in the next box it is mentioned as Part-A GSTR-2A whereas it should be Part-B of GSTR-2A. This may please be checked.

Well explained article