Recommendations for Changes In GST/IGST Rate and Clarifications in Respect of GST Rate on Certain Goods -As per discussions held in the 25th GST Council Meeting

The Union Finance Minister Shri Arun Jaitley Chaired the 25th Meeting of the GST Council in New Delhi today. The Council has recommended certain in GST/IGST rate and clarifications in respect of GST rate on Goods specified below as per discussions in the 25thGST Council Meeting held today. These decisions of the GST Council are being communicated for general information, and will be given effect to through Gazette notifications / circulars which only shall have the force of law.

Also Read-

- GST Rate changes on services by 25th GST Council Meeting

- 6 Policy Changes recommended by 25th GST Council Meeting

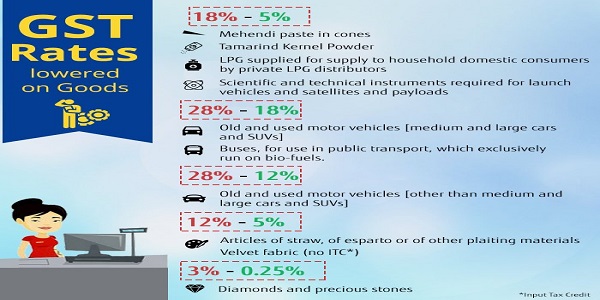

A. LIST OF GOODS ON WHICH GST RATE RECOMMENDED FOR REDUCTION FROM 28% TO 18%:

| S. No. | Chapter/Heading/Sub-heading/Tariff item | Description |

| 1. | 87 | Old and used motor vehicles [medium and large cars and SUVs] on the margin of the supplier, subject to the condition that no input tax credit of central excise duty/value added tax or GST paid on such vehicles has been availed by him. |

| 2. | 8702 | Buses, for use in public transport, which exclusively run on bio-fuels. |

B. LIST OF GOODS ON WHICH GST RATE RECOMMENDED FOR REDUCTION FROM 28% TO 12%:

| S.

No. |

Chapter/Heading/Sub-heading/Tariff item | Description |

| 87 | All types of old and used motors vehicles [other than medium and large cars and SUVs] on the margin of the supplier of subject to the conditions that no input tax credit of central excise duty /value added tax or GST paid on such vehicles has been availed by him. |

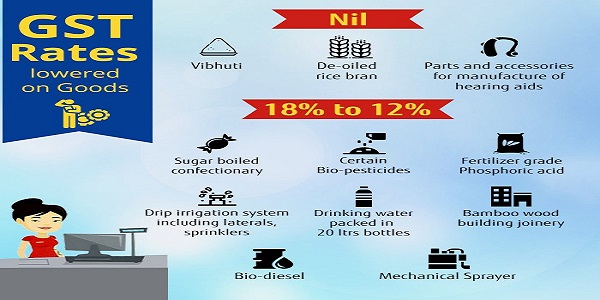

C. LIST OF GOODS ON WHICH GST RATE RECOMMENDED FOR REDUCTION FROM 18% TO 12%:

| S.

No. |

Chapter/Heading/Sub-heading/Tariff item | Description | ||||||||||||||||||||||||||

| 1. | 1704 | Sugar boiled confectionary | ||||||||||||||||||||||||||

| 2. | 2201 | Drinking water packed in 20 litters bottles | ||||||||||||||||||||||||||

| 3. | 2809 | Fertilizer grade Phosphoric acid | ||||||||||||||||||||||||||

| 4. | 29 or 38 | Bio-diesel | ||||||||||||||||||||||||||

| 5 | 38 | The following Bio-pesticides, –

|

||||||||||||||||||||||||||

| 6. | 4418 | Bamboo wood building joinery | ||||||||||||||||||||||||||

| 7. | 8424 | Drip irrigation system including laterals, sprinklers | ||||||||||||||||||||||||||

| 8. | 8424 | Mechanical Sprayer |

D. LIST OF GOODS ON WHICH GST RATE RECOMMENDED FOR REDUCTION FROM 18% TO 5%:

| S.

No. |

Chapter/Heading/Sub-heading/Tariff item | Description |

| 1. | 13 | Tamarind Kernel Powder |

| 2. | 1404/3305 | Mehendi paste in cones |

| 3. | 2711 | LPG supplied for supply to household domestic consumers by private LPG distributors |

| 4. | 88 or any other chapter | Scientific and technical instruments, apparatus, equipment, accessories, parts, components, spares, tools, mock ups and modules, raw material and consumables required for launch vehicles and satellites and payloads |

E. LIST OF GOODS ON WHICH GST RATE RECOMMENDED FOR REDUCTION FROM 12% TO 5%:

| S.

No. |

Chapter/Heading/Sub-heading/Tariff item | Description |

| 1. | 4601, 4602 | Articles of straw, of esparto or of other plaiting materials; basketware and wickerwork |

F. LIST OF GOODS ON WHICH GST RATE RECOMMENDED FOR INCREASE FROM 12% TO 18%:

| S.

No. |

Chapter/Heading/Sub-heading/Tariff item | Description |

| 1. | 5601 22 00 | Cigarette filter rods |

G. LIST OF GOODS ON WHICH GST RATE RECOMMENDED FOR REDUCTION FROM 12% TO 5% WITH NO REFUND OF UNUTILISED INPUT TAX CREDIT:

| S.

No. |

Chapter/Heading/Sub-heading/Tariff item | Description |

| 1. | 5801 37 20 | Velvet fabric |

H. LIST OF GOODS ON WHICH GST RATE RECOMMENDED FOR REDUCTION FROM 3% TO 0.25%:

| S.

No. |

Chapter/Heading/Sub-heading/Tariff item | Description |

| 1. | 7102 | Diamonds and precious stones |

I. NIL GST RATE:

- Vibhuti

- Parts and accessories for manufacture of hearing aids.

- De-oiled rice bran

J. LIST OF GOODS ON WHICH GST RATE RECOMMENDED FOR INCREASE FROM NIL TO 5%:

| S.

No. |

Chapter/Heading/Sub-heading/Tariff item | Description |

| 1. | 2302 | Rice bran (other than de-oiled rice bran) |

K. CHANGES IN COMPENSATION CESS ON CERTAIN GOODS:

| S.

No |

Chapter/

Heading/ Sub-heading/ Tariff item |

Description | Present Compensation Cess Rate | Compensation Cess Rate Recommended |

| 8702 | Motor vehicles [falling under heading 8702, as it was in excise regime] cleared as ambulances, duly fitted with all fitments, furniture and accessories necessary for an ambulance from the factory manufacturing such vehicles.10-13 seater buses and ambulances, subject to specified conditions. | 15% | Nil | |

| 2. | 87 | Old and used motor vehicles [medium and large cars and SUVs], on the margin of the supplier, subject to the condition that no input tax credit of central excise duty/value added tax or GST paid on such vehicles has been availed by him. | Applicable rate | Nil |

| 3. | 87 | All types of old and used motors vehicles [other than medium and large cars and SUVs] on the margin of the supplier of subject to the conditions that no input tax credit of central excise duty /value added tax or GST paid on such vehicles has been availed by him. | Applicable rate | Nil |

L. CHANGES IN IGST RATE RECOMMENDED ON CERTAIN GOODS:

| S.

No |

Chapter/

Heading/ Sub-heading/ Tariff item |

Description | Present IGST Rate | IGST Rate Recommended |

| 88or any other chapter

|

Satellites and payloads and Scientific and technical instruments, apparatus, equipment, accessories, parts, components, spares, tools, mock ups and modules, raw material and consumables required for launch vehicles and satellites and payloads | 18% | 5% |

M. MODIFICATION IN DEFINITION/ CLARIFICATION IN RESPECT OF CHANGES IN GST/IGST RATES ON GOODS:

| S.

No |

Chapter/

Heading/ Sub-heading/ Tariff item |

Description | Present GST Rate | Modification/clarification Recommended |

| 27 | Poly Butylene Feed Stock & Liquefied Petroleum Gas | 18%

|

The GST to apply only on the net quantity of Poly Butylene Feed Stock or Liquefied Petroleum Gases retained for the manufacture of Poly Iso Butylene or Propylene or di-butyl para cresol respectively, subject to specified conditions. | |

| Any chapter | Rail coach industry | Applicable GST rate | Only the goods falling under chapter 86 attract 5% GST rate with no refund of unutilised ITC.Goods falling in any other chapter will attract applicable GST rate under the respective chapters, even if supplied to the Indian railways. | |

| 2701 | Coal rejects | 5% + Rs. 400 PMT Compensation Cess | Coal rejects fall under heading 2701 and attract 5% GST and Rs. 400 PMT Compensation Cess.

|

It is proposed to issue notification giving effect to the recommendations of the Council on 25th January, 2018 to be effective from 00 HRS on 25th January, 2018.

Source- PIB

We have not seen in the gst exempted list of goods the handicraft items. There was a news that handicraft articles are exempted. Hope it will be exempted.

Since education institution & Hospital are not covered GST Regime,they should be given exemption from purchase of medicines ,medical equipments

The series of changes in rates and minute differentiation of goods only makes things worse. Better classify certain categories of products under the same rate ex: milk derivatives. There is no need to have dozens of micro classification for the sake of simplicity. Strangely the diamonds attracts 0.25% now instead of 3% earlier. I suggest the GST committee to categorise the goods and services in 3 groups and apply the rates accordingly. The real issues now are simplification and plugging the loopholes rather than rates. Those who are cheating the Government should be punished hard so that there will be no incentive to cheat the law.

It is strange that Milk in UHT packaging attracts 5% GST while Milk Cream in UHT attracts Nil GST. Case of “if poor man cannot afford bread, why doesn’t he eat cake”?

Dear Sir/Madam,

GST of Life saving drugs should be exempted. Poor people can not afford 12% of tax.

Thanks and regards.

If the Rates were required to be revised several times, from July 2017, does it not reflect on the wisdom of Finance Ministers of the Central and State Governments, who form the GST Council? .