SETTING UP FUND MANAGEMENT ENTITY (FME) TO PROVIDE PORTFOLIO MANAGEMENT SERVICES (PMS) IN GIFT SEZ – IFSC IN GIFT CITY, GANDHINAGAR, GUJARAT (INDIA)

About GIFT city:

GIFT City is the only operational green smart city in India, located between Ahmedabad and Gandhinagar on the bank of the river Sabarmati.

GIFT city includes Office spaces, Residential Apartments, Schools, Hospital, Hotels, Clubs, Retail and various Recreational facilities, which makes this City a truly “Walk to Work” City. GIFT City consist of a conducive Multi-Service SEZ (Special Economic Zone) and an exclusive Domestic Area.

It is being developed as a multi-service special economic zone and a global financial service hub having a competitive tax regime to attract financial service providers such as banking units, insurance companies, capital market intermediary and ancillary services providers to provide their services globally and also invite inbound and outbound individuals and corporates around the world to use the quality financial service products at India’s first IFSC platform.

Fund Management Entity (FME) as PMS in GIFT IFSC:

In this presentation we providing the brief about setting up fund management entity (FME) to provide portfolio management services (PMS) in GIFT-SEZ IFSC, GIFT city, Gandhinagar.

PMS set up in GIFT-SEZ IFSC will allow to invest in the securities listed or to be listed or traded on the stock exchanges, money market instruments, units of investment scheme and other financial products as specified by the Authority from time to time across the globe and avail various tax benefits under taxation laws of the India.

KEY Benefits for FME incorporated at India’s first International Financial Services Centre (IFSC) at GIFT city:

Tax Incentives

- 100% income tax exemption for 10 consecutive years out of 15 years.

- No GST

– On services or goods acquired by FME from DTA.

– On services provided by FME to fund, IFSC Units & offshore clients.

- No Security Transaction Tax (STT) and Commodity transaction tax

- (CTT) on securities traded on IFSC stock exchange.

- No Dividend Distribution Tax on IFSC Company.

- No Minimum Alternate Tax (MAT) is company opted for new taxation scheme u/s 115 BAA of income tax act.

- Exemption from customs duty for all goods imported in the SEZ used for authorized operations

Other Fiscal Incentives:

|

Type of Incentives |

Particulars |

| CAPEX (One Time)

Eligible CAPEX: Construction of building, computers, software, networking hardware, Stamp Duty & Registration/Conversion fee exemption and other fixed assets |

|

| OPEX (per year)

Eligible OPEX: Lease rental, Bandwidth expenditure, cloud rental, power tariff etc.) |

|

| Lease rental expenditure | Rs. 50/sq. ft. of build area or actual lease rental expenditure, whichever is lower |

Eligibility Criteria of FMEs

> Entity should be permits to carry on the activity by forming company or LLP or a branch thereof.

> The FME entity shall be authorised by MOA in case of company and LLP deed in case of LLP.

> Registered FME (non-retail) and Authorised FME, shall employ such employees who having relevant qualification and experiences.

> FME shall deploy Key Managerial Person designated who responsible for overall activities.

> Should have necessary infrastructure and manpower.

> Entity seeking registration as FME (Non- retail) should have minimum Net worth of USD 500,000 it is to be maintained all time for registration.

Statutory fees for FMEs in IFSC

| Criteria | Registered FME

(Non- Retail) |

| Incorporation Fees | Based on Capital |

| IFSCA Application Fee | $ 2500 |

| IFSCA Registration Fee | $ 7,500 |

| FME desirous to undertake PMS (Additional Fee) | $ 5000 |

| Annual Fee | $ 2000 |

| SEZ Application Fee (One Time) | Rs. 5000 |

| SEZ Registration Fee (One Time) | Rs. 25000 |

| RCMC (Annual) | Rs. 5000 |

Type of clients for PMS

> FME in its capacity as a portfolio manager may have the following categories as clients:

- A person resident outside India;

- A non-resident Indian;

- A non-individual resident in India who is eligible under FEMA to invest funds offshore, to the extent of outward investment permitted; and

- An individual resident in India who is eligible under FEMA to invest funds offshore, to the extent allowed under the liberalised remittance scheme (LRS) of Reserve Bank of India.

Investment by FMEs

> FME operating as a portfolio manager in an IFSC shall be permitted to invest in securities and financial products in an IFSC, India or Foreign Jurisdiction

> In case of a discretionary portfolio management the FME shall invest in following products

- Securities listed or to be listed or traded on the stock exchange specified by authority.

- Money market instruments

- Units of investment scheme

- Other financial instruments as specified by authority

RRBP Corpserve LLP

Corporate Advisory Services, GIFT SEZ-IFSC Consuktant

Services provided by RRBP for FMEs in GIFT City

- Assist to find out office space in GIFT-SEZ IFSC

- Application to certifying authority for issuing DSCs

- Drafting of charter documents, namely MOA, AOA or LLP deed

- Registration of charter documents with regulatory authority

- Reservation of name of entity

- Incorporation of entity

- Application for PAN & TAN

- Prepare SEZ application, liaison and obtain LOA

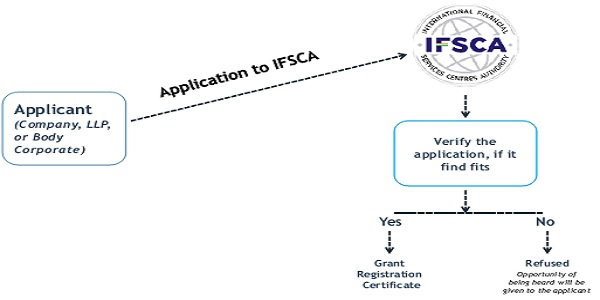

- Prepare IFSCA application, liaison and obtain registration certificate

- Application to Govt. of Gujarat to avail IT/ITeS policy benefits available for entities having office in GIFT city

- Tax advisory and auditing

- Legal, secretarial & compliance services

- Compliances of SEZ,IFSCA , FEMA and other regulatory authorities

Why RRBP

| Background: RRBP is promoted by experienced professionals who are members of the Institute of Company Secretaries of India (ICSI), the Institute of Chartered Accountants of India (ICAI) and MBA (Finance) and has been established with the objective of providing quality professional services. | Area of services: SEZ IFSC, Corporate Compliance, Taxation, Compliances, Corporate Advisory, Finance & Investment Consultancy, Government incentives, Compliance Management, Obtaining various Industrial Licenses and Registrations, IFSCA, SEZ, SEBI, FEMA, MCA, Compliances etc. |

| Firm Strength: Team of enthusiastic, energetic and competent young professionals to provide round the clock services to every entity by dedicated person. | Assessment of client requirements We unlock the potential for our clients by addressing their concerns by imbibing these core values:

|

Author – Bharat Prajapat is fellow member of the ICSI and can be contacted at Email: cs@rrbp.in; Mobile: 7817998658

Disclaimer: The entire contents of this document have been prepared based on relevant provisions and as per the information existing at the time of the preparation. Although care has been taken to ensure the accuracy, completeness, and reliability of the information provided, I assume no responsibility, therefore. Users of this information are expected to refer to the relevant existing provisions of applicable Laws. The user of the information agrees that the information is not professional advice and is subject to change without notice. I assume no responsibility for the consequences of the use of such information.

IN NO EVENT SHALL I SHALL BE LIABLE FOR ANY DIRECT, INDIRECT, SPECIAL OR INCIDENTAL DAMAGE RESULTING FROM, ARISING OUT OF OR IN CONNECTION WITH THE USE OF THE INFORMATION.