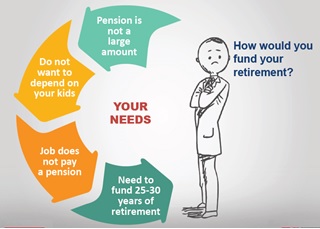

One of the biggest challenges that retirees face is how to make their retirement savings last a lifetime. Even if one has saved diligently throughout one’s working life and accumulated a sizeable nest egg, it may not be able to generate enough to sustain monthly expenses over the long term. This is mainly due to three factors: longer life spans, early retirement and falling interest rates. Another important factor is the rate at which personal inflation grows is much higher than anticipated. If you are one of those individuals who have been working all your life and accumulated your savings into various asset classes like LIC, Fixed Deposits, Provident fund and been conservative with your savings and give you fixed returns, then it is time to relook at your asset allocation.

Having saved all your working life for your retirement needs, is the corpus created by you enough to meet your family needs which of course keeps increasing with passage of time as personal inflation which often ignored hits each one of us hard. The average upper middle-class urban retiree must have enough corpus to last 25-30 years in retirement as against 15-20 years required in earlier times. It is also becoming increasingly common for people to retire in their early fifties to pursue their passion, hobbies and live a retired life based on their own terms. Further, interest rates are falling and investment options are narrowing down. Most of these low interest options also come with a lock in clause too, adding on to the pain. Hence arises a need for a good retirement plan.

Let us consider a scenario of a person having Rs. 1 crore to invest, in this case the best way would be to divide the same into 3 buckets :-

1. Bucket 1 – Meet the Needs of First Three Years

2. Bucket 2 – Meet the Needs of Next Three Years

3. Bucket 3 – Meet the Needs of Balance period / for life

The bucket strategy helps segregate long term investments from the money meant for immediate use. However, the investor needs to be fully committed to follow this approach. If he panics when stock markets tumble and withdraws his equity funds, the whole purpose of the strategy will be defeated. Hence, investors need to be fully committed to this approach and stay the course irrespective of market scenario.

Let us look at a scenario of growth for a portfolio at a growth rate of 10% per annum and how many years will one be able to survive based on average current needs of a family which varies from Rs 1 lakh to 1.5 lakhs on a monthly basis.

|

Mr. Chintamani |

||||

|

Option 1 : Appreciation at 10% |

||||

| Age | Initial Capital | Add | Growth | Ending Capital |

| 60 | 50,00,000 | – | 5,00,000 | 55,00,000 |

| 61 | 55,00,000 | 10,00,000 | 6,50,000 | 71,50,000 |

| 62 | 71,50,000 | 10,00,000 | 8,15,000 | 89,65,000 |

| 63 | 89,65,000 | 10,00,000 | 9,96,500 | 1,09,61,500 |

| 64 | 1,09,61,500 | 10,00,000 | 11,96,150 | 1,31,57,650 |

| 65 | 1,31,57,650 | 10,00,000 | 14,15,765 | 1,55,73,415 |

| Total | 50,00,000 | |||

| Yearly Amount | ||||

| Age | Initial Capital | Withdrawal | Growth | Ending Capital |

| 66 | 1,55,73,415 | 18,00,000 | 13,77,342 | 1,51,50,757 |

| 67 | 1,51,50,757 | 18,00,000 | 13,35,076 | 1,46,85,832 |

| 68 | 1,46,85,832 | 18,00,000 | 12,88,583 | 1,41,74,415 |

| 69 | 1,41,74,415 | 18,00,000 | 12,37,442 | 1,36,11,857 |

| 70 | 1,36,11,857 | 18,00,000 | 11,81,186 | 1,29,93,043 |

| 71 | 1,29,93,043 | 18,00,000 | 11,19,304 | 1,23,12,347 |

| 72 | 1,23,12,347 | 18,00,000 | 10,51,235 | 1,15,63,582 |

| 73 | 1,15,63,582 | 18,00,000 | 9,76,358 | 1,07,39,940 |

| 74 | 1,07,39,940 | 18,00,000 | 8,93,994 | 98,33,934 |

| 75 | 98,33,934 | 18,00,000 | 8,03,393 | 88,37,327 |

| 76 | 88,37,327 | 18,00,000 | 7,03,733 | 77,41,060 |

| 77 | 77,41,060 | 18,00,000 | 5,94,106 | 65,35,166 |

| 78 | 65,35,166 | 18,00,000 | 4,73,517 | 52,08,682 |

| 79 | 52,08,682 | 18,00,000 | 3,40,868 | 37,49,550 |

| 80 | 37,49,550 | 18,00,000 | 1,94,955 | 21,44,506 |

| 81 | 21,44,506 | 18,00,000 | 34,451 | 3,78,956 |

As we can see from the above table that the corpus created will be only sufficient enough till the age of 81 years or a twenty year period for a family with almost no capital left for survival thereafter and of course no legacy. Therefore arises a need for an asset allocation plan which can at least generate double digit returns on a consistent basis with almost no risk on capital. Also, we should not forget that as age advances, the need for withdrawal for personal expenses will keep increasing due to inflation and may be increase in medical expenses.

Conclusion:

A person would always want to live a financially independent life without depending on their children or anybody in the family to meet their financial needs. There are various expenses for a retired person which maybe unexpected in nature. A well thought out plan even when a person retires or is about to retire can help live a very comfortable life and meet the needs without any concern. One must start preparing for financial retirement plan at an early age and not start looking at when he or she is nearing the age of 60, earlier the better.

*****

(The author Rishabh Adukia is a Chartered Accountant and qualified professional advising on wealth management to individuals, millennial’s, emerging HNIs including others. His articles are published regularly in various financial newspapers and can be reached on adukia.rishabh@gmail.com )