Case Law Details

Inbisco India Pvt Ltd Vs C.C.E.-Ahmedabad-ii (CESTAT Ahmedabad)

CESTAT Ahmedabad held that sugar boiled confectionery Kopiko is more specifically classifiable under Central Excise Tariff Heading [CETH] 1704 9090 and not under CETH 2101 as claimed by department.

Facts-

The issue involved in the present case is that whether the product ‘Kopiko’ manufactured by the Appellant is classifiable under Central Excise Tariff Heading (CETH) 1704 9090 as claimed by the Appellant or under CETH 2101 1200 as claimed by the Revenue.

Conclusion-

Held that the sugar boiled confectionery is specifically provided under 1704 9090 and 2101 1200 where the department sought to classify gives a general description and as discussed above the only term ‘basis of coffee’ is not present in the appellant’s product. Therefore, on both the counts the appellant’s goods is more specifically covered under the entry of 1704 9090 i.e. sugar confectionery and by no imagination the same can be taken out from 1704 and classified under 2101. In the present case, most specific description applies to the appellant’s product is description given in heading 1704 and the description given in 2101 is more general for the reason that the sugar confectionery is specific product whereas the preparations with basis of extracts /essences/concentrates or basis of coffee is more general description which may apply to many product whereas the sugar confectionery is the description which is for only one product. Therefore, the description under 1704 is more specific and the description given in 2101 is more general. Accordingly, as per the principal of interpretation Rule 3A goods of the appellant is correctly classifiable under 1704.

FULL TEXT OF THE CESTAT AHMEDABAD ORDER

The issue involved in the present case is that whether the product ‘Kopiko’ manufactured by the Appellant is classifiable under Central Excise Tariff Heading (CETH) 1704 9090 as claimed by the Appellant or under CETH 2101 1200 as claimed by the Revenue.

1.1. The brief facts of the case are that the appellant is engaged in the distribution of food products like candy, biscuit and chocolate in India. The appellant entered into manufacturing by setting up manufacturing plant in Hyderabad in 2012 and Sanand, Gujarat in 2014.

1.2. In the said manufacturing facility they manufactured excisable goods, namely (i) hard boiled sugar and glucose confectionery sold under the brand name of Kopiko ( Cappuccino & Espresso varieties), Juizy Milk (Mango and Strawberry), Tamarin; (ii) Chocolate confectionery sold under the brand name of Choki-Choki; and (iii) noodles under the brand name of JoyMee noodles, all edible items.

1.3. The product in question, namely Kopiko, a hard boiled sugar and glucose confectionery, is being manufactured by the Hyderabad plant since September-2012 and Gujarat plant from November-2014. The Product Kopiko contains 1.57% flavour Coffee.

1.4. The officers of the Zonal units of the Directorate General of Central Excise intelligence, located at Hyderabad and Ahmedabad commenced investigations into classification of ‘Kopiko’ with summons vide F. No. INV/DGEI/HZU/CE/08/2015-CE dated 27.03.20153. The investigations culminated in the issuance of following two Show Cause Notices:-

(a) SCA NO. 23/2015 dated 03.07.2015, vide F. No. INV/DGEI/HZU/CE/08/2015, to the appellant at Ranga Reddy Plant, Hyderabad;

(b) F. No. DGCEI/AZU/36-64/2015-2016 dated 08.12.2015 to the Appellant at Ahmedabad plant.

1.5. This is the subject matter of the present appeal. In the Show Cause Notice it was also alleged that “Kopiko (cappuccino and espresso varieties)” is classifiable under Chapter Heading 2101 1200 of the First Schedule to the Central Excise Tariff Act, 1985 as “preparations with basis of extracts, essences, concentrates or with a basis of coffee”, attracting 12% ad valorem plus education cesses (less abatement based upon valuation in terms of Section 4A of the Central Excise Act, 1944) and that the Appellant has misclassified goods under Chapter Heading 1704 9090 as “sugar confessionary not containing cocoa” and thereby short -paying the Central Excise Duty.

The Show Cause Notice dated 08.12.2015 was adjudicated by the Commissioner of Central Excise Ahmedabad whereby Order-In-Original No. AHM-EXCUS-002-COMMR-03/2016-2017 dated 31.03.2017 and the demand of tax of Rs. 3,64,53,794/- for the period November, 2014 to July, 2015 along with applicable interest was confirmed and penalty of Rs. 36,45,379/- under Section 11 AC(1)(a) of the Central Excise, 1944 was imposed. Against this impugned order dated 31.03.2017, the present appeal has been filed.

2. Shri Prasad Pranjape learned Counsel appearing on behalf of the appellant at the outset submits that as regards the product manufactured by the appellant except percentage of flavour coffee, the goods is sugar confessionary and there is specific tariff entry for sugar confessionary under Chapter Heading 1704 and the Chapter Heading 2101 is very general heading. It is settled law that the specific heading prevails over general heading. Therefore, on this ground itself appellant’s product i.e. sugar confectionary under the brand name of ‘Kopiko’ is correctly classifiable under 1704 and not classifiable under 2101.

2.1. He submits that the product in question is a hard boiled sugar confectionary and is marketed as such. Coffee is added as only a flavouring agent and consists of a minuscule percentage of the overall product which is overwhelmingly constituted of sugar and glucose. The packaging of the product clearly mentions that it is a “HYGENIC DEPOSITED SUGAR BOILED CONFECTIONERY”. The product is marketed as a coffee candy. The term candy means a confectionery. Therefore, the heading 1704 which is for sugar confectionery not containing cocoa offers a more specific heading for the product in question than the heading which is for preparation with a basis of coffee.

2.2. He further submits that the respondent in the order has erred in reasoning that the Coffee Flavour forms the basis for manufacture of Kopiko.

2.3. It is submitted that on reading of the said sub-heading 2101 1200, it is evident that the preparations should be made with a basis of coffee, extracts of coffee, etc. The product Kopiko does contain the Coffee flavour by weight 1.57%, as submitted above. Further, there are other items like ethyl vanillin and flavour Milk whose function is to add flavour. Also, Butter, Salt, and Kernel are added for taste. Thus it is imperative for examining the meaning of the term ‘BASIS’, that determines the interpretation of the preparations covered by sub-heading 2101 1200.

2.4. He submits that as per the composition of the product Admittedly, the coffee essence which is used as a flavoring agent is not the basis/ underlying/ predominant material in the product which is predominantly sugar confectionery even as will be evident from the facts. There is a distinction between “preparations containing coffee” and “preparations on the basis of extracts /essences/concentrates or basis of coffee”.

2.5. In this regard he gives an example of Chapter Heading 1806 which deals with Chocolates & other Food preparations containing cocoa. Thus, any food preparations which contains cocoa will get covered under Chapter Heading 1806 irrespective of quantity, weight, volume of the cocoa present in the product. Whereas Chapter Heading 2101 covers preparations with basis of extracts, essences, concentrates, or with a basis of coffee. Thus, to classify an item under this chapter 2101, it is not enough for a product to merely contain extracts, essences, concentrates of coffee but the presence of extracts, concentrates, essences should be in such a position that it forms the basis for the preparations for Kopiko, then refined sugar and liquid glucose would constitute basis and by no stretch of imagination, it can be said that flavour coffee is the basis of preparation of sugar boiled confectionery Kopiko.

He placed reliance on the decision of the Hon’ble CESTAT in the case of CCE Vs. Plethico Pharmaceuticals Ltd. 2015 (328) E.L.T. 645 (Tri.-Del.).

2.6. He submit that in view of above it is clear that Rule 1 of the Rules for interpretation is followed/ satisfied in the first instance leaving no scope for further interpretation under Rule 2(b) or the consequential Rule 3, ibid. Without prejudice to the submissions as above, even by assuming that the added material, i.e. Flavour Coffee, coverage by sub heading 2101 1200 has to be examined, it is submitted that for the purpose of such examination in terms of Rule 3(a), sub heading 1704 9090 provides no less specific description than sub heading 2101 1200. He has also placed reliance on the Judgment of the Hon’ble Supreme Court of India in the case of Commissioner Vs. Jocil Limited [2011 (263) ELT (SC)]

2.7. He further submit that even if the classification has to be determined basis the essential character, still the product will be classified under the CETH 1704. The term essential character has not been defined in the tariff. The larger bench of Hon’ble CEGAT, New Delhi in the case of Bharat Heavy Electricals Limited Vs. Madras [ 1987 (28) E.L.T. 545 (Tribunal)] has sought to come to a conclusion in relation to the term ‘essential character’, wherein reference was made to the Customs Commodity Code Number (CCCN) explanatory notes.

2.8. He submit that on perusal of the ruling, it can be ascertained “essential character” may be determined by :

The nature of the material or component, It’s bulk quantity, weight or value.

2.9. On both the above counts it is sugar/glucose is the predominant input and therefore as per the principles of classification in the GIR, the product merits classification under CETH 1704.

2.10. He further submits that a small amount of other ingredients or marketing technique cannot alter the classification. In this regard he placed reliance on the following Judgments :

- Sampre Nutritions Ltd. Vs. CCE 2004 (169) E.L.T. 42 (Tri.- Bang.)

- Satnam Overseas Ltd. Vs. CCE, New Delhi 2015 (318) E.L.T. 538 (S.C)

- Hindustan Unilever Ltd. Vs. Central Board of Excise & Customs 2012 (283) E.L.T. 26 (Cal.)

- Blue Star Ltd. Vs. UOI 1980 (6) E.L.T. 280

- Hindustan Lever Ltd. Vs. CCE 2000 (121) ELT 451

- Commissioner Vs. Hindustan Lever Ltd.- 2002 (146) ELT A214

- Atul Glass Industries (P) Ltd. Vs. CCE 1986 (25) ELT 473 (SC)

2.11. He further submit that the product classified as sugar confectionary under FSSAI Act also.

2.12. He also placed reliance on the Tribunal’s judgment in the case of Collector of C. Ex., Chandigarh Vs. Sukhjit Starch & Chemicals Limited (maintained by Supreme Court in 1997 (96) E.L.T. A221 (S.C.))

2.13. He has submitted that the product imported in India and abroad are being classified under classification 1704. In this regard he refers to the import document as well as document of foreign country where the goods were imported and submits that in all such cases the very same goods have been classified under 1704 9090 for reason also the goods are correctly classified under 1704 9090. In this regards he placed reliance on the following judgment:-

- S. R. Foils & Tissues Ltd. Vs. Commissioner of Central Excise, Jaipur 2013 (294) ELT 565 (Tri.- Del.)

- Commissioner of Central Excise Vs. Hindalco Industries Ltd. (2023) 3 Centax 132 (SC)

2.14. He further submits that in the appellant’s Hyderabad branch, the similar show cause notice was issued which has been adjudicated vide Order-In-Original dated 08.12.2015, wherein the issue of classification of the subject product is decided in the appellant’s favour under CETH 1704 9090. However, against the said order the revenue’s appeal is pending before the CESTAT-Hyderabad.

3. Shri Tara Prakash, learned Deputy Commissioner (AR) appearing on behalf of the revenue reiterates the finding of the impugned order.

4. We have carefully considered the submission made by both the sides

and perused the record. We find that there is a dispute between the appellant and the department whether the goods is classifiable under Central Excise Tariff Act under 1704 as claimed by the appellant or under 2101 as claimed by the revenue.

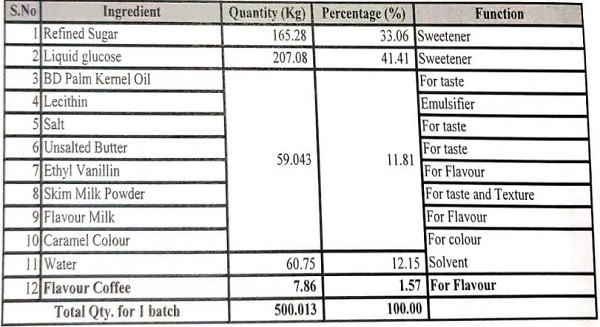

4.1. In order to understand the nature of product it is necessary to know the ingredients and formula used in the manufacture of the product in question namely Kopiko. The same is reproduced below :-

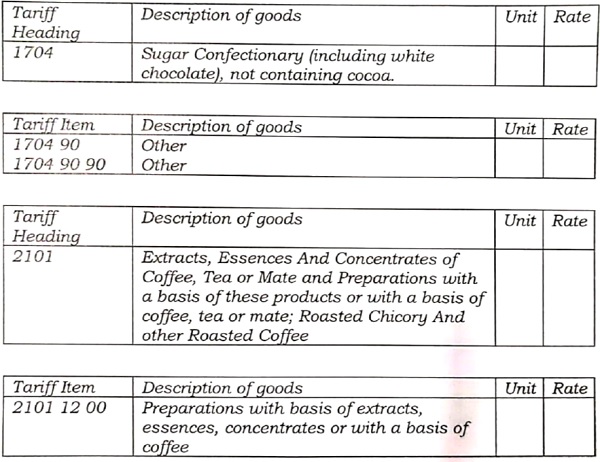

From the above it is clear that the product contains flavour coffee to the extent of 1.57 % whereas the majority ingredients are refined sugar 33.06%, liquid glucose 41.41%, other ingredients constitute to 11.81% and water at the rate of 12.5%. The Adjudicating Authority confirmed classification under 2101 1200 on the basis that the product Kopiko contains flavor coffee has the product meets with the description given in 2101 1200. For the reference both the rival entries are reproduced below :-

4.2. We find that the product manufactured by the appellant namely Kopiko based on its quantum of ingredients contained in the said product. Since the product contain more than 74% sugar and glucose. These ingredients are basis of the product, the flavour coffee was used only to the extent of 1.57% that for giving flavor and not contribute in the main product i.e. confectionery. Therefore, the product Kopiko by any imagination cannot be classified under 2101 1200 for the simple reason that it is not preparations with basis of coffee. The basis of the product is sugar and glucose and undisputedly the product is sugar confectionery not containing cocoa. Even as per the general Rule of interpretation of Central Excise Tariff the same support to the plea of the appellant. For the ready reference the rules for interpretation are reproduced below:-

GENERAL RULES FOR THE INTERPRETATION OF THIS SCHEDULE

“ Classification of goods in this Schedule shall be governed by the following principles:

1. The titles of Sections, Chapters and Sub-Chapters are provided for ease of reference only; for legal purposes, classification shall be determined according to the terms of the headings and any relative Section or Chapter Notes and, provided such headings or Notes do not otherwise require, according to the following provisions.

2. (a) Any reference in a heading to an article shall be taken to include a reference to that article incomplete or unfinished by virtue of this rule), presented unassembled or disassembled.

(b) Any reference in a heading to a material or substance shall be taken to include a reference to mixtures or combinations of that material or substance with other materials or substances. Any reference to goods of a given material or substance shall be taken to include a reference to goods consisting wholly or partly of such material or substance. The classification of goods consisting of more than one material or substance shall be according to the principles of Rule 3.

3. When by application of rule 2(b) or for any other reason, goods are, prima facie, classifiable under two or more headings, classification shall be effected as follows:

(a) the heading which provides the most specific description shall be preferred to headings providing a more general description. However, when two or more headings each refer to part only of the materials or substances contained in mixed or composite goods or to part only of the items in a set put up for retail sale, those headings are to be regarded as equally specific in relation to those goods, even if one of them gives a more complete or precise description of the goods.

(b) mixtures, composite goods consisting of different materials or made up of different components, and goods put up in sets for retail sale, which cannot be classified by reference to (a), shall be classified as if they consisted of the material or component which gives them their essential character, insofar as this criterion is applicable.

(c) when goods cannot be classified by reference to (a) or (b), they shall be classified under the heading which or curs last in numerical order among those which equally merit ”

Ongoing through the above rules for the interpretation, we find that even as per the Rule 1 the classification shall be determined according to the terms of headings. On reading of both the headings i.e. 1704 and 2101, we find that the sugar boiled confectionery is specifically provided under 1704 9090 and 2101 1200 where the department sought to classify gives a general description and as discussed above the only term ‘basis of coffee’ is not present in the appellant’s product. Therefore, on both the counts the appellant’s goods is more specifically covered under the entry of 1704 9090 i.e. sugar confectionery and by no imagination the same can be taken out from 1704 and classified under 2101. Further on going through the Rule 3 of the Rules (supra), even if it is assumed that the tariff entry proposed by the department can also be considered. It is provided under Rule 3 that if the goods are classified under 2 or more headings then as per the clause A of Rule 3 most specific description shall be preferred to headings over more general description. In the present case as discussed above most specific description applies to the appellant’s product is description given in heading 1704 and the description given in 2101 is more general for the reason that the sugar confectionery is specific product whereas the preparations with basis of extracts /essences/concentrates or basis of coffee is more general description which may apply to many product whereas the sugar confectionery is the description which is for only one product. Therefore, the description under 1704 is more specific and the description given in 2101 is more general. Accordingly, as per the principal of interpretation Rule 3A goods of the appellant is correctly classifiable under 1704.

4.3. We have also observed that as per the document submitted by the appellant the very same product under the same trade name i.e. Kopiko is imported as well as supplied to other countries and as per the documents the same has been classified under 1704 not only by foreign country but also in India. As per the value of this evidence the appellants get the support in their case. There is submission of the appellant that the original assessment once made on bill of entry is not challenged becomes final. The Custom Authority having been convinced that the product classification under chapter 17 cleared the goods at concessional rate of duty. This petition is supported by Tribunal’s decision in the case of Tesa Tapes India Pvt Ltd. (Supra) wherein it was held that when the entry in custom and excise tariff are identical that the goods classified under any entry of customs must be adopted for classifying of said goods under the excise tariff as well.

4.4. We also referred to the Judgment of S R Foils & Tissues Limited Vs. Commissioner of Central Excise, Jaipur 2013 (294) ELT 565 (Tri.- Del.) which was upheld by the SC wherein it is held that precedents decision or classification adopted by foreign countries on classification of goods have a persuasive value. In the present case also very product Kopiko were supplied to other country wherein the classification of goods has been accepted as under 1704. Therefore, this also support the case of the appellant.

As per our above discussion and finding we are of the view that appellants product namely Kopiko is correctly classifiable under 1704 9090 and not under 2101 1200.

5. Accordingly, the impugned order is set aside appeal is allowed.

(Pronounced in the open court on 13.08.2024 )