Notification No. 14/2005-Central Excise (N.T.)

New Delhi, dated the 1st March, 2005.

G.S.R. (E).- In exercise of the powers conferred by sub-rule (2) of rule 9 read with rule 33 of the Central Excise Rules, 2002, the Central Board of Excise and Customs, on being satisfied that it is necessary and expedient in the public interest so to do, hereby makes the following further amendment in notification of the Government of India in the Ministry of Finance (Department of Revenue) No. 36/2001- Central Excise (N.T.), dated the 26th June, 2001, which was published in the Gazette of India, Extraordinary vide number G.S.R. 465(E), dated the 26th June, 2001 namely:-

2. In the said notification,-

(i) in paragraph (3), in Explanation, for the words “ten lakh rupees”, the words “sixty lakh rupees” shall be substituted;

(ii) for the ‘Declaration Form’ and the schedule, the following shall be substituted namely:-

“Declaration Form

To

The Deputy Commissioner/Assistant Commissioner,

Central Excise,

I/We……………………………………………………………… declare that to the best of my/our knowledge and belief the information furnished in the Schedule below is true and complete.

I/We………………………………………………….. declare that wherever the exemption has been claimed on the basis of conditions mentioned in the notification(s) or in Central Excise Tariff Act, 1985 (5 of 1986), the said conditions have been fulfilled by me/us.

I/We undertake to apply for Central Excise Registration in the proper form as soon as the value of the goods, mentioned in the said Schedule, cleared for home consumption in a financial year, reaches the full exemption limit or as soon as the goods mentioned in the Schedule become chargeable to duty.

I/We undertake to maintain such records and follow such procedure as may be specified by the Commissioner in relation to the exempted goods.

I/We also undertake to intimate any change in the information furnished in the said Schedule.

The Schedule

1. Name and full address of the factory.

2. Name and addresses of other factories/manufacturers (producing such goods) in whom the manufacturer claiming the exemption has proprietary interest.

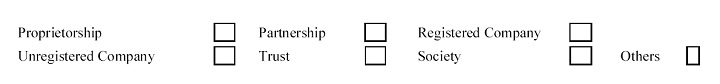

3. Status of business (tick only one box) 4. Details of the excisable goods manufactured by the factory during the preceding Financial year:

4. Details of the excisable goods manufactured by the factory during the preceding Financial year:

| S.No. | Description of excisable goods | Classification under First Schedule to the Central Excise Tariff Act, 1985 (5 of 1986) |

Value of clearance (Rs.) |

Notification No. and date, availed | Sr. No. in the notification (if any) |

| (1) | (2) | (3) | (4) | (5) | (6) |

(Signature of the Declarant)

Note.- 1. Portion of the Form/Schedule that is not relevant may be deleted.

2. Where the goods are exempted from the Tariff, the relevant provision giving such exemption may be mentioned in column (5) against particular Tariff sub-heading.”.

3. This notification shall come into force on 1st day of April, 2005.

[F.No.224/50/2004-CX.6]

(Neerav Kumar Mallick)

Under Secretary to the Government of India

Note: The principal notification was published in the Gazette of India Extraordinary, vide notification No. 36/2001-Central Excise (N.T.), dated the 26th June, 2001, vide number G.S.R. 465(E), dated the 26th June, 2001 and was last amended vide notification No. 53/2003-Central Excise (N.T.), dated the 9th June, 2003 vide number G.S.R. 464(E), dated the 9th June, 2003.