Through DGFT Trade Notice No 35/2021-22 dated 24.02.2022, it has been made mandatory for the exporters to file RCMC application through this common digital RCMC portal.

EPCES has also on-boarded on this digital e-RCMC portal. Now the members can apply for new/renew RCMC for EPCES through this portal.

Erstwhile, Registration cum membership certificate renewal process have made through respective board website where link of RCMC renewal is reflected, but today RCMC renewal application has made through DGFT website.

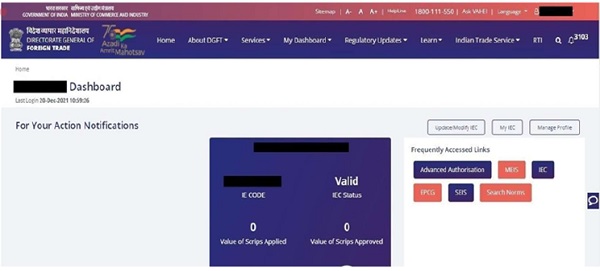

2.1. Issuance of Registration-cum Membership Certificate Applicant will register on DGFT Website https://www.dgft.gov.in as Importer/Exporter to access the Common Digital Platform.

To Login on Directorate General Foreign Trade (DGFT) portal you would require:

a) Internet Connection b) Valid User ID and password provided to log in Then proceed with the following steps.

1. Visit the DGFT website and proceed with Login by entering the user ID, Password and captcha then click on the Login button to log into the system.

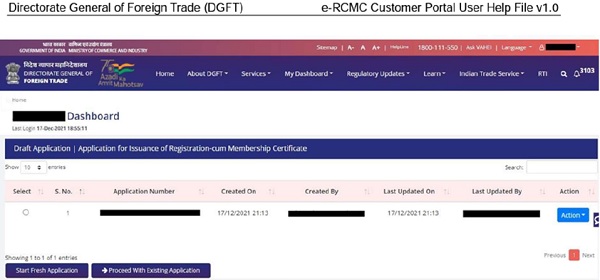

2. Navigat you e to Services > e-RCMC > Apply for e-RCM.

3. Now you can select the proceed with existing application or start as fresh application.

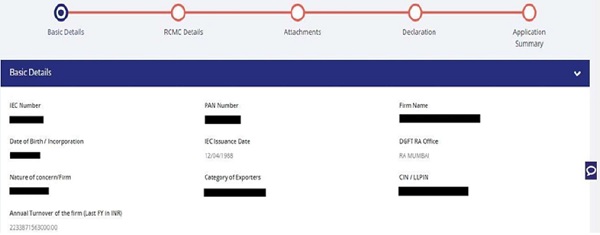

4. Dashboard with username is will be displayed with basic details.

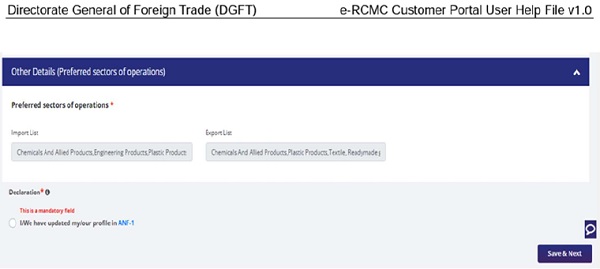

5. System would ask Applicant for Declaration whether he/she has updated profile or not.

6. select the check box and save and move to yes option.

7. Now under RCMC Details section Applicant would

a. Select Export Promotion Council / Commodity Board and Fee Details.

b. Select Export Products / Services and click Add button to save the details.

c. Select Authorised Representatives / Department Heads / Contact Persons for the Councils and click on Add Details button to save the details.

d. Select Authorised Representatives / Department Heads / Contact Persons for the Councils and click on Add Details button to save the details.

8. Applicant after filling all the details now proceed to Attach Documents under Attachments Section by uploading the document from Computer folder then clicking on Upload Attachments and finally Save & Next.

Documents such as

1) CA certificate

2) OLD RCMC certificate

3) GST CERTIFICATE

4) MSME CERTIFICATE if applicable

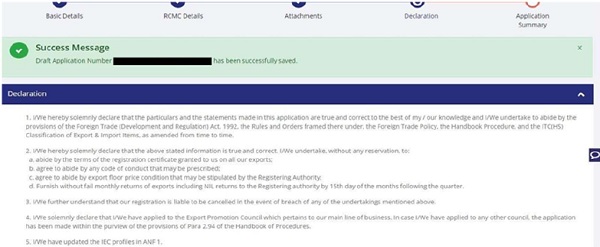

9. Now under the Declaration section read all the Declaration Lines

10. Click the Check box as acceptance of declaration and Enter the Place and then Save & Next.

11. System would show the filled application along with documents uploaded under Application Summary. Applicant would go ahead with the signing process by clicking Sign button.

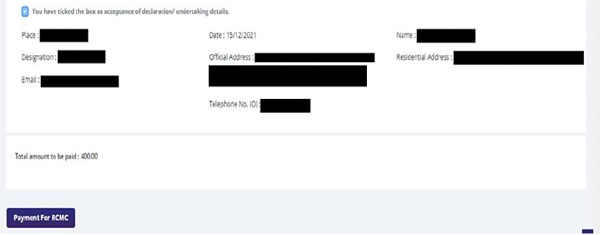

12. After that Click Payment for RCMC.

13. Applicant would be directed to the Payment gateway for the payment then click Submit.

14. Clicking Submit Applicant will see Payment Response Page with Transaction ID then again click Submit.

15. After Successful Payment Applicant will be receiving a e-Payment receipt.

16. Fee structure is vary for number of years for which you apply for renewal

17. following details are also require for filling the RCMC application

1. Nature of business

2. description of Goods or Services.

3. Applicable BOARD Name relating to RCMC

4. Authorised person name address and number etc

5. country in which you would export the goods and supply. Etc

18) I have not attached here the Screen short for many step which are understand easily without great effort.