DIRECTORATE GENERAL OF FOREIGN TRADE

Department of Commerce

Government of India

Foreign Trade Policy 2015-20

FTP 2015-20 which was to end on 31.3.2020 was extended due to COVID pandemic and volatile geo-political scenario till 31.03.2023.

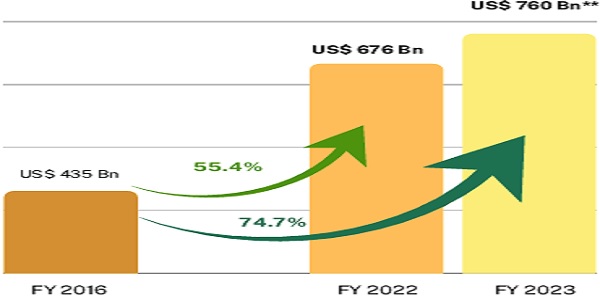

India has reach record high Export Performance in Merchandise and Services Exports during this period. India’s Merchandise and Services exports is expected to cross record USD 760 Billion in FY 2022-23. FTP 2015-20 contributed to this illustrious export performance.

India’s Exports

New Foreign Trade Policy 2023

- Policy changes were being undertaken since 2015 even without announcement of a new FTP responding dynamically to the emerging situations.

- The Foreign Trade Policy 2023 is being announced to provide the policy continuity and a responsive framework.

- Subsequent revision(s) in the FTP shall be done as and when required and shall not linked to any date.

- Continous feedback from Trade and Industry to streamline processes and update Policy & procedures.

New FTP Approach

- From Incentives to Tax Remission

- Greater Trade facilitation through technology, automation, and continuous process re-engineering

- Export promotion through collaboration: Exporters, States, Districts

- Focus on Emerging Areas – E- Commerce Exports, Developing Districts as Export Hubs, Streamlining SCOMET policy et al.

Key FTP Highlights

1. Ease of doing business, reduction in transaction cost and e-initiatives

1.1 Online approvals without physical interface

- Automatic approval of various permissions under Foreign Trade Policy based on process simplification and technology implementation.

- Reduction in processing time and immediate approval of applications under automatic route for exporters-

|

Permission type |

Current processing time | Automatic route processing time |

| Advance authorization issuance | 3 to 7 days | 1 day |

| EPCG issuance | 3 to 7 days | 1 day |

| Revalidation of authorizations | 3 days to 1 month | 1 day |

| Extension of Export Obligation period | 3 days to 1 month | 1 day |

1.2 Reduction in user charges for MSMEs under AA and EPCG

- Application fee being reduced for Advance Authorization and EPCG Schemes

- Will benefit 55-60% of exporters who are MSMEs.

- Fee structure as shown below-

(In Rupees)

| Licence Value in Rupees | User charges for non- MSMEs | Reduced User charges for MSMEs |

| Up to 1 crore | 1 per 1000 | 100 |

| 1 crore to 10 crores | 1 per 1000 | 5000 |

| Above 10 crores | Cap at 100000 | 5000 |

1.3 E-Certificate of Origin

- Revamp of the e-Certificate of Origin platform proposed- to provide for self-certification of CoOs as well as automatic approval of CoOs, where feasible.

- Initiatives for electronic exchange of CoO data with partner countries envisaged.

1.4 Paperless filing of export obligation discharge applications

- All authorisation redemption applications to be paperless – This is in addition to application process for issuance being already paperless. With this, the entire lifecycle of the authorization shall become paperless.

2. Export promotion initiatives

2.1 Status Holder Export Thresholds Rationalised

Export performance threshold for Recognition of Exporters as Status Holders rationalized. Enabling more exporters to achieve higher status and reduced transaction cost for exports.

(In USD Million)

|

Status House |

Existing Export Performance Threshold |

Revised Export performance Threshold |

| One Star | 3 | 3 |

| Two Star | 25 | 15 |

| Three Star | 100 | 50 |

| Four Star | 500 | 200 |

| Five Star | 2000 | 800 |

2.2 Merchanting trade reform

To boost merchanting activities from India – Merchanting trade involving shipment of goods from one foreign country to another foreign country without touching Indian ports, involving an Indian intermediary is allowed subject to compliance with RBI guidelines, except for goods/items in the CITES and SCOMET list.

2.3 Rupee payment to be accepted under FTP Schemes

- Effective step towards internationalisation of Rupee

- FTP benefits extended for rupee realisations through special Vostro accounts setup as per RBI circular issued on 11 July 2022

2.4 Towns of Export Excellence

- Four new towns of export excellence declared.

|

Town of Export Excellence |

Product Category |

| Faridabad | Apparel |

| Moradabad | Handicrafts |

| Mirzapur | Handmade Carpet and Dari |

| Varanasi | Handloom & Handicraft |

- These 4 new towns of export excellence (TEE) are in addition to the already existing 39 towns of export excellence.

- This scheme gives thrust to cluster based economic development.

- TEEs are industrial clusters that are recognized based on their export performance

- Recognition to these industrial clusters is granted with a view to maximize their potential and enable them to move up the value chain and to tap new markets.

- Benefits under TEE Scheme are:

Recognition-

- Helps in getting recognition/credibility attached to industrial units of the region/town while exploring/expanding into newer markets.

- Puts such industrial units/town on the global stage.

MAI Scheme –

Recognized associations of units are provided financial assistance under Market Access Initiative Scheme on priority basis, for export promotion projects for marketing, capacity building and technological services. Through this scheme such units can get financial assistance to visit various trade exhibitions/fairs for exploring more marketing avenues.

Common Service Provider facility –

- Common Service Providers in TEE are entitled for Authorisation under EPCG Scheme which can help in increasing the competitiveness of the cluster and provide enabling environment.

- This arrangement gives facility to exporters to not own all the infrastructure for conversion from inputs to final export products.

3. Districts as Export Hubs initiative

3.1 States and Districts as partners in export promotion

- Districts as Export Hubs aims to boost India’s foreign trade by decentralizing export promotion.

- Bring a greater level of awareness and commitment regarding exports at the district level.

- Identification of products/services in all the districts.

- Create institutional mechanisms at the State and District level to strategize exports (State Export Promotion Committee & District Export Promotion Committee).

- Preparation of District Export Action Plans (DEAPs) outlining the action plan to promote identified products and services.

- Make States and Districts meaningful stakeholders and active participants.

3.2 Capacity building at district level

- Capacity building to create new exporters and identification of new markets.

- Training, handholding, and outreach programs by DGFT field offices in coordination with District Industries Centers.

- Regional Authorities of DGFT working with the States/UTs to prepare District specific Export Plans.

- Export promotion outreach programs in districts to focus on branding, packaging, design and marketing of identified product & services.

3.3 Infrastructure and logistics development intervention

- To address Infrastructure and Logistics bottlenecks impeding exports.

- Districts to focus on development of logistics, testing facilities, connectivity for exports and other export-oriented ecosystem.

- Convergence of ongoing schemes to support these initiatives

4. E-Commerce Exports

4.1 Facilitation for E-Commerce exports

- All FTP benefits to be extended to e-Commerce exports.

- Necessary enablement of IT systems in Department of Commerce, Post, CBIC to be undertaken in the six months.

- To streamline e-Commerce export facilitation – Guidelines being formulated in consultation with other ministries to facilitate further exports under e-Commerce.

- Special outreach and training activities for small e-commerce exporters

- Handholding through industry and knowledge partners

4.2 Dak Niryat facilitation

- Dak Ghar Niryat Kendras shall be operationalised throughout the country to work in a hub-and-spoke model with Foreign Post Offices (FPOs) to facilitate cross-border e-Commerce and to enable artisans, weavers, craftsmen, MSMEs in the hinterland and land-locked regions to reach international markets.

4.3 E-Commerce Export Hubs

Designated hubs with warehousing facility to be notified, to help e-commerce aggregators for easy stocking, customs clearance and returns processing. Processing facility to be allowed for last mile activities such as labelling, testing, repackaging etc.

5. Steps to Boost Manufacturing

- Prime Minister Mega Integrated Textile Region and Apparel Parks (PM MITRA) scheme has been added as an additional scheme eligible to claim benefits under CSP(Common Service Provider) Scheme of Export Promotion capital Goods Scheme(EPCG).

- Dairy sector to be exempted from maintaining Average Export Obligation – to support dairy sector to upgrade the technology.

- Battery Electric Vehicles (BEV) of all types, Vertical Farming equipment, Wastewater Treatment and Recycling, Rainwater harvesting system and Rainwater Filters, and Green Hydrogen are added to Green Technology products – will now be eligible for reduced Export Obligation requirement under EPCG Scheme

- Special Advance Authorisation Scheme extended to export of Apparel and Clothing sector under para 4.07 of HBP on self-declaration basis to facilitate prompt execution of export orders – Norms would be fixed within fixed time-frame.

- Benefits of Self-Ratification Scheme for fixation of Input-Output Norms extended to 2 star and above status holders in addition to Authorised Economic Operators at present.

- Fruits and Vegetables exporters are being included for double weightage for counting export performance under eligibility criteria for Status House certification. This is in addition to existing MSME sector who also get double weightage.

6. Special one-time Amnesty Scheme for default in Export Obligations

- In the interest of trade and industry and to motivate the exporters, relief to be provided to exporters who are unable to fulfill their EO against the EPCG and Advance Authorizations.

- Amnesty scheme for one-time settlement of default in export obligation by Advance Authorization and EPCG authorization holders being introduced.

- All pending cases of default in Export Obligation (EO) of authorizations mentioned can be regularized by the authorization holder on payment of all customs duties exempted in proportion to unfulfilled Export Obligation and maximum interest is capped at 100% of such duties exempted. However, no interest is payable on the portion of Additional Customs Duty and Special Additional Customs Duty.

- Amnesty scheme shall be available for a limited period, up to 30.09.2023. Cases under investigation for fraud and diversion are not eligible under this scheme.

7. Emphasis on streamlining SCOMET Licensing Procedure

- Focus of FTP 2023 on Special Chemicals, Organisms, Materials, Equipment and Technologies (SCOMET)

- Policy for export of dual use items under SCOMET consolidated at one place for ease of understanding and compliance by industry.

- SCOMET policy emphasizes India’s export control in line with its International commitments under various export control regimes (Wassenaar arrangement, Australia group and Missile Technology Control Regime) to control trade in sensitive and dual use items including software and technology

- Recent policy changes introduced such as general authorizations for export of certain SCOMET items to streamline licensing of these items to make export of SCOMET items globally competitive.

- Focus on simplifying policies to facilitate export of dual use high end goods/technology such as UAV/Drones, Cryogenic Tanks, Certain chemicals etc.

Way Forward

- Foreign Trade Policy to be dynamic and responsive to the emerging trade scenario.

- Wider Engagement with States and Districts to promote exports from the grassroots.

- Focus on E-commerce exports to streamline processes and make it easier for exports to grow in e-commerce space.

- Sector specific targets to achieve the goal of a one trillion-dollar merchandise exports by 2030.

- Consultative mechanism to resolve issues of trade and Industry.

- Work towards making Indian Rupees a global currency and facilitating International Trade settlement in INR.

- Restructuring of Department of Commerce to make it future ready.

ok

Open ended policy validity is welcome step. No mention of timeline for Import Licenses, Export Licenses, CCPs. Also Grievance Redressing Mechanism is weak as before. Few other pain points existed earlier are not addressed. New Policy document is yet to be uploaded on the DGFT Portal. In all a better version open for more improvements.